TRADING ANALYSIS OF GRAVESTONE DOJI CANDLESTICK

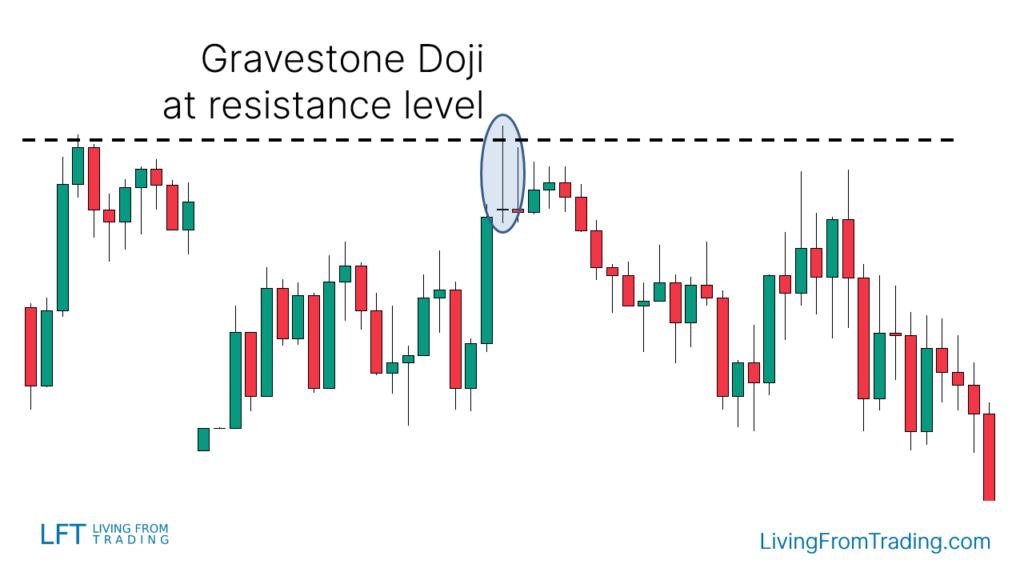

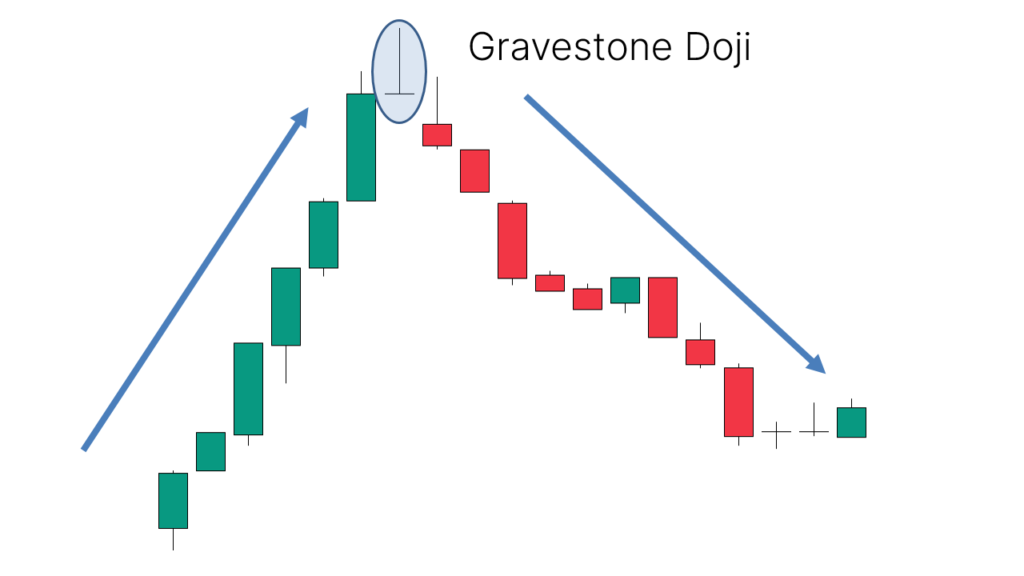

Gravestone Doji ek candlestick pattern hai jo forex trading mein ek potential bearish reversal signal hota hai. Yeh pattern tab banta hai jab opening, closing, aur low prices lagbhag same hoti hain aur high price significantly upar hoti hai.

INTERPRETATION OF GRAVESTONE DOJI

DOJI BODY

Yeh candle ek doji hoti hai jisme open aur close prices lagbhag same hoti hain. Stop loss ko Gravestone Doji ke high price ke thoda upar place karna chahiye. Isse risk minimize hota hai agar market opposite direction mein move kare.

LONG UPPER SHADOW

Is candle ki ek lambi upper shadow hoti hai jo high price ko indicate karti hai.

NO LOWER SHADOW

Is candle ki koi lower shadow nahi hoti, ya bohot choti hoti hai, jo yeh show karta hai ke opening aur closing prices almost same hain.Profit targets ko pehle support levels ya calculated risk-reward ratio ke basis par set karna chahiye. Pehle se defined exit strategy rakhni chahiye taake profits ko effectively manage kiya ja sake.

BEARISH REVERSAL SIGNAL

Gravestone Doji ek bearish reversal signal hota hai jo indicate karta hai ke buyers market ko upar le jane mein kamyab nahi ho sake aur sellers ne control wapas le liya.Yeh dono almost same hoti hain aur candle ke neeche hoti hain.Yeh upper shadow ke end par hota hai, jo significantly upar hota hai.

MARKET SENTIMENT

Yeh pattern yeh show karta hai ke market sentiment bullish se bearish ho gaya hai.Jab Gravestone Doji banta hai, to yeh ek potential sell signal hota hai. Traders is point par short positions enter kar sakte hain. Confirmation ke liye, agle candle ka bearish hona zaroori hai taake trend reversal confirm ho sake.

GRAVESTONE DOJI KI LIMITATIONS

Gravestone Doji kabhi kabhi false signals generate kar sakta hai, especially jab market highly volatile ho. Is pattern ko doosre technical indicators ke sath combine karna chahiye taake accuracy barh sake. Gravestone Doji ko confirm karne ke liye additional indicators aur market context ka analysis zaroori hai. Trend confirmation ke liye volume analysis aur momentum indicators ka bhi use kar sakte hain.

Gravestone Doji ek important bearish reversal pattern hai jo forex trading mein potential trend reversal ko indicate karta hai. Is pattern ko sahi tarike se identify karna aur confirm karna zaroori hai taake profitable trading decisions le sakein. Isko doosre technical indicators ke sath combine karke trading strategy ko enhance kiya ja sakta hai. Effective risk management aur confirmation strategies ke sath, Gravestone Doji traders ke liye ek valuable tool ho sakta hai.

Gravestone Doji ek candlestick pattern hai jo forex trading mein ek potential bearish reversal signal hota hai. Yeh pattern tab banta hai jab opening, closing, aur low prices lagbhag same hoti hain aur high price significantly upar hoti hai.

INTERPRETATION OF GRAVESTONE DOJI

DOJI BODY

Yeh candle ek doji hoti hai jisme open aur close prices lagbhag same hoti hain. Stop loss ko Gravestone Doji ke high price ke thoda upar place karna chahiye. Isse risk minimize hota hai agar market opposite direction mein move kare.

LONG UPPER SHADOW

Is candle ki ek lambi upper shadow hoti hai jo high price ko indicate karti hai.

NO LOWER SHADOW

Is candle ki koi lower shadow nahi hoti, ya bohot choti hoti hai, jo yeh show karta hai ke opening aur closing prices almost same hain.Profit targets ko pehle support levels ya calculated risk-reward ratio ke basis par set karna chahiye. Pehle se defined exit strategy rakhni chahiye taake profits ko effectively manage kiya ja sake.

BEARISH REVERSAL SIGNAL

Gravestone Doji ek bearish reversal signal hota hai jo indicate karta hai ke buyers market ko upar le jane mein kamyab nahi ho sake aur sellers ne control wapas le liya.Yeh dono almost same hoti hain aur candle ke neeche hoti hain.Yeh upper shadow ke end par hota hai, jo significantly upar hota hai.

MARKET SENTIMENT

Yeh pattern yeh show karta hai ke market sentiment bullish se bearish ho gaya hai.Jab Gravestone Doji banta hai, to yeh ek potential sell signal hota hai. Traders is point par short positions enter kar sakte hain. Confirmation ke liye, agle candle ka bearish hona zaroori hai taake trend reversal confirm ho sake.

GRAVESTONE DOJI KI LIMITATIONS

Gravestone Doji kabhi kabhi false signals generate kar sakta hai, especially jab market highly volatile ho. Is pattern ko doosre technical indicators ke sath combine karna chahiye taake accuracy barh sake. Gravestone Doji ko confirm karne ke liye additional indicators aur market context ka analysis zaroori hai. Trend confirmation ke liye volume analysis aur momentum indicators ka bhi use kar sakte hain.

Gravestone Doji ek important bearish reversal pattern hai jo forex trading mein potential trend reversal ko indicate karta hai. Is pattern ko sahi tarike se identify karna aur confirm karna zaroori hai taake profitable trading decisions le sakein. Isko doosre technical indicators ke sath combine karke trading strategy ko enhance kiya ja sakta hai. Effective risk management aur confirmation strategies ke sath, Gravestone Doji traders ke liye ek valuable tool ho sakta hai.

تبصرہ

Расширенный режим Обычный режим