What is Gator oscillator?

Oscillator aik Bill Williams indicator hai yes is degree ko pehchanney mein madad karta hai jis tak market ka rujhan hai. yeh alligator indicator ( aik aur Williams indicator jo market mein bdalty hue rujhanaat ka taayun karne ke liye moving average istemaal beh hai ) aurli karta karta keith sateen. yeh laundry saada moving averages hain jin ka hisaab mukhtalif auqaat mein darj zail hai .

1)-Green alligator ke honton ka hisaab 5 muddat ke saada moving average ke tor par kya jata hai aur 3 baar agay muntaqil kya jata hai .

2) -Red alligator ke danoton ka hisaab 9 muddat ke saada moving average ke tor par kya jata hai aur usay 5 baar agay muntaqil kya jata hai .

3) -Blue alligator ka jabra 13 muddat ka saada moving average hai aur 8 baar agay muntaqil kar diya gaya hai .

Un linon ka istemaal un eqdaar ka hisaab laganay ke liye kya jata hai jo dohri Histogram bananas mein madad karti hain. dono Histogram zero line ke dono taraf, oopar aur neechay banaye gaye hain. woh qeemat ke graph ke neechay rakhay gaye hain aur market ke jari rujhan ko samajhney mein madad karte hain .

jabron aur danoton ke darmiyan mutlaq farq misbet qader hai, yes sifar ki lakeer ke oopar niilii aur surkh lakiron ki terhan khenchi jati hai. manfi qader danoton aur honton ke darmiyan mutlaq farq hai, yes sifar ki lakeer ke neechay surkh aur sabz lakiron ke tor par khenchi gayi hai. qader jitni ziyada hogi ( Histogramki ziyada se ziyada ya kam az kam ), rujhan itna hi mazboot hoga aur is ke bar aks. mukhtalif rang ki salakhain market ke mukhtalif halaat ki nishandahi karti hain.

1) -Gator eats ji ki soorat e haal je waqt banti hai jab zero line ke dono taraf sabz rang ki salakhain hon ( blush market ka jazbaat ).

2) - Gator jaagne ki soorat e haal je waqt banti hai jab sifar line ke dono taraf mukhtalif rang ki salakhain hon (mazboot market).

3) -Gator slips ki soorat e haal is waqt banti hai jab zero line ke dono taraf surkh salakhain hon (mandi ka bazar ka jazba).

4) -Gator fils out ki soorat e haal is waqt banti hai jab Gator eats Fez ke douran sifar line ke dono taraf sirf aik hi surkh baar hota hai .

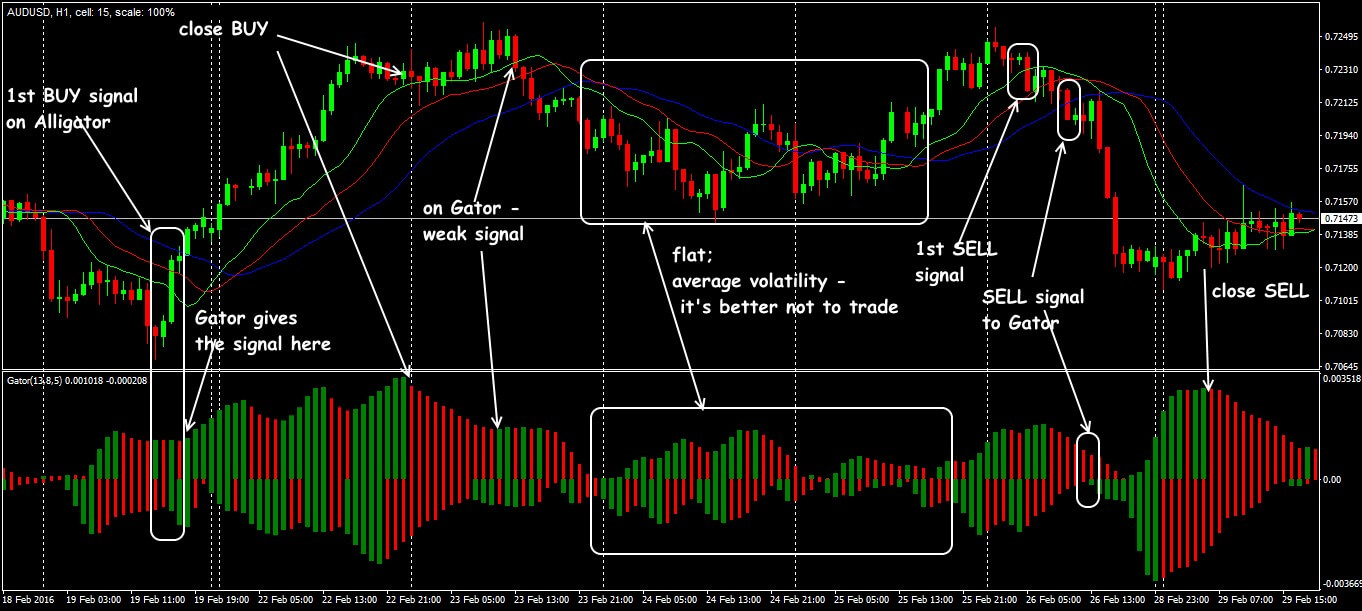

How to read Gator oscillator?

Gator oscillator window ke sath qeemat ke chart mein, sifar ki lakeer ke ird gird sabz aur surkh dono baar nazar atay hain. yeh sifar line ke oopar aur neechay bal tarteeb oscillator ki misbet aur manfi dono qadron ko aik sath dekhata hai .

Gator oscillator isharay mein chaar oscillator hain, aur yeh hai ke aap inhen kaisay parh satke hain ;

1)-khanay ka marhala yeh zahir karta hai ke aik trending trh hai aur yeh tajweez karta hai ke aap tijarti muddat ke douran apni pozishnin khuli rakhen. je marhalay mein, mutharrak ost mukhtalif qeematon ki sthon par phaily hui hain aur aap ki mojooda pozishnon ko khula rakhnay aur nai daakhil karne ke liye dakhlay ki misali satah faraham karti hain .

2) -Baydaari ka marhala yeh zahir karta hai ke aik naya rujhan ban raha hai aur aik purana khatam ho raha hai. je marhalay mein harkat pazeeri ost pehlay se ziyada wasee hoti hai, aur isharay je baat ka taayun karta hai ke yeh mutharrak ost mustaqbil mein market ko kis simt le ja sakti hai. je marhalay ko riursel Fez bhi kaha ja sakta hai aur taizi ke ulat ya bear riursel mein misali dakhlay ya kharji satah faraham karta hai. bal tarteeb

3) -Neend ke marhalay se morad aisi sorat e haal hai jis ka koi rujhan nahi hai. is ka matlab hai ke tamam mutharrak ost baghair kisi wazeh simt ke aik dosray ko uboor kar rahay hain. is soorat e haal mein, aap ko koi nai position nah kholnay ka mahswara diya jata hai .

is ke bajaye, aap ko is waqt tak intzaar karna chahiye jab tak ke aik wazeh rujhan ki simt nah ban jaye .

4) -Bharnay ke marhalay ko bayan kardah marhalay ke naam se bhi jana jata hai, jis ka matlab hai ke rujhan saaz market ab sust ho rahi hai. je ka matlab yeh bhi ho sakta hai ke mojooda rujhan khatam ho raha hai, je liye aap ko je ke mutabiq positions khareedna ya bechna chahiye. agar koi up trained khatam ho raha hai, to aap ko farokht karne ka ishara diya jata hai, aur agar neechay ka rujhan khatam ho raha hai, to aap ko naye anay walay rujhan se faida uthany ke liye kharidne diya ja mah.

Oscillator aik Bill Williams indicator hai yes is degree ko pehchanney mein madad karta hai jis tak market ka rujhan hai. yeh alligator indicator ( aik aur Williams indicator jo market mein bdalty hue rujhanaat ka taayun karne ke liye moving average istemaal beh hai ) aurli karta karta keith sateen. yeh laundry saada moving averages hain jin ka hisaab mukhtalif auqaat mein darj zail hai .

1)-Green alligator ke honton ka hisaab 5 muddat ke saada moving average ke tor par kya jata hai aur 3 baar agay muntaqil kya jata hai .

2) -Red alligator ke danoton ka hisaab 9 muddat ke saada moving average ke tor par kya jata hai aur usay 5 baar agay muntaqil kya jata hai .

3) -Blue alligator ka jabra 13 muddat ka saada moving average hai aur 8 baar agay muntaqil kar diya gaya hai .

Un linon ka istemaal un eqdaar ka hisaab laganay ke liye kya jata hai jo dohri Histogram bananas mein madad karti hain. dono Histogram zero line ke dono taraf, oopar aur neechay banaye gaye hain. woh qeemat ke graph ke neechay rakhay gaye hain aur market ke jari rujhan ko samajhney mein madad karte hain .

jabron aur danoton ke darmiyan mutlaq farq misbet qader hai, yes sifar ki lakeer ke oopar niilii aur surkh lakiron ki terhan khenchi jati hai. manfi qader danoton aur honton ke darmiyan mutlaq farq hai, yes sifar ki lakeer ke neechay surkh aur sabz lakiron ke tor par khenchi gayi hai. qader jitni ziyada hogi ( Histogramki ziyada se ziyada ya kam az kam ), rujhan itna hi mazboot hoga aur is ke bar aks. mukhtalif rang ki salakhain market ke mukhtalif halaat ki nishandahi karti hain.

1) -Gator eats ji ki soorat e haal je waqt banti hai jab zero line ke dono taraf sabz rang ki salakhain hon ( blush market ka jazbaat ).

2) - Gator jaagne ki soorat e haal je waqt banti hai jab sifar line ke dono taraf mukhtalif rang ki salakhain hon (mazboot market).

3) -Gator slips ki soorat e haal is waqt banti hai jab zero line ke dono taraf surkh salakhain hon (mandi ka bazar ka jazba).

4) -Gator fils out ki soorat e haal is waqt banti hai jab Gator eats Fez ke douran sifar line ke dono taraf sirf aik hi surkh baar hota hai .

How to read Gator oscillator?

Gator oscillator window ke sath qeemat ke chart mein, sifar ki lakeer ke ird gird sabz aur surkh dono baar nazar atay hain. yeh sifar line ke oopar aur neechay bal tarteeb oscillator ki misbet aur manfi dono qadron ko aik sath dekhata hai .

Gator oscillator isharay mein chaar oscillator hain, aur yeh hai ke aap inhen kaisay parh satke hain ;

1)-khanay ka marhala yeh zahir karta hai ke aik trending trh hai aur yeh tajweez karta hai ke aap tijarti muddat ke douran apni pozishnin khuli rakhen. je marhalay mein, mutharrak ost mukhtalif qeematon ki sthon par phaily hui hain aur aap ki mojooda pozishnon ko khula rakhnay aur nai daakhil karne ke liye dakhlay ki misali satah faraham karti hain .

2) -Baydaari ka marhala yeh zahir karta hai ke aik naya rujhan ban raha hai aur aik purana khatam ho raha hai. je marhalay mein harkat pazeeri ost pehlay se ziyada wasee hoti hai, aur isharay je baat ka taayun karta hai ke yeh mutharrak ost mustaqbil mein market ko kis simt le ja sakti hai. je marhalay ko riursel Fez bhi kaha ja sakta hai aur taizi ke ulat ya bear riursel mein misali dakhlay ya kharji satah faraham karta hai. bal tarteeb

3) -Neend ke marhalay se morad aisi sorat e haal hai jis ka koi rujhan nahi hai. is ka matlab hai ke tamam mutharrak ost baghair kisi wazeh simt ke aik dosray ko uboor kar rahay hain. is soorat e haal mein, aap ko koi nai position nah kholnay ka mahswara diya jata hai .

is ke bajaye, aap ko is waqt tak intzaar karna chahiye jab tak ke aik wazeh rujhan ki simt nah ban jaye .

4) -Bharnay ke marhalay ko bayan kardah marhalay ke naam se bhi jana jata hai, jis ka matlab hai ke rujhan saaz market ab sust ho rahi hai. je ka matlab yeh bhi ho sakta hai ke mojooda rujhan khatam ho raha hai, je liye aap ko je ke mutabiq positions khareedna ya bechna chahiye. agar koi up trained khatam ho raha hai, to aap ko farokht karne ka ishara diya jata hai, aur agar neechay ka rujhan khatam ho raha hai, to aap ko naye anay walay rujhan se faida uthany ke liye kharidne diya ja mah.

تبصرہ

Расширенный режим Обычный режим