Ichimoku Kinko Hyo indicator kya hai?

Ichimoku Kinko Hyo (IKH), jise "a glance at a chart in equilibrium" ke roop mein bhi jana jata hai, ek technical analysis indicator hai jo trend, momentum aur support/resistance levels ko samajhne mein traders ki madad karta hai. yah kai alag-alag indicators ko ek chart mein jodkar kam karta hai aur traders ko ek nazar mein bazaar ki sthiti ka jaayza lene mein madad karta hai.

IKH ke 5 pramukh hisse hain:

IKH ka use kaise karen:

Trend direction:

Momentum:

Support/resistance:

IKH ka upyog karne ke liye kuchh Suggestion:

IKH ek powerful technical analysis tool hai jo traders ko trend, momentum aur support/resistance levels ko samajhne mein madad kar sakta hai. halanki, yah yad rakhna mahatvpurn hai ki koi bhi indicator foolproof nahin hai aur hamesha risk management ka upyog karna chahie.

Mujhe ummed ha ka ya jankari app sab ke liey helpfull rahi hoghi = thanks =

Ichimoku Kinko Hyo (IKH), jise "a glance at a chart in equilibrium" ke roop mein bhi jana jata hai, ek technical analysis indicator hai jo trend, momentum aur support/resistance levels ko samajhne mein traders ki madad karta hai. yah kai alag-alag indicators ko ek chart mein jodkar kam karta hai aur traders ko ek nazar mein bazaar ki sthiti ka jaayza lene mein madad karta hai.

IKH ke 5 pramukh hisse hain:

- Tenkan-sen (TK): yah ek moving average hai jo 9 aur 26 samay avadhiyon ke beech ki kimat ka ausat hai.

- Kijun-sen (KJ): yah ek moving average hai jo 26 aur 52 samay avadhiyon ke beech ki kimat ka ausat hai.

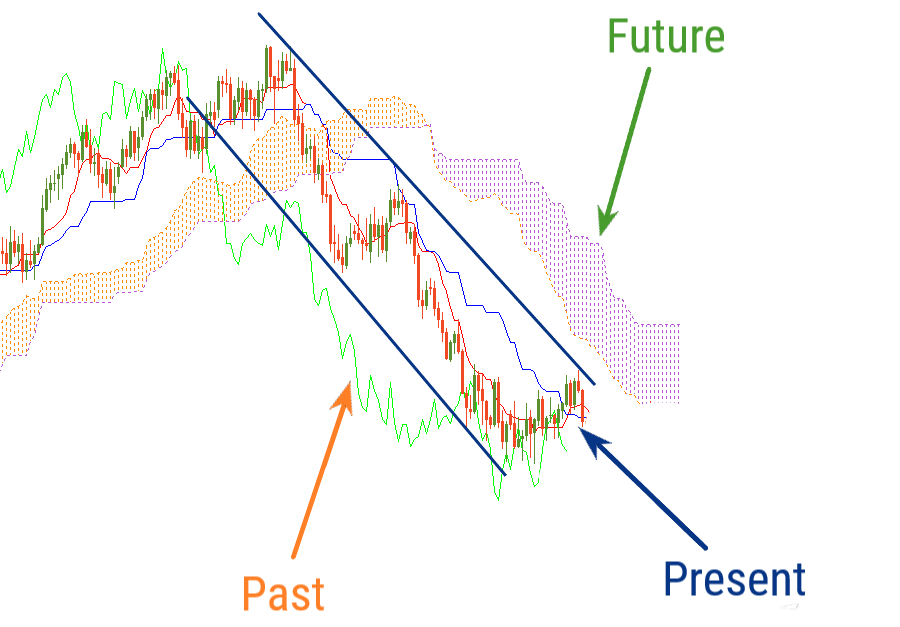

- Senkou Span A (SA): yah TK aur KJ ke bich ke madhya bindu se 26 samay avadhiyon aage badhta hai.

- Senkou Span B (SB): yah TK aur KJ ke bich ke madhya bindu se 52 samay avadhiyon aage badhta hai.

- Chikou Span (CS): yah vartman kimat ko 26 samay avadhiyon piche badhata hai.

IKH ka use kaise karen:

Trend direction:

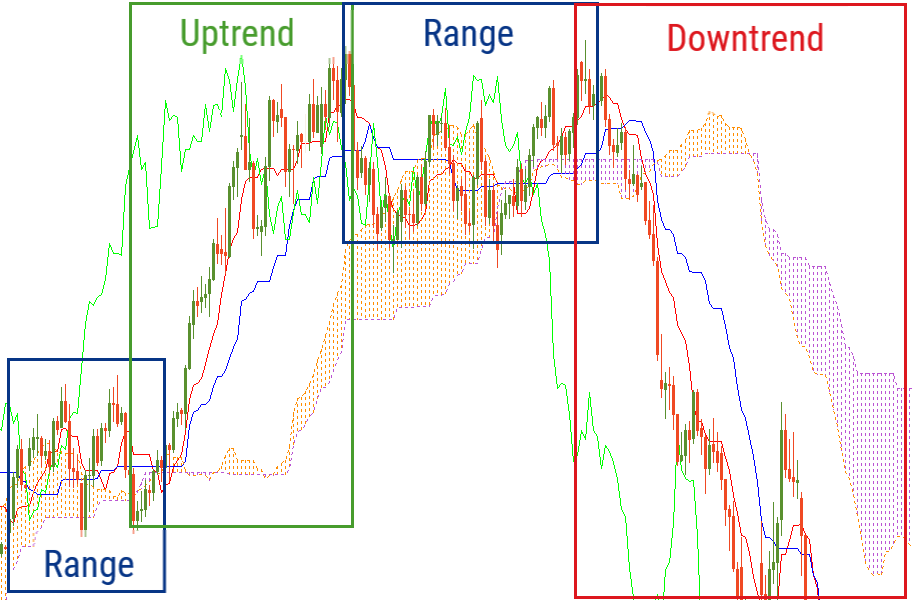

- TK KJ se upar hai aur SA SB se upar hai: yah ek uptrend ka sandesh deta hai.

- TK KJ se niche hai aur SA SB se niche hai: yah ek downtrend ka sandesh deta hai.

- TK KJ ko paar karta hai: yah trend mein badlav ka sandesh deta hai.

Momentum:

- CS kimat se upar hai: yah bullish momentum ka sandesh deta hai.

- CS kimat se niche hai: yah bearish momentum ka sandesh deta hai.

Support/resistance:

- SA aur SB: ine lines ka use support aur resistance levels ke roop mein kiya ja sakta hai.

- TK aur KJ: ine lines ka use secondary support aur resistance levels ke roop mein kiya ja sakta hai.

IKH ka upyog karne ke liye kuchh Suggestion:

- IKH ko anya technical indicators ke sath jodkar use karen.

- IKH se signals lene se pahle trend direction ki tasdik karen.

- risk management ka use karen aur apne trade ko rokane ke liye stop-loss order ka use karen.

IKH ek powerful technical analysis tool hai jo traders ko trend, momentum aur support/resistance levels ko samajhne mein madad kar sakta hai. halanki, yah yad rakhna mahatvpurn hai ki koi bhi indicator foolproof nahin hai aur hamesha risk management ka upyog karna chahie.

Mujhe ummed ha ka ya jankari app sab ke liey helpfull rahi hoghi = thanks =

تبصرہ

Расширенный режим Обычный режим