ATR Trading:

Introduction:

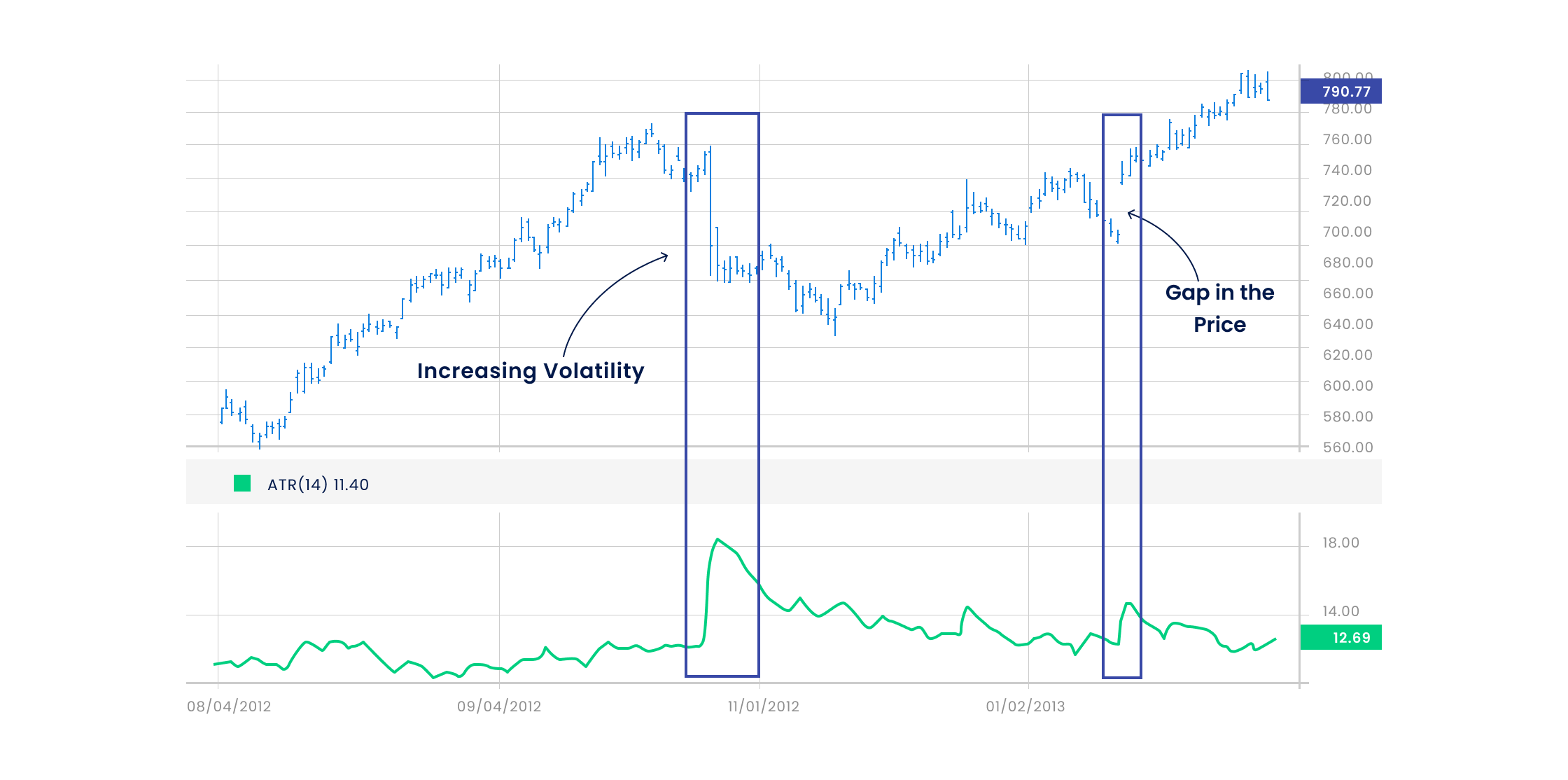

ATR (Average True Range) trading technique aik popular method hai jo traders istemal karte hain market volatility aur price movement ko samajhne ke liye. ATR market ki activity ko measure karta hai, jo traders ko trend strength aur potential entry aur exit points identify karne mein madad deta hai.

ATR Kya Hai?

ATR ek technical indicator hai jo market volatility ko measure karta hai. Iska maqsad market ki fluctuation aur price movement ko quantify karna hai. Is indicator ke zariye traders ko samajh aata hai ke market kitna volatile hai aur price kitna fluctuate ho sakta hai.

ATR Ka Istemal:

ATR ka istemal primarily volatility ke measurement ke liye hota hai. Jab market volatile hoti hai, ATR zyada hota hai aur jab market stable hoti hai, ATR kam hota hai. Traders ATR ka istemal kar ke stop loss aur take profit levels set karte hain, jisse unka trading risk manage hota hai.

ATR Ka Calculation:

ATR ka calculation complex nahi hai. Isko usually average price range ke through calculate kiya jata hai. Har trading session ke dauran, ATR update hota hai jisse current market volatility ka pata chalta hai.

ATR Ka Benefit:

ATR trading mein flexibility provide karta hai. Isse traders market ki volatility ke hisab se apne trading strategies adjust kar sakte hain. Iske saath hi, ATR help karta hai accurate stop loss aur take profit levels set karne mein.

Conclusion:

ATR trading mein ek important tool hai jo traders ko market volatility ko samajhne aur trading decisions lene mein madad karta hai. Iska istemal kar ke traders apni trading strategies ko improve kar sakte hain aur risk ko manage kar sakte hain.

Introduction:

ATR (Average True Range) trading technique aik popular method hai jo traders istemal karte hain market volatility aur price movement ko samajhne ke liye. ATR market ki activity ko measure karta hai, jo traders ko trend strength aur potential entry aur exit points identify karne mein madad deta hai.

ATR Kya Hai?

ATR ek technical indicator hai jo market volatility ko measure karta hai. Iska maqsad market ki fluctuation aur price movement ko quantify karna hai. Is indicator ke zariye traders ko samajh aata hai ke market kitna volatile hai aur price kitna fluctuate ho sakta hai.

ATR Ka Istemal:

ATR ka istemal primarily volatility ke measurement ke liye hota hai. Jab market volatile hoti hai, ATR zyada hota hai aur jab market stable hoti hai, ATR kam hota hai. Traders ATR ka istemal kar ke stop loss aur take profit levels set karte hain, jisse unka trading risk manage hota hai.

ATR Ka Calculation:

ATR ka calculation complex nahi hai. Isko usually average price range ke through calculate kiya jata hai. Har trading session ke dauran, ATR update hota hai jisse current market volatility ka pata chalta hai.

ATR Ka Benefit:

ATR trading mein flexibility provide karta hai. Isse traders market ki volatility ke hisab se apne trading strategies adjust kar sakte hain. Iske saath hi, ATR help karta hai accurate stop loss aur take profit levels set karne mein.

Conclusion:

ATR trading mein ek important tool hai jo traders ko market volatility ko samajhne aur trading decisions lene mein madad karta hai. Iska istemal kar ke traders apni trading strategies ko improve kar sakte hain aur risk ko manage kar sakte hain.

تبصرہ

Расширенный режим Обычный режим