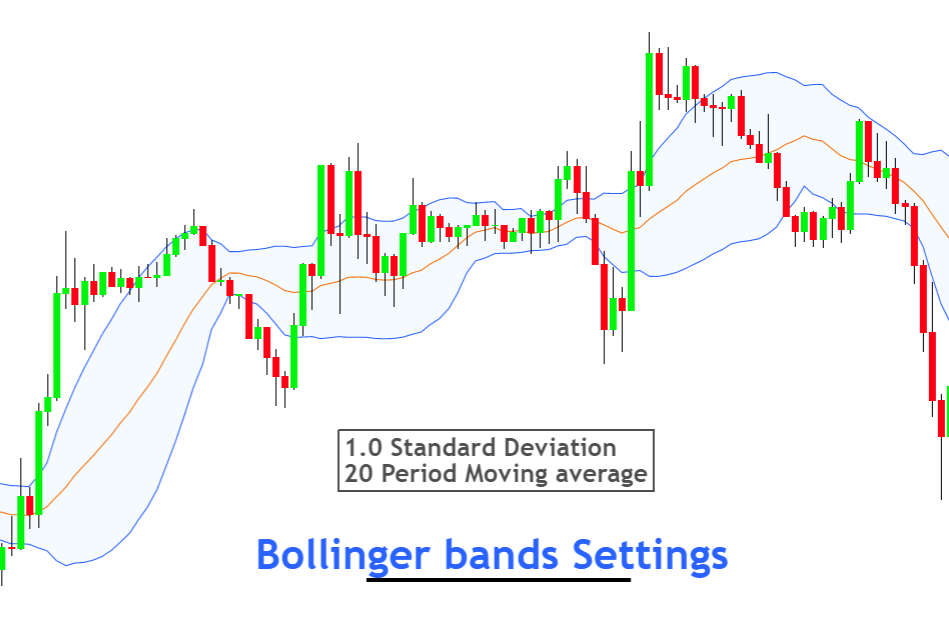

Bollinger Bands, jo forex trading mein aik ahem indicator hai, unhein market volatility ko analyze karne ke liye istemal kia jata hai. Ye indicator 1980s mein John Bollinger ne develop kia tha. Bollinger Bands aam tor par three lines se mushtamil hotay hain: upper band, lower band, aur middle band.

1. Upper Band (Uper Wala Hissa):

Upper band, typically 20-day simple moving average (SMA) plus double the standard deviation of price, ke upar hota hai. Ye band market ke upward movement ko darust karta hai.

2. Middle Band (Darmiani Hissa):

Darmiani band, 20-day SMA par based hota hai. Ye band average price ko darust karta hai.

3. Lower Band (Neeche Wala Hissa):

Lower band, typically 20-day SMA minus double the standard deviation of price, ke neeche hota hai. Ye band market ke downward movement ko darust karta hai.

Bollinger Bands ke istemal se traders market ki volatility ko samajh sakte hain aur potential entry aur exit points talaash kar sakte hain.

Bollinger bands ke faide:

1. Volatility ki Tafseel:

Bollinger Bands market volatility ko tafseel se dikhate hain. Jab bands chauri hote hain, ye high volatility ko indicate karte hain, jabke jab bands tang hote hain, ye low volatility ko show karte hain.

2. Entry aur Exit Points ka Pata:

Upper aur lower bands ko istemal karke traders entry aur exit points talaash kar sakte hain. Jab price upper band ko touch karta hai, ye selling opportunity ho sakti hai, aur jab price lower band ko touch karta hai, ye buying opportunity ho sakti hai.

3. Trend ki Tafseel:

Bollinger Bands ke madhyam se traders trend ko bhi analyze kar sakte hain. Agar price upper band ke qareeb hai, to trend bullish ho sakti hai, aur agar price lower band ke qareeb hai, to trend bearish ho sakti hai.

Bollinger Bands ek mufeed tool hai jo traders ko market ki dynamics ko samajhne mein madad deta hai aur unhein trading decisions lene mein madad karta hai.

تبصرہ

Расширенный режим Обычный режим