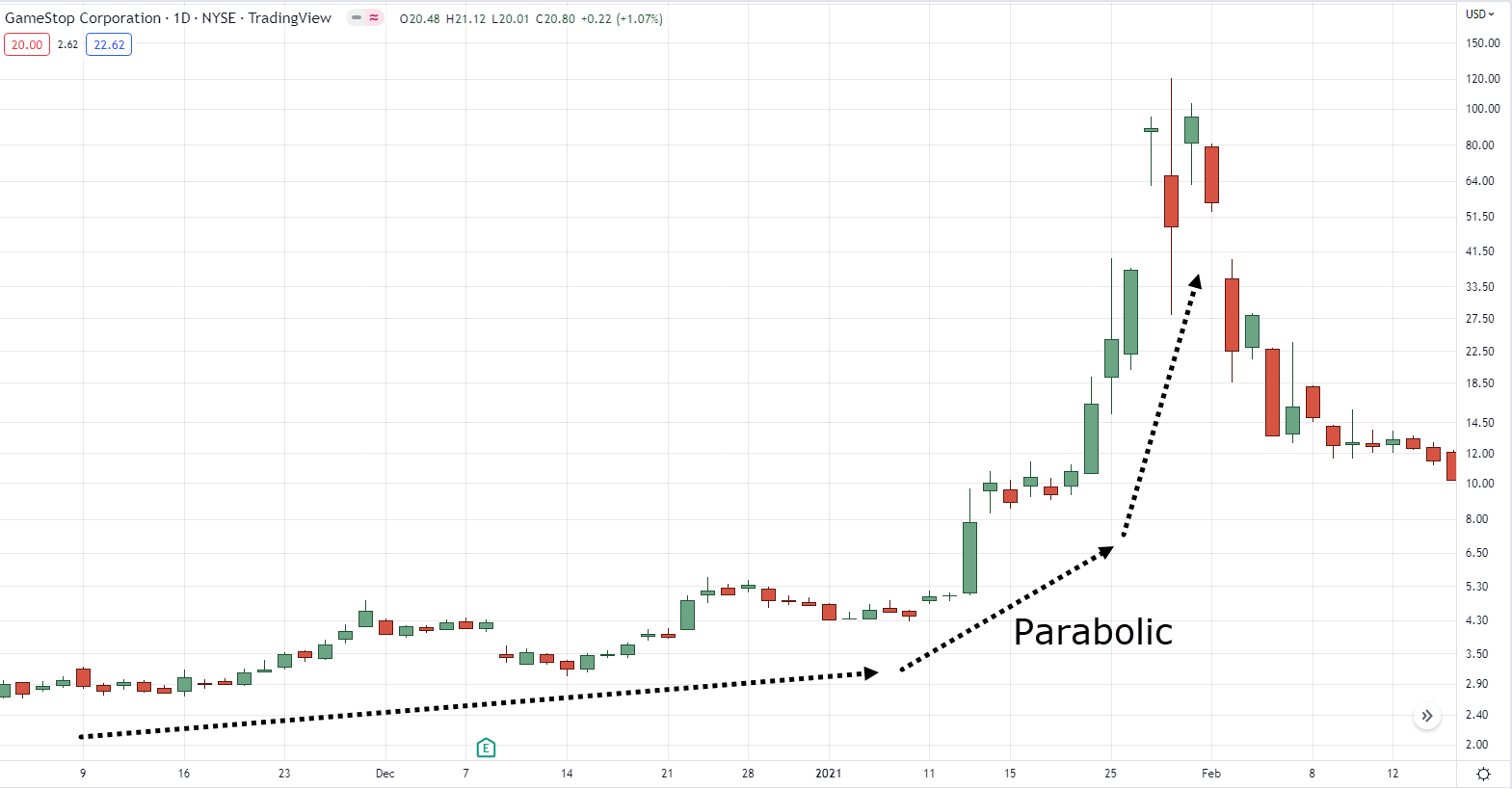

Market chop se hum is tarah ki market movement ko samajhte hain jismein prices ka koi clear trend nahi hota hai aur prices up and down ke beech mein chalte rehte hain. Yeh market situation market volatility ka ek hissa hota hai aur traders ke liye challenging ho sakta hai.is me apko price k bary me pta hna chaye q k apko jtna knowledge hoga utna hi ap is pe sai kam kr sken gy aur acha profit len gy ye b aik risky kam h is me Risk apko fda b ho skta h aur loss b q k ye market ki situation pr chl rha hta h.

Experience Traders

Agar aap beginner trader hain toh market chop se trade karna aapke liye challenging ho sakta hai. Iske liye aapko market analysis aur technical analysis ke concepts ko achhe se samajhna hoga. Agar aap experienced trader hain toh aap market chop se trade kar sakte hain aur isse profit earn kar sakte hain.is me apko market k bary me full pta hna chaye k khan rate chl rha h.

Market conditions

Lekin, market chop mein trade karna risky hota hai aur ismein aapko losses bhi ho sakte hain. Isliye, market chop mein trade karne se pehle aapko market conditions aur market trends ka analysis karna hoga aur sahi trading strategy apnani hogi.

Conclusion

Overall, market chop se trade karna challenging aur risky ho sakta hai, isliye experienced traders hi isse trade karna chahiye aur beginners ko isse avoid karna chahiye.

:max_bytes(150000):strip_icc()/dotdash_INV-final-Choppy-Market_Feb_2021-01-d1a35e704e4e49ed9a36456352dfd30a.jpg)

تبصرہ

Расширенный режим Обычный режим