Introduction:

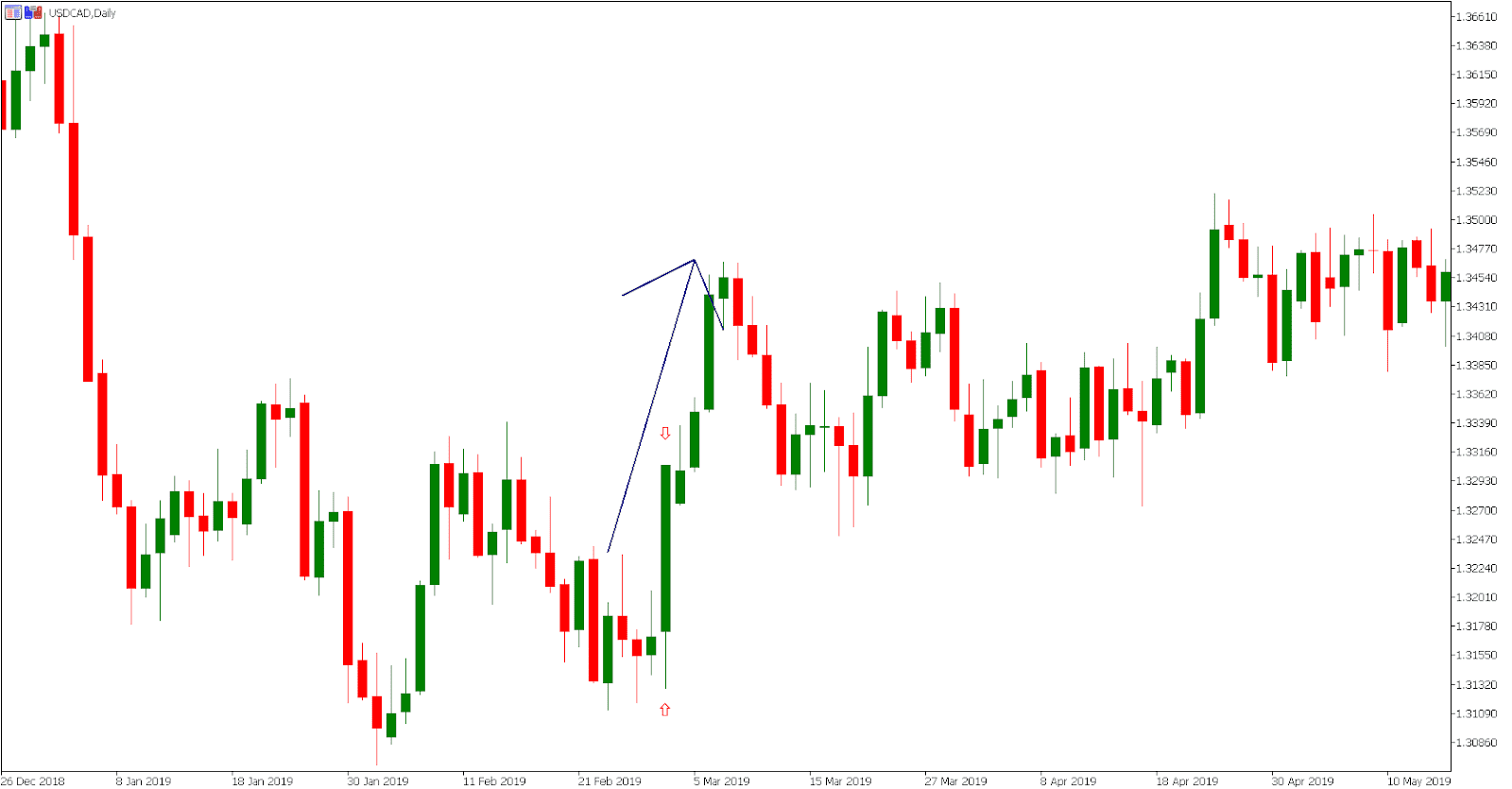

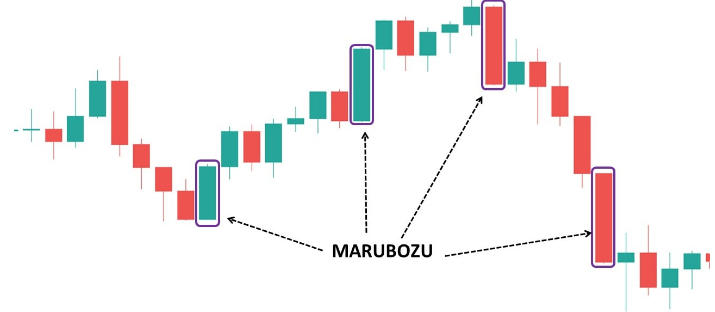

Marubozu candlestick pattern ek powerful aur straightforward pattern hai jo traders ko market ki direction ka clear signal deta hai. Yeh pattern bullish ya bearish trend ko indicate kar sakta hai, aur traders ko entry aur exit points provide karta hai.

Bullish Marubozu:

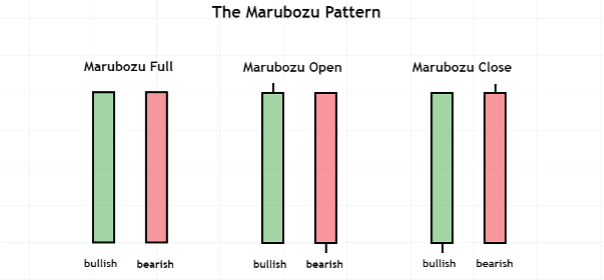

Bullish Marubozu ek single candlestick hai jo market mein strong uptrend ko represent karta hai.Is candlestick mein koi shadow nahi hoti, matlab ke opening price aur closing price bilkul ya aik dam qareeb hoti hai.Iski lambai bara hoti hai, jo bullish momentum ko show karta hai.Is pattern ko dekhte hue traders usually long positions lete hain.Bullish Marubozu pattern mein, candle ka open price day ka lowest price hota hai aur close price day ka highest price hota hai. Iska matlab hai ke buyers ne poori trading session mein control rakha aur market ko upar le gaya. Bearish Marubozu mein, situation ulta hoti hai, jahan candle ka open price day ka highest price hota hai aur close price day ka lowest price hota hai. Yahan sellers ne control rakha aur market ko neeche le gaya.

Bearish Marubozu:

Dosto Bearish Marubozu bhi ek single candlestick hai, lekin yeh market mein strong downtrend ko indicate karta hai.Iski lambai bhi bara hoti hai, lekin ismein shadow hoti hai ya toh upper shadow hoti hai.ya phir lower shadow hoti hai .Bearish Marubozu dekh kar traders generally short positions lete hain, expecting further downward movement.Marubozu candlestick pattern ko dekh kar, traders market direction ka idea bana sakte hain aur uss direction mein trading decisions le sakte hain. Lekin, jaise har technical indicator aur pattern ki tarah, isko bhi confirmatory indicators aur risk management ke saath istemal karna zaroori hai.is ki bhot ahmiyat hai ye ek bhot achai bearish marubozu hai bullish marub hota hai jisay hum achi tarha se jantay hain aur is mein hum secceful ho skte hain.

Marubozu candlestick pattern ek powerful aur straightforward pattern hai jo traders ko market ki direction ka clear signal deta hai. Yeh pattern bullish ya bearish trend ko indicate kar sakta hai, aur traders ko entry aur exit points provide karta hai.

Bullish Marubozu:

Bullish Marubozu ek single candlestick hai jo market mein strong uptrend ko represent karta hai.Is candlestick mein koi shadow nahi hoti, matlab ke opening price aur closing price bilkul ya aik dam qareeb hoti hai.Iski lambai bara hoti hai, jo bullish momentum ko show karta hai.Is pattern ko dekhte hue traders usually long positions lete hain.Bullish Marubozu pattern mein, candle ka open price day ka lowest price hota hai aur close price day ka highest price hota hai. Iska matlab hai ke buyers ne poori trading session mein control rakha aur market ko upar le gaya. Bearish Marubozu mein, situation ulta hoti hai, jahan candle ka open price day ka highest price hota hai aur close price day ka lowest price hota hai. Yahan sellers ne control rakha aur market ko neeche le gaya.

Bearish Marubozu:

Dosto Bearish Marubozu bhi ek single candlestick hai, lekin yeh market mein strong downtrend ko indicate karta hai.Iski lambai bhi bara hoti hai, lekin ismein shadow hoti hai ya toh upper shadow hoti hai.ya phir lower shadow hoti hai .Bearish Marubozu dekh kar traders generally short positions lete hain, expecting further downward movement.Marubozu candlestick pattern ko dekh kar, traders market direction ka idea bana sakte hain aur uss direction mein trading decisions le sakte hain. Lekin, jaise har technical indicator aur pattern ki tarah, isko bhi confirmatory indicators aur risk management ke saath istemal karna zaroori hai.is ki bhot ahmiyat hai ye ek bhot achai bearish marubozu hai bullish marub hota hai jisay hum achi tarha se jantay hain aur is mein hum secceful ho skte hain.

تبصرہ

Расширенный режим Обычный режим