### Forex Market Mein Gap

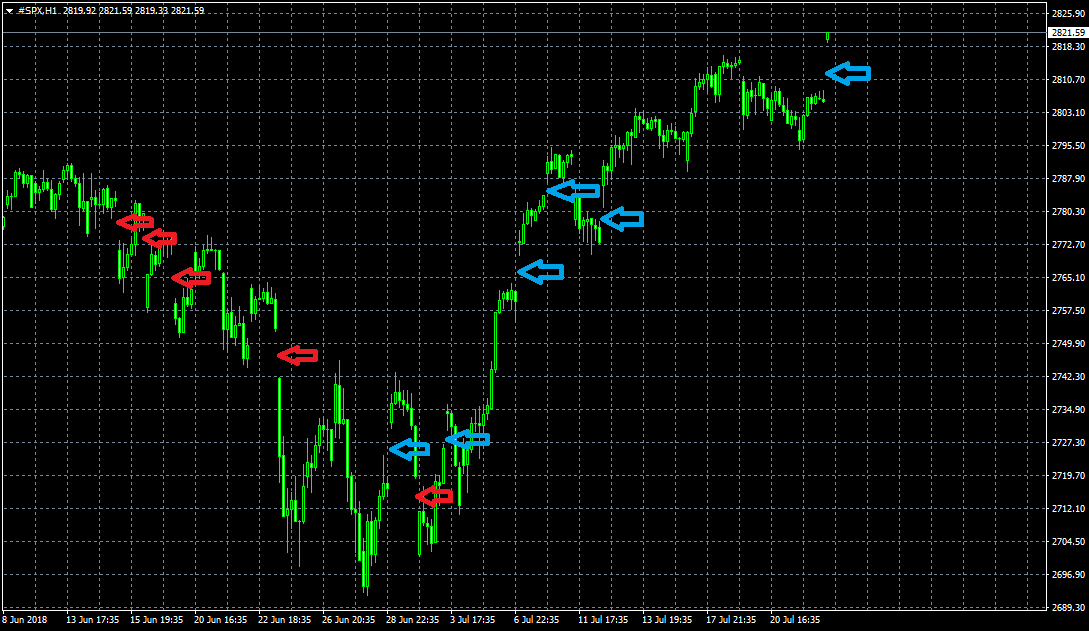

Forex market mein gap ek aisi phenomenon hai jo price charts pe asaan dikhai deti hai aur trading ke decision-making process ko asar انداز mein effect kar sakti hai. Gap se murad woh interval hota hai jab ek currency pair ki price achanak upar ya neeche jump kar jati hai, aur beech mein koi trading nahi hoti. Ye usually weekends, economic news releases, ya major market events ke baad hota hai. Aayiye, forex market mein gap ke asar aur trading strategies ko samajhte hain.

#### Gap Ke Types

1. **Common Gap:**

Ye gaps zyadatar daily trading ke duran dekhne ko milte hain aur inka koi khaas significance nahi hota. Ye usually market ke normal fluctuations ke wajah se hote hain aur jaldi fill ho jate hain.

2. **Breakaway Gap:**

Breakaway gap tab hota hai jab market ek significant price level ya support/resistance level ko break karta hai. Ye gaps aksar strong trends ka aaghaz karte hain aur inhe fill hone mein kaafi waqt lag sakta hai.

3. **Runaway Gap:**

Runaway gaps existing trend ke duran bante hain aur trend ki continuity ko indicate karte hain. Ye gaps strong market sentiment ka pata dete hain aur aksar price ke further movement ko signal karte hain.

4. **Exhaustion Gap:**

Exhaustion gaps trend ke end pe bante hain aur trend reversal ka indication dete hain. Ye gaps market ke overbought ya oversold conditions ko dikhate hain aur price ke ulta move karne ki potential ko highlight karte hain.

#### Gap Ka Asar

1. **Market Sentiment:**

Gaps market sentiment ko reflect karte hain. Breakaway aur runaway gaps strong bullish ya bearish sentiment ka pata dete hain, jabke exhaustion gaps trend reversal ka indication dete hain.

2. **Trading Opportunities:**

Gaps trading opportunities ko identify karne mein madadgar hote hain. Breakaway gaps potential entry points provide karte hain jab market ek significant level ko break karta hai, aur runaway gaps trend-following strategies ko support karte hain.

3. **Risk Management:**

Gaps risk management strategies ko affect karte hain. Weekend gaps ya major news ke baad ke gaps unexpected price movements ko trigger karte hain jo stop-loss levels ko hit kar sakte hain. Isliye, proper risk management aur position sizing ka hona bohot zaruri hai.

#### Gap Trading Strategies

1. **Gap and Go:**

Is strategy mein traders breakaway gaps aur runaway gaps ko follow karte hain. Jab market gap ke baad ek significant move karta hai, toh traders us direction mein trade initiate karte hain taake trend ka faida utha sakein.

2. **Gap Fill:**

Gap fill strategy mein traders assume karte hain ke gap jaldi fill ho jayega. Common gaps aksar fill hote hain, aur traders is opportunity ko short-term trades ke liye use karte hain.

3. **Risk Management:**

Gap trading mein proper risk management bohot zaruri hai. Traders ko stop-loss levels ko carefully place karna chahiye taake unexpected price movements se apne capital ko protect kar sakein. Position sizing aur diversification bhi risk ko manage karne ke liye important hote hain.

#### Conclusion

Forex market mein gaps ek important phenomenon hain jo trading decisions ko significantly affect kar sakte hain. Inhe samajhna aur inki basis pe sahi trading strategies adopt karna profitable trading ke liye zaruri hai. Proper risk management aur market sentiment analysis ke zariye traders gaps ko effectively trade kar sakte hain aur apne trading performance ko improve kar sakte hain.

Forex market mein gap ek aisi phenomenon hai jo price charts pe asaan dikhai deti hai aur trading ke decision-making process ko asar انداز mein effect kar sakti hai. Gap se murad woh interval hota hai jab ek currency pair ki price achanak upar ya neeche jump kar jati hai, aur beech mein koi trading nahi hoti. Ye usually weekends, economic news releases, ya major market events ke baad hota hai. Aayiye, forex market mein gap ke asar aur trading strategies ko samajhte hain.

#### Gap Ke Types

1. **Common Gap:**

Ye gaps zyadatar daily trading ke duran dekhne ko milte hain aur inka koi khaas significance nahi hota. Ye usually market ke normal fluctuations ke wajah se hote hain aur jaldi fill ho jate hain.

2. **Breakaway Gap:**

Breakaway gap tab hota hai jab market ek significant price level ya support/resistance level ko break karta hai. Ye gaps aksar strong trends ka aaghaz karte hain aur inhe fill hone mein kaafi waqt lag sakta hai.

3. **Runaway Gap:**

Runaway gaps existing trend ke duran bante hain aur trend ki continuity ko indicate karte hain. Ye gaps strong market sentiment ka pata dete hain aur aksar price ke further movement ko signal karte hain.

4. **Exhaustion Gap:**

Exhaustion gaps trend ke end pe bante hain aur trend reversal ka indication dete hain. Ye gaps market ke overbought ya oversold conditions ko dikhate hain aur price ke ulta move karne ki potential ko highlight karte hain.

#### Gap Ka Asar

1. **Market Sentiment:**

Gaps market sentiment ko reflect karte hain. Breakaway aur runaway gaps strong bullish ya bearish sentiment ka pata dete hain, jabke exhaustion gaps trend reversal ka indication dete hain.

2. **Trading Opportunities:**

Gaps trading opportunities ko identify karne mein madadgar hote hain. Breakaway gaps potential entry points provide karte hain jab market ek significant level ko break karta hai, aur runaway gaps trend-following strategies ko support karte hain.

3. **Risk Management:**

Gaps risk management strategies ko affect karte hain. Weekend gaps ya major news ke baad ke gaps unexpected price movements ko trigger karte hain jo stop-loss levels ko hit kar sakte hain. Isliye, proper risk management aur position sizing ka hona bohot zaruri hai.

#### Gap Trading Strategies

1. **Gap and Go:**

Is strategy mein traders breakaway gaps aur runaway gaps ko follow karte hain. Jab market gap ke baad ek significant move karta hai, toh traders us direction mein trade initiate karte hain taake trend ka faida utha sakein.

2. **Gap Fill:**

Gap fill strategy mein traders assume karte hain ke gap jaldi fill ho jayega. Common gaps aksar fill hote hain, aur traders is opportunity ko short-term trades ke liye use karte hain.

3. **Risk Management:**

Gap trading mein proper risk management bohot zaruri hai. Traders ko stop-loss levels ko carefully place karna chahiye taake unexpected price movements se apne capital ko protect kar sakein. Position sizing aur diversification bhi risk ko manage karne ke liye important hote hain.

#### Conclusion

Forex market mein gaps ek important phenomenon hain jo trading decisions ko significantly affect kar sakte hain. Inhe samajhna aur inki basis pe sahi trading strategies adopt karna profitable trading ke liye zaruri hai. Proper risk management aur market sentiment analysis ke zariye traders gaps ko effectively trade kar sakte hain aur apne trading performance ko improve kar sakte hain.

تبصرہ

Расширенный режим Обычный режим