Dumpling Candlestick Pattern Kya Hai

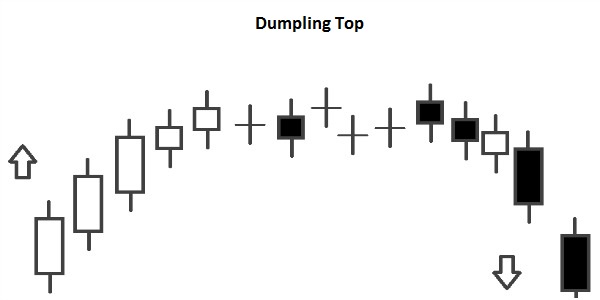

Dumpling candlestick pattern aik bearish reversal pattern hai jo forex trading main market k trend ko ulatnay ka signal daita hai. Yeh pattern jab market overbought ho aur upward trend k baad nazar aata hai tou yeh indicate karta hai ke prices ab neeche ja sakti hain.

Pattern Ki Shakal Aur Structure:

Yeh pattern chaar ya us se zyada small bearish candles se mil kar banta hai jinka structure rounded top jaisa hota hai. In candles ka size chota hota hai aur yeh ek rounded form main dikhai deti hain, is liye isay 'dumpling' pattern kaha jata hai.

Formation Aur Identification:

1. Upward Trend: Yeh pattern tab hota hai jab market already ek upward trend main hoti hai.

2. Small Candles: Aik ke baad aik chaar ya us se zyada small bearish candles banti hain.

3. Rounded Top: In candles ka collective structure ek rounded top jaisa hota hai.

Significance Aur Implications:

Yeh pattern indicate karta hai ke market main buying momentum khatam ho raha hai aur selling pressure increase ho raha hai. Dumpling pattern ka matlab hai ke ab market ka trend ulat sakta hai aur prices neeche ja sakti hain.

Trading Strategy:

1. Confirmation Wait Karo: Pattern complete hone ke baad ek bearish confirmation candle ka wait karo.

2. Entry Point: Confirmation candle ke close hone par sell position open karo.

3. Stop Loss: Apna stop loss last high ke thora upar set karo.

4. Take Profit: Previous support levels par take profit set karo.

Common Mistakes:

1. Early Entry: Pattern complete hone se pehle entry mat lo.

2. Stop Loss Bhoolna: Hamesha stop loss use karo.

3. Over-Reliance: Sirf ek pattern par reliance mat karo, doosre indicators bhi check karo.

Conclusion:

Dumpling candlestick pattern aik powerful tool hai jo forex traders ko market reversal detect karne main madad karta hai. Magar is pattern ko effectively use karne ke liye proper confirmation aur risk management strategies ka hona zaroori hai.

Dumpling candlestick pattern aik bearish reversal pattern hai jo forex trading main market k trend ko ulatnay ka signal daita hai. Yeh pattern jab market overbought ho aur upward trend k baad nazar aata hai tou yeh indicate karta hai ke prices ab neeche ja sakti hain.

Pattern Ki Shakal Aur Structure:

Yeh pattern chaar ya us se zyada small bearish candles se mil kar banta hai jinka structure rounded top jaisa hota hai. In candles ka size chota hota hai aur yeh ek rounded form main dikhai deti hain, is liye isay 'dumpling' pattern kaha jata hai.

Formation Aur Identification:

1. Upward Trend: Yeh pattern tab hota hai jab market already ek upward trend main hoti hai.

2. Small Candles: Aik ke baad aik chaar ya us se zyada small bearish candles banti hain.

3. Rounded Top: In candles ka collective structure ek rounded top jaisa hota hai.

Significance Aur Implications:

Yeh pattern indicate karta hai ke market main buying momentum khatam ho raha hai aur selling pressure increase ho raha hai. Dumpling pattern ka matlab hai ke ab market ka trend ulat sakta hai aur prices neeche ja sakti hain.

Trading Strategy:

1. Confirmation Wait Karo: Pattern complete hone ke baad ek bearish confirmation candle ka wait karo.

2. Entry Point: Confirmation candle ke close hone par sell position open karo.

3. Stop Loss: Apna stop loss last high ke thora upar set karo.

4. Take Profit: Previous support levels par take profit set karo.

Common Mistakes:

1. Early Entry: Pattern complete hone se pehle entry mat lo.

2. Stop Loss Bhoolna: Hamesha stop loss use karo.

3. Over-Reliance: Sirf ek pattern par reliance mat karo, doosre indicators bhi check karo.

Conclusion:

Dumpling candlestick pattern aik powerful tool hai jo forex traders ko market reversal detect karne main madad karta hai. Magar is pattern ko effectively use karne ke liye proper confirmation aur risk management strategies ka hona zaroori hai.

تبصرہ

Расширенный режим Обычный режим