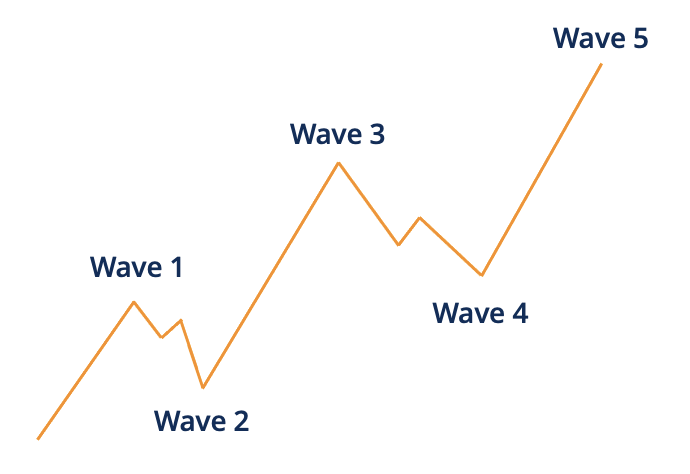

Impulsive waves trading ke andar ek bahut important concept hain jo Elliott Wave Theory ka hissa hain. Elliott Wave Theory ko Ralph Nelson Elliott ne develop kiya tha. Yeh theory market trends aur price movements ko analyze karne ke liye use hoti hai. Impulsive waves, jo ke trend direction mein hoti hain, 5 waves ka pattern follow karti hain: 1, 2, 3, 4, aur 5. In waves mein, 1, 3, aur 5 waves trend direction mein hoti hain aur inke darmiyan 2 aur 4 waves correction waves hoti hain.

Impulsive Waves ko Identify Karna

Pehla qadam yeh hota hai ke impulsive waves ko identify kiya jaye. Yeh waves clearly defined hoti hain aur market ki dominant trend ko follow karti hain.

Entry aur Exit Points

Impulsive waves ko trade karne ke liye, sahi entry aur exit points ko identify karna zaroori hain.

Risk Management

Trading mein risk management bahut zaroori hain. Impulsive waves ko trade karte waqt, stop-loss ka use karein.

Analysis Tools

Technical analysis tools ka use karna trading mein helpfull hota hain. Kuch important tools hain:

Impulsive Waves ko Identify Karna

Pehla qadam yeh hota hai ke impulsive waves ko identify kiya jaye. Yeh waves clearly defined hoti hain aur market ki dominant trend ko follow karti hain.

- Wave 1: Pehli wave usually market ka reversal point hoti hain.

- Wave 2: Pehli wave ke baad aane wali correction wave jo ke 50% se 61.8% tak pehli wave ko retrace karti hain.

- Wave 3: Yeh sabse lambi aur strongest wave hoti hain jo ke trend ko continue karti hain.

- Wave 4: Yeh wave phir se ek correction wave hoti hain, lekin yeh third wave ka 38.2% se zyada retrace nahi karti.

- Wave 5: Aakhri wave jo ke trend ka final push hota hain.

Entry aur Exit Points

Impulsive waves ko trade karne ke liye, sahi entry aur exit points ko identify karna zaroori hain.

- Entry: Wave 2 ke complete hone ka wait karein aur phir wave 3 ke start par entry lein. Is wave ka confirmation breakout aur high volume se milta hain.

- Exit: Wave 3 ke complete hone par profit book kar sakte hain. Agar aap zyada aggressive trader hain to wave 5 tak hold kar sakte hain. Lekin, wave 5 ke top par exit karna better hota hain kyun ke correction aane ke chances hoti hain.

Risk Management

Trading mein risk management bahut zaroori hain. Impulsive waves ko trade karte waqt, stop-loss ka use karein.

- Stop-Loss: Wave 2 ke niche stop-loss set karein jab wave 3 start hoti hain. Yeh aapke loss ko minimize karta hain agar market aapke against chali jaye.

- Position Sizing: Apne account size ke mutabiq position sizing karein. Apne total capital ka 1-2% se zyada risk na lein ek trade par.

Analysis Tools

Technical analysis tools ka use karna trading mein helpfull hota hain. Kuch important tools hain:

- Fibonacci Retracement: Yeh tool waves ki retracement levels ko identify karne mein madad karta hain.

- Moving Averages: Trend direction aur strength ko identify karne ke liye moving averages ka use karein.

- Volume Analysis: High volume impulsive waves ki confirmation hoti hain, isliye volume ko analyze karein.

تبصرہ

Расширенный режим Обычный режим