What is Three White Soldiers Pattern

forex market mei three white soldiers candlestick pattern aik kesam ka candlestick pattern hota hey jo keh aam tor par forex market mein bullish candlestick pattern hota hey or yeh forex market mein nechay kay trend doran mein samnay aate hey or yeh forex market mein bullish candlestick par moshtamel ho sakte hey yeh forex market mein start pechlay high ya close candlestick pattern ho sakta hey jo keh forex market kay jazbaat ko bearish ke taraf tabdele ko bhe identify kar sakte hey trader s kesam kay chart pattern ko mumkana bearish ke taraf tabdele ko bhe indicate kar sakta hey trader zyada tar es kesam kay chart pattern ko trend reversal kay tor par bhee estamal kar sakta hey or forex market mein mumkana oper ke taraf slow direction ko jar rakhnay kay indicator kay tor par bhe estamal kar sakta hey forex market kay confidence mein ezafa or market mein profitable planning ke rah humwar karta hey

Pehchan Three White Soldiers Pattern

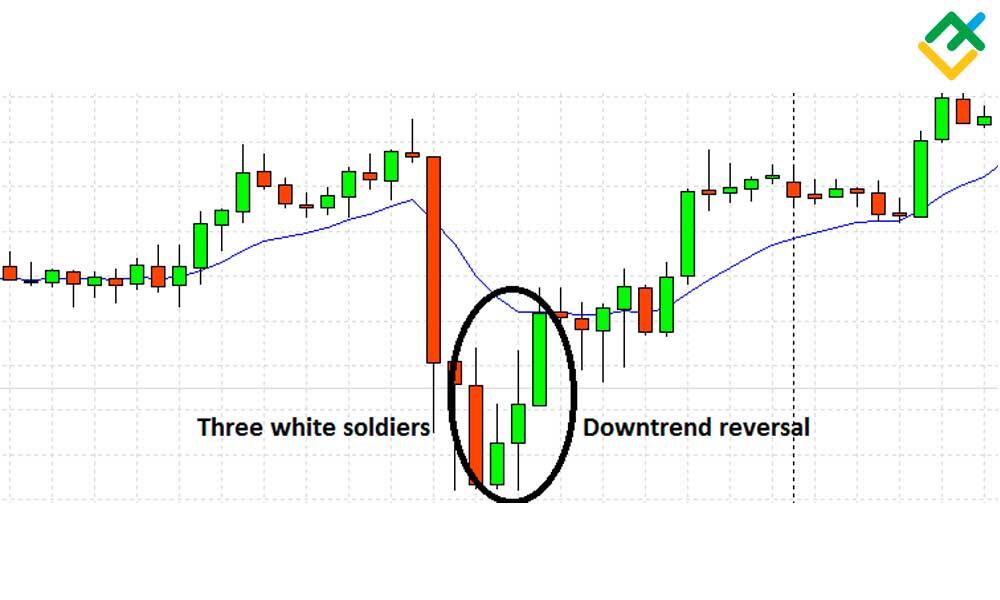

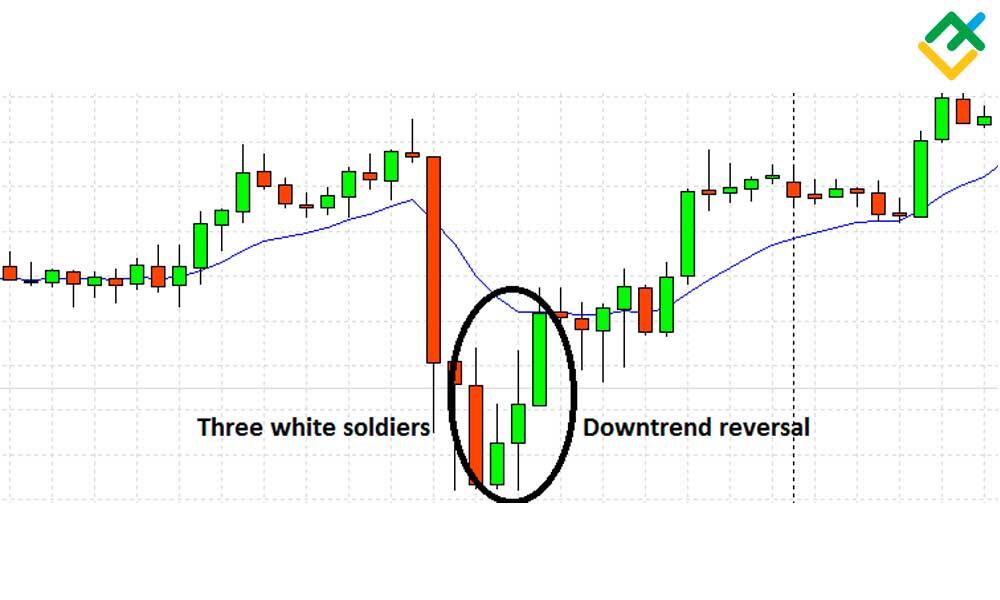

forex market mein three white soldiers candlestick pattern aik kesam ka candlestick pattern hota hey jo keh forex market mein bullish reversal candlestick pattern kay tor par he daikha ja sakta hey jes ko fatah kay tor par march karnay wallay soldiers kay tor pehchan ke jate hey es keam kay bullish candlestick pattern teen jare white candlestick hote hein jes mein har aik candlestick pechle candlestick say zyada open hote hey or close bhe hote hey

1 soldier zoor dar bullish kay sath he forex market ka charge ko open kar layta hey pr yeh forex market peak kay sath he close ho jata hey

2 soldier ke raftar mein ezafa ho choka hota hey yeh forex market mein pechlay close say bhe zyada ezzafa kar sakta hey market mein bullish ke raftar kaim rehte hey

3 Soldier yeh bhe dosray soldier say bhe zyada par open hota hey or market mein bullish movement mein taize say ezaffa ho jata hey yeh last soldier trend ke strength mein ezaffa kar sakta hey

three white soldiers ke confirmation

forex market mein three white soldiers pattern ke confirmation os time hote hey forex market mein har candlestick ka opening or close pechle candlestick say bhe zyada ho sakta hey jo keh forex market mein bulls kay ghalbay mein bhe ezaffa kar sakta hey yeh pattern forex market ke tashkeel mein mumkana ezaffay ko bhe identify kar sakte hey jo keh forex market bohut he acha trading tool bana sakte hey es bat ko yad rakhni chihay keh forex market kay soldire jetnay bhe strong hon gay ap ko forex market entry laynay mein otna he assane ho ge or trading ko profitable bana saktay hein

Trade with Three White Soldiers Pattern

forex market mein trend ke or pattern ke confirmation honay kay bad trader forex market mein entry layta hey or es kay bad trader market ke long position mein he enter ho saktay hein yeh forex market ke key support level ya moving average kay ley bhe estamal kar saktay hein forex market mein top loss ya take profit order ko set karna hota hey forex market kay mumkana losses ko kam karnay or mumkana profit ko zyada say karnay kay ley forex market mein risk management ke strategy ko bhe estamal karna chihay forex market mein reccentrly swing low ya stop loss order ko set karna chihay resistance par target ya take profit level ko set karna chihay forex market mein trade ke egrane karne chihay or forex take profit ya stop loss order ko set karna chihay

forex market mei three white soldiers candlestick pattern aik kesam ka candlestick pattern hota hey jo keh aam tor par forex market mein bullish candlestick pattern hota hey or yeh forex market mein nechay kay trend doran mein samnay aate hey or yeh forex market mein bullish candlestick par moshtamel ho sakte hey yeh forex market mein start pechlay high ya close candlestick pattern ho sakta hey jo keh forex market kay jazbaat ko bearish ke taraf tabdele ko bhe identify kar sakte hey trader s kesam kay chart pattern ko mumkana bearish ke taraf tabdele ko bhe indicate kar sakta hey trader zyada tar es kesam kay chart pattern ko trend reversal kay tor par bhee estamal kar sakta hey or forex market mein mumkana oper ke taraf slow direction ko jar rakhnay kay indicator kay tor par bhe estamal kar sakta hey forex market kay confidence mein ezafa or market mein profitable planning ke rah humwar karta hey

Pehchan Three White Soldiers Pattern

forex market mein three white soldiers candlestick pattern aik kesam ka candlestick pattern hota hey jo keh forex market mein bullish reversal candlestick pattern kay tor par he daikha ja sakta hey jes ko fatah kay tor par march karnay wallay soldiers kay tor pehchan ke jate hey es keam kay bullish candlestick pattern teen jare white candlestick hote hein jes mein har aik candlestick pechle candlestick say zyada open hote hey or close bhe hote hey

1 soldier zoor dar bullish kay sath he forex market ka charge ko open kar layta hey pr yeh forex market peak kay sath he close ho jata hey

2 soldier ke raftar mein ezafa ho choka hota hey yeh forex market mein pechlay close say bhe zyada ezzafa kar sakta hey market mein bullish ke raftar kaim rehte hey

3 Soldier yeh bhe dosray soldier say bhe zyada par open hota hey or market mein bullish movement mein taize say ezaffa ho jata hey yeh last soldier trend ke strength mein ezaffa kar sakta hey

three white soldiers ke confirmation

forex market mein three white soldiers pattern ke confirmation os time hote hey forex market mein har candlestick ka opening or close pechle candlestick say bhe zyada ho sakta hey jo keh forex market mein bulls kay ghalbay mein bhe ezaffa kar sakta hey yeh pattern forex market ke tashkeel mein mumkana ezaffay ko bhe identify kar sakte hey jo keh forex market bohut he acha trading tool bana sakte hey es bat ko yad rakhni chihay keh forex market kay soldire jetnay bhe strong hon gay ap ko forex market entry laynay mein otna he assane ho ge or trading ko profitable bana saktay hein

Trade with Three White Soldiers Pattern

forex market mein trend ke or pattern ke confirmation honay kay bad trader forex market mein entry layta hey or es kay bad trader market ke long position mein he enter ho saktay hein yeh forex market ke key support level ya moving average kay ley bhe estamal kar saktay hein forex market mein top loss ya take profit order ko set karna hota hey forex market kay mumkana losses ko kam karnay or mumkana profit ko zyada say karnay kay ley forex market mein risk management ke strategy ko bhe estamal karna chihay forex market mein reccentrly swing low ya stop loss order ko set karna chihay resistance par target ya take profit level ko set karna chihay forex market mein trade ke egrane karne chihay or forex take profit ya stop loss order ko set karna chihay

تبصرہ

Расширенный режим Обычный режим