Intro

Assalamu alaikum friend me there will be ache honge achi kaam mein mashbool honge acche kam Mein majboor samrajya hai ki aap acche friend per kam kar rahe honge main aapko yah topic yah topic inshallah aapka aasani se samajh aaega kyunki maine bahut jyada mehnat aur Tel se aapke liye yah message yah post likhiye hai

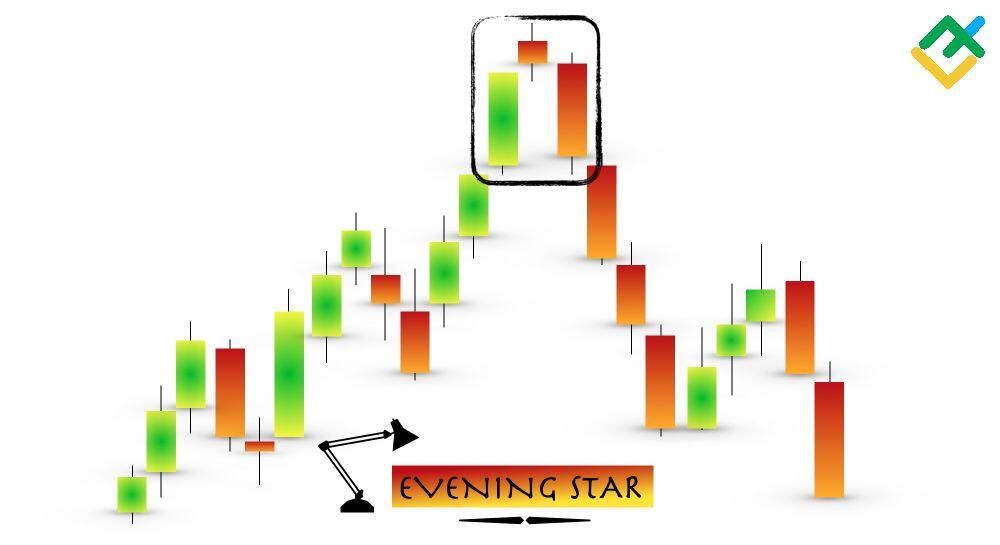

what is the evening star candlestick pattern

forex market mein evening star candlestick pattern aik kesam ka chart hota pattern hey jes mein technical analysis es bat ka pata laganay kay ley estamal keya jata hey lkeh forex market ka trend kab tabdel hota hey yeh aik bearish candlestick pattern hota hey jo keh forex market mein teen candlestick pattern hota hey aik bare white candlestick aik chote candlestick hote hey or kabhi kabhi yeh doji bhe ho sakte hey or aik bare red candlestick bhe ho sakte hey

evening star trend ko top trend kay sath connected kar sakta hey jo keh forex market mein es bat ko identify card keh market mein oper ka trend kab end ho raha hota hey

Understanding the Večernice pattern

evening star candlestick pattern bearish trend reversal candlestick pattern hota hey jo keh forex market mein up trend kay sab say oper zahair hota hey yeh forex market kay trend ko oper ke taraf trend ko kam karnay ke taraf eshara karta hey es say pehlay aik new step nechay ke taraf forex market kay chalnay ke taraf eshara card hey or forex market mein down trend ke base bante hey

Evening Star Doji

forex market mein evening star candlestick pattern 3 candlestick pattern hota center ke candle Doji bhe ho sakte hey yeh forex market mein aik he level par open bhe hote hey or close bhe aik he level hote hey yeh adam faisla bearish kay step ke rah humwar card hey Doji kay bad bearish candlestick ka zahair hona bearish to confirm frahm card hey

Trade with the Evening Star

forex market ka chart daikhnay kay bad formation mokamal honay kay bad trader agle he candlestick ke opening mein enter ho saktay hein zyada qadamat passand trader apni entry ein takhair karta hey or yeh daikhnay kay ley intazar kar saktay hein mein keh forex market action kam ho rehe hey ya zyada ho rehe hey es ke kharabe ke aik wajah yeh ho sakte hey keh trader bohut he kgharab level mein enter ho sakta hey khas tor par bullish say chalte hove market mein

target ko support or resistance ke pechle level par he rakha ja sakta hey or forex market kay stop ko pechle swing kay oper herakh saktay hein kunkeh es level ka gap forex market ko reversal janay ko fake kar day ga chonkeh forex market ke koi guarantee nahi hote hey trader ko hamaisha positive rsk or reward ratio kaim rakhna chihay or risk management say kam laya chihay

Assalamu alaikum friend me there will be ache honge achi kaam mein mashbool honge acche kam Mein majboor samrajya hai ki aap acche friend per kam kar rahe honge main aapko yah topic yah topic inshallah aapka aasani se samajh aaega kyunki maine bahut jyada mehnat aur Tel se aapke liye yah message yah post likhiye hai

what is the evening star candlestick pattern

forex market mein evening star candlestick pattern aik kesam ka chart hota pattern hey jes mein technical analysis es bat ka pata laganay kay ley estamal keya jata hey lkeh forex market ka trend kab tabdel hota hey yeh aik bearish candlestick pattern hota hey jo keh forex market mein teen candlestick pattern hota hey aik bare white candlestick aik chote candlestick hote hey or kabhi kabhi yeh doji bhe ho sakte hey or aik bare red candlestick bhe ho sakte hey

evening star trend ko top trend kay sath connected kar sakta hey jo keh forex market mein es bat ko identify card keh market mein oper ka trend kab end ho raha hota hey

Understanding the Večernice pattern

evening star candlestick pattern bearish trend reversal candlestick pattern hota hey jo keh forex market mein up trend kay sab say oper zahair hota hey yeh forex market kay trend ko oper ke taraf trend ko kam karnay ke taraf eshara karta hey es say pehlay aik new step nechay ke taraf forex market kay chalnay ke taraf eshara card hey or forex market mein down trend ke base bante hey

Evening Star Doji

forex market mein evening star candlestick pattern 3 candlestick pattern hota center ke candle Doji bhe ho sakte hey yeh forex market mein aik he level par open bhe hote hey or close bhe aik he level hote hey yeh adam faisla bearish kay step ke rah humwar card hey Doji kay bad bearish candlestick ka zahair hona bearish to confirm frahm card hey

Trade with the Evening Star

forex market ka chart daikhnay kay bad formation mokamal honay kay bad trader agle he candlestick ke opening mein enter ho saktay hein zyada qadamat passand trader apni entry ein takhair karta hey or yeh daikhnay kay ley intazar kar saktay hein mein keh forex market action kam ho rehe hey ya zyada ho rehe hey es ke kharabe ke aik wajah yeh ho sakte hey keh trader bohut he kgharab level mein enter ho sakta hey khas tor par bullish say chalte hove market mein

target ko support or resistance ke pechle level par he rakha ja sakta hey or forex market kay stop ko pechle swing kay oper herakh saktay hein kunkeh es level ka gap forex market ko reversal janay ko fake kar day ga chonkeh forex market ke koi guarantee nahi hote hey trader ko hamaisha positive rsk or reward ratio kaim rakhna chihay or risk management say kam laya chihay

تبصرہ

Расширенный режим Обычный режим