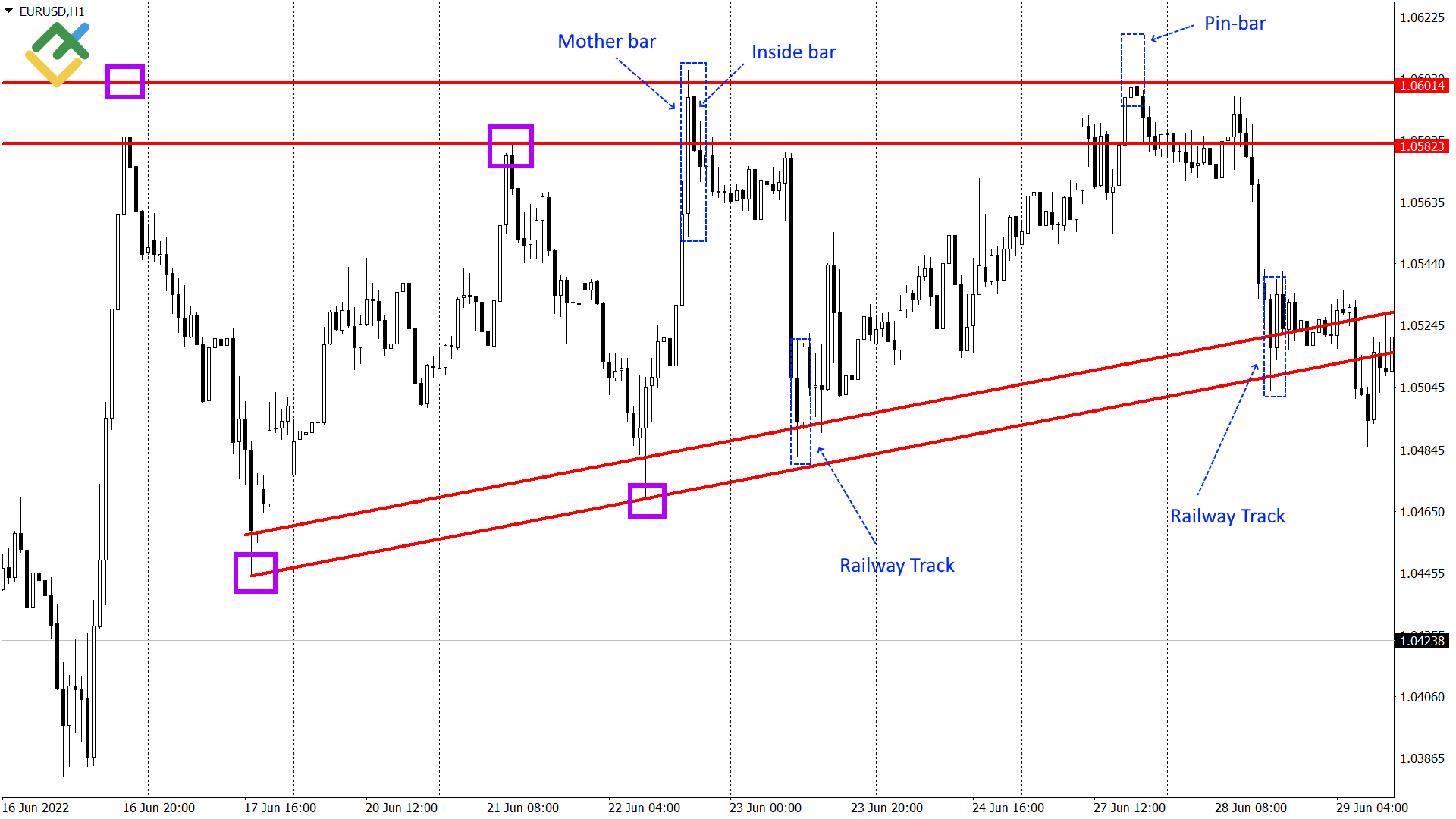

Price action trading ek technical analysis technique hai jo market mein keemat mein hone wali badlavon ka analysis karke trading decisions leti hai. Is technique mein, traders candlesticks, charts aur patterns ka use karte hain yeh samajhne ke liye ke market kaha jaa raha hai aur bhavishya mein kya ho sakta hai.

Price action trading mein kuchh aam patterns hain:

Price action trading ke kuchh fayde hain:

Price action trading ke kuchh nuksan bhi hain:

Agar aap price action trading mein interest rakhte hain, to yeh important hai ki aap apna research karen aur ek trading plan develop karen. Aapko demo account par practice karne aur apni skills develop karne mein bhi time spend karna chahiye.

Price action trading mein kuchh aam patterns hain:

- Bullish engulfing: Yeh pattern ek bullish reversal signal hai jo tab hota hai jab ek badi bearish candle ko ek chhoti bullish candle se engulf kiya jata hai.

- Bearish engulfing: Yeh pattern ek bearish reversal signal hai jo tab hota hai jab ek badi bullish candle ko ek chhoti bearish candle se engulf kiya jata hai.

- Hammer: Yeh pattern ek bullish reversal signal hai jo tab hota hai jab ek candle ka lower wick badi hoti hai aur uska body chhoti hoti hai.

- Shooting star: Yeh pattern ek bearish reversal signal hai jo tab hota hai jab ek candle ka upper wick badi hoti hai aur uska body chhoti hoti hai.

Price action trading ke kuchh fayde hain:

- Yeh ek versatile technique hai jo various markets mein use ki ja sakti hai.

- Yeh relatively simple hai aur ise sikhna aasan hai.

- Yeh subjective hai, jiska matlab hai ke traders apne experience aur judgment ka use kar sakte hain trading decisions lene ke liye.

Price action trading ke kuchh nuksan bhi hain:

- Yeh subjective hai, jiska matlab hai ke traders ki interpretations mein differences ho sakte hain.

- Yeh time-consuming ho sakti hai, kyunki traders ko charts ka analysis karne mein bahut samay lag sakta hai.

- Yeh risky ho sakti hai, kyunki traders galat interpretations kar sakte hain aur losses utha sakte hain.

Agar aap price action trading mein interest rakhte hain, to yeh important hai ki aap apna research karen aur ek trading plan develop karen. Aapko demo account par practice karne aur apni skills develop karne mein bhi time spend karna chahiye.

تبصرہ

Расширенный режим Обычный режим