Gann Fan Trading Pattern in Forex

Gann Fan kya hai?

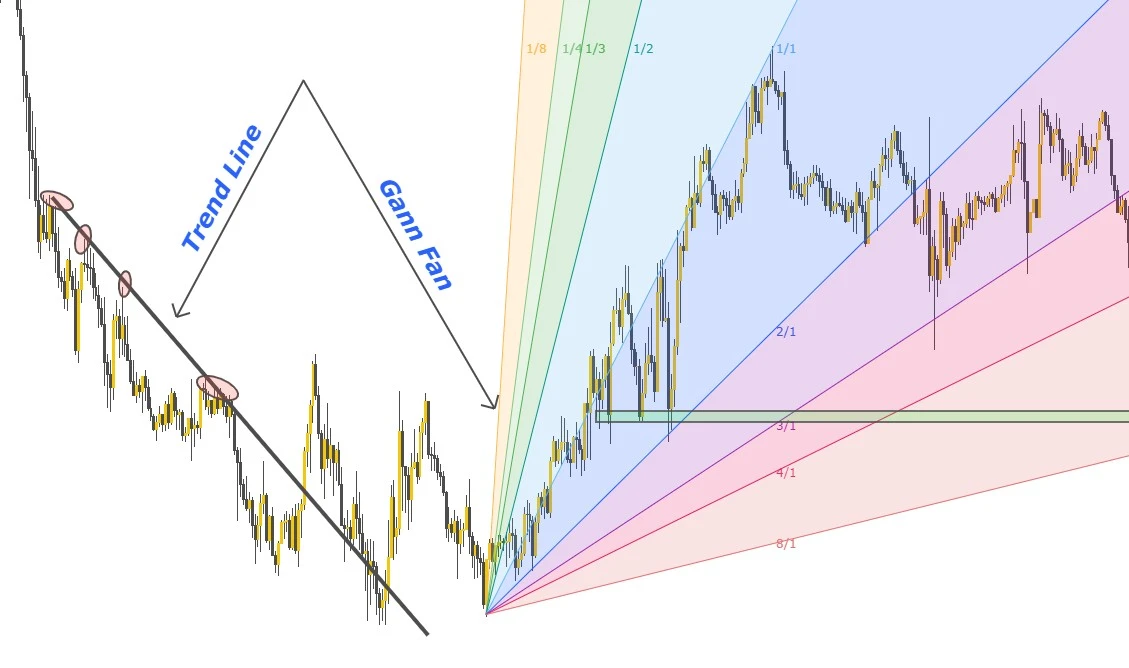

Gann Fan aik technical analysis tool hai jo financial markets, jaise forex, mein istimaal hota hai. Yeh tool 20th century ke mashhoor trader aur technical analyst W.D. Gann ne develop kiya tha. Gann Fan mein multiple lines hoti hain jo chart par angle ke sath draw ki jati hain, aur yeh lines potential support aur resistance levels ko highlight karti hain.

Gann Fan ka Maqsad

Gann Fan ka maqsad yeh hota hai ke market ke trend aur price movements ko predict kiya ja sake. Yeh tool traders ko madad deta hai ke woh identify kar saken ke kab aur kahan market mein buying ya selling karni chahiye. Is tarah, traders apni trading strategies ko behtar bana sakte hain aur potential profits kama sakte hain.

Gann Fan ka Structure

Gann Fan lines aik specific angle pe draw hoti hain, aur yeh angles W.D. Gann ke theories pe based hote hain. In theories ke mutabiq, price aur time ka specific relationship hota hai jo market movements ko influence karta hai. Gann Fan lines typically 45 degrees ke angle pe hoti hain, lekin aur bhi angles use hote hain, jaise 26.25 degrees, 63.75 degrees, waghera.

Gann Fan ko Draw Karna

Gann Fan ko draw karne ke liye, pehle market ke ek significant high ya low point ko identify karna hota hai. Iske baad, us point se multiple lines different angles par draw ki jati hain. Yeh lines upward aur downward direction mein move karti hain aur potential support aur resistance levels ko identify karti hain.

Gann Fan ka Istimaal

Gann Fan ko forex trading mein istimaal karne ke liye kuch important points hain jo yaad rakhni chahiye:

Misal ke Taur pe Gann Fan ka Istimaal

Chaliye ek example dekhte hain. Agar humara significant low point 1.1000 pe ho, toh hum is point se multiple lines different angles pe draw karenge. Agar price 45 degree line ke upar move karti hai, toh yeh strong bullish signal hai. Agar price 26.25 degree line ko break karti hai, toh yeh potential reversal ka signal ho sakta hai.

Gann Fan ki Limitations

Gann Fan tool powerful hai, lekin iske kuch limitations bhi hain:

Gann Fan kya hai?

Gann Fan aik technical analysis tool hai jo financial markets, jaise forex, mein istimaal hota hai. Yeh tool 20th century ke mashhoor trader aur technical analyst W.D. Gann ne develop kiya tha. Gann Fan mein multiple lines hoti hain jo chart par angle ke sath draw ki jati hain, aur yeh lines potential support aur resistance levels ko highlight karti hain.

Gann Fan ka Maqsad

Gann Fan ka maqsad yeh hota hai ke market ke trend aur price movements ko predict kiya ja sake. Yeh tool traders ko madad deta hai ke woh identify kar saken ke kab aur kahan market mein buying ya selling karni chahiye. Is tarah, traders apni trading strategies ko behtar bana sakte hain aur potential profits kama sakte hain.

Gann Fan ka Structure

Gann Fan lines aik specific angle pe draw hoti hain, aur yeh angles W.D. Gann ke theories pe based hote hain. In theories ke mutabiq, price aur time ka specific relationship hota hai jo market movements ko influence karta hai. Gann Fan lines typically 45 degrees ke angle pe hoti hain, lekin aur bhi angles use hote hain, jaise 26.25 degrees, 63.75 degrees, waghera.

Gann Fan ko Draw Karna

Gann Fan ko draw karne ke liye, pehle market ke ek significant high ya low point ko identify karna hota hai. Iske baad, us point se multiple lines different angles par draw ki jati hain. Yeh lines upward aur downward direction mein move karti hain aur potential support aur resistance levels ko identify karti hain.

Gann Fan ka Istimaal

Gann Fan ko forex trading mein istimaal karne ke liye kuch important points hain jo yaad rakhni chahiye:

- Trend Identification: Gann Fan lines ko use kar ke market ke trend ko identify karna. Agar price Gann Fan lines ke upar move kar rahi hai, toh yeh bullish trend ka signal hota hai. Agar price lines ke niche move kar rahi hai, toh yeh bearish trend ka signal hota hai.

- Support and Resistance Levels: Gann Fan lines support aur resistance levels ko identify karne mein madad karti hain. Agar price ek specific Gann Fan line pe support le rahi hai, toh yeh buying opportunity ho sakti hai. Similarly, agar price ek line pe resistance face kar rahi hai, toh yeh selling opportunity ho sakti hai.

- Entry and Exit Points: Gann Fan lines ko use kar ke entry aur exit points ko determine karna. Jab price ek significant Gann Fan line ko cross karti hai, toh yeh market mein entry ya exit ka signal ho sakta hai.

Misal ke Taur pe Gann Fan ka Istimaal

Chaliye ek example dekhte hain. Agar humara significant low point 1.1000 pe ho, toh hum is point se multiple lines different angles pe draw karenge. Agar price 45 degree line ke upar move karti hai, toh yeh strong bullish signal hai. Agar price 26.25 degree line ko break karti hai, toh yeh potential reversal ka signal ho sakta hai.

Gann Fan ki Limitations

Gann Fan tool powerful hai, lekin iske kuch limitations bhi hain:

- Complexity: Gann Fan ko samajhna aur effectively use karna thoda complex ho sakta hai, especially beginners ke liye. Isko sahi tarah se use karne ke liye practice aur experience ki zarurat hoti hai.

- Market Conditions: Gann Fan har market condition mein accurate nahi hota. Market mein sudden news events ya high volatility periods mein Gann Fan ka reliability kam ho sakti hai.

- Subjectivity: Gann Fan lines ko draw karna thoda subjective ho sakta hai, kyunki different traders different high aur low points ko choose kar sakte hain.

:max_bytes(150000):strip_icc()/GannFans-4455374b2cb347e5be9d6cbdb73c0e65.png)

تبصرہ

Расширенный режим Обычный режим