Waves in Technical Analysis: Samajhne Ka Tariqa

Technical analysis, jo ke market trends aur price movements ko samajhne ka ek tareeqa hai, usmein "waves" ka concept bohot important hai. Waves, basically, market ki price movements ko samajhne aur predict karne mein madad karte hain. In waves ko identify kar ke traders market ki future direction ko samajhte hain. Is article mein hum waves ke concept ko explore karenge, aur samjhenge ke yeh kis tarah se technical analysis mein use hoti hain.

1. Waves Ka Basic Concept:

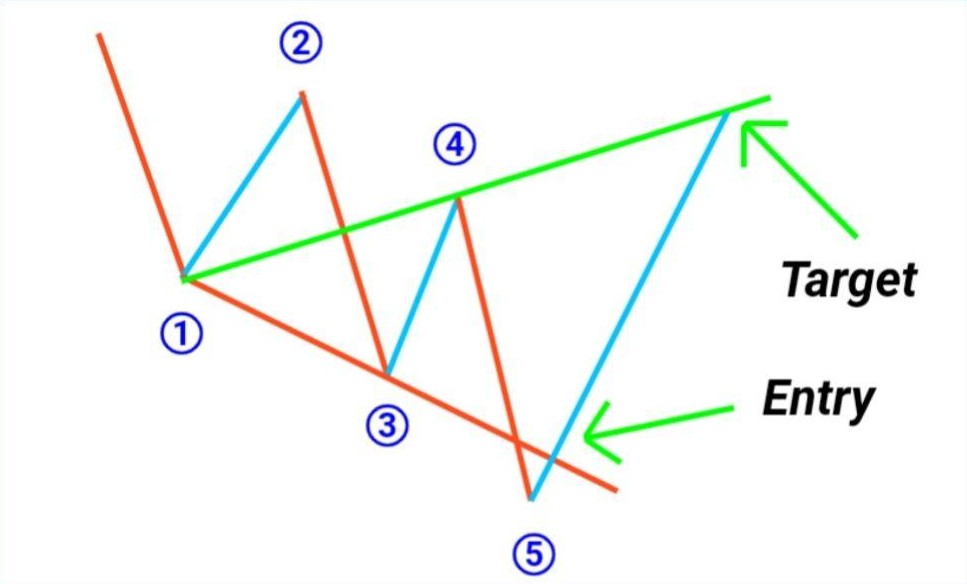

Waves ka concept Elliott Wave Theory se aata hai, jo 1930s mein Ralph Nelson Elliott ne develop ki thi. Unhone yeh kaha tha ke markets mein price movements repetitive patterns mein hoti hain, jo ke waves ke form mein hoti hain. In waves ko do categories mein divide kiya gaya hai: impulse waves aur corrective waves.

Elliott Wave Theory ki madad se hum market ki price movement ko samajhne ki koshish karte hain. Is theory ke mutabiq, har wave ek pattern ko follow karti hai, aur har wave ka apna ek specific time frame aur amplitude hota hai. Elliott ne market ke price movements ko 5 impulse waves aur 3 corrective waves mein divide kiya tha. Yeh waves ek cycle ke form mein hoti hain aur in cycles ko repeat hota hai.

Elliott Wave Theory ke mutabiq, market ke movements ko predict karna possible hai, agar aap correctly waves ko identify kar sakein. Is theory mein, har wave ka ek specific role hota hai jo aapko market ki future direction ko samajhne mein madad deta hai.

3. Wave Patterns Ko Pehchanna:

Technical analysis mein, waves ko pehchanna bohot zaroori hota hai, kyun ke yeh aapko trend reversal aur continuation ke signals dete hain. Jab aap impulse aur corrective waves ko samajh lete hain, toh aap market ki movements ko predict kar sakte hain.

Wave patterns ko identify karna thoda challenging ho sakta hai, lekin experience ke sath aap yeh kar paenge. Aapko yeh samajhna hoga ke impulse waves aksar trend ke direction mein hoti hain, aur corrective waves trend ke against hoti hain. Jab aap in patterns ko accurately identify karte hain, toh aap entry aur exit points ko bohot behtar tarike se manage kar sakte hain.

4. Market Trend Aur Waves:

Market trends ko samajhne ke liye waves ka analysis bohot zaroori hai. Jab market ka trend upward hota hai, toh impulse waves upward hoti hain aur corrective waves downward. Is trend ko samajh kar, aap market ke movements ko track kar sakte hain. Har wave ka apna ek duration aur amplitude hota hai, aur yeh sab cheezein aapko trend ko samajhne mein madad deti hain.

Agar aap trend ko accurately identify karte hain, toh aapko pata chal sakta hai ke market kis direction mein move karne wala hai.

5. Waves Ko Use Karna:

Technical analysis mein waves ka use karna market ke future movements ko predict karne ka ek behtareen tareeqa hai. Jab aap market ki waves ko samajhte hain, toh aap entry aur exit points ko identify kar sakte hain. Yeh waves aapko price action ke basis par trading decisions lene mein madad karte hain.

Waves ka analysis aapko market ke major reversals aur continuation points ko samajhne mein madad karta hai, jo ke trading decisions mein crucial hote hain.

6. Challenges in Using Waves:

Waves ka analysis karte waqt kuch challenges bhi samne aa sakte hain. Sabse pehla challenge yeh hai ke waves har time bilkul clear nahi hoti. Kabhi-kabhi waves ki identification bohot mushkil hoti hai, aur incorrect identification se losses bhi ho sakte hain. Iske alawa, market conditions bhi kabhi unpredictable hoti hain, jo waves ke pattern ko alter kar deti hain.

Is liye, technical analysis mein waves ka use karte waqt experience aur practice bohot zaroori hai.

Conclusion:

Waves in technical analysis ek powerful tool hain jo traders ko market ke trends aur price movements ko samajhne mein madad deti hain. Elliott Wave Theory ke zariye, hum market ki price action ko identify kar ke future trends ko predict kar sakte hain. Lekin, waves ka analysis karte waqt challenges bhi hote hain, is liye practice aur patience zaroori hai. Agar aap waves ko accurately identify kar lete hain, toh aap trading decisions ko behtar tarike se manage kar sakte hain.

Technical analysis, jo ke market trends aur price movements ko samajhne ka ek tareeqa hai, usmein "waves" ka concept bohot important hai. Waves, basically, market ki price movements ko samajhne aur predict karne mein madad karte hain. In waves ko identify kar ke traders market ki future direction ko samajhte hain. Is article mein hum waves ke concept ko explore karenge, aur samjhenge ke yeh kis tarah se technical analysis mein use hoti hain.

1. Waves Ka Basic Concept:

Waves ka concept Elliott Wave Theory se aata hai, jo 1930s mein Ralph Nelson Elliott ne develop ki thi. Unhone yeh kaha tha ke markets mein price movements repetitive patterns mein hoti hain, jo ke waves ke form mein hoti hain. In waves ko do categories mein divide kiya gaya hai: impulse waves aur corrective waves.

- Impulse Waves: Yeh waves market ke main trend ko follow karti hain. Jab market upward move kar raha hota hai, toh impulse waves bhi upward hoti hain, aur jab market downward move kar raha hota hai, toh impulse waves bhi downward hoti hain. Impulse waves ko 5 sub-waves mein divide kiya gaya hai.

- Corrective Waves: Yeh waves market ke trend ke against hoti hain. Agar market upward trend mein hai, toh corrective waves downward hoti hain, aur agar market downward trend mein hai, toh corrective waves upward hoti hain. Corrective waves ko 3 sub-waves mein divide kiya jata hai.

Elliott Wave Theory ki madad se hum market ki price movement ko samajhne ki koshish karte hain. Is theory ke mutabiq, har wave ek pattern ko follow karti hai, aur har wave ka apna ek specific time frame aur amplitude hota hai. Elliott ne market ke price movements ko 5 impulse waves aur 3 corrective waves mein divide kiya tha. Yeh waves ek cycle ke form mein hoti hain aur in cycles ko repeat hota hai.

- Impulse Waves: 5 waves hoti hain, jo market ke main trend ko follow karti hain.

- Corrective Waves: 3 waves hoti hain, jo market ke main trend ke against hoti hain.

Elliott Wave Theory ke mutabiq, market ke movements ko predict karna possible hai, agar aap correctly waves ko identify kar sakein. Is theory mein, har wave ka ek specific role hota hai jo aapko market ki future direction ko samajhne mein madad deta hai.

3. Wave Patterns Ko Pehchanna:

Technical analysis mein, waves ko pehchanna bohot zaroori hota hai, kyun ke yeh aapko trend reversal aur continuation ke signals dete hain. Jab aap impulse aur corrective waves ko samajh lete hain, toh aap market ki movements ko predict kar sakte hain.

Wave patterns ko identify karna thoda challenging ho sakta hai, lekin experience ke sath aap yeh kar paenge. Aapko yeh samajhna hoga ke impulse waves aksar trend ke direction mein hoti hain, aur corrective waves trend ke against hoti hain. Jab aap in patterns ko accurately identify karte hain, toh aap entry aur exit points ko bohot behtar tarike se manage kar sakte hain.

4. Market Trend Aur Waves:

Market trends ko samajhne ke liye waves ka analysis bohot zaroori hai. Jab market ka trend upward hota hai, toh impulse waves upward hoti hain aur corrective waves downward. Is trend ko samajh kar, aap market ke movements ko track kar sakte hain. Har wave ka apna ek duration aur amplitude hota hai, aur yeh sab cheezein aapko trend ko samajhne mein madad deti hain.

- Uptrend: Jab market ka trend upward hota hai, toh impulse waves upward hoti hain aur corrective waves downward hoti hain. Is scenario mein, traders zyada opportunities dekhte hain jo buy positions ke liye hoti hain.

- Downtrend: Jab market ka trend downward hota hai, toh impulse waves downward hoti hain aur corrective waves upward hoti hain. Is scenario mein, traders sell positions ko target karte hain.

Agar aap trend ko accurately identify karte hain, toh aapko pata chal sakta hai ke market kis direction mein move karne wala hai.

5. Waves Ko Use Karna:

Technical analysis mein waves ka use karna market ke future movements ko predict karne ka ek behtareen tareeqa hai. Jab aap market ki waves ko samajhte hain, toh aap entry aur exit points ko identify kar sakte hain. Yeh waves aapko price action ke basis par trading decisions lene mein madad karte hain.

- Trend Reversal: Jab corrective waves apni maximum level tak pohanchti hain, toh yeh ek potential trend reversal ka signal hota hai. Yani agar market ek downward trend mein ho aur corrective wave upward move kar rahi ho, toh yeh upward trend ke start ka indication de sakti hai.

- Trend Continuation: Jab impulse waves apne maximum level tak pohanchti hain, aur corrective waves start hoti hain, toh yeh ek trend continuation ka signal hota hai. Yeh indicate karta hai ke market apne current trend ko continue karega.

Waves ka analysis aapko market ke major reversals aur continuation points ko samajhne mein madad karta hai, jo ke trading decisions mein crucial hote hain.

6. Challenges in Using Waves:

Waves ka analysis karte waqt kuch challenges bhi samne aa sakte hain. Sabse pehla challenge yeh hai ke waves har time bilkul clear nahi hoti. Kabhi-kabhi waves ki identification bohot mushkil hoti hai, aur incorrect identification se losses bhi ho sakte hain. Iske alawa, market conditions bhi kabhi unpredictable hoti hain, jo waves ke pattern ko alter kar deti hain.

- Overlapping Waves: Kabhi kabhi waves overlap kar jaati hain, jo pattern ko samajhna mushkil bana deti hain.

- False Signals: Waves ke analysis se kabhi kabhi false signals bhi generate ho sakte hain, jo misleading ho sakte hain.

Is liye, technical analysis mein waves ka use karte waqt experience aur practice bohot zaroori hai.

Conclusion:

Waves in technical analysis ek powerful tool hain jo traders ko market ke trends aur price movements ko samajhne mein madad deti hain. Elliott Wave Theory ke zariye, hum market ki price action ko identify kar ke future trends ko predict kar sakte hain. Lekin, waves ka analysis karte waqt challenges bhi hote hain, is liye practice aur patience zaroori hai. Agar aap waves ko accurately identify kar lete hain, toh aap trading decisions ko behtar tarike se manage kar sakte hain.

تبصرہ

Расширенный режим Обычный режим