Leverage ki Pehchaan:

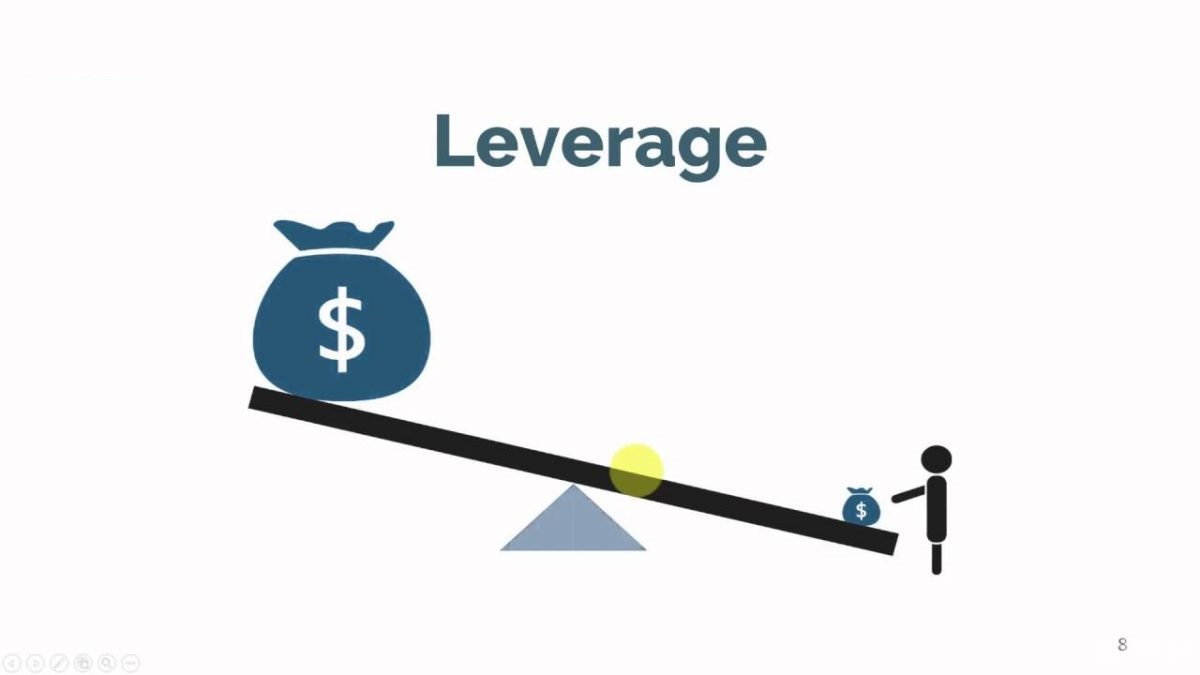

Leverage ka matlab hai ke aap apne paas se kam paise laga kar zyadah paisay control kar saktay hain. Forex trading mein, leverage aapko apne investment ko multiply karne ka moka deta hai. Yeh ek borrowed capital ka form hai jo aapko brokers provide karte hain.

Leverage ki Ahemiyat:

Forex trading mein leverage ki ahemiyat kaafi zyada hai kyunki is se traders apne profits ko multiply kar sakte hain. Choti investments se bade profits kamana leverage ki wajah se mumkin hota hai. Is ki madad se aap choti price movements se bhi achi returns hasil kar sakte hain.

High Risk High Reward:

Leverage ke sath trading ka matlab hai ke aap high risk lete hain, magar agar aapki trade successful hoti hai to aapko high rewards bhi milte hain. Yeh ek double-edged sword ki tarah hai jahan ek taraf aap zyada kama sakte hain, magar dosri taraf agar market aapki expectation ke khilaf jati hai to aapko zyada losses bhi uthana pad sakta hai.

Risk Management:

Leverage use karte waqt risk management bohat zaroori hai. Is mein stop-loss orders, proper position sizing aur risk-to-reward ratio ko consider karna shamil hai. Aapko yeh samajhna hoga ke leverage aapki investment ko kitna expose karta hai aur accordingly apni strategies banana hogi.

Margin Requirements:

Leverage ka direct ta’luq margin requirements se hota hai. Brokers aapko kuch percentage as margin maintain karne ko kehte hain. Agar market aapke khilaf jati hai aur aapke margin call level se neeche gir jaati hai, to broker aapki positions liquidate kar sakta hai.

Leverage ki Limits:

Har broker leverage ke different limits offer karta hai, aur yeh countries ke regulations par bhi depend karta hai. High leverage tempting hoti hai magar zyada leverage lene se pehle aapko apne trading skills aur market understanding ko zaroor assess kar lena chahiye.

Summary:

Akhir mein, leverage forex trading mein bohat ahem role ada karta hai. Yeh aapki profitability ko enhance kar sakta hai magar sath hi aapke risk ko bhi badhata hai. Leverage ko wisely use karna aur strong risk management practices follow karna hi successful forex trading ka raaz hai.

Leverage ka matlab hai ke aap apne paas se kam paise laga kar zyadah paisay control kar saktay hain. Forex trading mein, leverage aapko apne investment ko multiply karne ka moka deta hai. Yeh ek borrowed capital ka form hai jo aapko brokers provide karte hain.

Leverage ki Ahemiyat:

Forex trading mein leverage ki ahemiyat kaafi zyada hai kyunki is se traders apne profits ko multiply kar sakte hain. Choti investments se bade profits kamana leverage ki wajah se mumkin hota hai. Is ki madad se aap choti price movements se bhi achi returns hasil kar sakte hain.

High Risk High Reward:

Leverage ke sath trading ka matlab hai ke aap high risk lete hain, magar agar aapki trade successful hoti hai to aapko high rewards bhi milte hain. Yeh ek double-edged sword ki tarah hai jahan ek taraf aap zyada kama sakte hain, magar dosri taraf agar market aapki expectation ke khilaf jati hai to aapko zyada losses bhi uthana pad sakta hai.

Risk Management:

Leverage use karte waqt risk management bohat zaroori hai. Is mein stop-loss orders, proper position sizing aur risk-to-reward ratio ko consider karna shamil hai. Aapko yeh samajhna hoga ke leverage aapki investment ko kitna expose karta hai aur accordingly apni strategies banana hogi.

Margin Requirements:

Leverage ka direct ta’luq margin requirements se hota hai. Brokers aapko kuch percentage as margin maintain karne ko kehte hain. Agar market aapke khilaf jati hai aur aapke margin call level se neeche gir jaati hai, to broker aapki positions liquidate kar sakta hai.

Leverage ki Limits:

Har broker leverage ke different limits offer karta hai, aur yeh countries ke regulations par bhi depend karta hai. High leverage tempting hoti hai magar zyada leverage lene se pehle aapko apne trading skills aur market understanding ko zaroor assess kar lena chahiye.

Summary:

Akhir mein, leverage forex trading mein bohat ahem role ada karta hai. Yeh aapki profitability ko enhance kar sakta hai magar sath hi aapke risk ko bhi badhata hai. Leverage ko wisely use karna aur strong risk management practices follow karna hi successful forex trading ka raaz hai.

تبصرہ

Расширенный режим Обычный режим