SIGNIFICANT ASPECTS OF DOUBLE TOP CANDLESTICK PATTERN IN FOREX

DEFINITION

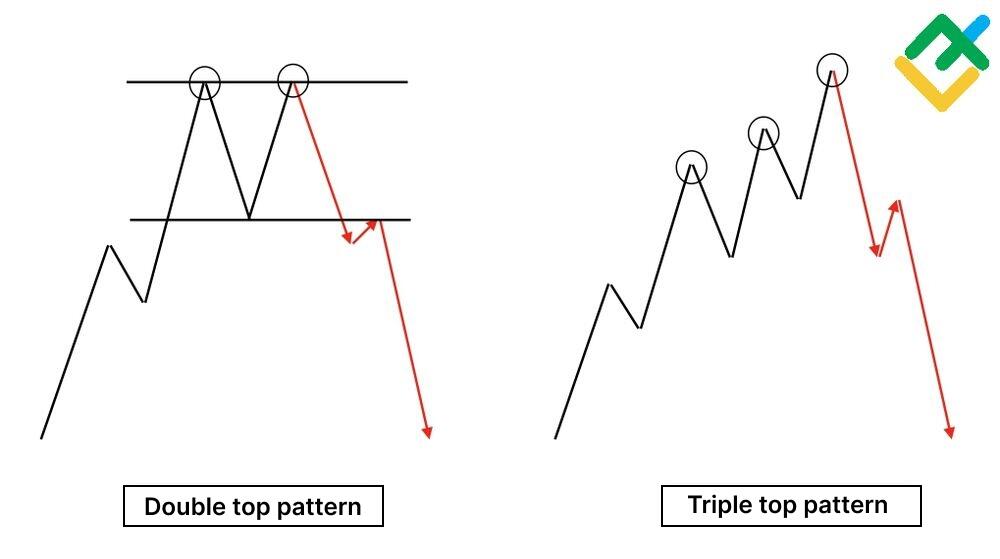

Double Top candlestick pattern ek bearish reversal pattern hai jo market mein uptrend ke baad downtrend ko indicate karta hai. Yeh pattern tab banta hai jab price do baar ek specific high level ko touch karti hai aur phir neeche girti hai.

CHARACTERISTICS OF DOUBLE TOP CANDLESTICK PATTERN

Price do baar high level ko touch karti hai aur dono peaks lagbhag same height par hoti hain. Dono peaks ke beech mein ek low point hota hai jo trough kehlata hai. Neckline Yeh horizontal line hai jo intermediate trough ko represent karti hai.

INTERPRETATION

Yeh pattern aksar uptrend ke baad appear hota hai aur trend reversal ko signify karta hai. Jab price neckline ko break karti hai aur neeche close hoti hai, yeh ek strong selling signal hota hai. Volume Confirmation Volume ka increase neckline break ke waqt bearish reversal ko confirm karta hai.

PRACTICAL EXAMPLE

Agar aap daily chart par double top pattern dekhein, toh yeh signify karta hai ke market mein uptrend weak ho raha hai aur downtrend shuru ho sakta hai. Jab price neckline ko neeche break karti hai, toh yeh ek strong selling signal hota hai.

TRADING STRATEGY

-Entry IN POINT:

Jab price neckline ko neeche cross kare aur close kare, tab sell position lena ek acha idea ho sakta hai.

- STOP LOSS:

Second peak ke high point ko stop loss ke tor par use karna chahiye.

- TAKE PROFIT:

First peak se neckline ka distance measure kar ke, us distance ko neckline break ke point se neeche subtract karna chahiye take profit level ke liye.

CONFIRMATION SIGNALS

Volume Analysis Neckline break ke waqt high volume bearish reversal ko confirm karta hai. RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence) ka use karna beneficial ho sakta hai taake aap pattern ki confirmation le sakein. Position size ko apni risk tolerance aur overall trading plan ke mutabiq adjust karna chahiye. Trailing Stops Trailing stops ka use karna beneficial ho sakta hai taake aapko maximum profit book karne ka mauka mile jab price aapki favour mein move karein.

RISK MANAGEMENTS

Double Top candlestick pattern forex trading mein ek important bearish reversal signal hai jo aapko market sentiment aur price movement ko samajhne mein madad deta hai. Is pattern ko dekhte hue aap apni trading strategies ko accordingly adjust kar sakte hain aur better trading decisions le sakte hain.

DEFINITION

Double Top candlestick pattern ek bearish reversal pattern hai jo market mein uptrend ke baad downtrend ko indicate karta hai. Yeh pattern tab banta hai jab price do baar ek specific high level ko touch karti hai aur phir neeche girti hai.

CHARACTERISTICS OF DOUBLE TOP CANDLESTICK PATTERN

Price do baar high level ko touch karti hai aur dono peaks lagbhag same height par hoti hain. Dono peaks ke beech mein ek low point hota hai jo trough kehlata hai. Neckline Yeh horizontal line hai jo intermediate trough ko represent karti hai.

INTERPRETATION

Yeh pattern aksar uptrend ke baad appear hota hai aur trend reversal ko signify karta hai. Jab price neckline ko break karti hai aur neeche close hoti hai, yeh ek strong selling signal hota hai. Volume Confirmation Volume ka increase neckline break ke waqt bearish reversal ko confirm karta hai.

PRACTICAL EXAMPLE

Agar aap daily chart par double top pattern dekhein, toh yeh signify karta hai ke market mein uptrend weak ho raha hai aur downtrend shuru ho sakta hai. Jab price neckline ko neeche break karti hai, toh yeh ek strong selling signal hota hai.

TRADING STRATEGY

-Entry IN POINT:

Jab price neckline ko neeche cross kare aur close kare, tab sell position lena ek acha idea ho sakta hai.

- STOP LOSS:

Second peak ke high point ko stop loss ke tor par use karna chahiye.

- TAKE PROFIT:

First peak se neckline ka distance measure kar ke, us distance ko neckline break ke point se neeche subtract karna chahiye take profit level ke liye.

CONFIRMATION SIGNALS

Volume Analysis Neckline break ke waqt high volume bearish reversal ko confirm karta hai. RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence) ka use karna beneficial ho sakta hai taake aap pattern ki confirmation le sakein. Position size ko apni risk tolerance aur overall trading plan ke mutabiq adjust karna chahiye. Trailing Stops Trailing stops ka use karna beneficial ho sakta hai taake aapko maximum profit book karne ka mauka mile jab price aapki favour mein move karein.

RISK MANAGEMENTS

Double Top candlestick pattern forex trading mein ek important bearish reversal signal hai jo aapko market sentiment aur price movement ko samajhne mein madad deta hai. Is pattern ko dekhte hue aap apni trading strategies ko accordingly adjust kar sakte hain aur better trading decisions le sakte hain.

تبصرہ

Расширенный режим Обычный режим