Evening Star Candlestick Pattern Kya Hai?

Evening Star Candlestick Pattern Kya Hai?Introduction to Evening Star Pattern

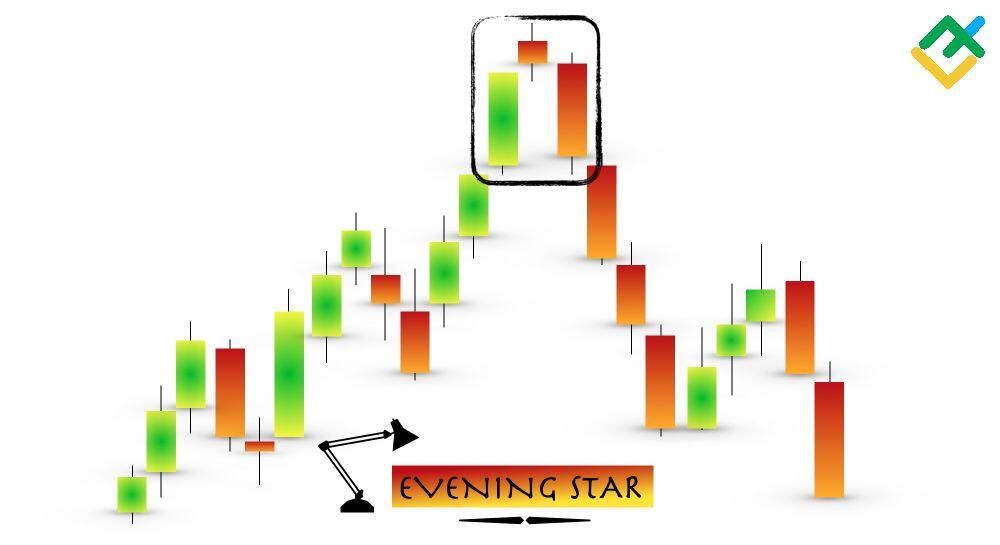

Evening Star candlestick pattern ek bearish reversal pattern hai jo zyada tar price charts par tab dikhai deta hai jab market apni bullish (upar ki taraf) momentum khatam kar raha hota hai aur bearish (neeche ki taraf) movement shuru kar raha hota hai. Yeh pattern technical analysis mein kaafi important maana jata hai aur traders ke liye ek signal hota hai ke price neeche jaane wala hai.

Evening Star Pattern Ka Structure

Evening Star pattern 3 candlesticks ka combination hota hai:

- First Candle (Bullish): Yeh ek lambi green (ya white) candle hoti hai jo market ke bullish trend ko dikhati hai. Iska matlab hai ke buyers strong hain aur price upar ja raha hai.

- Second Candle (Indecision): Yeh ek chhoti candle hoti hai, jo doji ya spinning top ke shape ki ho sakti hai. Iska rang green (bullish) ya red (bearish) ho sakta hai. Yeh candle is baat ka indication deti hai ke market mein buyers aur sellers ke darmiyan indecision ya confusion hai.

- Third Candle (Bearish): Yeh ek lambi red (ya black) candle hoti hai jo price ka neeche girna dikhati hai. Iska close price first candle ke body ke halfway ya neeche hona chahiye.

Evening Star Pattern Ban'ne Ki Sharaait

- Yeh pattern aksar resistance levels ya uptrend ke end par banta hai.

- Second candle (middle) ke baad market mein selling pressure zyada hota hai jo teesri candle ke bearish nature ko support karta hai.

- Is pattern ka significance us waqt badhta hai jab teesri candle high volume ke sath banti hai.

Evening Star Ko Samajhne Ka Tareeqa

Yeh pattern market ke sentiment mein badlaav ka signal deta hai. Jab market bullish hota hai, to buyers dominate karte hain, lekin jab evening star pattern banta hai, to iska matlab hai ke sellers zyada active ho rahe hain aur buyers ki strength khatam ho rahi hai.

Key Confirmation Points

- Gap Formation: Second candle (indecision) ka opening aur closing price aksar first aur third candle ke beech gap create karta hai.

- Volume Analysis: Third candle ka high volume hona zaroori hai, jo bearish trend ke start hone ki confirmation deta hai.

- Support Break: Agar price is pattern ke baad ek strong support level todta hai, to yeh bearish movement ko aur strengthen karta hai.

Traders Ke Liye Kaise Useful Hai?

- Entry Point: Jab evening star pattern banta hai aur price neeche girta hai, to yeh ek short-sell karne ka moka ho sakta hai.

- Stop Loss Placement: Stop-loss ko pattern ke high point ke upar set karna chahiye, taake unexpected reversals se bachaa ja sake.

- Take Profit Target: Pehle support level ya Fibonacci retracement levels ka use karte hue apna profit target set karna chahiye.

Limitations

- Yeh pattern har baar 100% accurate signal nahi deta. Confirmation ke liye aur indicators jaise RSI, MACD ya volume analysis ka use karna zaroori hai.

- Market manipulation aur news events is pattern ke effectiveness ko kam kar sakte hain.

Conclusion

Evening Star candlestick pattern ek powerful bearish reversal indicator hai jo technical analysis mein kaafi popular hai. Lekin is pattern ka use tabhi karna chahiye jab isse confirm karne ke liye additional tools aur indicators ka support ho. Agar aap isse sahi tarah samajh kar use karte hain, to yeh pattern aapke liye profitable trading decisions lene mein madadgar ho sakta hai.

تبصرہ

Расширенный режим Обычный режим