Bullish Hammer Pattern Kya Hai.

Bullish Hammer Pattern aik candlestick pattern hai jo aksar downtrend ke baad banta hai aur price ke uptrend (bullish reversal) ka signal deta hai. Yeh pattern market ke support level par develop hota hai aur buyers ke control mein aane ki nishani hota

Bullish Hammer Pattern Ki Pehchaan

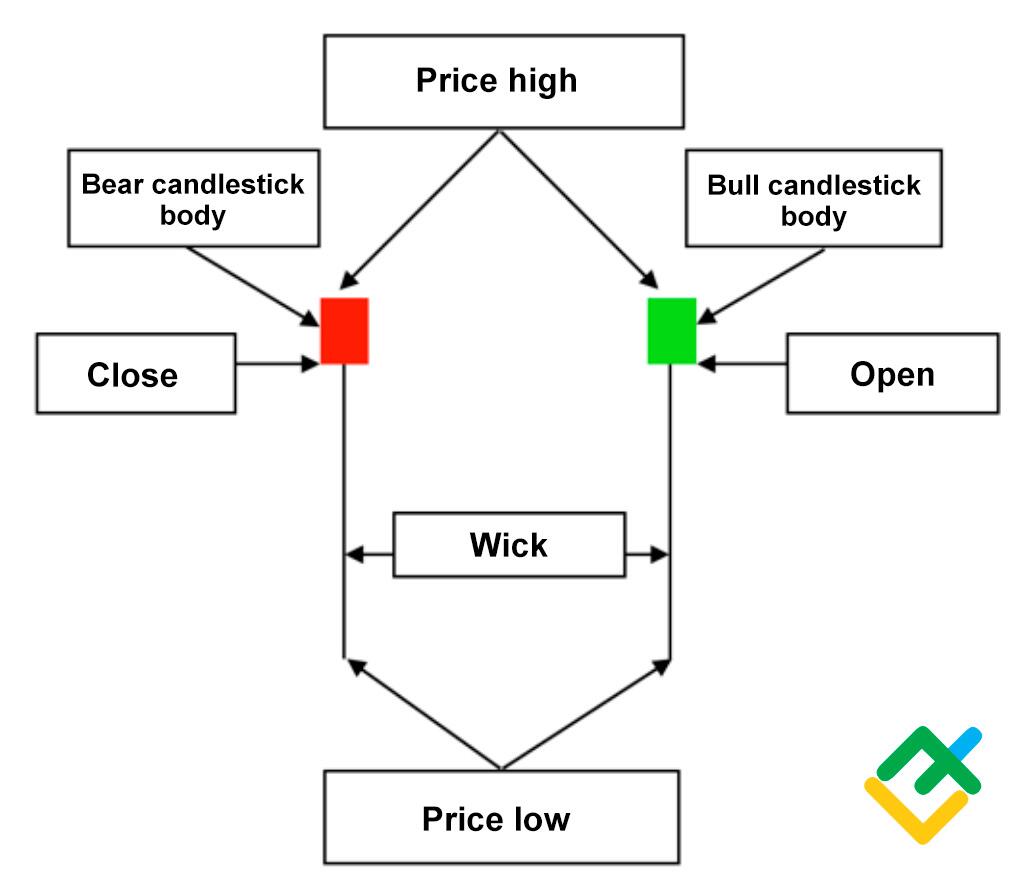

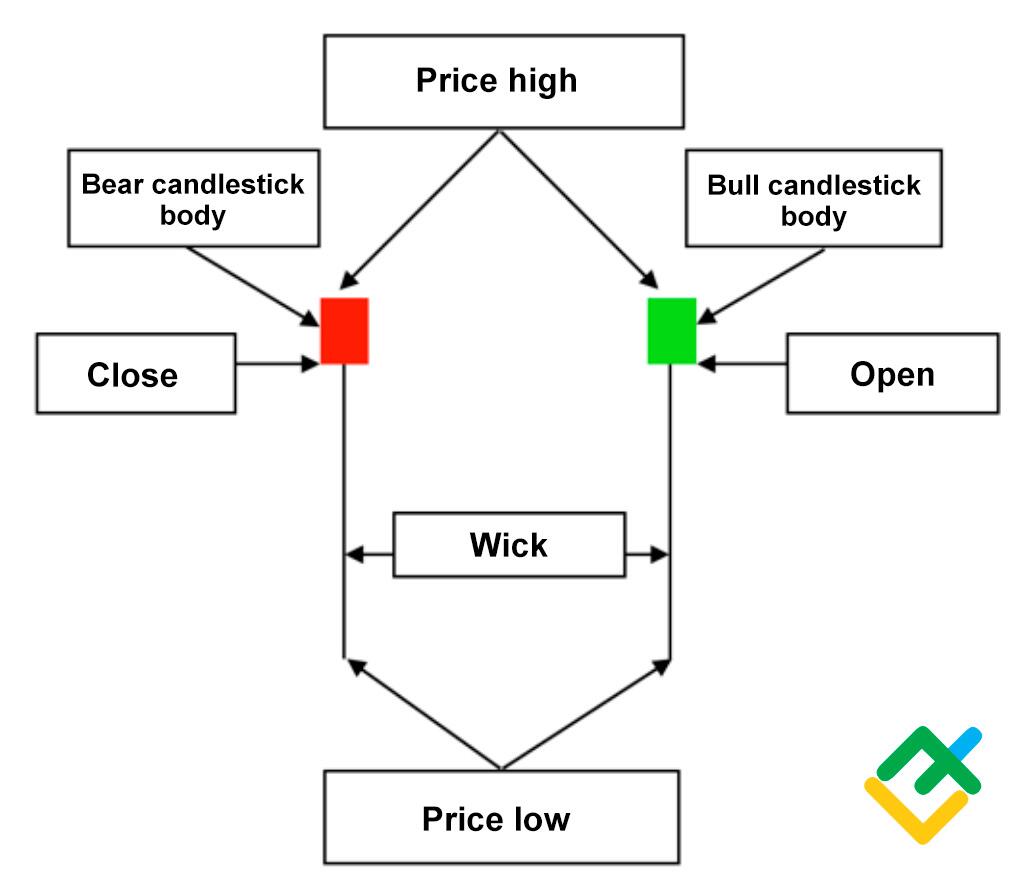

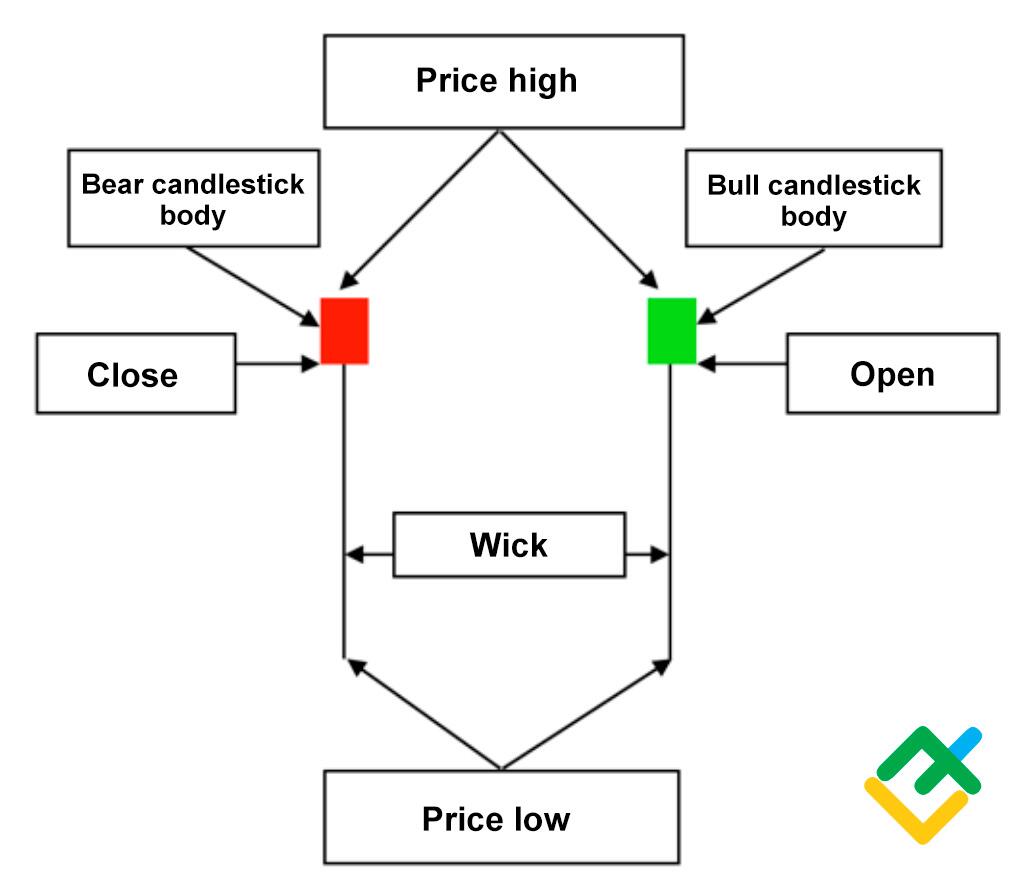

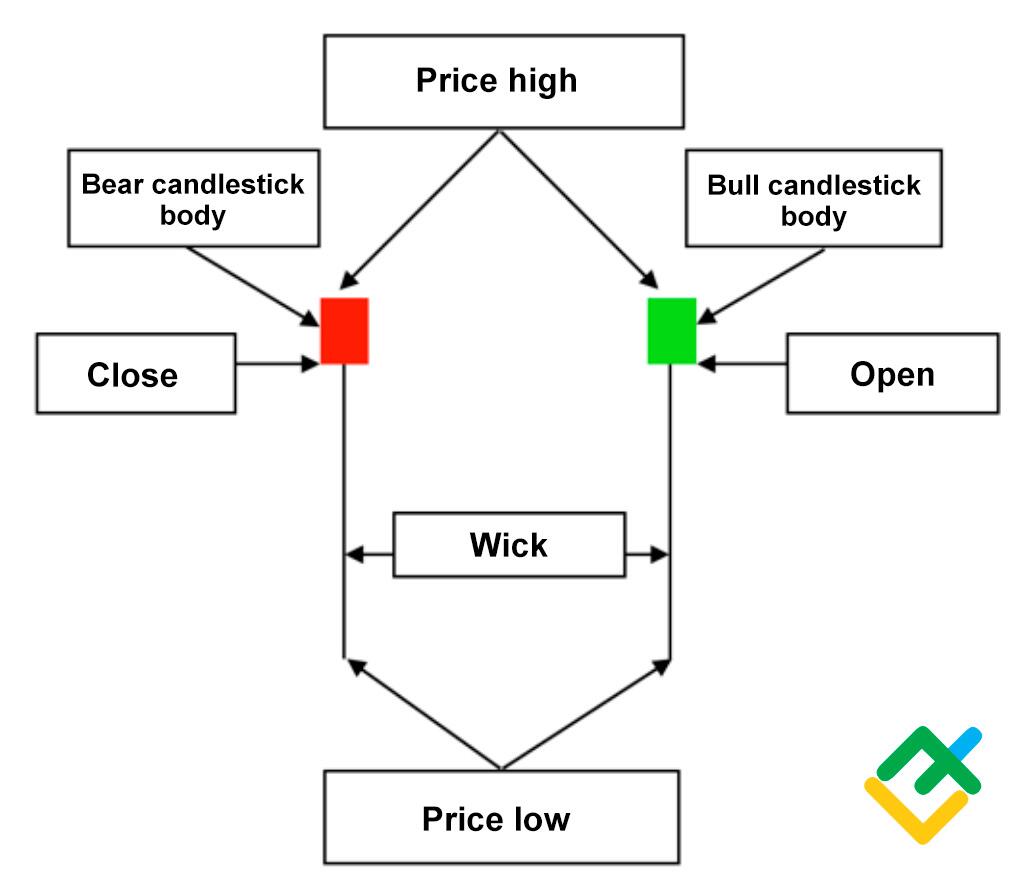

1. Shape (Shakal):

Candle ki body chhoti hoti hai (open aur close ka difference).

Candle ka lower shadow (wick) bohot lamba hota hai, jo total candle ki length ka kam az kam 2x hota hai.

Upper shadow ya toh hoti hi nahi, ya bohot chhoti hoti hai.

2. Position:

Yeh aksar downtrend ke dauran ya support level par appear hoti hai.

3. Color:

Candle green (bullish) bhi ho sakti hai aur red (bearish) bhi. Lekin green color wali hammer bullish reversal ke liye zyada strong hoti hai

commodity markets.

Bullish Hammer Pattern Ka Matlab

Yeh pattern yeh dikhata hai ke:

Market pehle neeche gaya (sellers ne price ko push kiya).

Lekin buyers ne us low level par control le liya aur price upar le aaye.

Close price opening ke kareeb ya us se upar hoti hai, jo buyers ke strength ko indicate karti hai.

Trading Strategy

1. Pattern Identify Karna

Pehle downtrend ko identify karein.

Bullish hammer candle ko dekh kar uske lower shadow ki length check karein (2x longer than body).

2. Confirmation

Hammer ke baad aane wali ek bullish candle (price upar ki taraf close kare) se confirmation lein.

Yeh confirmation zaroori hai kyun ke sirf hammer pe entry lena risky ho sakta hai.

3. Entry Point

Confirmation candle ke high ke upar buy karein.

4. Stop Loss

Hammer candle ke low ke neeche apna stop loss set karein.

5. Take Profit

Fibonacci retracement levels, previous resistance, ya price action ki madad se apna target set karein.

Bullish Hammer Ka Example

Scenario:

Downtrend chal raha hai.

Market support level par pohanchta hai.

Ek hammer candle banti hai jisme:

Price neeche ja kar upar close hoti hai.

Long lower wick hoti hai.

Action Plan:

Confirmation ke liye agle candle ka wait karein.

Price jab upar break kare, tab buy entry lein.

Stop loss hammer ke low ke neeche set karein.

Practical Tips

1. Indicators Use Karein:

RSI (Relative Strength Index) agar oversold zone mein ho, toh hammer ka signal aur zyada reliable hota hai.

2. Timeframes:

1-hour, 4-hour, ya daily timeframes par hammer pattern zyada reliable hota hai.

3. Risk Management:

Hamesha apni risk/reward ratio ka dhyan rakhein (kam az kam 1:2 ho).

Summary:

Bullish Hammer aik powerful reversal pattern hai jo buyers ke strength aur market mein bullish momentum ka signal deta hai. Is pattern ke saath confirmation aur risk management ko zaroor include karein.

Bullish Hammer Pattern aik candlestick pattern hai jo aksar downtrend ke baad banta hai aur price ke uptrend (bullish reversal) ka signal deta hai. Yeh pattern market ke support level par develop hota hai aur buyers ke control mein aane ki nishani hota

Bullish Hammer Pattern Ki Pehchaan

1. Shape (Shakal):

Candle ki body chhoti hoti hai (open aur close ka difference).

Candle ka lower shadow (wick) bohot lamba hota hai, jo total candle ki length ka kam az kam 2x hota hai.

Upper shadow ya toh hoti hi nahi, ya bohot chhoti hoti hai.

2. Position:

Yeh aksar downtrend ke dauran ya support level par appear hoti hai.

3. Color:

Candle green (bullish) bhi ho sakti hai aur red (bearish) bhi. Lekin green color wali hammer bullish reversal ke liye zyada strong hoti hai

commodity markets.

Bullish Hammer Pattern Ka Matlab

Yeh pattern yeh dikhata hai ke:

Market pehle neeche gaya (sellers ne price ko push kiya).

Lekin buyers ne us low level par control le liya aur price upar le aaye.

Close price opening ke kareeb ya us se upar hoti hai, jo buyers ke strength ko indicate karti hai.

Trading Strategy

1. Pattern Identify Karna

Pehle downtrend ko identify karein.

Bullish hammer candle ko dekh kar uske lower shadow ki length check karein (2x longer than body).

2. Confirmation

Hammer ke baad aane wali ek bullish candle (price upar ki taraf close kare) se confirmation lein.

Yeh confirmation zaroori hai kyun ke sirf hammer pe entry lena risky ho sakta hai.

3. Entry Point

Confirmation candle ke high ke upar buy karein.

4. Stop Loss

Hammer candle ke low ke neeche apna stop loss set karein.

5. Take Profit

Fibonacci retracement levels, previous resistance, ya price action ki madad se apna target set karein.

Bullish Hammer Ka Example

Scenario:

Downtrend chal raha hai.

Market support level par pohanchta hai.

Ek hammer candle banti hai jisme:

Price neeche ja kar upar close hoti hai.

Long lower wick hoti hai.

Action Plan:

Confirmation ke liye agle candle ka wait karein.

Price jab upar break kare, tab buy entry lein.

Stop loss hammer ke low ke neeche set karein.

Practical Tips

1. Indicators Use Karein:

RSI (Relative Strength Index) agar oversold zone mein ho, toh hammer ka signal aur zyada reliable hota hai.

2. Timeframes:

1-hour, 4-hour, ya daily timeframes par hammer pattern zyada reliable hota hai.

3. Risk Management:

Hamesha apni risk/reward ratio ka dhyan rakhein (kam az kam 1:2 ho).

Summary:

Bullish Hammer aik powerful reversal pattern hai jo buyers ke strength aur market mein bullish momentum ka signal deta hai. Is pattern ke saath confirmation aur risk management ko zaroor include karein.

تبصرہ

Расширенный режим Обычный режим