### Trading Opportunities Ke Liye Imbalance Kahan Dhoondein?

Trading mein imbalance ka concept bohot ahmiyat rakhta hai. Jab market mein buyers aur sellers ke darmiyan balance na ho, to isse trading opportunities ka janm hota hai. Is post mein, hum dekhenge ke aap imbalance kahan dhoond sakte hain taake profitable trades hasil kar sakein.

**1. Technical Analysis:**

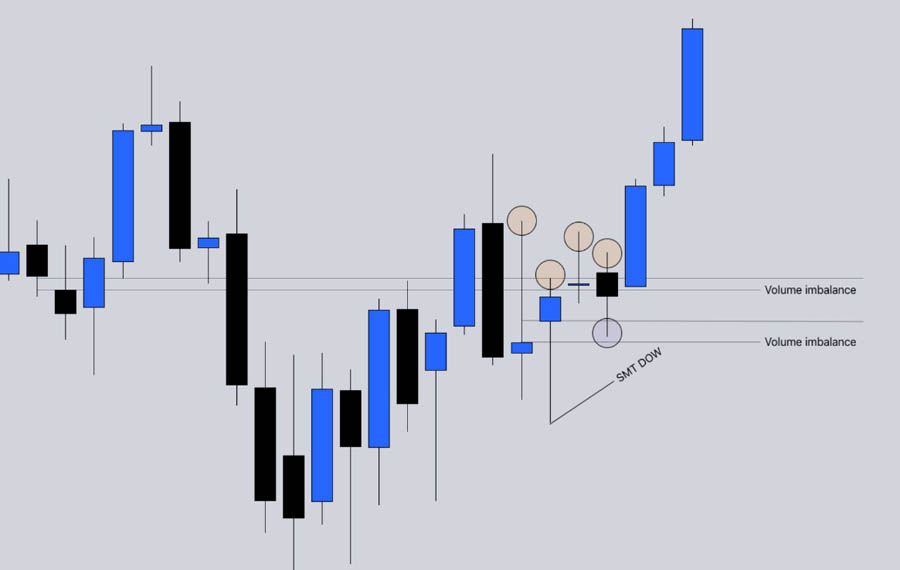

Technical analysis ke zariye aap charts par price action ko dekh kar imbalance identify kar sakte hain. Jab price kisi level par tezi se move karti hai, to ye darshata hai ke wahan par buyers ya sellers ka dominance hai. Is tarah ke price movements ke darmiyan gaps ya significant price changes imbalance ke nishani hote hain.

**2. Support aur Resistance Levels:**

Support aur resistance levels par bhi imbalance ki talash karna zaroori hai. Jab price support level ko todti hai, to ye indicate karta hai ke sellers ki taqat barh rahi hai. Is waqt aapko short position lene ka sochna chahiye. Uske baraks, agar price resistance level ko todti hai, to buyers ki taqat ka signal milta hai, jo long position lene ka mauqa de sakta hai.

**3. Economic News Events:**

Economic news aur data releases bhi market mein imbalance create kar sakte hain. Jab koi major news announce hoti hai, to market mein tezi se movement hoti hai. Traders ko chahiye ke wo economic calendars ka istemal karein taake ye jaan sakein ke kab kab important news aane wali hai. Is waqt imbalance dhoondna profitable ho sakta hai.

**4. Order Flow Analysis:**

Order flow analysis ke zariye aap market ki real-time activity ko samajh sakte hain. Jab aap dekhte hain ke kis taraf zyada orders lag rahe hain, to ye imbalance ka signal hota hai. Agar aapko zyada buying orders nazar aate hain, to ye bullish momentum ka indication hai, jabke zyada selling orders bearish momentum ko darshate hain.

**5. Volume Analysis:**

Volume analysis bhi imbalance dhoondne ka ek effective tareeqa hai. Jab price kisi specific direction mein move karti hai aur volume high hota hai, to ye imbalance ko darshata hai. High volume ke sath price ki movement aapko confirm karti hai ke market mein strong interest hai.

**Conclusion:**

Imbalance dhoondna trading ke liye ek ahmiyat rakhta hai, kyunki ye profitable opportunities ka signal deta hai. Technical analysis, support aur resistance levels, economic news events, order flow analysis, aur volume analysis ka istemal karke aap in imbalances ko identify kar sakte hain. Hamesha yaad rakhein ke market dynamics aur risk management ko samajhna bhi bohot zaroori hai taake aap apni trading strategy ko behtar bana sakein.

Trading mein imbalance ka concept bohot ahmiyat rakhta hai. Jab market mein buyers aur sellers ke darmiyan balance na ho, to isse trading opportunities ka janm hota hai. Is post mein, hum dekhenge ke aap imbalance kahan dhoond sakte hain taake profitable trades hasil kar sakein.

**1. Technical Analysis:**

Technical analysis ke zariye aap charts par price action ko dekh kar imbalance identify kar sakte hain. Jab price kisi level par tezi se move karti hai, to ye darshata hai ke wahan par buyers ya sellers ka dominance hai. Is tarah ke price movements ke darmiyan gaps ya significant price changes imbalance ke nishani hote hain.

**2. Support aur Resistance Levels:**

Support aur resistance levels par bhi imbalance ki talash karna zaroori hai. Jab price support level ko todti hai, to ye indicate karta hai ke sellers ki taqat barh rahi hai. Is waqt aapko short position lene ka sochna chahiye. Uske baraks, agar price resistance level ko todti hai, to buyers ki taqat ka signal milta hai, jo long position lene ka mauqa de sakta hai.

**3. Economic News Events:**

Economic news aur data releases bhi market mein imbalance create kar sakte hain. Jab koi major news announce hoti hai, to market mein tezi se movement hoti hai. Traders ko chahiye ke wo economic calendars ka istemal karein taake ye jaan sakein ke kab kab important news aane wali hai. Is waqt imbalance dhoondna profitable ho sakta hai.

**4. Order Flow Analysis:**

Order flow analysis ke zariye aap market ki real-time activity ko samajh sakte hain. Jab aap dekhte hain ke kis taraf zyada orders lag rahe hain, to ye imbalance ka signal hota hai. Agar aapko zyada buying orders nazar aate hain, to ye bullish momentum ka indication hai, jabke zyada selling orders bearish momentum ko darshate hain.

**5. Volume Analysis:**

Volume analysis bhi imbalance dhoondne ka ek effective tareeqa hai. Jab price kisi specific direction mein move karti hai aur volume high hota hai, to ye imbalance ko darshata hai. High volume ke sath price ki movement aapko confirm karti hai ke market mein strong interest hai.

**Conclusion:**

Imbalance dhoondna trading ke liye ek ahmiyat rakhta hai, kyunki ye profitable opportunities ka signal deta hai. Technical analysis, support aur resistance levels, economic news events, order flow analysis, aur volume analysis ka istemal karke aap in imbalances ko identify kar sakte hain. Hamesha yaad rakhein ke market dynamics aur risk management ko samajhna bhi bohot zaroori hai taake aap apni trading strategy ko behtar bana sakein.

تبصرہ

Расширенный режим Обычный режим