The movement in the forex market is ensured through fundamental factors. In fact, they are the main macroeconomic indicators showing the state of both the whole global economy and certain national economies. A change in these indicators has a direct impact on market participants and, accordingly, price dynamics on Forex. Study and analysis of these factors refer to fundamental analysis.

Thus, fundamental analysis is a process of collecting and thoroughly analyzing the indicators of various economic sectors and companies. Based on this analysis, market participants can make long-term projections and then devise their trading strategies.

The term "fundamental analysis" was first mentioned in the 1930s of the 20th century in "Security Analysis". The book was written by Benjamin Graham and David Dodd and became a classic with time. The success of the theories described by the authors has been repeatedly proven by traders in the stock market.

According to them, the most important indicators for fundamental analysis are the interest rates of major regulators, including central banks, the economic policy of a country, prospects for political changes at the state level, as well as rumors, forecasts, and expectations that form an external news flow.

The main events that should be taken into account when conducting fundamental analysis are as follows:

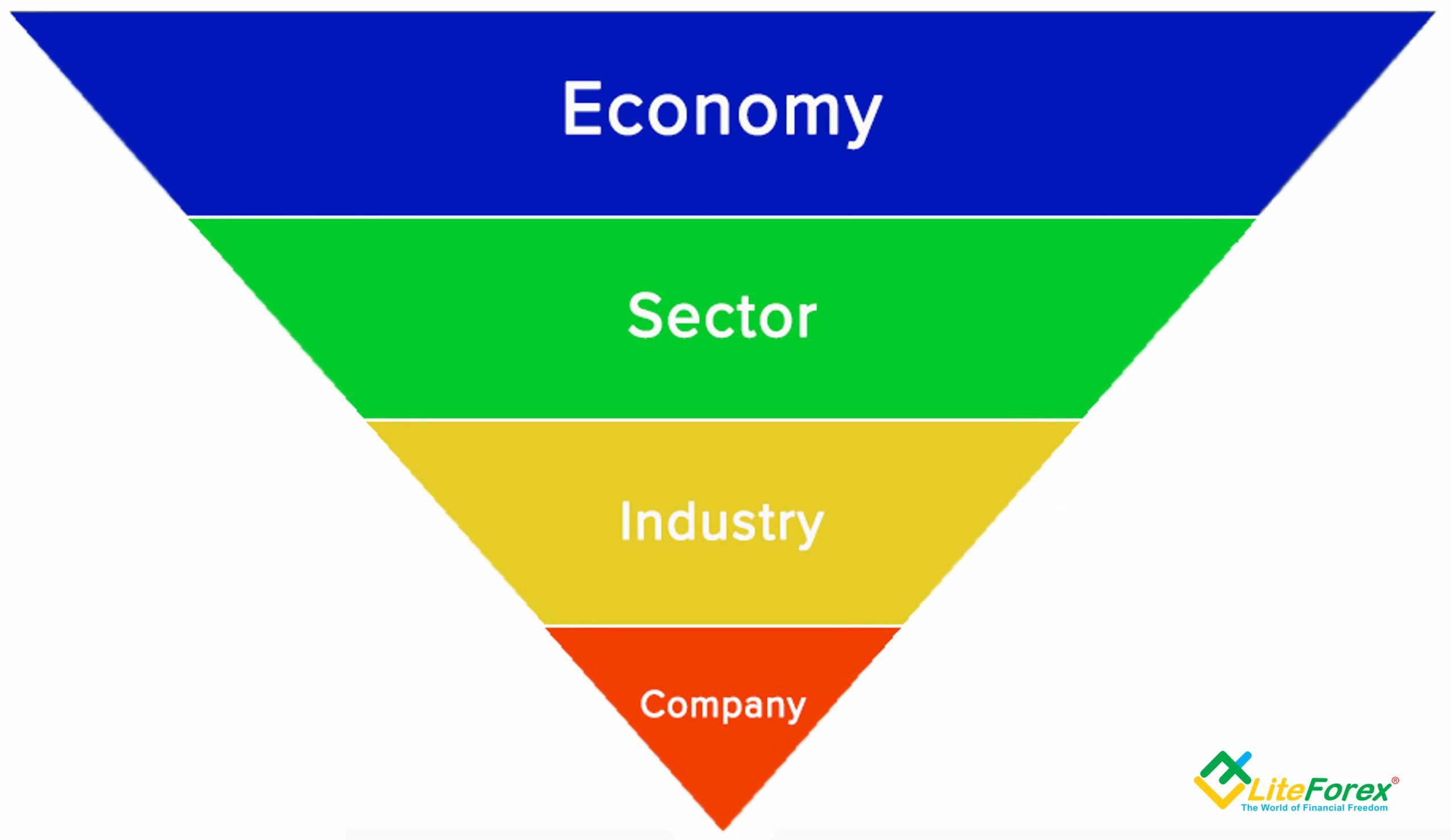

Fundamental market analysis usually starts with the study of the state of a national economy. First of all, you should figure out the current economic condition. It is important to know whether the country is experiencing an upturn or, on the contrary, a downturn. In the latter case, you should focus exclusively on companies with extensive market experience which have proved to be crisis-resistant. If the economy is growing, attention should be paid to the main trends in the most burgeoning industries.

After the companies of potential interest have been defined, you can move on to their comparative analysis. You must identify their strengths and weaknesses, opportunities and threats to growth. However, you should first assess the prospects for each individual firm. A detailed analysis of the company’s financial performance and its main management approach will help you get a better look at the company's work and make a forecast.

In this way, traders can receive granular information on the companies of concern to them. Only then can you make a decision on further investments. Beginners are recommended to execute all the steps of market analysis, while experienced traders can omit the first two stages. Later, your skills will help you make fundamental analysis faster and easier.

Thus, fundamental analysis is a process of collecting and thoroughly analyzing the indicators of various economic sectors and companies. Based on this analysis, market participants can make long-term projections and then devise their trading strategies.

The term "fundamental analysis" was first mentioned in the 1930s of the 20th century in "Security Analysis". The book was written by Benjamin Graham and David Dodd and became a classic with time. The success of the theories described by the authors has been repeatedly proven by traders in the stock market.

According to them, the most important indicators for fundamental analysis are the interest rates of major regulators, including central banks, the economic policy of a country, prospects for political changes at the state level, as well as rumors, forecasts, and expectations that form an external news flow.

The main events that should be taken into account when conducting fundamental analysis are as follows:

- geopolitical and social changes

- potential economic changes and investors’ attitude towards them

- natural disasters (extreme weather conditions, earthquakes, hurricanes, and other events that have a severe impact on economic development)

- wars and conflicts between states

- key political events (elections, referendums, forums, etc.)

- important statistics that are published in a certain period (for example, indicators of the state’s economic health and its certain industries)

Fundamental market analysis usually starts with the study of the state of a national economy. First of all, you should figure out the current economic condition. It is important to know whether the country is experiencing an upturn or, on the contrary, a downturn. In the latter case, you should focus exclusively on companies with extensive market experience which have proved to be crisis-resistant. If the economy is growing, attention should be paid to the main trends in the most burgeoning industries.

After the companies of potential interest have been defined, you can move on to their comparative analysis. You must identify their strengths and weaknesses, opportunities and threats to growth. However, you should first assess the prospects for each individual firm. A detailed analysis of the company’s financial performance and its main management approach will help you get a better look at the company's work and make a forecast.

In this way, traders can receive granular information on the companies of concern to them. Only then can you make a decision on further investments. Beginners are recommended to execute all the steps of market analysis, while experienced traders can omit the first two stages. Later, your skills will help you make fundamental analysis faster and easier.

تبصرہ

Расширенный режим Обычный режим