FOREX Me Slippage Ka Kirdar

FOREX, yaani Foreign Exchange Market, dunya ka sabse bara aur liquid market hai jahan currencies ka trading hota hai. Har din trillions of dollars ka transactions hote hain. Is market mein, slippage ek ahem kirdar ada karta hai. Slippage se muraad woh farq hai jo ek trader ko apne expected price aur actual executed price ke darmiyan milta hai.

Slippage Kya Hai?

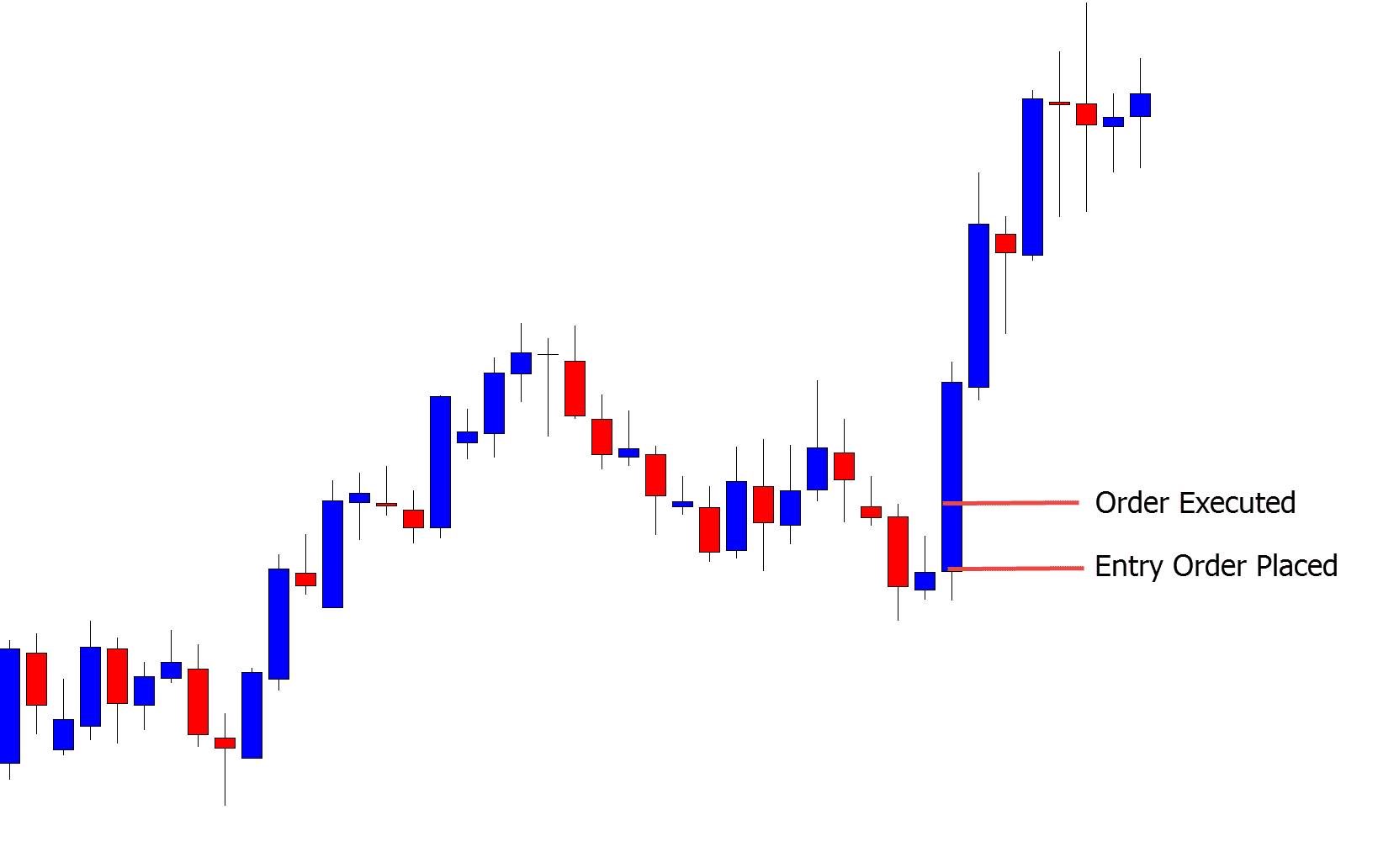

Slippage aksar tab hota hai jab market mein bohot zyada volatility hoti hai ya jab kisi currency pair ke liquidity kam hoti hai. Is situation mein, jab aap koi order place karte hain, to woh order aapki desired price par execute nahi hota. Instead, woh order kuch upar ya neeche ke price par execute ho jata hai.

Slippage Ke Types

Slippage Hone Ki Wajahain

Slippage Ka Asar Traders Par

Slippage Se Bachne Ke Tareeqay

Forex market mein slippage ek ahem kirdar ada karta hai aur yeh har trader ko samajhna chahiye. Iski wajah se trades expected prices par execute nahi hoti, jo ke risk aur cost ko barha sakti hain. Slippage ko samajh kar aur usse bachne ke tareeqay istemal kar ke traders apni trading efficiency aur profitability ko barha sakte hain. Forex trading mein successful hone ke liye market dynamics, risk management aur trading strategies ka acchi tarah se samajhna zaruri hai.

FOREX, yaani Foreign Exchange Market, dunya ka sabse bara aur liquid market hai jahan currencies ka trading hota hai. Har din trillions of dollars ka transactions hote hain. Is market mein, slippage ek ahem kirdar ada karta hai. Slippage se muraad woh farq hai jo ek trader ko apne expected price aur actual executed price ke darmiyan milta hai.

Slippage Kya Hai?

Slippage aksar tab hota hai jab market mein bohot zyada volatility hoti hai ya jab kisi currency pair ke liquidity kam hoti hai. Is situation mein, jab aap koi order place karte hain, to woh order aapki desired price par execute nahi hota. Instead, woh order kuch upar ya neeche ke price par execute ho jata hai.

Slippage Ke Types

- Positive Slippage: Yeh tab hota hai jab aapki trade expected price se better price par execute hoti hai. Matlab, agar aap buy kar rahe hain aur aapki expected price se kam price par buy execute hoti hai, to yeh aapke liye faida mand hota hai.

- Negative Slippage: Yeh tab hota hai jab aapki trade expected price se worse price par execute hoti hai. Matlab, agar aap sell kar rahe hain aur aapki expected price se kam price par sell execute hoti hai, to yeh aapke liye nuksan mand hota hai.

Slippage Hone Ki Wajahain

- Market Volatility: Forex market bohot dynamic hai aur news releases, economic data, aur political events ka asar currencies ke prices par hota hai. Aise events ke waqt market mein prices bohot tezi se change hoti hain, jis se slippage hota hai.

- Liquidity Issues: Agar kisi currency pair mein trading volume kam ho, to liquidity kam hoti hai. Iska matlab yeh hai ke aapka order asaani se execute nahi hoga aur prices shift hone ke chances barh jate hain.

- Order Size: Badi trades ke liye zyada liquidity ki zarurat hoti hai. Agar aap bohot bara order place karte hain, to ho sakta hai ke woh ek hi price par execute na ho sake aur multiple prices par execute ho, jis se slippage hota hai.

Slippage Ka Asar Traders Par

- Risk Management: Slippage se traders ka risk barh jata hai, kyunki aapka stop loss ya take profit expected price par execute nahi hota. Is wajah se aapki risk management strategies kamzor pad sakti hain.

- Trading Costs: Negative slippage se aapke trading costs barh jate hain. Aapko expected se zyada price par buy karna padta hai ya kam price par sell karna padta hai, jis se aapka overall profit kam ho jata hai.

Slippage Se Bachne Ke Tareeqay

- Market Orders se Parhaiz: Market orders instantly execute hote hain aur slippage ke chances zyada hote hain. Limit orders use karne se aap specific price par trade execute kar sakte hain aur slippage se bach sakte hain.

- High Liquidity Pairs Mein Trade Karna: Jahan liquidity zyada hoti hai, wahan slippage ke chances kam hote hain. Major currency pairs jaise EUR/USD, GBP/USD mein liquidity zyada hoti hai aur slippage kam hota hai.

- Economic Calendars Ka Use: Economic news aur events market ko bohot affect karte hain. Economic calendar use kar ke aap jaan sakte hain ke kab major events hone wale hain aur aise waqt mein trading se gurez kar sakte hain.

- Trading Platforms Aur Brokers: Achi trading platforms aur reliable brokers ka intekhab bhi slippage kam kar sakta hai. Kuch brokers aise hain jo market volatility ke bawajood aapki orders ko best possible prices par execute karte hain.

Forex market mein slippage ek ahem kirdar ada karta hai aur yeh har trader ko samajhna chahiye. Iski wajah se trades expected prices par execute nahi hoti, jo ke risk aur cost ko barha sakti hain. Slippage ko samajh kar aur usse bachne ke tareeqay istemal kar ke traders apni trading efficiency aur profitability ko barha sakte hain. Forex trading mein successful hone ke liye market dynamics, risk management aur trading strategies ka acchi tarah se samajhna zaruri hai.

تبصرہ

Расширенный режим Обычный режим