Breadth Thrust Indicator (BTI) forex trading ka aik ahem aur powerful tool hai jo traders ko market ke sentiment aur momentum ko assess karne mein madad deta hai. Yeh indicator market ke breadth ko measure karta hai, jo ke overall market participation ko reflect karta hai. Iska basic concept yeh hai ke jab zyada securities participate kar rahi hoti hain, toh market mein strength aur potential rally ka chance hota hai.

Breadth Thrust Indicator Ka Concept

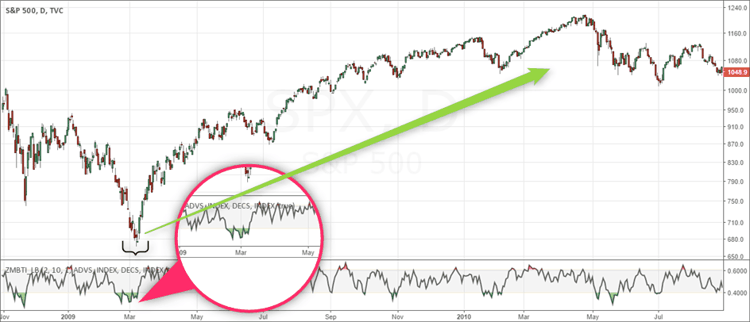

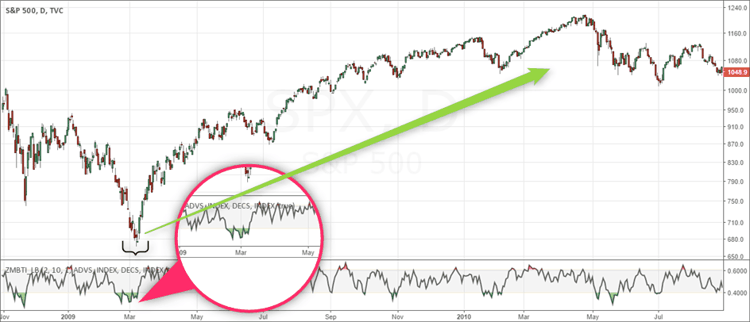

Breadth thrust indicator market ki overall breadth ko measure karta hai, jo ke advance aur decline hone wali securities ke beech ka ratio hota hai. Jab market breadth positive hoti hai, toh zyada securities price mein increase hoti hain, aur yeh bullish sentiment ko indicate karta hai. Jab market breadth negative hoti hai, toh zyada securities price mein decrease hoti hain, aur yeh bearish sentiment ko indicate karta hai.

Calculation of Breadth Thrust Indicator

Breadth thrust indicator ko calculate karne ke liye, hum advance/decline ratio ko use karte hain. Yeh ratio calculate karne ke liye humein do cheezon ki zaroorat hoti hai:

Importance of Breadth Thrust Indicator

Forex trading mein breadth thrust indicator ko use karne ke liye, humein kuch specific steps ko follow karna padta hai:

Breadth thrust indicator ko use karte hue, kuch trading strategies ko implement kiya ja sakta hai:

1. Trend Following Strategy

Yeh strategy market ke trend ko follow karne par focus karti hai. Breadth thrust indicator ko use karte hue, hum trend direction ko identify kar sakte hain aur uske according trade kar sakte hain.

Steps

Yeh strategy market reversals ko detect karne par focus karti hai. Breadth thrust indicator ko use karte hue, hum overbought aur oversold conditions ko identify kar sakte hain aur uske according trade kar sakte hain.

Steps

Yeh strategy divergence ko detect karne par focus karti hai, jo ke potential trend reversal ko indicate kar sakta hai. Breadth thrust indicator aur price action ke beech divergence ko identify karna is strategy ka core hai.

Steps

Breadth thrust indicator forex trading mein aik valuable tool hai jo market sentiment aur trend ko assess karne mein madad karta hai. Yeh indicator simple calculation aur effective market sentiment analysis ki wajah se popular hai. Lekin isko standalone use karna sahi nahi hai, isko dusre indicators ke sath combine karke use karna chahiye. Breadth thrust indicator ko effectively use karte hue, traders better trading decisions le sakte hain aur market trends ko accurately identify kar sakte hain. Forex trading mein is indicator ka proper understanding aur application trading performance ko enhance kar sakta hai.

Breadth Thrust Indicator Ka Concept

Breadth thrust indicator market ki overall breadth ko measure karta hai, jo ke advance aur decline hone wali securities ke beech ka ratio hota hai. Jab market breadth positive hoti hai, toh zyada securities price mein increase hoti hain, aur yeh bullish sentiment ko indicate karta hai. Jab market breadth negative hoti hai, toh zyada securities price mein decrease hoti hain, aur yeh bearish sentiment ko indicate karta hai.

Calculation of Breadth Thrust Indicator

Breadth thrust indicator ko calculate karne ke liye, hum advance/decline ratio ko use karte hain. Yeh ratio calculate karne ke liye humein do cheezon ki zaroorat hoti hai:

- Advancing Issues (A): Yeh woh securities hain jin ki prices upar ja rahi hain.

- Declining Issues (D): Yeh woh securities hain jin ki prices neeche ja rahi hain.

Importance of Breadth Thrust Indicator

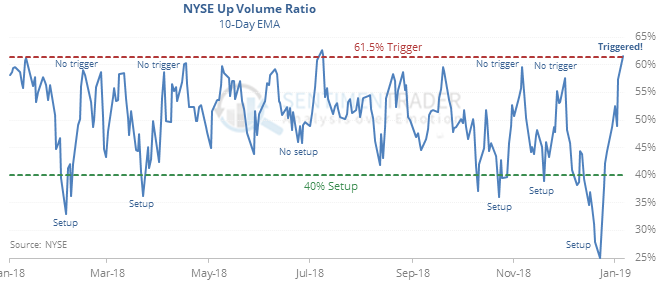

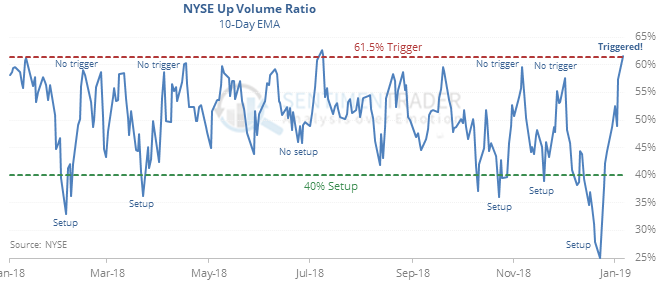

- Market Sentiment: Breadth thrust indicator market ke sentiment ko assess karne ka aik powerful tool hai. Yeh traders ko batata hai ke market participants ka overall behavior kya hai, aur kis taraf market move karne ke chances hain.

- Trend Identification: Yeh indicator market trend ko identify karne mein madadgar hota hai. Agar breadth thrust indicator high readings show kar raha hai, toh yeh indicate karta hai ke market mein strong bullish trend hai. Wohi agar yeh low readings show kar raha hai, toh yeh bearish trend ko indicate karta hai.

- Market Reversals: Breadth thrust indicator ko market reversals ko detect karne ke liye bhi use kiya ja sakta hai. Jab yeh indicator extreme levels par pohanch jata hai, toh yeh potential market reversal ko signal kar sakta hai. For example, agar breadth thrust indicator 0.80 se zyada ho jaye, toh market mein overbought condition ho sakti hai, aur price reversal ke chances hain.

Forex trading mein breadth thrust indicator ko use karne ke liye, humein kuch specific steps ko follow karna padta hai:

- Identify Market Breadth: Sabse pehle, humein market breadth ko identify karna hota hai. Yeh hum kar sakte hain by looking at the number of advancing and declining currency pairs. Forex market mein, yeh slightly different ho sakta hai kyun ke humein major currency pairs par focus karna hota hai.

- Calculate Breadth Thrust: Once humne advancing aur declining currency pairs ko identify kar liya, hum breadth thrust indicator ko calculate kar sakte hain using the formula mentioned above.

- Analyze the Indicator: Breadth thrust indicator ko analyze karte waqt, humein yeh dekhna hota hai ke yeh indicator kis range mein trade kar raha hai. Agar yeh high readings show kar raha hai (above 0.70), toh yeh bullish market ko indicate karta hai. Agar yeh low readings show kar raha hai (below 0.40), toh yeh bearish market ko indicate karta hai.

- Make Trading Decisions: Breadth thrust indicator ko use karte hue, hum apni trading decisions ko enhance kar sakte hain. Agar indicator bullish market ko indicate kar raha hai, toh hum buy positions ko consider kar sakte hain. Agar yeh bearish market ko indicate kar raha hai, toh hum sell positions ko consider kar sakte hain.

Breadth thrust indicator ko use karte hue, kuch trading strategies ko implement kiya ja sakta hai:

1. Trend Following Strategy

Yeh strategy market ke trend ko follow karne par focus karti hai. Breadth thrust indicator ko use karte hue, hum trend direction ko identify kar sakte hain aur uske according trade kar sakte hain.

Steps

- Breadth thrust indicator ko calculate karein.

- Agar indicator high readings show kar raha hai (above 0.70), toh bullish trend hai. Is situation mein, hum buy trades ko consider kar sakte hain.

- Agar indicator low readings show kar raha hai (below 0.40), toh bearish trend hai. Is situation mein, hum sell trades ko consider kar sakte hain.

Yeh strategy market reversals ko detect karne par focus karti hai. Breadth thrust indicator ko use karte hue, hum overbought aur oversold conditions ko identify kar sakte hain aur uske according trade kar sakte hain.

Steps

- Breadth thrust indicator ko calculate karein.

- Agar indicator extremely high readings show kar raha hai (above 0.80), toh market overbought ho sakta hai. Is situation mein, hum sell trades ko consider kar sakte hain.

- Agar indicator extremely low readings show kar raha hai (below 0.20), toh market oversold ho sakta hai. Is situation mein, hum buy trades ko consider kar sakte hain.

Yeh strategy divergence ko detect karne par focus karti hai, jo ke potential trend reversal ko indicate kar sakta hai. Breadth thrust indicator aur price action ke beech divergence ko identify karna is strategy ka core hai.

Steps

- Breadth thrust indicator ko calculate karein.

- Price action ko analyze karein.

- Agar price action higher highs bana raha hai lekin breadth thrust indicator lower highs bana raha hai, toh yeh bearish divergence hai. Is situation mein, hum sell trades ko consider kar sakte hain.

- Agar price action lower lows bana raha hai lekin breadth thrust indicator higher lows bana raha hai, toh yeh bullish divergence hai. Is situation mein, hum buy trades ko consider kar sakte hain.

- Simple Calculation: Breadth thrust indicator ko calculate karna simple aur straightforward hai. Yeh sirf advancing aur declining issues ka ratio hota hai, jo easily available data se calculate ho sakta hai.

- Effective Market Sentiment Analysis: Yeh indicator market sentiment ko effectively analyze kar sakta hai, jo traders ko market ke direction aur strength ko samajhne mein madad deta hai.

- Versatile Usage: Breadth thrust indicator ko multiple trading strategies mein use kiya ja sakta hai, jese ke trend following, reversal, aur divergence strategies.

- Lagging Indicator: Breadth thrust indicator lagging nature ka hota hai, jo past data par base karta hai. Yeh timely signals provide nahi kar sakta, especially in fast-moving markets.

- Market Breadth Dependency: Yeh indicator market breadth par depend karta hai, jo har market mein consistent nahi hota. Forex market mein, major currency pairs par focus karna zaroori hai to get accurate readings.

- Not a Standalone Indicator: Breadth thrust indicator ko standalone use karna advisable nahi hai. Isko dusre technical indicators aur analysis ke sath combine karna chahiye for better trading decisions.

Breadth thrust indicator forex trading mein aik valuable tool hai jo market sentiment aur trend ko assess karne mein madad karta hai. Yeh indicator simple calculation aur effective market sentiment analysis ki wajah se popular hai. Lekin isko standalone use karna sahi nahi hai, isko dusre indicators ke sath combine karke use karna chahiye. Breadth thrust indicator ko effectively use karte hue, traders better trading decisions le sakte hain aur market trends ko accurately identify kar sakte hain. Forex trading mein is indicator ka proper understanding aur application trading performance ko enhance kar sakta hai.

تبصرہ

Расширенный режим Обычный режим