Introduction

moving average indicator aik kesam ka technical indicator hota hey jo keh forex market mein indicate hota hey jo keh forex market mein trend ko identify karnay kay ley convergence or divergence trading mein estamal hota hey yeh indicator forex market mein moving average kay darmean mein relation ko bhe zahair kar sakta hey yeh indicator forex market mein basic hota hey laken effective trading indicator hota hey

MACD indicator forex market mein aik achay time ka indicator hota hey kai MACD indicator ko MACD indicator divergence kay naam say bhe jana jata hey kuch tradr sahi time period par mokhtalef kesam kay indictor ko etamal kar saktay hein

Types o MACD Divergence Indicators

forex market ke 2 basic lines MACD indicator ko zahair kar sakte hein forex market mein price mein tabdele kay sath he bartao karna chihay price mein tabdele ya markze line kay sath he tabdele hone chihay MACD line 2 types mein taqseem ho choke hote hein

MACD Divergence Indicator

ager forex market ke prices central line say hat jate hein MACD divergence line forex market mein trend ko bhe identify kar sakte hein yeh woh time hota hey jo keh forex market mein bullish ke movement ko hasell kar sakta hey forex market mein yeh woh time hota hey jahan par market bullish kay tend ko hasel kar rehe hote hey or forex market mein buyer ke tadad mein ezafa ho raha hota hey kunkeh forex market mein average MACD line say bullish divergence barah choka hota hey forex market ko aik or entry ka chance frahm kar choka hota hey

MACD Convergence

jaisa keh ap ke forex market price Average MACD line ke taraf barah rehe hote hey yeh forex market ke prices kay ley important he hota hey forex market ke prices kay ley hum ahang hona forex market kay ley zaroore hota hey yeh forex market kay assert sell honay kay chance ko bhe identify kar sakta hey

MACD Trading Strategy

forex market mein MACD ke entry ka best time hota hey forex market mein MACD line say hatnay lagen gay or forex market mein woh time hota hey jab forex market ke prices hatnay lagen gay jab forex market ke prices aam tor pr barhna start ho jate hein lahza ap anay walay time kay ley forex market ke zyada entry lay saken gay or forex market mein enter honay ka dosra tareka yeh hota hey jab forex market mein slow or bullish line forex market mein aik dosray ko over loop kar lein gay

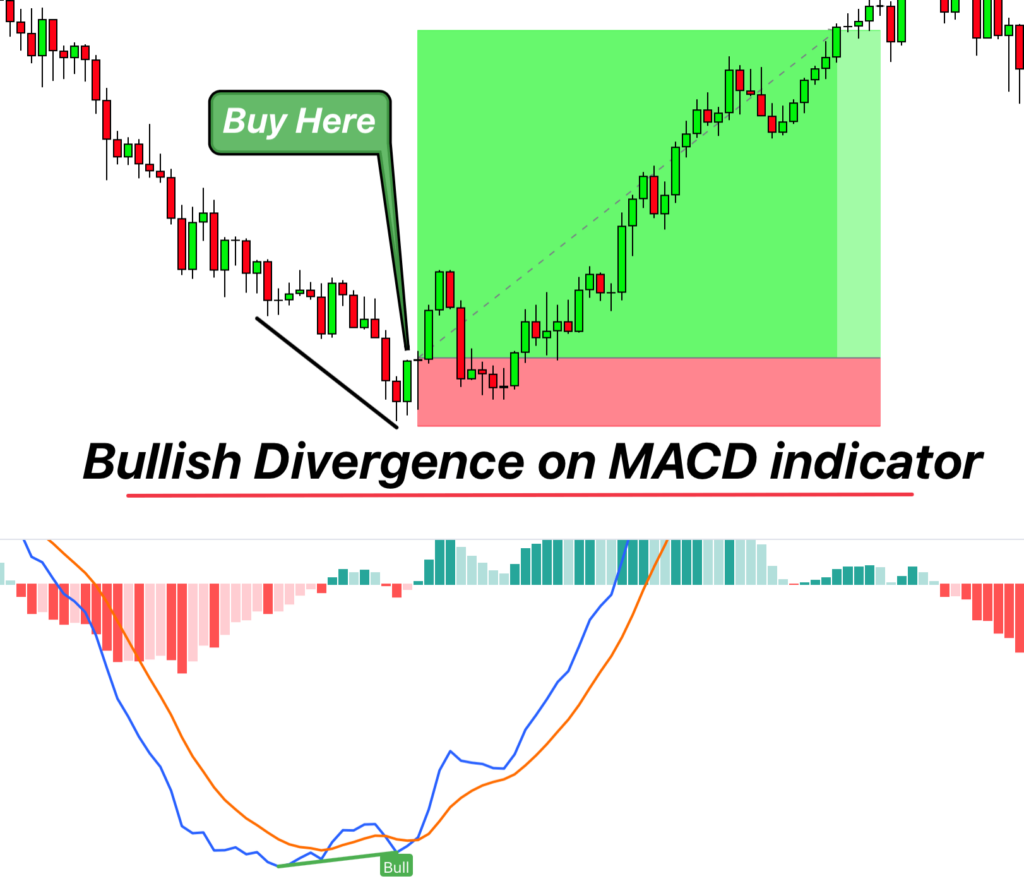

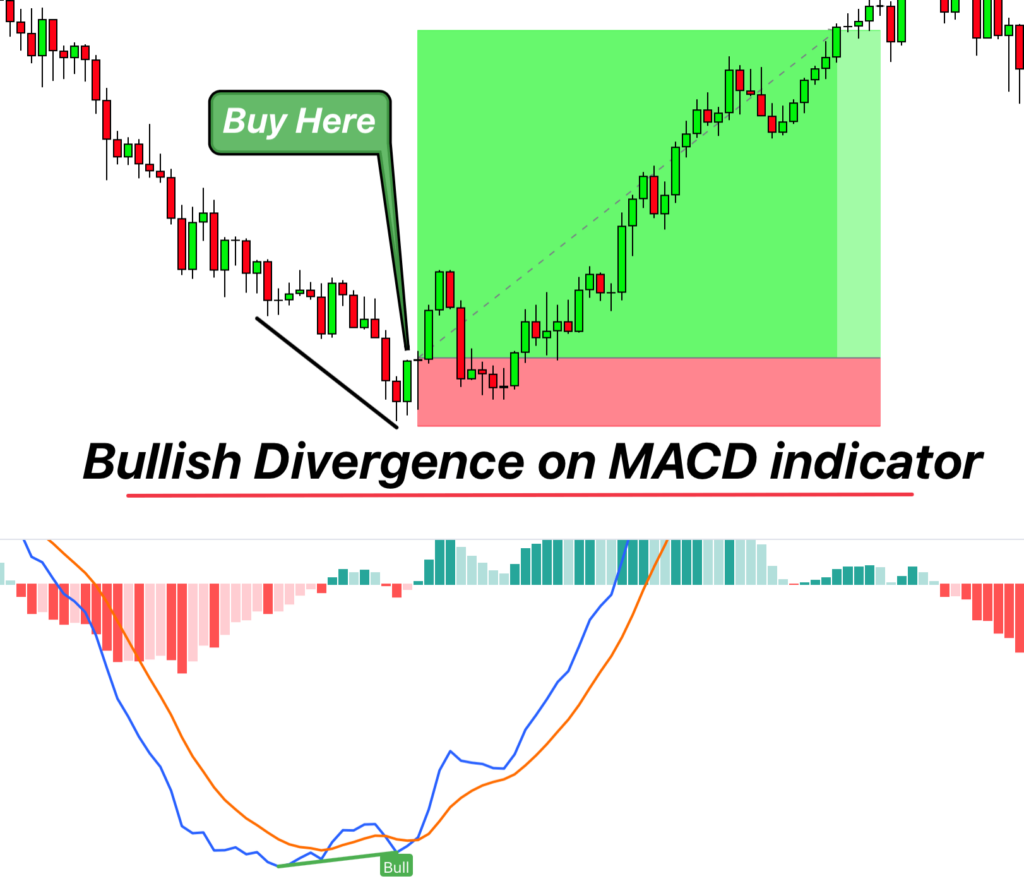

MACD Bullish Divergence Signal

jab forex market mein MACD technical indicator bullish ya bearish signal ko identify karta hy to forex market ke price lower level ke sotrat mein divergence start kar dayte hey jes say market mein bullish signal paida ho jata hey bad mein candlestick bare bullish candlestick ke sorat mein divergence ko bhe indicate kar sakte hey or forex market mein candlestick confirm buy trade mein enter ho sakte hey

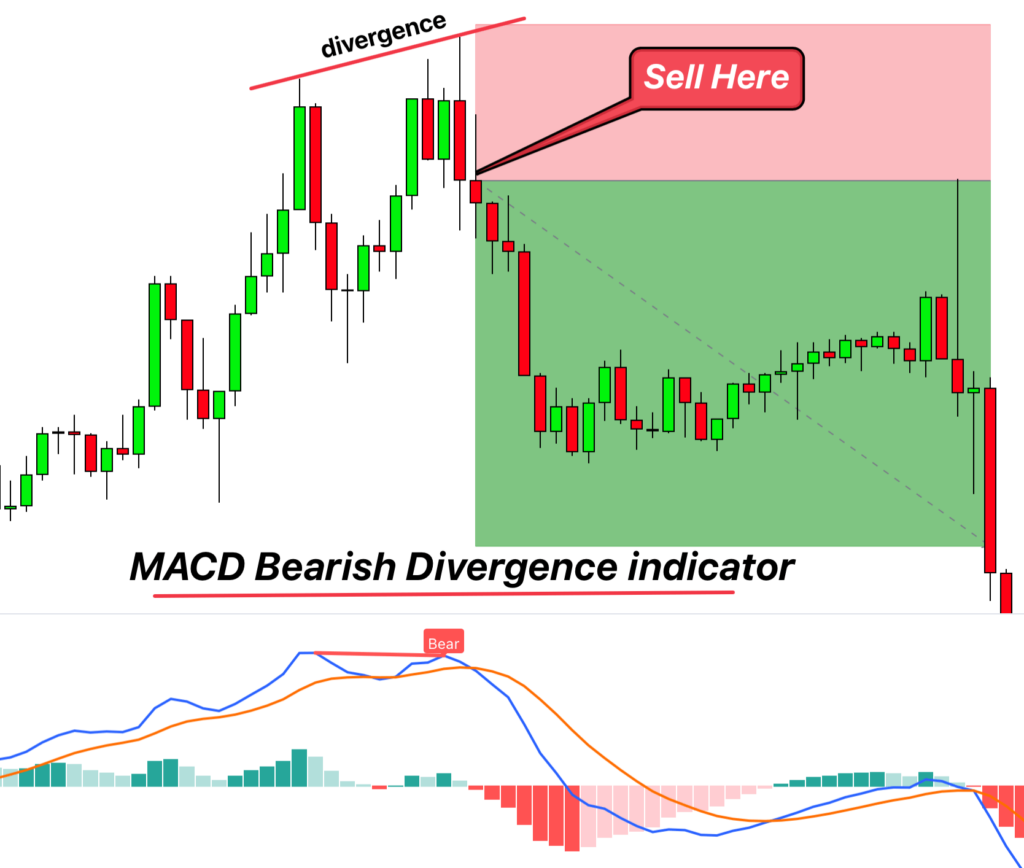

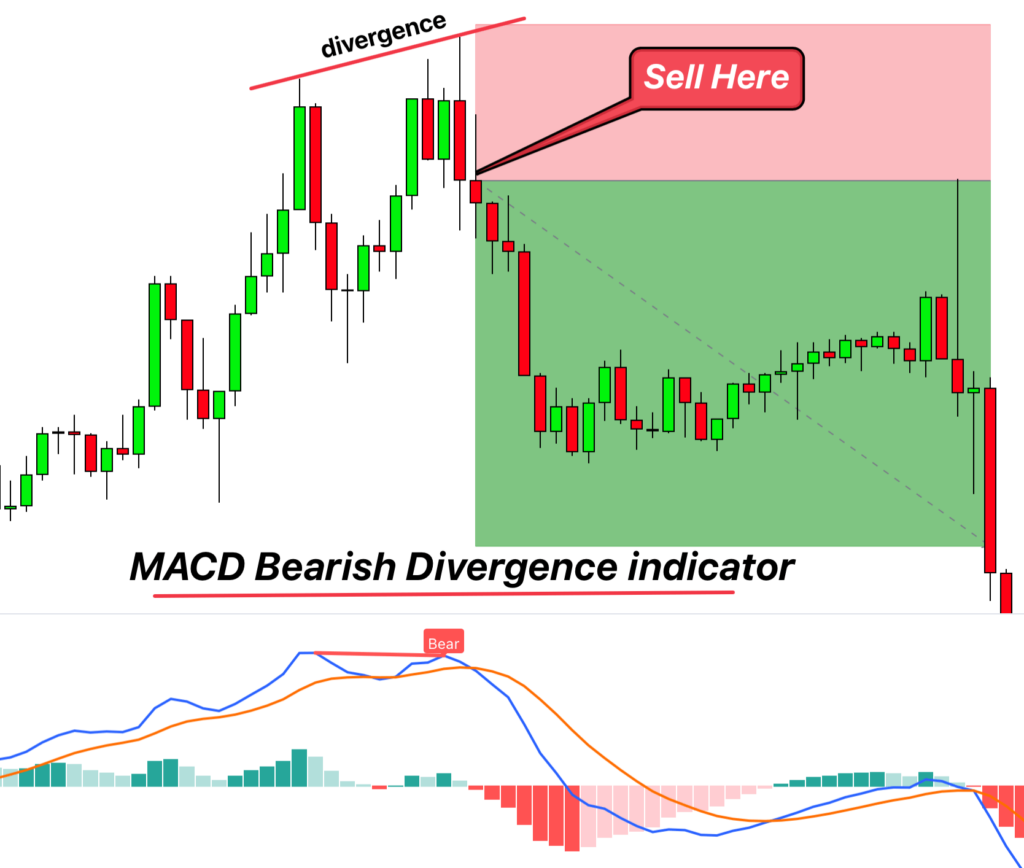

MACD Bearish Signal

forex market mein selling kay signal ko paida karna chihay or yeh bearish signal ke confirmation hote hey jab forex market indicator low high or market mein price zyada high banate hey

moving average indicator aik kesam ka technical indicator hota hey jo keh forex market mein indicate hota hey jo keh forex market mein trend ko identify karnay kay ley convergence or divergence trading mein estamal hota hey yeh indicator forex market mein moving average kay darmean mein relation ko bhe zahair kar sakta hey yeh indicator forex market mein basic hota hey laken effective trading indicator hota hey

MACD indicator forex market mein aik achay time ka indicator hota hey kai MACD indicator ko MACD indicator divergence kay naam say bhe jana jata hey kuch tradr sahi time period par mokhtalef kesam kay indictor ko etamal kar saktay hein

Types o MACD Divergence Indicators

forex market ke 2 basic lines MACD indicator ko zahair kar sakte hein forex market mein price mein tabdele kay sath he bartao karna chihay price mein tabdele ya markze line kay sath he tabdele hone chihay MACD line 2 types mein taqseem ho choke hote hein

MACD Divergence Indicator

ager forex market ke prices central line say hat jate hein MACD divergence line forex market mein trend ko bhe identify kar sakte hein yeh woh time hota hey jo keh forex market mein bullish ke movement ko hasell kar sakta hey forex market mein yeh woh time hota hey jahan par market bullish kay tend ko hasel kar rehe hote hey or forex market mein buyer ke tadad mein ezafa ho raha hota hey kunkeh forex market mein average MACD line say bullish divergence barah choka hota hey forex market ko aik or entry ka chance frahm kar choka hota hey

MACD Convergence

jaisa keh ap ke forex market price Average MACD line ke taraf barah rehe hote hey yeh forex market ke prices kay ley important he hota hey forex market ke prices kay ley hum ahang hona forex market kay ley zaroore hota hey yeh forex market kay assert sell honay kay chance ko bhe identify kar sakta hey

MACD Trading Strategy

forex market mein MACD ke entry ka best time hota hey forex market mein MACD line say hatnay lagen gay or forex market mein woh time hota hey jab forex market ke prices hatnay lagen gay jab forex market ke prices aam tor pr barhna start ho jate hein lahza ap anay walay time kay ley forex market ke zyada entry lay saken gay or forex market mein enter honay ka dosra tareka yeh hota hey jab forex market mein slow or bullish line forex market mein aik dosray ko over loop kar lein gay

MACD Bullish Divergence Signal

jab forex market mein MACD technical indicator bullish ya bearish signal ko identify karta hy to forex market ke price lower level ke sotrat mein divergence start kar dayte hey jes say market mein bullish signal paida ho jata hey bad mein candlestick bare bullish candlestick ke sorat mein divergence ko bhe indicate kar sakte hey or forex market mein candlestick confirm buy trade mein enter ho sakte hey

MACD Bearish Signal

forex market mein selling kay signal ko paida karna chihay or yeh bearish signal ke confirmation hote hey jab forex market indicator low high or market mein price zyada high banate hey

تبصرہ

Расширенный режим Обычный режим