Spinning Top candlestick pattern trading mein ek commonly used aur well-known pattern hai, jo market ki indecision ko reflect karta hai. Yeh pattern tab form hota hai jab buyers aur sellers ka control market mein barabar hota hai, aur dono mein se koi bhi ek clear direction mein price ko push nahi kar pata. Spinning Top ek candlestick pattern hai jo market ke indecision ko represent karta hai. Is pattern ki body chhoti hoti hai, jab ke upper aur lower shadows (wicks) lambi hoti hain. Chhoti body ka matlab hota hai ke opening aur closing price ke darmiyan bohot kam fark hota hai, jab ke lambi wicks yeh show karti hain ke price session ke dauran upar aur neeche dono taraf move hui lekin buyers aur sellers mein se koi bhi clear control nahi le saka.

Aam tor par Spinning Top pattern tab form hota hai jab market trend continuation ya reversal ke phase mein hoti hai. Agar market ek strong uptrend ya downtrend ke baad Spinning Top banaye, toh iska matlab yeh ho sakta hai ke market mein ab strength kam ho rahi hai aur ya toh trend continuation ke chances hain, ya market reverse kar sakti hai.

Spinning Top Candlestick Ki Identification

Spinning Top candlestick pattern ko pehchana relatively aasaan hota hai, lekin kuch key characteristics ko dhyaan mein rakhna zaroori hai:

Spinning Top candlestick ko samajhna is baat ka indication deta hai ke market mein uncertainty hai. Yeh pattern signal karta hai ke price action mein buyers aur sellers ka tug-of-war chal raha hai, lekin koi bhi ek clear winner nahi ban raha. Is indecision ko samajhne ke liye hum Spinning Top ki different situations mein interpretation ko detail se samjhte hain:

Spinning Top candlestick pattern ki kuch main types bhi hain jo slightly different scenarios ko represent karti hain:

Spinning Top pattern kaafi similar hota hai kuch doosray candlestick patterns se, lekin kuch key differences hain jo traders ko samajhne chahiye:

Spinning Top candlestick ko trading mein use karte waqt kuch specific strategies aur considerations ka dhyaan rakhna bohot zaroori hai:

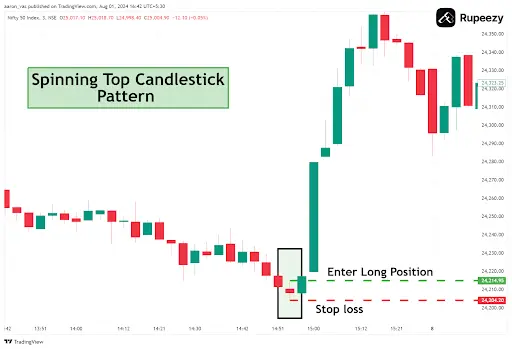

Real-Life Example of Spinning Top Candlestick

Ek stock ka price ek uptrend mein chal raha hai aur achanak ek Spinning Top candlestick form hoti hai, toh yeh ek sign ho sakta hai ke market mein ab uptrend ke baad buyers ki strength kam ho rahi hai. Ab aap confirmation ke liye agla candle dekhenge. Agar agla candle bearish ho aur Spinning Top ke low ko break kare, toh yeh ek signal ho sakta hai ke ab market reverse hone wali hai. Is scenario mein aap sell position le sakte hain, lekin stop-loss Spinning Top ke high ke uper rakhna zaroori hoga takay risk control mein rahe. Spinning Top candlestick pattern ek neutral signal hota hai jo market ke indecision ko represent karta hai. Yeh pattern market mein tug-of-war ko reflect karta hai jahan buyers aur sellers dono active hote hain lekin koi bhi ek clear direction mein market ko push nahi kar pata. Is pattern ko pehchan'na relatively aasaan hota hai, lekin confirmation candle aur proper risk management ke baghair ispar trade lena risky ho sakta hai.

Spinning Top pattern ka significance tab barhta hai jab yeh kisi trend ke end mein ya major support/resistance levels par form ho. Traders ke liye yeh zaroori hota hai ke woh is pattern ko context mein samjhein aur agle candle ka confirmation ka intezaar karen. Risk management aur volume analysis Spinning Top pattern ko effectively trade karne ke liye essential factors hain.

Aam tor par Spinning Top pattern tab form hota hai jab market trend continuation ya reversal ke phase mein hoti hai. Agar market ek strong uptrend ya downtrend ke baad Spinning Top banaye, toh iska matlab yeh ho sakta hai ke market mein ab strength kam ho rahi hai aur ya toh trend continuation ke chances hain, ya market reverse kar sakti hai.

Spinning Top Candlestick Ki Identification

Spinning Top candlestick pattern ko pehchana relatively aasaan hota hai, lekin kuch key characteristics ko dhyaan mein rakhna zaroori hai:

- Chhoti Real Body: Spinning Top ka sabse distinctive feature iska chhota body hota hai, jo opening aur closing price ke kareeb hota hai. Yeh body dono bullish (green) ya bearish (red) ho sakti hai, lekin body ka color itna important nahi hota jitna ke iski size.

- Lambi Upper Aur Lower Shadows: Spinning Top candlestick ki upper aur lower shadows lambi hoti hain. Yeh is baat ko show karta hai ke price ne ek session ke dauran upper aur lower levels touch kiye, lekin end mein price wapis apni open ke kareeb hi close hui.

- Market Indecision: Yeh pattern market ke indecision ko batata hai, jahan buyers aur sellers dono active hain, lekin unmein se koi bhi ek doosre par dominance hasil nahi kar raha. Dono taraf se price push hone ke bawajood, market ke closing aur opening levels mein zyada farq nahi hota.

- Trend Ka Pause Ya Potential Reversal: Spinning Top candlestick pattern ka paish aana yeh indicate karta hai ke market shayad apne trend ko slow kar rahi hai aur ek possible reversal ho sakta hai. Yeh pattern trend ke andar pause ko bhi represent kar sakta hai jahan market thodi dair ke liye sideways chalti hai.

Spinning Top candlestick ko samajhna is baat ka indication deta hai ke market mein uncertainty hai. Yeh pattern signal karta hai ke price action mein buyers aur sellers ka tug-of-war chal raha hai, lekin koi bhi ek clear winner nahi ban raha. Is indecision ko samajhne ke liye hum Spinning Top ki different situations mein interpretation ko detail se samjhte hain:

- Uptrend Mein Spinning Top: Agar ek Spinning Top candlestick ek strong uptrend ke baad form hoti hai, toh iska matlab yeh ho sakta hai ke buyers ki strength ab kam ho rahi hai aur sellers market mein enter ho rahe hain. Yeh ek signal ho sakta hai ke trend reverse ho sakta hai, ya market mein kuch time ke liye sideways movement shuru hone wali hai.

- Downtrend Mein Spinning Top: Jab Spinning Top candlestick ek downtrend ke dauran form hoti hai, toh yeh signal deti hai ke sellers ki strength ab decrease ho rahi hai aur buyers market mein interest lena shuru kar rahe hain. Yeh potential reversal ka signal ho sakta hai jahan market ab bullish ho sakti hai, lekin confirmation ke liye agle candlestick patterns ka intezaar karna zaroori hota hai.

- Sideways Market Mein Spinning Top: Sideways ya range-bound market mein Spinning Top ka aana usually ek continuation signal hota hai. Iska matlab hota hai ke market mein koi naya direction decide nahi ho raha aur abhi tak buyers aur sellers ke darmiyan equilibrium (tawaazun) bana hua hai.

Spinning Top candlestick pattern ki kuch main types bhi hain jo slightly different scenarios ko represent karti hain:

- Bullish Spinning Top: Jab Spinning Top ki real body bullish ho (green ya white), toh yeh indicate karta hai ke buyers ne market ko thoda upar push kar diya, lekin market abhi bhi indecision mein hai. Bullish Spinning Top ka significance tab barhta hai jab yeh downtrend ke baad form ho aur agla candle bhi bullish ho.

- Bearish Spinning Top: Bearish Spinning Top tab form hota hai jab candlestick ki real body bearish ho (red ya black). Iska matlab yeh hota hai ke sellers ne price ko thoda neeche push kiya, lekin market abhi bhi indecisive hai. Agar bearish Spinning Top ek uptrend ke baad form ho, toh yeh ek potential reversal ka signal ho sakta hai.

- Doji Spinning Top: Doji Spinning Top candlestick mein real body bohot chhoti hoti hai, kabhi kabhi almost non-existent. Doji Spinning Top complete indecision ka signal deti hai jahan open aur close price lagbhag equal hoti hain. Doji Spinning Top ek powerful reversal signal bhi ho sakti hai, lekin confirmation ke baghair trade lena risky ho sakta hai.

Spinning Top pattern kaafi similar hota hai kuch doosray candlestick patterns se, lekin kuch key differences hain jo traders ko samajhne chahiye:

- Doji Candlestick: Doji candlestick aur Spinning Top kaafi similar hain kyun ke dono market ke indecision ko represent karte hain. Farq sirf itna hota hai ke Doji candlestick mein real body bohot chhoti hoti hai ya bilkul nahi hoti, jab ke Spinning Top mein chhoti body hoti hai. Doji aur Spinning Top dono ek reversal ka signal de sakti hain, lekin confirmation zaroori hoti hai.

- Hammer Candlestick: Hammer candlestick ek bullish reversal pattern hota hai jo ek downtrend ke baad form hota hai. Spinning Top aur Hammer ka farq yeh hai ke Hammer mein lower shadow lamba hota hai aur body chhoti hoti hai, jab ke Spinning Top mein dono shadows lambi hoti hain aur body beech mein hoti hai. Hammer candlestick bullish signal deti hai jab ke Spinning Top neutral hota hai aur market ke indecision ko batata hai.

- Shooting Star: Shooting Star ek bearish reversal pattern hai jo Spinning Top se kuch milta julta lag sakta hai, lekin ismein upper shadow lambi hoti hai aur lower shadow bohot chhoti ya bilkul nahi hoti. Shooting Star ek strong bearish reversal signal deti hai jab ke Spinning Top sirf indecision ko batata hai.

Spinning Top candlestick ko trading mein use karte waqt kuch specific strategies aur considerations ka dhyaan rakhna bohot zaroori hai:

- Confirmation Candle Ka Intezaar: Spinning Top pattern ek clear direction nahi batata, is liye agle candle ka confirmation zaroori hota hai. Agar agla candle bullish ho, toh Spinning Top ek reversal signal ho sakta hai. Isi tarah, agar agla candle bearish ho, toh yeh trend continuation ka indication ho sakta hai. Confirmation ke baghair trade lena risky ho sakta hai, kyun ke Spinning Top akela kaafi nahi hota clear signal dene ke liye.

- Support Aur Resistance Levels Ka Analysis: Spinning Top pattern ko trade karte waqt support aur resistance levels ka analysis karna zaroori hai. Agar Spinning Top kisi major support level ke kareeb form ho, toh yeh ek potential bullish reversal ka signal ho sakta hai. Isi tarah, agar yeh resistance ke paas form ho, toh yeh market ke reversal ka indication ho sakta hai.

- Risk Management Ka Ahmiyat: Spinning Top pattern ko trade karte waqt risk management ka khayal rakhna bohot zaroori hota hai. Kyun ke yeh pattern indecision ko batata hai, aapko apna stop-loss clear define karna chahiye, usually candle ke high ya low ke neeche/uper rakhna behtar hota hai. Yeh strategy aapke losses ko minimize karne mein madadgar ho sakti hai.

- Trend Context Ka Dhyaan Rakhna: Spinning Top ka significance tab aur barh jata hai jab aap market ke trend ko context mein samajh rahe hote hain. For example, agar Spinning Top ek strong uptrend ke dauran form hoti hai, toh yeh buyers ki exhaustion ka signal ho sakti hai. Isi tarah, downtrend mein Spinning Top sellers ki weakness ko reflect karti hai.

- Volume Analysis: Volume bhi Spinning Top pattern ke significance ko samajhne mein madadgar hota hai. Agar Spinning Top high volume ke sath form hoti hai, toh yeh indicate karta hai ke market mein heavy indecision hai aur ek potential reversal ka strong chance hai. Low volume ke sath Spinning Top ka signal itna strong nahi hota.

Real-Life Example of Spinning Top Candlestick

Ek stock ka price ek uptrend mein chal raha hai aur achanak ek Spinning Top candlestick form hoti hai, toh yeh ek sign ho sakta hai ke market mein ab uptrend ke baad buyers ki strength kam ho rahi hai. Ab aap confirmation ke liye agla candle dekhenge. Agar agla candle bearish ho aur Spinning Top ke low ko break kare, toh yeh ek signal ho sakta hai ke ab market reverse hone wali hai. Is scenario mein aap sell position le sakte hain, lekin stop-loss Spinning Top ke high ke uper rakhna zaroori hoga takay risk control mein rahe. Spinning Top candlestick pattern ek neutral signal hota hai jo market ke indecision ko represent karta hai. Yeh pattern market mein tug-of-war ko reflect karta hai jahan buyers aur sellers dono active hote hain lekin koi bhi ek clear direction mein market ko push nahi kar pata. Is pattern ko pehchan'na relatively aasaan hota hai, lekin confirmation candle aur proper risk management ke baghair ispar trade lena risky ho sakta hai.

Spinning Top pattern ka significance tab barhta hai jab yeh kisi trend ke end mein ya major support/resistance levels par form ho. Traders ke liye yeh zaroori hota hai ke woh is pattern ko context mein samjhein aur agle candle ka confirmation ka intezaar karen. Risk management aur volume analysis Spinning Top pattern ko effectively trade karne ke liye essential factors hain.

تبصرہ

Расширенный режим Обычный режим