**Three Inside Up Candlestick Pattern**

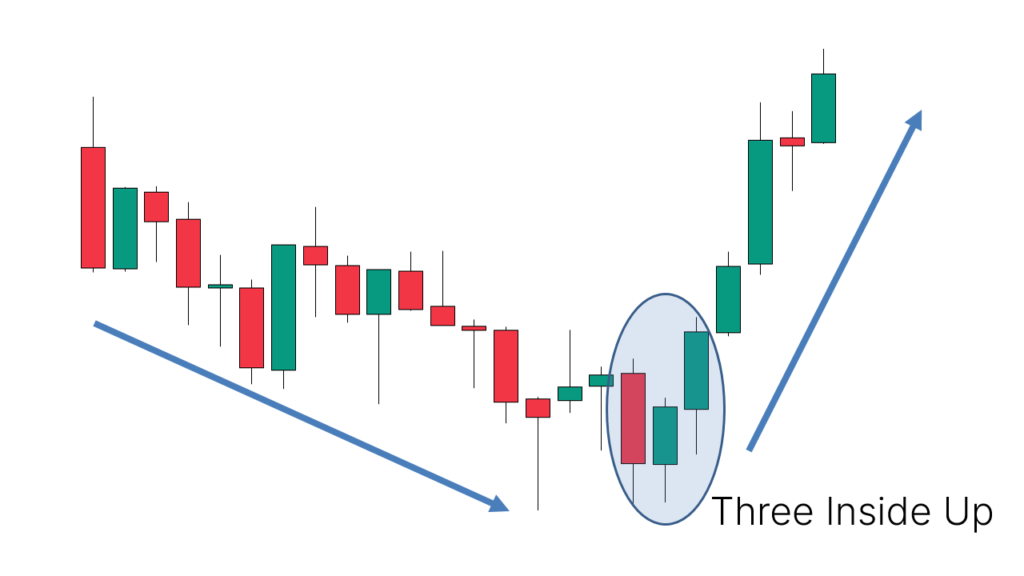

Candlestick patterns market mein traders ke liye bohat ahem hote hain jo market ki sentiments ko samajhne mein madad dete hain. Ek aisi pattern jo "Three Inside Up" kehlata hai, yeh bullish reversals ki possibility ko signal karta hai. Yeh pattern tab banta hai jab ek downtrend ke baad market ki direction mein change hone ki ummeed hoti hai.

**Pattern Ko Identify Karna:**

Three Inside Up pattern ko pehchane ke liye, in cheezon par tawajjo dein:

1. **Pehla Candle:** Lamba bearish candle jo sellers ki dominance ko darshata hai.

2. **Doosra Candle:** Chota bullish candle, jo pehle candle ke andar close hota hai.

3. **Teesra Candle:** Ek aur bullish candle, jo doosre candle ke high ke upar close hota hai, aksar ek gap-up ke saath.

**Market Sentiment Ki Tashkeel:**

- **Bearish Exhaustion:** Pehla candle strong selling pressure dikhata hai lekin doosre candle mein buyers ki activity nazar aati hai.

- **Bullish Reversal Confirmation:** Teesra candle trend reversal ko confirm karta hai jab wo higher close hota hai, is se maloom hota hai ke buyers control mein aa rahe hain.

**Trading Strategy:**

- **Entry:** Teesre candle ke higher close ke baad long position enter karein, preferably stop-loss pehle pattern ke lowest point ke neeche lagaye.

- **Exit:** Price resistance ya exhaustion ke signs dikhane par profit book karein.

**Risk Management:**

- **Stop-loss:** Losses ko limit karne ke liye zaroori hai agar pattern fail ho jaye. Market conditions aur timeframe ke mutabiq adjust karein.

- **Confirmation:** Strong signals ke liye doosre technical indicators aur volume analysis ke saath combine karein.

**Misal mein:**

- **Chart Analysis:** Daily chart par dekhein ke kaise pattern unfold hota hai aur iska asar subsequent price movements par hota hai.

- **Timeframe Consideration:** Swing traders aur investors ke liye suitable hai jo trend reversals ko dekh rahe hain.

**Conclusion:**

Candlestick patterns jaise Three Inside Up seekhna trading decisions ko improve karta hai. Practice karke patterns ko identify aur validate karna trading strategy ko refine karta hai aur market opportunities ko capitalize karne mein madad deta hai.

Yaad rakhein, successful trading ke liye discipline, risk management aur continuous learning zaroori hai. Candlestick patterns ko apne technical analysis toolkit ka hissa banayein aur informed trading decisions lein.

Candlestick patterns market mein traders ke liye bohat ahem hote hain jo market ki sentiments ko samajhne mein madad dete hain. Ek aisi pattern jo "Three Inside Up" kehlata hai, yeh bullish reversals ki possibility ko signal karta hai. Yeh pattern tab banta hai jab ek downtrend ke baad market ki direction mein change hone ki ummeed hoti hai.

**Pattern Ko Identify Karna:**

Three Inside Up pattern ko pehchane ke liye, in cheezon par tawajjo dein:

1. **Pehla Candle:** Lamba bearish candle jo sellers ki dominance ko darshata hai.

2. **Doosra Candle:** Chota bullish candle, jo pehle candle ke andar close hota hai.

3. **Teesra Candle:** Ek aur bullish candle, jo doosre candle ke high ke upar close hota hai, aksar ek gap-up ke saath.

**Market Sentiment Ki Tashkeel:**

- **Bearish Exhaustion:** Pehla candle strong selling pressure dikhata hai lekin doosre candle mein buyers ki activity nazar aati hai.

- **Bullish Reversal Confirmation:** Teesra candle trend reversal ko confirm karta hai jab wo higher close hota hai, is se maloom hota hai ke buyers control mein aa rahe hain.

**Trading Strategy:**

- **Entry:** Teesre candle ke higher close ke baad long position enter karein, preferably stop-loss pehle pattern ke lowest point ke neeche lagaye.

- **Exit:** Price resistance ya exhaustion ke signs dikhane par profit book karein.

**Risk Management:**

- **Stop-loss:** Losses ko limit karne ke liye zaroori hai agar pattern fail ho jaye. Market conditions aur timeframe ke mutabiq adjust karein.

- **Confirmation:** Strong signals ke liye doosre technical indicators aur volume analysis ke saath combine karein.

**Misal mein:**

- **Chart Analysis:** Daily chart par dekhein ke kaise pattern unfold hota hai aur iska asar subsequent price movements par hota hai.

- **Timeframe Consideration:** Swing traders aur investors ke liye suitable hai jo trend reversals ko dekh rahe hain.

**Conclusion:**

Candlestick patterns jaise Three Inside Up seekhna trading decisions ko improve karta hai. Practice karke patterns ko identify aur validate karna trading strategy ko refine karta hai aur market opportunities ko capitalize karne mein madad deta hai.

Yaad rakhein, successful trading ke liye discipline, risk management aur continuous learning zaroori hai. Candlestick patterns ko apne technical analysis toolkit ka hissa banayein aur informed trading decisions lein.

تبصرہ

Расширенный режим Обычный режим