What is Falling Wedge Pattern?

Falling wedge pattern aik taizi ka namona hai. pachar ki barhti hui tashkeel ke sath, yeh dono aik taaqatwar namona banatay hain jo rujhan ki simt mein tabdeeli ka ishara dete hain. aam tor par, girtay hue pay patteren ko aik ulat patteren samjha jata hai, halaank aisi misalein mojood hain jab yeh aik hi rujhan ko jari rakhnay mein sahoolat faraham karta hai. yeh mazmoon girtay hue pachar ki saakht, je ki ahmiyat ke sath sath je patteren ko trade karne ke liye takneeki nuqta nazar ki wazahat karta hai. hum aik alehda blog post mein pachar ke barhatay hue patteren par baat karen ge .

where does the Falling wedge occur?

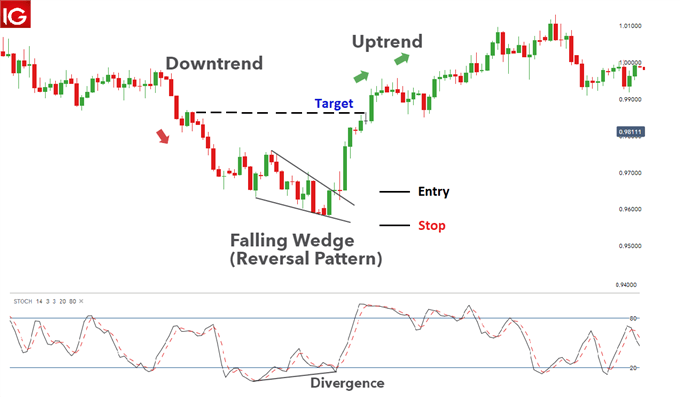

Falling wedge pattern is waqt hota hai jab asasa ki qeemat majmoi tor par taizi ke rujhan mein agay barh rahi hoti hai je se pehlay ke qeemat ki karwai kam ho jaye. is friend back to andar, to trained linen khenchi gayi hain. Consolidation ka hissa je waqt khatam hota hai strike price action oopri trained line ke zariye phatt jata hai, ya wages rizstns. girtay hue pay patteren ki ahem khususiyaat mein se aik hajam hai, jo channel ke knorj honay par kam hota hai. channel ke andar tawanai ke istehkaam ke baad, khredar tawazun ko apne faiday ke liye muntaqil kar satke hain aur qeemat ki karwai ko ziyada shuru kar satke hain .

Characteristics of Falling wedge pattern;

1) -Qeemat ki karwai earzi tor par neechay ke rujhan mein tijarat karti hai ( nichli oonchai aur nichli satah );

2) -Doing trained laundry hain (oopri aur lower) jo aapas mein mil rahi hain.

3) -channel ki taraqqi ke sath hi hajam mein kami waqay hoti hai .

Spotting the Falling wedge pattern;

Sab se aam girtay hue pachar ki tashkeel clean trained mein hoti hai. qeemat ki karwai ziyada tijarat karti hai, taham khredar aik mauqa par raftaar kho dete hain aur reechh qeemat ki karwai par earzi control haasil kar letay hain .

Dosra marhala woh hai jab konsolideshan ka marhala shuru hota hai, jo qeemat ki karwai ko kam karta hai. utartay hue channel aur girnay walay pachar ke darmiyan farq ko note karna zaroori hai. aik channel mein, price action nichli oonchaiyon aur nichli sthon ka aik silsila banata hai jab ke nazooli pachar mein hamaray paas nichli oonchai bhi hoti hai lekin kam qeematein ziyada qeematon par print hoti hain. je wajah se, hamaray paas do trained lines hain jo matawazi nahi chal rahi hain .

What the Falling wedge tell us?

Falling wedge pattern aik takneeki tashkeel hai jo istehkaam ke marhalay ke ekhtataam ka ishara children hai jis ne neechay ki taraf palat back ko sahoolat faraham ki. jaisa ke pehlay bayan kya gaya hai, girtay hue pachar aik ulat aur tasalsul ka namona dono ho satke hain. johar mein, tasalsul aur ulat dono mnzrname fitri tor par taiz hain .

je terhan, girnay walay pachar ko" tufaan se pehlay pursukoon" ke tor par bayan kya ja sakta hai. ka marhala kharidaron ki taraf se dobarah jama honay aur nai kharidari ki dilchaspi ko buland karne ke liye kya jaye ga .

Lehaza, girta sun-hwa pachar aik ahem takneeki tashkeel hai jo is baat ka ishara karta hai ke islaah, ya istehkaam, abhi khatam sun-hwa hai kyunkay asasa ki qeemat ne pachar ko oopar ki taraf a mamutar diya me majmoi rujhan ka tasalsul jari hey

Falling wedge pattern aik taizi ka namona hai. pachar ki barhti hui tashkeel ke sath, yeh dono aik taaqatwar namona banatay hain jo rujhan ki simt mein tabdeeli ka ishara dete hain. aam tor par, girtay hue pay patteren ko aik ulat patteren samjha jata hai, halaank aisi misalein mojood hain jab yeh aik hi rujhan ko jari rakhnay mein sahoolat faraham karta hai. yeh mazmoon girtay hue pachar ki saakht, je ki ahmiyat ke sath sath je patteren ko trade karne ke liye takneeki nuqta nazar ki wazahat karta hai. hum aik alehda blog post mein pachar ke barhatay hue patteren par baat karen ge .

where does the Falling wedge occur?

Falling wedge pattern is waqt hota hai jab asasa ki qeemat majmoi tor par taizi ke rujhan mein agay barh rahi hoti hai je se pehlay ke qeemat ki karwai kam ho jaye. is friend back to andar, to trained linen khenchi gayi hain. Consolidation ka hissa je waqt khatam hota hai strike price action oopri trained line ke zariye phatt jata hai, ya wages rizstns. girtay hue pay patteren ki ahem khususiyaat mein se aik hajam hai, jo channel ke knorj honay par kam hota hai. channel ke andar tawanai ke istehkaam ke baad, khredar tawazun ko apne faiday ke liye muntaqil kar satke hain aur qeemat ki karwai ko ziyada shuru kar satke hain .

Characteristics of Falling wedge pattern;

1) -Qeemat ki karwai earzi tor par neechay ke rujhan mein tijarat karti hai ( nichli oonchai aur nichli satah );

2) -Doing trained laundry hain (oopri aur lower) jo aapas mein mil rahi hain.

3) -channel ki taraqqi ke sath hi hajam mein kami waqay hoti hai .

Spotting the Falling wedge pattern;

Sab se aam girtay hue pachar ki tashkeel clean trained mein hoti hai. qeemat ki karwai ziyada tijarat karti hai, taham khredar aik mauqa par raftaar kho dete hain aur reechh qeemat ki karwai par earzi control haasil kar letay hain .

Dosra marhala woh hai jab konsolideshan ka marhala shuru hota hai, jo qeemat ki karwai ko kam karta hai. utartay hue channel aur girnay walay pachar ke darmiyan farq ko note karna zaroori hai. aik channel mein, price action nichli oonchaiyon aur nichli sthon ka aik silsila banata hai jab ke nazooli pachar mein hamaray paas nichli oonchai bhi hoti hai lekin kam qeematein ziyada qeematon par print hoti hain. je wajah se, hamaray paas do trained lines hain jo matawazi nahi chal rahi hain .

What the Falling wedge tell us?

Falling wedge pattern aik takneeki tashkeel hai jo istehkaam ke marhalay ke ekhtataam ka ishara children hai jis ne neechay ki taraf palat back ko sahoolat faraham ki. jaisa ke pehlay bayan kya gaya hai, girtay hue pachar aik ulat aur tasalsul ka namona dono ho satke hain. johar mein, tasalsul aur ulat dono mnzrname fitri tor par taiz hain .

je terhan, girnay walay pachar ko" tufaan se pehlay pursukoon" ke tor par bayan kya ja sakta hai. ka marhala kharidaron ki taraf se dobarah jama honay aur nai kharidari ki dilchaspi ko buland karne ke liye kya jaye ga .

Lehaza, girta sun-hwa pachar aik ahem takneeki tashkeel hai jo is baat ka ishara karta hai ke islaah, ya istehkaam, abhi khatam sun-hwa hai kyunkay asasa ki qeemat ne pachar ko oopar ki taraf a mamutar diya me majmoi rujhan ka tasalsul jari hey

تبصرہ

Расширенный режим Обычный режим