### Position Trading Strategy in Forex

Position trading strategy forex market mein ek long-term trading approach hai jo traders ko market ke broader trends ka faida uthane ki salahiyat deti hai. Is strategy ka maqsad long-term price movements ko samajhna aur un par based trades kholna hota hai. Position traders aksar weeks, months, ya kabhi kabhi years tak apni positions ko hold karte hain, jo is strategy ko day trading ya swing trading se mukhtalif banata hai.

**1. Market Analysis:** Position trading ke liye pehla qadam thorough market analysis hai. Traders ko macroeconomic factors, geopolitical events, aur central bank policies ka ghor se dekhna chahiye. Yeh factors currency pairs ki long-term movements par asar daal sakte hain. Fundamental analysis ke alawa, technical analysis bhi zaroori hai, jisme long-term charts par trends aur support/resistance levels ko identify kiya jata hai.

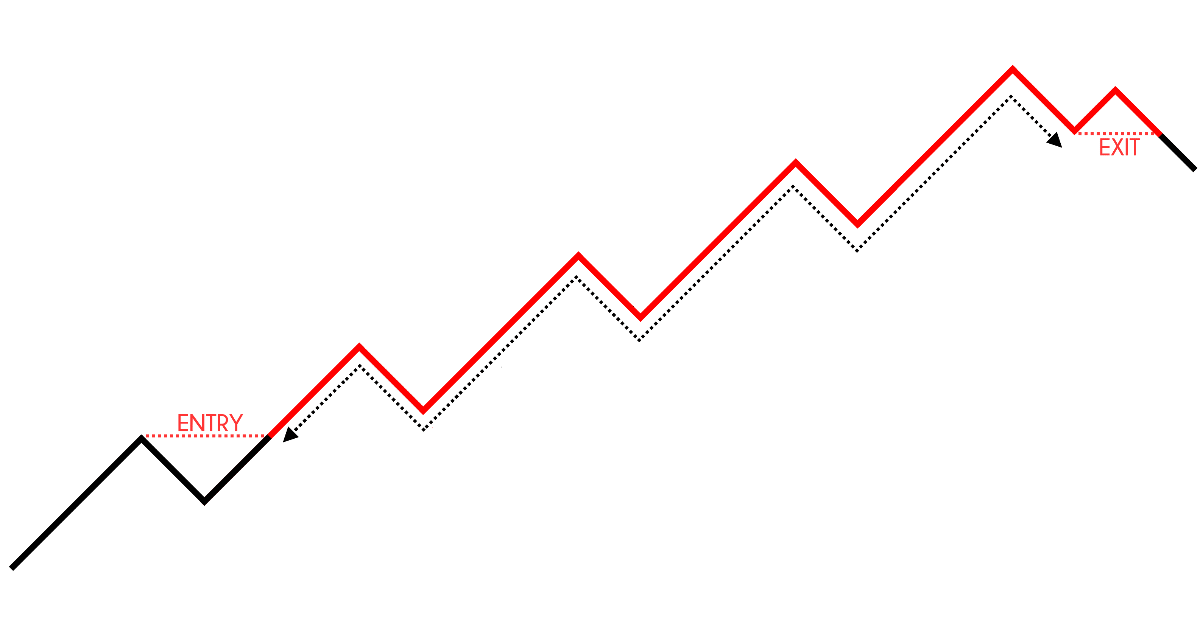

**2. Trend Following:** Is strategy mein trend following ka concept bohot important hai. Position traders aksar upward ya downward trends ki pehchaan karte hain aur in trends ke mutabiq trades kholte hain. Jab ek bullish trend banta hai, to traders buy positions kholte hain, jabke bearish trend mein sell positions kholte hain.

**3. Entry and Exit Points:** Position trading mein entry aur exit points ko sahi tarah identify karna zaroori hai. Traders ko apne analysis ke mutabiq entry points tay karne chahiye. Exit points bhi pre-determined hone chahiye, jo aapke profit targets ya stop-loss levels par based ho sakte hain. Yeh disciplined approach aapko emotional decisions lene se bachata hai.

**4. Risk Management:** Position trading ke liye effective risk management bhi zaroori hai. Aapko apne total capital ka ek chhota hissa har trade par risk karna chahiye. Stop-loss orders ka istemal bhi zaroori hai, jo aapki position ko protect karte hain agar market aapke khilaf jaye.

**5. Patience and Discipline:** Position trading mein patience aur discipline ka bohot bada role hota hai. Aapko apne analysis par bharosa karna hota hai aur market ki short-term fluctuations par react nahi karna hota. Yeh strategy un logon ke liye behtar hai jo long-term vision rakhte hain aur immediate results nahi chahte.

**6. Regular Review:** Aakhir mein, position traders ko apne trades aur market conditions ka regular review karna chahiye. Market dynamics change ho sakte hain, isliye aapko apne positions ko adjust karna pad sakta hai.

Aakhir mein, position trading strategy forex market mein ek effective long-term approach hai jo traders ko market ki broader trends ka faida uthane mein madad karti hai. Agar aap is strategy ko sahi tareeqe se istemal karte hain, to yeh aapki trading performance ko behter bana sakti hai. Isliye, apne analysis par ghor karein aur patience ke saath market mein apne positions ko manage karein.

Position trading strategy forex market mein ek long-term trading approach hai jo traders ko market ke broader trends ka faida uthane ki salahiyat deti hai. Is strategy ka maqsad long-term price movements ko samajhna aur un par based trades kholna hota hai. Position traders aksar weeks, months, ya kabhi kabhi years tak apni positions ko hold karte hain, jo is strategy ko day trading ya swing trading se mukhtalif banata hai.

**1. Market Analysis:** Position trading ke liye pehla qadam thorough market analysis hai. Traders ko macroeconomic factors, geopolitical events, aur central bank policies ka ghor se dekhna chahiye. Yeh factors currency pairs ki long-term movements par asar daal sakte hain. Fundamental analysis ke alawa, technical analysis bhi zaroori hai, jisme long-term charts par trends aur support/resistance levels ko identify kiya jata hai.

**2. Trend Following:** Is strategy mein trend following ka concept bohot important hai. Position traders aksar upward ya downward trends ki pehchaan karte hain aur in trends ke mutabiq trades kholte hain. Jab ek bullish trend banta hai, to traders buy positions kholte hain, jabke bearish trend mein sell positions kholte hain.

**3. Entry and Exit Points:** Position trading mein entry aur exit points ko sahi tarah identify karna zaroori hai. Traders ko apne analysis ke mutabiq entry points tay karne chahiye. Exit points bhi pre-determined hone chahiye, jo aapke profit targets ya stop-loss levels par based ho sakte hain. Yeh disciplined approach aapko emotional decisions lene se bachata hai.

**4. Risk Management:** Position trading ke liye effective risk management bhi zaroori hai. Aapko apne total capital ka ek chhota hissa har trade par risk karna chahiye. Stop-loss orders ka istemal bhi zaroori hai, jo aapki position ko protect karte hain agar market aapke khilaf jaye.

**5. Patience and Discipline:** Position trading mein patience aur discipline ka bohot bada role hota hai. Aapko apne analysis par bharosa karna hota hai aur market ki short-term fluctuations par react nahi karna hota. Yeh strategy un logon ke liye behtar hai jo long-term vision rakhte hain aur immediate results nahi chahte.

**6. Regular Review:** Aakhir mein, position traders ko apne trades aur market conditions ka regular review karna chahiye. Market dynamics change ho sakte hain, isliye aapko apne positions ko adjust karna pad sakta hai.

Aakhir mein, position trading strategy forex market mein ek effective long-term approach hai jo traders ko market ki broader trends ka faida uthane mein madad karti hai. Agar aap is strategy ko sahi tareeqe se istemal karte hain, to yeh aapki trading performance ko behter bana sakti hai. Isliye, apne analysis par ghor karein aur patience ke saath market mein apne positions ko manage karein.

تبصرہ

Расширенный режим Обычный режим