Flag pattern ek bohot mashhoor aur powerful continuation pattern hai jo trading mein technical analysis ke liye use hota hai. Yeh pattern dikhata hai ke price temporarily consolidate karti hai lekin phir apni asal direction follow karti hai. Yeh bullish aur bearish dono situations mein ban sakta hai aur agar isko sahi tareeke se samjha jaye toh bohot acha profit generate kiya ja sakta hai. Is pattern ka structure simple hota hai magar isko samajhna aur trade karna thoda skill aur practice demand karta hai.

Flag Pattern

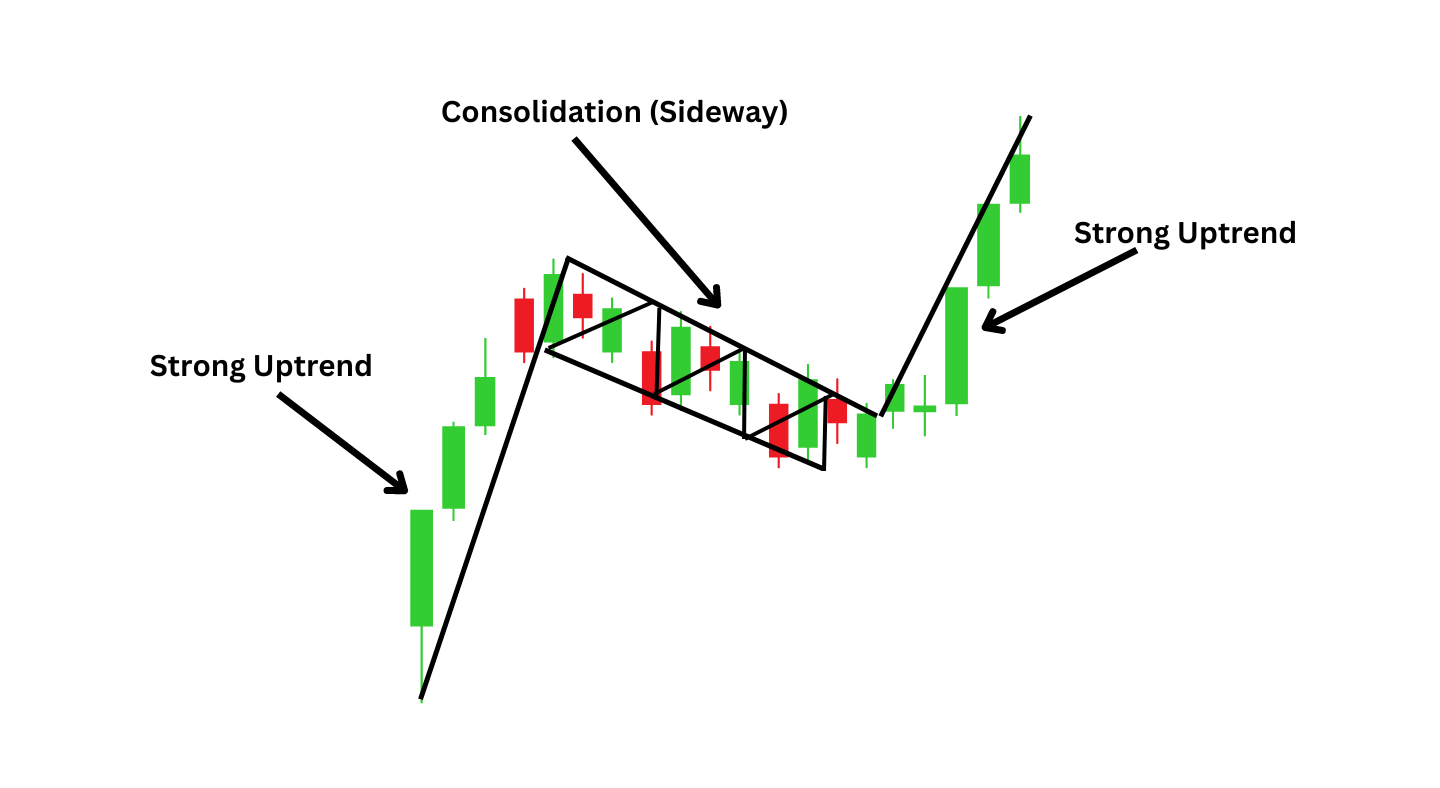

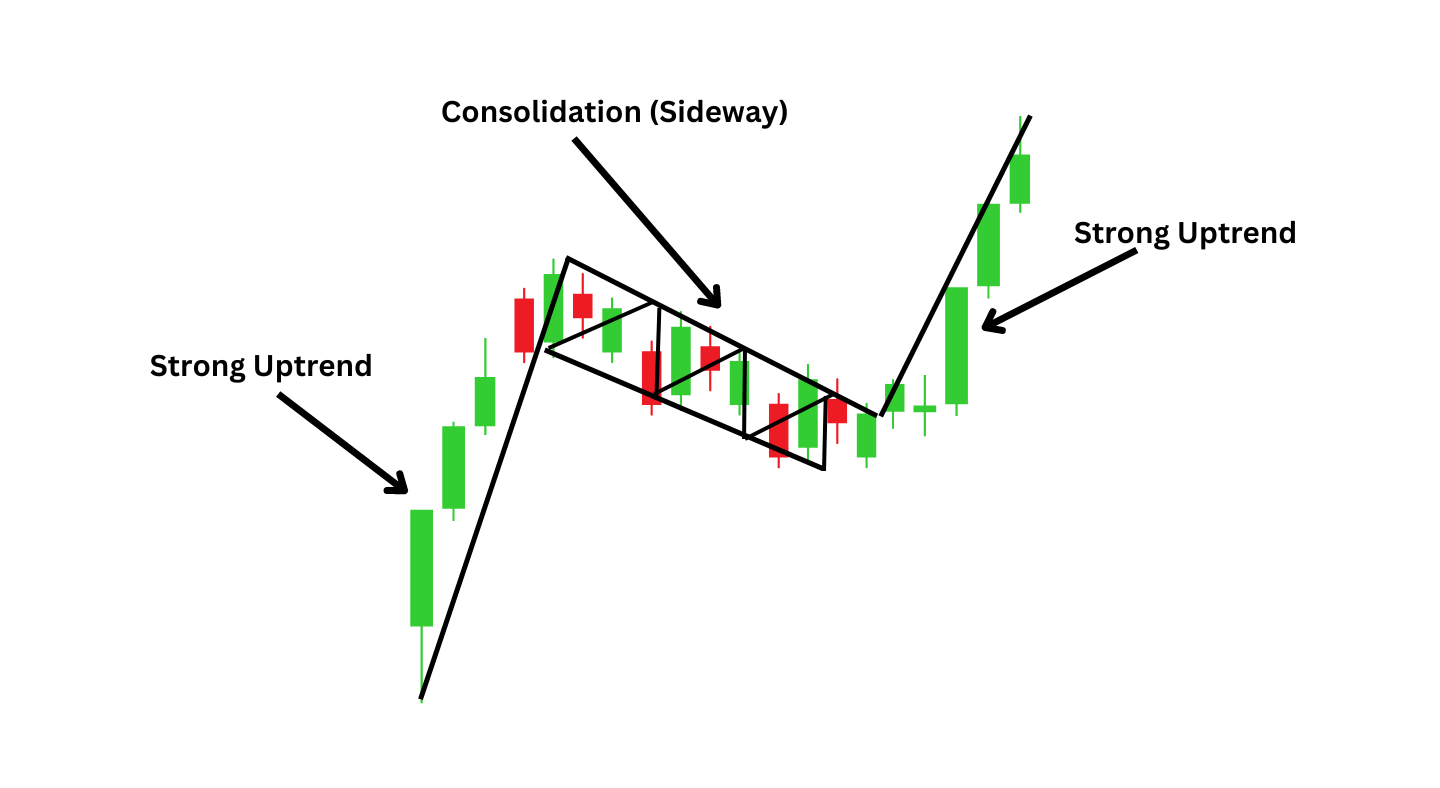

Flag pattern do parts par depend hota hai, pehla part flagpole aur doosra part flag. Jab market mein ek strong move aata hai jo steep aur sharp hota hai toh usay flagpole kaha jata hai. Yeh move bullish bhi ho sakta hai aur bearish bhi. Jab price is strong move ke baad consolidation karti hai aur ek rectangular ya parallel channel form karti hai toh usay flag kaha jata hai. Yeh consolidation temporary hoti hai aur jab price breakout karti hai toh trend apni pehli direction mein continue karta hai.

Bullish Flag Pattern

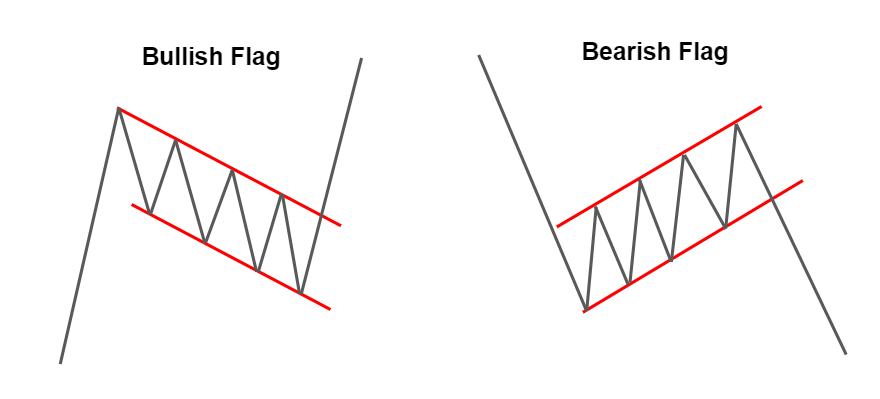

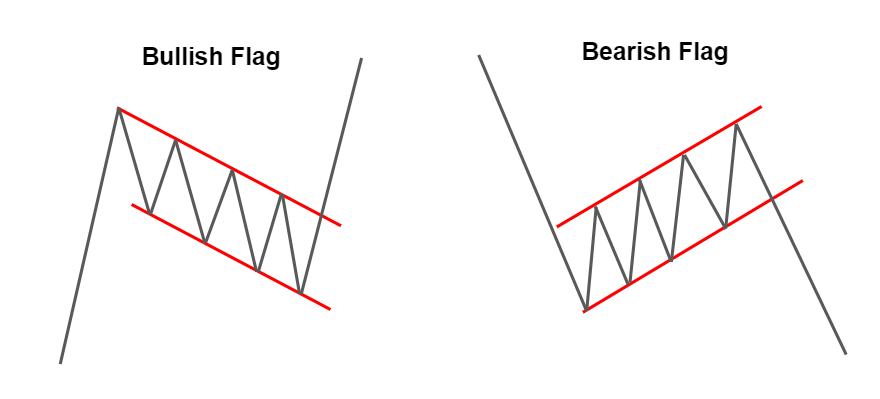

Jab bullish flag pattern banta hai toh iska matlab hota hai ke price ek strong bullish move ke baad thodi der ke liye sideways ya downward consolidate kar rahi hai. Iska breakout jab hota hai tab price wapas bullish trend continue karti hai. Yeh pattern aksar uptrend markets mein dekha jata hai jahan buyers dominate kar rahe hote hain.

Bullish flag pattern ko identify karne ka tareeka yeh hai ke pehle ek strong bullish move aaye jo flagpole banaye. Uske baad price consolidation zone mein chali jaye aur ek chhoti descending channel ya sideways movement dikhaye. Yeh consolidation resistance aur support ke andar hoti hai. Jab price resistance tod kar breakout karti hai toh bullish flag confirm ho jata hai aur traders entry le sakte hain.

Is pattern par trade karne ke liye breakout ka wait karna zaroori hota hai. Jaise hi price previous resistance todti hai aur volume increase hota hai, wahan ek achi buy entry li ja sakti hai. Stop-loss usually flag ke lowest point ke neeche lagaya jata hai taake risk minimize ho sake. Target price estimate karne ke liye flagpole ka height measure karna madadgar hota hai, jise breakout point se upar apply kiya jata hai.

Bearish Flag Pattern

Bearish flag pattern bilkul bullish flag ka ulta hota hai. Yeh tab form hota hai jab price ek strong bearish move karti hai aur phir temporarily upward ya sideways consolidate karti hai. Jab price support todti hai toh bearish trend continue hota hai.

Is pattern ko identify karne ka tareeka bhi simple hai. Pehle ek strong bearish move hota hai jo flagpole form karta hai. Phir price ek chhoti ascending channel ya sideways movement mein consolidate karti hai. Yeh consolidation resistance aur support ke andar hoti hai. Jab price support tod kar neeche breakout karti hai toh bearish flag confirm ho jata hai.

Is pattern par trade karne ke liye breakdown ka wait karna zaroori hota hai. Jaise hi price previous support todti hai aur volume increase hota hai, wahan ek achi sell entry li ja sakti hai. Stop-loss usually flag ke highest point ke upar lagaya jata hai taake risk minimize ho sake. Target price ka estimation flagpole ke height ko measure karne ke baad breakout point se neeche apply karke kiya jata hai.

Best Way to Trade Flag Patterns

Flag pattern ko trade karne ke liye sabse pehle usay sahi tareeke se identify karna zaroori hai. Aksar traders galti karte hain aur consolidation ko flag pattern samajh lete hain jabke wo sirf ek normal sideways move hota hai. Is wajah se breakout ka wait karna aur volume ka analysis karna zaroori hai.

Jab bullish flag pattern banta hai toh buy entry sirf breakout ke baad leni chahiye. Ussi tarah bearish flag pattern mein sell entry breakdown ke baad leni chahiye. Entry ke saath saath stop-loss ka bhi proper setup hona chahiye taake market ki volatility se bach sakein. Risk-reward ratio maintain karna bhi zaroori hai taake profits maximize ho sakein aur losses control mein rahein.

Ek aur behtareen tareeka yeh hai ke flag pattern ko doosre indicators ke saath combine kiya jaye jaise ke RSI, MACD, aur moving averages. Yeh indicators confirmation dete hain ke breakout ya breakdown real hai ya fake. Bina confirmation ke blindly trade lena loss ka sabab ban sakta hai.

Common Mistakes Traders Should Avoid

Kai traders flag pattern ko samajhne mein galti karte hain aur unka analysis weak hota hai. Sabse badi mistake yeh hoti hai ke breakout ka wait nahi karte aur consolidation ke beech mein hi entry le lete hain. Yeh ek risk factor hai kyunki consolidation ke andar price kisi bhi direction mein ja sakti hai.

Dusri badi mistake yeh hoti hai ke traders volume ko check nahi karte. Jab ek strong breakout hota hai lekin uske saath volume nahi hoti toh aksar yeh breakout fake hota hai aur price wapas consolidate karna shuru kar deti hai. Is wajah se hamesha breakout ke saath volume ka analysis zaroor karna chahiye.

Teesri mistake yeh hoti hai ke stop-loss lagane ka sahi tareeka nahi aata. Kai traders ya toh stop-loss bohot close rakhte hain jisse chhoti si market volatility bhi unki trade ko stop kar deti hai, ya phir bohot door rakhte hain jisse loss zyada ho jata hai. Stop-loss hamesha flag pattern ke neeche ya upar is tarah rakhna chahiye ke agar price fake breakout kare toh risk minimize ho.

Flag pattern ek bohot useful aur powerful trading pattern hai jo bullish aur bearish dono conditions mein kaam karta hai. Is pattern ko sahi tareeke se identify karna aur uske breakout ya breakdown ka wait karna zaroori hai. Bullish flag breakout hone par buy entry aur bearish flag breakdown hone par sell entry lena best strategy hai. Risk management ka bhi bohot bara role hai, is wajah se hamesha stop-loss aur risk-reward ratio ko maintain karna chahiye. Volume aur doosre indicators ka use karna bhi zaroori hai taake confirmation mil sake. Sabse zaroori baat yeh hai ke patience aur discipline maintain kiya jaye aur blindly trades na li jayein. Agar aap in tamam cheezon ka dhyan rakhein toh flag pattern trading se consistent profits generate kiya ja sakta hai.

Flag Pattern

Flag pattern do parts par depend hota hai, pehla part flagpole aur doosra part flag. Jab market mein ek strong move aata hai jo steep aur sharp hota hai toh usay flagpole kaha jata hai. Yeh move bullish bhi ho sakta hai aur bearish bhi. Jab price is strong move ke baad consolidation karti hai aur ek rectangular ya parallel channel form karti hai toh usay flag kaha jata hai. Yeh consolidation temporary hoti hai aur jab price breakout karti hai toh trend apni pehli direction mein continue karta hai.

Bullish Flag Pattern

Jab bullish flag pattern banta hai toh iska matlab hota hai ke price ek strong bullish move ke baad thodi der ke liye sideways ya downward consolidate kar rahi hai. Iska breakout jab hota hai tab price wapas bullish trend continue karti hai. Yeh pattern aksar uptrend markets mein dekha jata hai jahan buyers dominate kar rahe hote hain.

Bullish flag pattern ko identify karne ka tareeka yeh hai ke pehle ek strong bullish move aaye jo flagpole banaye. Uske baad price consolidation zone mein chali jaye aur ek chhoti descending channel ya sideways movement dikhaye. Yeh consolidation resistance aur support ke andar hoti hai. Jab price resistance tod kar breakout karti hai toh bullish flag confirm ho jata hai aur traders entry le sakte hain.

Is pattern par trade karne ke liye breakout ka wait karna zaroori hota hai. Jaise hi price previous resistance todti hai aur volume increase hota hai, wahan ek achi buy entry li ja sakti hai. Stop-loss usually flag ke lowest point ke neeche lagaya jata hai taake risk minimize ho sake. Target price estimate karne ke liye flagpole ka height measure karna madadgar hota hai, jise breakout point se upar apply kiya jata hai.

Bearish Flag Pattern

Bearish flag pattern bilkul bullish flag ka ulta hota hai. Yeh tab form hota hai jab price ek strong bearish move karti hai aur phir temporarily upward ya sideways consolidate karti hai. Jab price support todti hai toh bearish trend continue hota hai.

Is pattern ko identify karne ka tareeka bhi simple hai. Pehle ek strong bearish move hota hai jo flagpole form karta hai. Phir price ek chhoti ascending channel ya sideways movement mein consolidate karti hai. Yeh consolidation resistance aur support ke andar hoti hai. Jab price support tod kar neeche breakout karti hai toh bearish flag confirm ho jata hai.

Is pattern par trade karne ke liye breakdown ka wait karna zaroori hota hai. Jaise hi price previous support todti hai aur volume increase hota hai, wahan ek achi sell entry li ja sakti hai. Stop-loss usually flag ke highest point ke upar lagaya jata hai taake risk minimize ho sake. Target price ka estimation flagpole ke height ko measure karne ke baad breakout point se neeche apply karke kiya jata hai.

Best Way to Trade Flag Patterns

Flag pattern ko trade karne ke liye sabse pehle usay sahi tareeke se identify karna zaroori hai. Aksar traders galti karte hain aur consolidation ko flag pattern samajh lete hain jabke wo sirf ek normal sideways move hota hai. Is wajah se breakout ka wait karna aur volume ka analysis karna zaroori hai.

Jab bullish flag pattern banta hai toh buy entry sirf breakout ke baad leni chahiye. Ussi tarah bearish flag pattern mein sell entry breakdown ke baad leni chahiye. Entry ke saath saath stop-loss ka bhi proper setup hona chahiye taake market ki volatility se bach sakein. Risk-reward ratio maintain karna bhi zaroori hai taake profits maximize ho sakein aur losses control mein rahein.

Ek aur behtareen tareeka yeh hai ke flag pattern ko doosre indicators ke saath combine kiya jaye jaise ke RSI, MACD, aur moving averages. Yeh indicators confirmation dete hain ke breakout ya breakdown real hai ya fake. Bina confirmation ke blindly trade lena loss ka sabab ban sakta hai.

Common Mistakes Traders Should Avoid

Kai traders flag pattern ko samajhne mein galti karte hain aur unka analysis weak hota hai. Sabse badi mistake yeh hoti hai ke breakout ka wait nahi karte aur consolidation ke beech mein hi entry le lete hain. Yeh ek risk factor hai kyunki consolidation ke andar price kisi bhi direction mein ja sakti hai.

Dusri badi mistake yeh hoti hai ke traders volume ko check nahi karte. Jab ek strong breakout hota hai lekin uske saath volume nahi hoti toh aksar yeh breakout fake hota hai aur price wapas consolidate karna shuru kar deti hai. Is wajah se hamesha breakout ke saath volume ka analysis zaroor karna chahiye.

Teesri mistake yeh hoti hai ke stop-loss lagane ka sahi tareeka nahi aata. Kai traders ya toh stop-loss bohot close rakhte hain jisse chhoti si market volatility bhi unki trade ko stop kar deti hai, ya phir bohot door rakhte hain jisse loss zyada ho jata hai. Stop-loss hamesha flag pattern ke neeche ya upar is tarah rakhna chahiye ke agar price fake breakout kare toh risk minimize ho.

Flag pattern ek bohot useful aur powerful trading pattern hai jo bullish aur bearish dono conditions mein kaam karta hai. Is pattern ko sahi tareeke se identify karna aur uske breakout ya breakdown ka wait karna zaroori hai. Bullish flag breakout hone par buy entry aur bearish flag breakdown hone par sell entry lena best strategy hai. Risk management ka bhi bohot bara role hai, is wajah se hamesha stop-loss aur risk-reward ratio ko maintain karna chahiye. Volume aur doosre indicators ka use karna bhi zaroori hai taake confirmation mil sake. Sabse zaroori baat yeh hai ke patience aur discipline maintain kiya jaye aur blindly trades na li jayein. Agar aap in tamam cheezon ka dhyan rakhein toh flag pattern trading se consistent profits generate kiya ja sakta hai.

تبصرہ

Расширенный режим Обычный режим