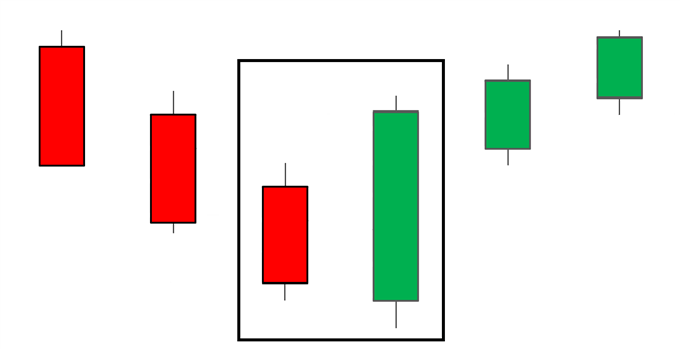

what is Bullish Engulfing candlestick pattern

Forex market mein bullish engulfing candlestick pattern jo keh forex market mein trend kay nechay zahair hote hey yeh forex market kau buying pressure mein ezafay ko identify kar sakta hey forex market kay bullish engulfing mein anay wala pattern forex market mein ezafay ko bhe identify kar sakta hey kunkeh forex market mein zyada tar buyer forex market kay prices mein ezafay ko bhe identify kar saktay hein es candlestick pattern mein 2 candlestick shaml hote hein jo keh forex market ke pechle red candlestick ke body ko mokamal tor par engulfing kar layte hey

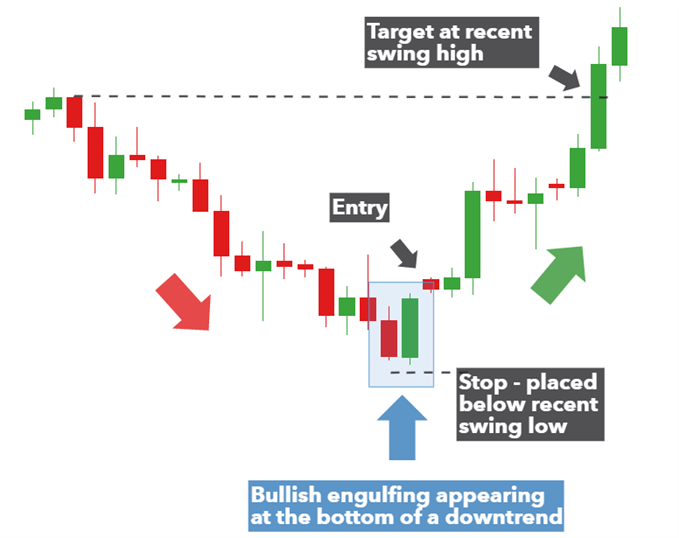

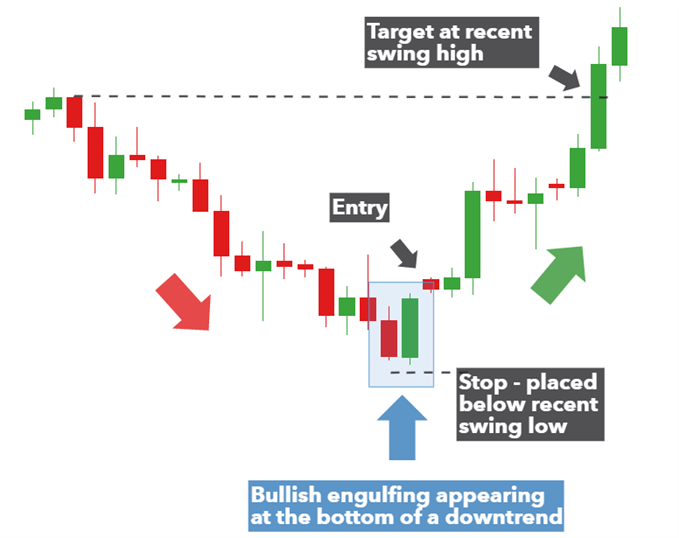

Trade with Bullish Engulfing candlestick pattern

nechay GBP/USD ka daily ka chart pattern deya geya hey jo keh forex market kay bullish engulfing candlestick pattern ko daikh sakta hey es candlestick pattern mein bad mein anay wale candlestick pattern market mein bullish engulfing candlestick pattern ke confirmation kar sakte hey forex market mein candlestick pattern highs kay oper aa kar close ho jate hey forex market kay stop ko bullish engulfing candlestick pattrn kay lower darjay kay nechay he set kar deya jata hey jes mein forex market kay key level ka target set kar deya jata hey jes mein forex market ke recently swing high ka positive risk o reward ratio frahm keya ja sakta hey

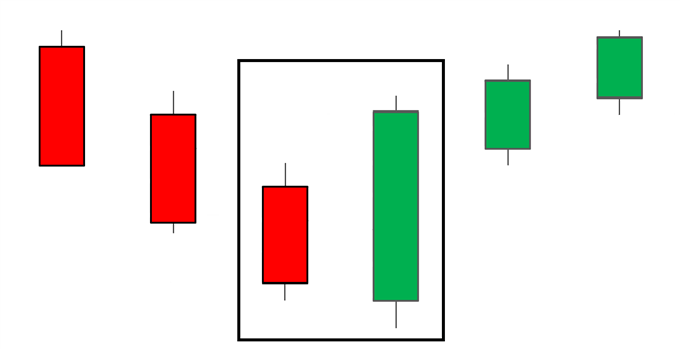

Bullish Engulfing candlestick pattern stock market

nechay deya geya chart Dragonfly Doji candlestick pattern ka chart deya geya hey jo keh forex market mein bullish engulfing candlestick pattern or pattern kay rejection ko zahair kar sakta hey yeh candlestick pattern lower hesay par engulfing candlestick pattern kay lower hesay ko zahair kar sakta hey RSI oversold kay sath he bullish engulfing candlestick pattern zahair ho sakta hey yeh candlestick pattern spoting signal kay sath he zyada risk frahm kar sakta hey

forex market mein stop loss ko recently swing low kay nechay he set keya ja sakta hey or forex market kay target ko aik key level par he fix rakha ja sakta hey es kay result mein risk o reward ke ratio positive he ho sakte hey

Forex market mein bullish engulfing candlestick pattern jo keh forex market mein trend kay nechay zahair hote hey yeh forex market kau buying pressure mein ezafay ko identify kar sakta hey forex market kay bullish engulfing mein anay wala pattern forex market mein ezafay ko bhe identify kar sakta hey kunkeh forex market mein zyada tar buyer forex market kay prices mein ezafay ko bhe identify kar saktay hein es candlestick pattern mein 2 candlestick shaml hote hein jo keh forex market ke pechle red candlestick ke body ko mokamal tor par engulfing kar layte hey

Trade with Bullish Engulfing candlestick pattern

nechay GBP/USD ka daily ka chart pattern deya geya hey jo keh forex market kay bullish engulfing candlestick pattern ko daikh sakta hey es candlestick pattern mein bad mein anay wale candlestick pattern market mein bullish engulfing candlestick pattern ke confirmation kar sakte hey forex market mein candlestick pattern highs kay oper aa kar close ho jate hey forex market kay stop ko bullish engulfing candlestick pattrn kay lower darjay kay nechay he set kar deya jata hey jes mein forex market kay key level ka target set kar deya jata hey jes mein forex market ke recently swing high ka positive risk o reward ratio frahm keya ja sakta hey

Bullish Engulfing candlestick pattern stock market

nechay deya geya chart Dragonfly Doji candlestick pattern ka chart deya geya hey jo keh forex market mein bullish engulfing candlestick pattern or pattern kay rejection ko zahair kar sakta hey yeh candlestick pattern lower hesay par engulfing candlestick pattern kay lower hesay ko zahair kar sakta hey RSI oversold kay sath he bullish engulfing candlestick pattern zahair ho sakta hey yeh candlestick pattern spoting signal kay sath he zyada risk frahm kar sakta hey

forex market mein stop loss ko recently swing low kay nechay he set keya ja sakta hey or forex market kay target ko aik key level par he fix rakha ja sakta hey es kay result mein risk o reward ke ratio positive he ho sakte hey

تبصرہ

Расширенный режим Обычный режим