Asslaam O Alikum.!

Bullish rectangle candlestick pattern ek important technical analysis tool hai jo traders ko market mein uptrend ke potential opportunities ke baare mein maloomat deta hai. Yeh pattern market mein consolidation ke baad bullish move ko suggest karta hai.

Bullish Rectangle Pattern Kiya hota hai:

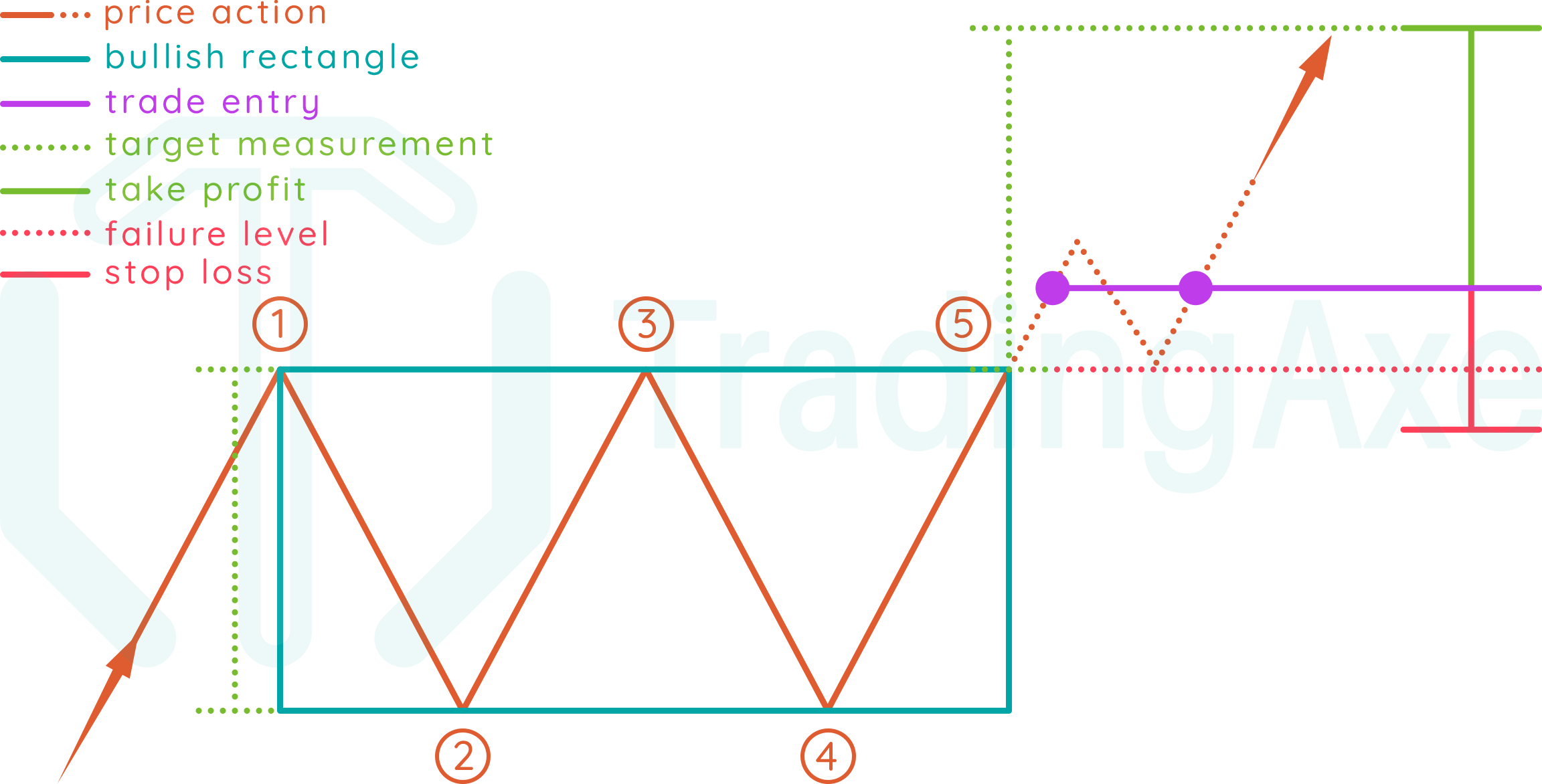

Dosto Bullish rectangle candlestick pattern ek continuation pattern hai jo uptrend ke dauraan market mein short-term pause ya consolidation ko represent karta hai. Yeh pattern typically rectangle shape mein hota hai, jisme price range defined hoti hai. Rectangle ke upper aur lower boundary ko support aur resistance levels ke roop mein consider kiya jata hai. Pattern ka confirmation tab hota hai jab price rectangle ke upper boundary ko break karta hai aur uptrend continue hota hai.

Identification Bullish Rectangle:

Dosto Bullish rectangle candlestick pattern ko pehchanne ke liye, traders ko kuch important points par dhyan dena chahiye.

1. Market mein previous uptrend hona chahiye.

2. Rectangle shape formation ka dhyan dena chahiye jisme price range defined hoti hai.

3. Candlesticks ki wicks aur bodies ka analysis karna chahiye. Consolidation ke doran wicks choti hoti hai aur bodies small hoti hai.

4. Pattern ka confirmation upper boundary break ke baad hota hai.

Trading Strategy:

Dosto Bullish rectangle candlestick pattern ko trading strategy mein istemal karne ke liye, traders ko kuch steps follow karne chahiye.

1. Pattern ki confirmation ke liye upper boundary break ka wait karein.

2. Entry point ko determine karein upper boundary break ke baad.

3. Stop loss aur target levels ko set karein. Stop loss usually rectangle ke lower boundary ke neeche aur target rectangle ke height se calculate kiya ja sakta hai.

Conclusion:

Dosto Bullish rectangle candlestick pattern ek valuable technical analysis tool hai jo traders ko market mein uptrend ke continuation ke baare mein maloomat deta hai. Traders ko is pattern ko samajhna aur istemal karna chahiye, lekin hamesha risk management ke saath trading karein.

Note:

Dosto Yeh tha bullish rectangle candlestick pattern trading ke roman Urdu mein maloomat. Agar aapko aur details chahiye ya koi sawal ho, toh zaroor poochhein.

Bullish rectangle candlestick pattern ek important technical analysis tool hai jo traders ko market mein uptrend ke potential opportunities ke baare mein maloomat deta hai. Yeh pattern market mein consolidation ke baad bullish move ko suggest karta hai.

Bullish Rectangle Pattern Kiya hota hai:

Dosto Bullish rectangle candlestick pattern ek continuation pattern hai jo uptrend ke dauraan market mein short-term pause ya consolidation ko represent karta hai. Yeh pattern typically rectangle shape mein hota hai, jisme price range defined hoti hai. Rectangle ke upper aur lower boundary ko support aur resistance levels ke roop mein consider kiya jata hai. Pattern ka confirmation tab hota hai jab price rectangle ke upper boundary ko break karta hai aur uptrend continue hota hai.

Identification Bullish Rectangle:

Dosto Bullish rectangle candlestick pattern ko pehchanne ke liye, traders ko kuch important points par dhyan dena chahiye.

1. Market mein previous uptrend hona chahiye.

2. Rectangle shape formation ka dhyan dena chahiye jisme price range defined hoti hai.

3. Candlesticks ki wicks aur bodies ka analysis karna chahiye. Consolidation ke doran wicks choti hoti hai aur bodies small hoti hai.

4. Pattern ka confirmation upper boundary break ke baad hota hai.

Trading Strategy:

Dosto Bullish rectangle candlestick pattern ko trading strategy mein istemal karne ke liye, traders ko kuch steps follow karne chahiye.

1. Pattern ki confirmation ke liye upper boundary break ka wait karein.

2. Entry point ko determine karein upper boundary break ke baad.

3. Stop loss aur target levels ko set karein. Stop loss usually rectangle ke lower boundary ke neeche aur target rectangle ke height se calculate kiya ja sakta hai.

Conclusion:

Dosto Bullish rectangle candlestick pattern ek valuable technical analysis tool hai jo traders ko market mein uptrend ke continuation ke baare mein maloomat deta hai. Traders ko is pattern ko samajhna aur istemal karna chahiye, lekin hamesha risk management ke saath trading karein.

Note:

Dosto Yeh tha bullish rectangle candlestick pattern trading ke roman Urdu mein maloomat. Agar aapko aur details chahiye ya koi sawal ho, toh zaroor poochhein.

تبصرہ

Расширенный режим Обычный режим