Trading Mein Green Line Candle Stick Ki Ahmiyat

Trading ki duniya mein, candlestick chart ek ahem tool hai jo traders ko market ke behavior aur price movements ko samajhne mein madad deta hai. Candlestick chart mein mukhtalif types ki candlesticks hoti hain, jinhon ne trading ke trends aur patterns ko identify karne mein badi role play kiya hai. Unmein se ek "Green Line Candle Stick" ya "Bullish Candle" hai, jo market ke bullish behavior ko represent karti hai. Iss article mein, hum Green Line Candle Stick ko Roman Urdu mein tafseel se samjhenge.

Green Line Candle Stick Ka Taaruf

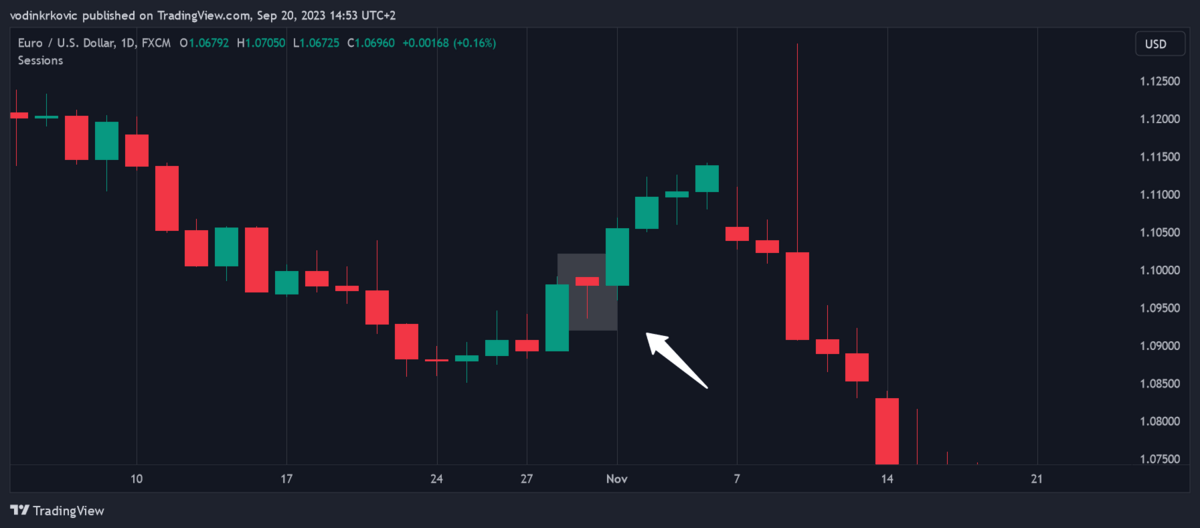

Green Line Candle Stick ko hum aksar trading charts par dekhtay hain jab market bullish hoti hai, yani jab price increase ho rahi hoti hai. Is candlestick ka color green hota hai aur yeh indicate karta hai ke closing price opening price se zyada hai. Iska matlab yeh hota hai ke buyers ka control market mein hai aur woh price ko upar le jaane mein kamiyab ho rahe hain.

Candlestick Structure

Candlestick ka structure kuch is tarah ka hota hai:

Green Line Candle Stick Ki Pehchaan

Agar closing price opening price se zyada ho, aur body green ho, to yeh Green Line Candle Stick hoti hai.

Bullish Signal

Green Line Candle Stick ko bullish signal kaha jata hai, kyunki yeh indicate karta hai ke market mein buyers ka pressure zyada hai. Yeh candlestick jab chart mein naz

ar aati hai, to yeh ek positive indicator hota hai ke market future mein aur bhi bullish ho sakti hai. Trading mein yeh signal aksar iss baat ka izhar hota hai ke trend upar ki taraf jaane wala hai aur prices mein izafa ho sakta hai.

Green Line Candle Stick Patterns

Green Line Candle Stick aksar kuch khas patterns mein bhi nazar aati hai jo traders ko aur bhi clear signals deti hain. In patterns ko samajhna aur pehchanna trading ke liye intehai zaroori hai:

Trading Strategy

Green Line Candle Stick ko trading strategies mein mukhtalif tareeqon se istemal kiya jata hai:

Risk Management

Jitni zaroori yeh samajhna hai ke Green Line Candle Stick bullish signal deti hai, utni hi zaroori yeh bhi hai ke risk management ka bhi khayal rakha jaye. Har signal foolproof nahi hota, aur kabhi kabhi market mein unexpected movements bhi ho sakti hain. Isliye, stop-loss orders lagana aur proper risk management strategies ko follow karna trading ka laazmi hissa hona chahiye.

Conclusion

Green Line Candle Stick trading mein ek ahem role play karti hai. Yeh bullish signal deti hai aur market ke positive trend ko indicate karti hai. Is candlestick ke patterns aur trading strategies ko samajhna aur apply karna traders ke liye bohot faidemand hota hai. Lekin, risk management ka khayal rakhna aur market ke doosre factors ko bhi madde nazar rakhna intehai zaroori hai. Trading mein hamesha informed decisions lena chahiye aur technical analysis ke tools ko effectively use karna chahiye.

Trading ki duniya mein, candlestick chart ek ahem tool hai jo traders ko market ke behavior aur price movements ko samajhne mein madad deta hai. Candlestick chart mein mukhtalif types ki candlesticks hoti hain, jinhon ne trading ke trends aur patterns ko identify karne mein badi role play kiya hai. Unmein se ek "Green Line Candle Stick" ya "Bullish Candle" hai, jo market ke bullish behavior ko represent karti hai. Iss article mein, hum Green Line Candle Stick ko Roman Urdu mein tafseel se samjhenge.

Green Line Candle Stick Ka Taaruf

Green Line Candle Stick ko hum aksar trading charts par dekhtay hain jab market bullish hoti hai, yani jab price increase ho rahi hoti hai. Is candlestick ka color green hota hai aur yeh indicate karta hai ke closing price opening price se zyada hai. Iska matlab yeh hota hai ke buyers ka control market mein hai aur woh price ko upar le jaane mein kamiyab ho rahe hain.

Candlestick Structure

Candlestick ka structure kuch is tarah ka hota hai:

- Body: Candlestick ka main portion body kehlata hai. Agar body green ho, to iska matlab opening price se zyada closing price hai.

- Wick/Shadow: Body ke upar aur neeche jo thin lines hoti hain unhein wick ya shadow kehte hain. Upper wick indicate karti hai high price aur lower wick indicate karti hai low price.

Green Line Candle Stick Ki Pehchaan

- Opening Price: Yeh wo price hai jahan se trading period start hota hai.

- Closing Price: Yeh wo price hai jahan par trading period end hota hai.

- High Price: Trading period mein highest point jo touch hua.

- Low Price: Trading period mein lowest point jo touch hua.

Agar closing price opening price se zyada ho, aur body green ho, to yeh Green Line Candle Stick hoti hai.

Bullish Signal

Green Line Candle Stick ko bullish signal kaha jata hai, kyunki yeh indicate karta hai ke market mein buyers ka pressure zyada hai. Yeh candlestick jab chart mein naz

ar aati hai, to yeh ek positive indicator hota hai ke market future mein aur bhi bullish ho sakti hai. Trading mein yeh signal aksar iss baat ka izhar hota hai ke trend upar ki taraf jaane wala hai aur prices mein izafa ho sakta hai.

Green Line Candle Stick Patterns

Green Line Candle Stick aksar kuch khas patterns mein bhi nazar aati hai jo traders ko aur bhi clear signals deti hain. In patterns ko samajhna aur pehchanna trading ke liye intehai zaroori hai:

- Bullish Engulfing Pattern: Is pattern mein green candlestick previous red candlestick ko completely engulf kar leti hai. Yeh strong bullish signal hota hai aur indicate karta hai ke market mein trend reversal ho sakta hai.

- Morning Star: Yeh three-candlestick pattern hota hai jo ek bearish trend ke baad aata hai. Pehli candlestick red hoti hai, doosri short-bodied hoti hai (green ya red), aur teesri green candlestick hoti hai jo pehli candlestick ke midpoint se upar close hoti hai. Yeh pattern bhi bullish reversal ka indication hai.

- Hammer: Yeh single candlestick pattern hai jisme green body ke neeche long lower wick hoti hai. Yeh pattern indicate karta hai ke lower prices reject ho gaye hain aur buyers ne price ko upar push kiya hai.

Trading Strategy

Green Line Candle Stick ko trading strategies mein mukhtalif tareeqon se istemal kiya jata hai:

- Confirmation: Aksar traders green candlestick ko confirmation ke liye use karte hain. Jab ek green candlestick kisi support level par form hoti hai, to yeh confirmation hota hai ke market wahan se bounce karne wala hai.

- Entry Points: Green candlestick ko entry points identify karne ke liye bhi use kiya jata hai. Jab ek green candlestick breakouts ke saath form hoti hai, to yeh entry point ke liye signal ho sakta hai.

- Trend Following: Green candlesticks ke sequence ko dekh kar trend following strategies ko implement kiya jata hai. Agar lagataar green candlesticks form ho rahi hain, to yeh bullish trend continuation ka indication ho sakta hai.

Risk Management

Jitni zaroori yeh samajhna hai ke Green Line Candle Stick bullish signal deti hai, utni hi zaroori yeh bhi hai ke risk management ka bhi khayal rakha jaye. Har signal foolproof nahi hota, aur kabhi kabhi market mein unexpected movements bhi ho sakti hain. Isliye, stop-loss orders lagana aur proper risk management strategies ko follow karna trading ka laazmi hissa hona chahiye.

Conclusion

Green Line Candle Stick trading mein ek ahem role play karti hai. Yeh bullish signal deti hai aur market ke positive trend ko indicate karti hai. Is candlestick ke patterns aur trading strategies ko samajhna aur apply karna traders ke liye bohot faidemand hota hai. Lekin, risk management ka khayal rakhna aur market ke doosre factors ko bhi madde nazar rakhna intehai zaroori hai. Trading mein hamesha informed decisions lena chahiye aur technical analysis ke tools ko effectively use karna chahiye.

تبصرہ

Расширенный режим Обычный режим