Forex Exchanging kya hai:

Forex exchanging yaani ke Foreign Exchange Market, aik aisa market hai jahan pe currencies ka lein-dein hota hai. Yeh market duniya ka sabse bara aur sabse liquid market hai jahan trillions of dollars ka rozana lein-dein hota hai. Is market mein log currencies kharidte aur bechte hain taake profit kama sakein.

Envelope Pointer kya hota hai:

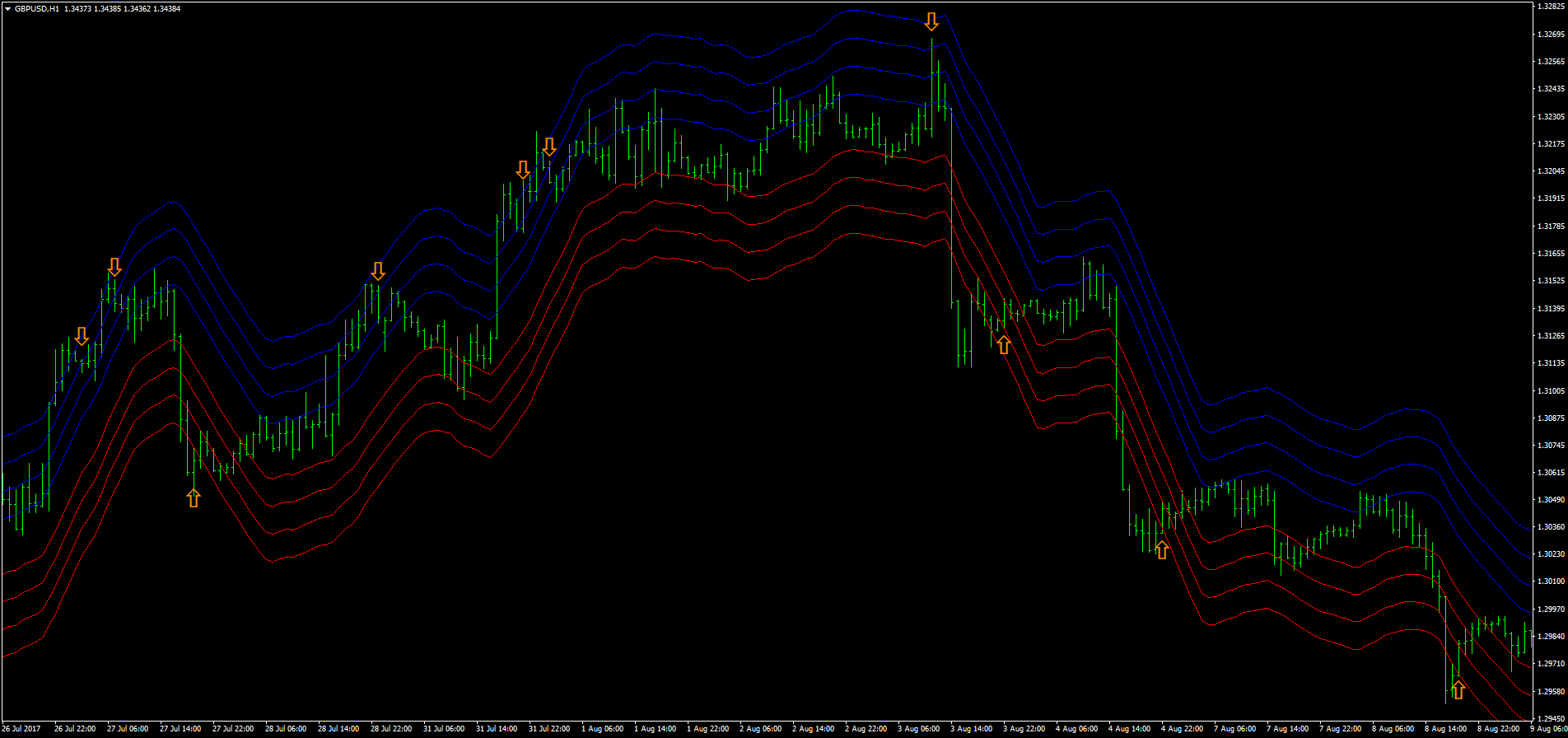

Envelope pointer aik technical indicator hota hai jo trading strategies mein use hota hai. Yeh indicator do moving averages ko upar aur neeche shift karta hai taake ek envelope ya band ban sake. Yeh bands traders ko help karte hain taake woh overbought ya oversold conditions ko identify kar sakein.

Envelope Indicator ka Istemaal:

Envelope indicator ko forex trading mein istimaal karna kafi aasaan hai. Sab se pehle, trader ko ek moving average select karna hota hai. Phir is moving average ko ek specific percentage se upar aur neeche shift kiya jata hai. Yeh shift percentage, market volatility par depend karta hai. Jab market price in bands ko touch karti hai, toh yeh trading signals generate karti hai.

Trading Signals:

Jab price upper band ko touch karti hai, toh yeh overbought condition ko show karta hai aur selling signal deta hai. Jab price lower band ko touch karti hai, toh yeh oversold condition ko show karta hai aur buying signal deta hai. Traders in signals ko use karte hain taake profitable trades enter kar sakein.

Advantages of Envelope Pointer:

Envelope pointer ka aik bara advantage yeh hai ke yeh simple aur asaan hai samajhne ke liye. Yeh volatile markets mein bhi effective hota hai aur traders ko clear signals deta hai. Iske ilawa, yeh overbought aur oversold levels ko identify karne mein help karta hai jo ke traders ke liye kaafi valuable hota hai.

Limitations of Envelope Pointer:

Halaanke envelope pointer useful hai, magar iske kuch limitations bhi hain. Yeh indicator trending markets mein kam effective hota hai kyunke yeh mostly range-bound markets mein achha kaam karta hai. Iske ilawa, yeh false signals bhi generate kar sakta hai jo ke losses ka sabab ban sakte hain.

Conclusion:

Envelope pointer forex trading mein aik useful tool hai jo ke traders ko overbought aur oversold conditions identify karne mein madad deta hai. Yeh simple aur asaan hai, magar iska use karte waqt market conditions ko madde nazar rakhna zaroori hai. Proper understanding aur practice se, traders is indicator ko effectively use kar sakte hain taake profitable trades kar sakein.

Forex exchanging yaani ke Foreign Exchange Market, aik aisa market hai jahan pe currencies ka lein-dein hota hai. Yeh market duniya ka sabse bara aur sabse liquid market hai jahan trillions of dollars ka rozana lein-dein hota hai. Is market mein log currencies kharidte aur bechte hain taake profit kama sakein.

Envelope Pointer kya hota hai:

Envelope pointer aik technical indicator hota hai jo trading strategies mein use hota hai. Yeh indicator do moving averages ko upar aur neeche shift karta hai taake ek envelope ya band ban sake. Yeh bands traders ko help karte hain taake woh overbought ya oversold conditions ko identify kar sakein.

Envelope Indicator ka Istemaal:

Envelope indicator ko forex trading mein istimaal karna kafi aasaan hai. Sab se pehle, trader ko ek moving average select karna hota hai. Phir is moving average ko ek specific percentage se upar aur neeche shift kiya jata hai. Yeh shift percentage, market volatility par depend karta hai. Jab market price in bands ko touch karti hai, toh yeh trading signals generate karti hai.

Trading Signals:

Jab price upper band ko touch karti hai, toh yeh overbought condition ko show karta hai aur selling signal deta hai. Jab price lower band ko touch karti hai, toh yeh oversold condition ko show karta hai aur buying signal deta hai. Traders in signals ko use karte hain taake profitable trades enter kar sakein.

Advantages of Envelope Pointer:

Envelope pointer ka aik bara advantage yeh hai ke yeh simple aur asaan hai samajhne ke liye. Yeh volatile markets mein bhi effective hota hai aur traders ko clear signals deta hai. Iske ilawa, yeh overbought aur oversold levels ko identify karne mein help karta hai jo ke traders ke liye kaafi valuable hota hai.

Limitations of Envelope Pointer:

Halaanke envelope pointer useful hai, magar iske kuch limitations bhi hain. Yeh indicator trending markets mein kam effective hota hai kyunke yeh mostly range-bound markets mein achha kaam karta hai. Iske ilawa, yeh false signals bhi generate kar sakta hai jo ke losses ka sabab ban sakte hain.

Conclusion:

Envelope pointer forex trading mein aik useful tool hai jo ke traders ko overbought aur oversold conditions identify karne mein madad deta hai. Yeh simple aur asaan hai, magar iska use karte waqt market conditions ko madde nazar rakhna zaroori hai. Proper understanding aur practice se, traders is indicator ko effectively use kar sakte hain taake profitable trades kar sakein.

تبصرہ

Расширенный режим Обычный режим