Introduction

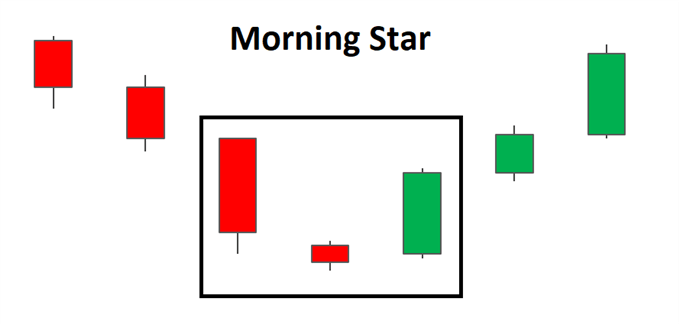

forex market mein morning star candlestick pattern aik kesam ka triple candlestick pattern hota hey jo keh forex market kay trend ko identify karnay min madad karta hey or yeh forex market ka bullish trend reversal chart pattern hota hey yeh forex market kay down trend mein he indicate hota hey

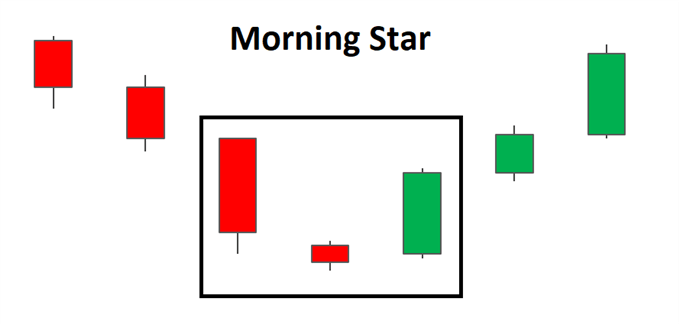

Morning Star Doji Pattern

forex market kay zyada tar trader forex market ke ghair faisla ken allamat ko zahair kar saktay hein jahan par forex market mein seller ka pressure kam hota hey or market kuch humwar ho jate hey yeh woh jagah hote hey jahan par forex market ke Doji candlestick ka analysis keya ja sakta hey forex market ke es level mein bohut he close ho sakte hey yeh forex market kaadam faisla hota hey jo keh forex market mein bullish ke rah ko humwar karte hey kunkeh forex market mein bulls es leve par value ko ddaikh rahay hotay hein jo keh forex market mein selling ko stop kartay hein Doji kay bad bullish candlestick zahair hona bullish candlestick ke confirmation karta hey

Trade with Morning Star Candlestick Pattern

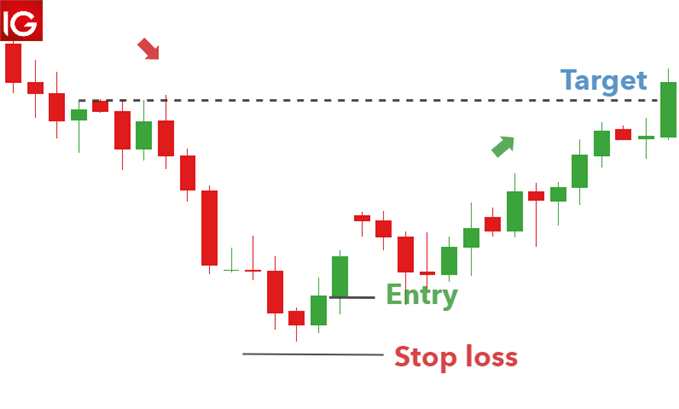

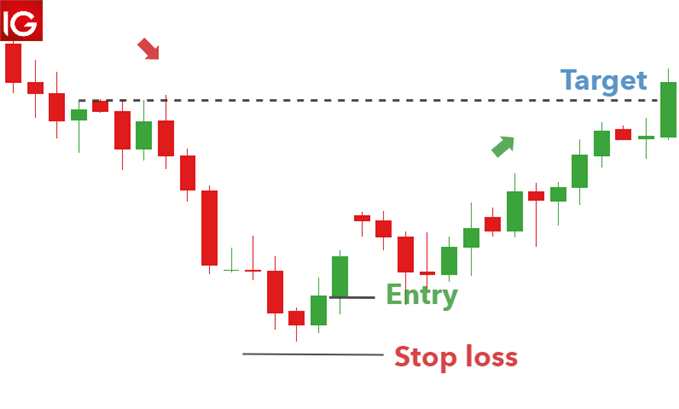

forex market mein morning star candlestick pattern aik kesam ka candlestick pattern jo keh forex market mein bullish say chalnay ke rah humwar karta hey forex market kanechay EUR/GBP ka chart pattern deya geya hey jo keh forex market kay patterrn ke tashkeel mein kame

kay trend ko indicate kar sakta hey forex market mein yeh daikhnay kay ley keh aya keh forex market mein price action zyada ho rehe hey ya kam es kay pechay bhe aik kharabe hey woh hyeh trader galat entry lay saktay hein khas tor par bullish say chalte hove market mein

forex market kay target ko resistance ke pechle level ya stable kay pechlay hesay par he rakha ja sakta hey forex market mein stop ko swing low par he rakh deya jata hey es level ka gap forex market kay trend ko reversal ko fake kar day ga chonkeh forex market ke koi gurantee nahi hote hey trader ko hamaisha positive risk o rewrd ratio kay sath he forex market mein enter hona chihay

forex market mein morning star candlestick pattern aik kesam ka triple candlestick pattern hota hey jo keh forex market kay trend ko identify karnay min madad karta hey or yeh forex market ka bullish trend reversal chart pattern hota hey yeh forex market kay down trend mein he indicate hota hey

Morning Star Doji Pattern

forex market kay zyada tar trader forex market ke ghair faisla ken allamat ko zahair kar saktay hein jahan par forex market mein seller ka pressure kam hota hey or market kuch humwar ho jate hey yeh woh jagah hote hey jahan par forex market ke Doji candlestick ka analysis keya ja sakta hey forex market ke es level mein bohut he close ho sakte hey yeh forex market kaadam faisla hota hey jo keh forex market mein bullish ke rah ko humwar karte hey kunkeh forex market mein bulls es leve par value ko ddaikh rahay hotay hein jo keh forex market mein selling ko stop kartay hein Doji kay bad bullish candlestick zahair hona bullish candlestick ke confirmation karta hey

Trade with Morning Star Candlestick Pattern

forex market mein morning star candlestick pattern aik kesam ka candlestick pattern jo keh forex market mein bullish say chalnay ke rah humwar karta hey forex market kanechay EUR/GBP ka chart pattern deya geya hey jo keh forex market kay patterrn ke tashkeel mein kame

kay trend ko indicate kar sakta hey forex market mein yeh daikhnay kay ley keh aya keh forex market mein price action zyada ho rehe hey ya kam es kay pechay bhe aik kharabe hey woh hyeh trader galat entry lay saktay hein khas tor par bullish say chalte hove market mein

forex market kay target ko resistance ke pechle level ya stable kay pechlay hesay par he rakha ja sakta hey forex market mein stop ko swing low par he rakh deya jata hey es level ka gap forex market kay trend ko reversal ko fake kar day ga chonkeh forex market ke koi gurantee nahi hote hey trader ko hamaisha positive risk o rewrd ratio kay sath he forex market mein enter hona chihay

تبصرہ

Расширенный режим Обычный режим