Introduction

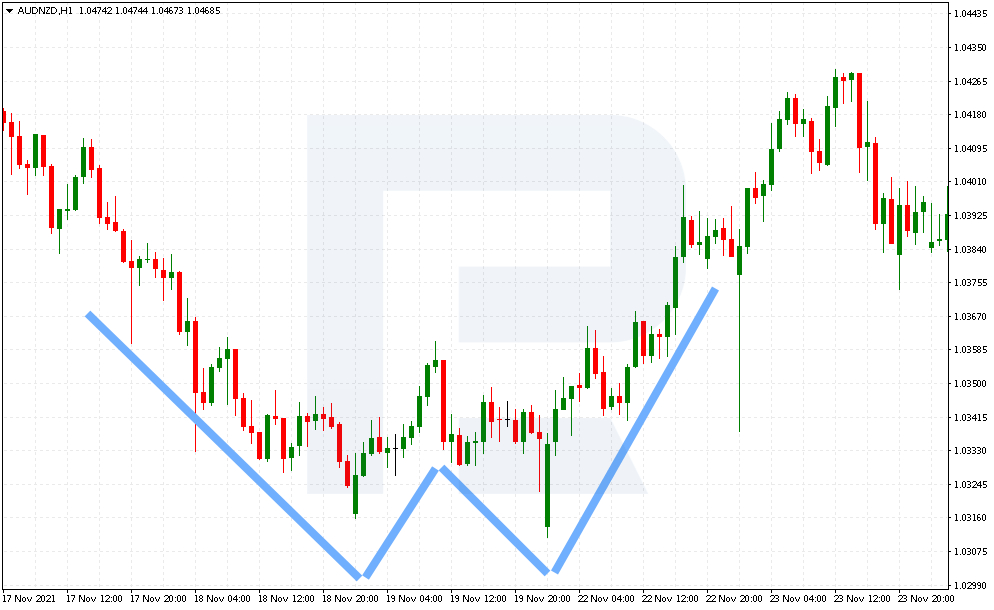

forex market mein dragon pattern aik kesam ka chart pattern hota hey jo keh technical hota hey es ke shape English lafz W , M say melte julte hey yeh pattern es bat ko identify karta hey keh market mein ana wala trend market ke price mein tabdele ka samna karay ga ya nahi karay ga yeh forex market ka reversal trend hota hey ya to bearish ka hota hey ya phir bullish ka he hota hey

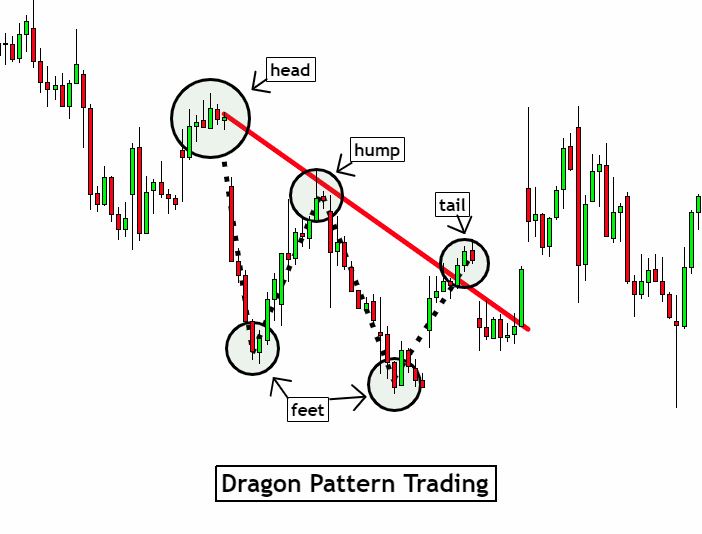

Component of Dragon pattern

1 Head

2 Feet

3 Hump

4 Tail

Head

Dragon pattern ka head forex market mein pattern ke bheek hota hey yeh forex market kay sabqa trend ko identify kar sakta hey Dragon ke sorat mein pehlay trend bearish ka he hota hey dosree taraf aik bullish dragon trend kay oper he ban sakta hey

Feet

yahan par forex market mein Dragon kay 2 paon bhe hotay hein or position es tarah ke hote hey keh forex market mein dosra paon pehlay paon say nechay close ho jata hey ager forex market mein dosra paon aam tor par bara hota hey to yeh market kay trend ko reversal janay ko he indicate kar sakte hey

bearish dragon kay paon inverted hotay hein jabkeh bullish dragon kay paon reversed hotay hein

Hump

yeh dragon kay paon kay competition mein prices mein mamole sa ezafa kar saktay hein yeh forex market mein 2 feeet kay darmean mein he hota hey aik bullish dragon ke sorat mein thore ce high level bhe ho sakte hey bearish dragon ke sorat mein hump feeet kay nechay hota hey

Tail

yeh dragon ke body ka last component hota hey yeh forex market ka woh pain hota hey jahan par forex market ka breakout he ho jata hey tail ke tashkeel kay bad market mein price barhna start ho jate hey yeh forex market ke highs lows ko start kar dayte hey arket new lows layna start kar dayte hey to forex market ka trend bearish ka he hota hey yeh os time hota hey jab forex market mein buyer ke tadad ghalab ho jate hey

bearih dragon ke sorat mein breakout tail kay sath he ho jata hey bearish dragon ke sorat mein forex market mein breakout tail kay sath barhna start ho jata hey market mein seller ghalab aa jatay hein

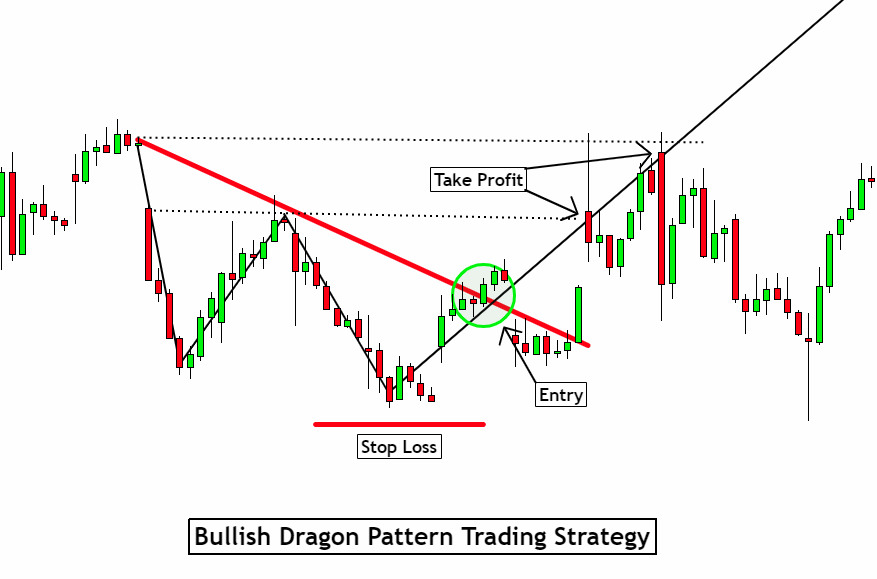

Trading strategy

forex market mein dragon e tashkeel kay bad market mein entry layne hote hey ager bullish dragon ke confirmation ho jate hey to trader ko buy ke entry layne hote hey ager bearish dragon ke confirmation ho jate hey to trader ko sell ke entry layne hote hey

best entry point ko identify karnay kay ley forex market mein aik trend line ko draw karna chihay dosray kay bad feet ko bhe cross kar sakte hey forex market ke prices mein halke ce kame wakay ho sakte hey

head , feet or hump or tail kay bad entry layne chihay yeh point aik kesam ka mesale entry point hota hey bad mein es entry point kay bad forex market ke price mein kamee atte jate hey or bullish breakout ho jata hey

Take Profit

ager forex market mein bullish dragon say nametna ho to forex market mein profit set karna chihay ap forex market mein es bat ko suppose karna chihay keh ap forex market ke short trade mein enter ho rahay hotay hein jab forex market mein prices increase hona start ho jate hein to ap dragon ke belkul tail kay oper hedd or hump kay barabar profit ka target set kar saktay hein

Risk management

forex market mein risk management aik important step hota hy jab forex market mein bullish dragon par trade ho rehe hote hey to dragon mamol kay motabaq bartao nahi karta hey price reversal jate hey market mein mumkana losses kay bad safe stop loss set karna chihay

forex market mein dragon pattern aik kesam ka chart pattern hota hey jo keh technical hota hey es ke shape English lafz W , M say melte julte hey yeh pattern es bat ko identify karta hey keh market mein ana wala trend market ke price mein tabdele ka samna karay ga ya nahi karay ga yeh forex market ka reversal trend hota hey ya to bearish ka hota hey ya phir bullish ka he hota hey

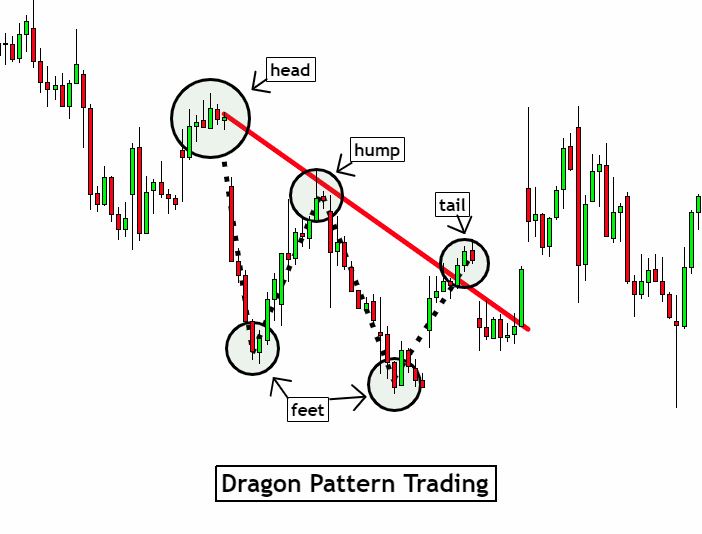

Component of Dragon pattern

1 Head

2 Feet

3 Hump

4 Tail

Head

Dragon pattern ka head forex market mein pattern ke bheek hota hey yeh forex market kay sabqa trend ko identify kar sakta hey Dragon ke sorat mein pehlay trend bearish ka he hota hey dosree taraf aik bullish dragon trend kay oper he ban sakta hey

Feet

yahan par forex market mein Dragon kay 2 paon bhe hotay hein or position es tarah ke hote hey keh forex market mein dosra paon pehlay paon say nechay close ho jata hey ager forex market mein dosra paon aam tor par bara hota hey to yeh market kay trend ko reversal janay ko he indicate kar sakte hey

bearish dragon kay paon inverted hotay hein jabkeh bullish dragon kay paon reversed hotay hein

Hump

yeh dragon kay paon kay competition mein prices mein mamole sa ezafa kar saktay hein yeh forex market mein 2 feeet kay darmean mein he hota hey aik bullish dragon ke sorat mein thore ce high level bhe ho sakte hey bearish dragon ke sorat mein hump feeet kay nechay hota hey

Tail

yeh dragon ke body ka last component hota hey yeh forex market ka woh pain hota hey jahan par forex market ka breakout he ho jata hey tail ke tashkeel kay bad market mein price barhna start ho jate hey yeh forex market ke highs lows ko start kar dayte hey arket new lows layna start kar dayte hey to forex market ka trend bearish ka he hota hey yeh os time hota hey jab forex market mein buyer ke tadad ghalab ho jate hey

bearih dragon ke sorat mein breakout tail kay sath he ho jata hey bearish dragon ke sorat mein forex market mein breakout tail kay sath barhna start ho jata hey market mein seller ghalab aa jatay hein

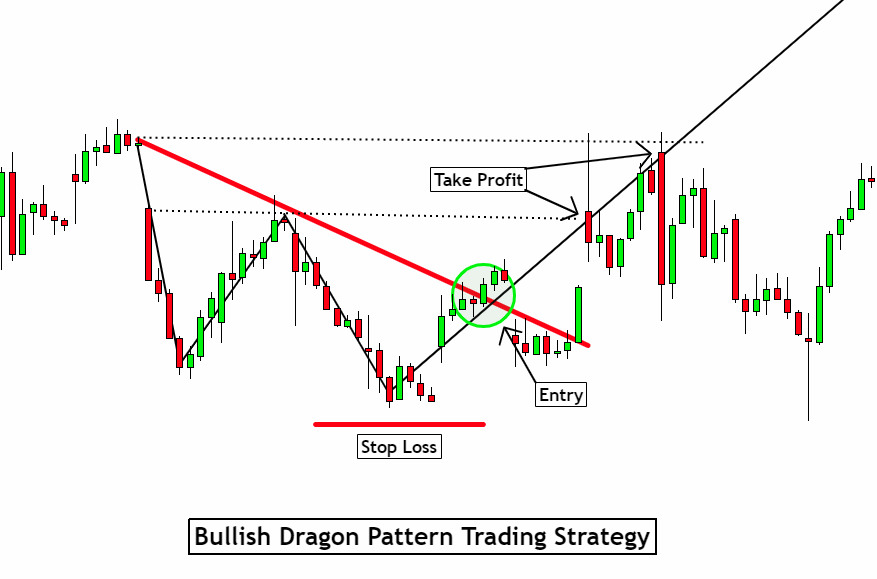

Trading strategy

forex market mein dragon e tashkeel kay bad market mein entry layne hote hey ager bullish dragon ke confirmation ho jate hey to trader ko buy ke entry layne hote hey ager bearish dragon ke confirmation ho jate hey to trader ko sell ke entry layne hote hey

best entry point ko identify karnay kay ley forex market mein aik trend line ko draw karna chihay dosray kay bad feet ko bhe cross kar sakte hey forex market ke prices mein halke ce kame wakay ho sakte hey

head , feet or hump or tail kay bad entry layne chihay yeh point aik kesam ka mesale entry point hota hey bad mein es entry point kay bad forex market ke price mein kamee atte jate hey or bullish breakout ho jata hey

Take Profit

ager forex market mein bullish dragon say nametna ho to forex market mein profit set karna chihay ap forex market mein es bat ko suppose karna chihay keh ap forex market ke short trade mein enter ho rahay hotay hein jab forex market mein prices increase hona start ho jate hein to ap dragon ke belkul tail kay oper hedd or hump kay barabar profit ka target set kar saktay hein

Risk management

forex market mein risk management aik important step hota hy jab forex market mein bullish dragon par trade ho rehe hote hey to dragon mamol kay motabaq bartao nahi karta hey price reversal jate hey market mein mumkana losses kay bad safe stop loss set karna chihay

تبصرہ

Расширенный режим Обычный режим