USE OF NORMAL MOVING AVERAGES TO FIND TREND IN FOREX

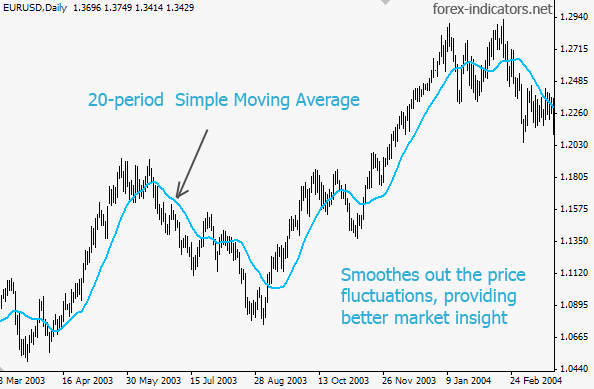

Forex trading mein moving averages ka istemal bahut aam hai. Moving Averages price data ko smooth karke trends ko identify karne mein madadgar hoti hain. Yahan normal moving averages ke baare mein tafseel se bataya gaya hai. Simple Moving Average ek basic moving average hai jo given period ka average price show karta hai. Is mein past prices ka average nikaal kar current value calculate ki jati hai.

CALCULATION

SMA ko calculate karne ke liye, specific period (jaise 10, 20, 50 days) ki closing prices ko add karke total number of periods se divide karte hain. SMA ko trend direction aur potential support/resistance levels ko identify karne ke liye use kiya jata hai. Agar price SMA se upar ho, to uptrend ka indication hota hai, aur agar price SMA se neeche ho, to downtrend ka indication hota hai.

EXPONENTIAL MOVING AVERAGE (EMA)

Exponential Moving Average SMA ka advanced version hai jo recent price data ko zyada weightage deta hai. Isse recent price movements par zyada focus hota hai. EMA calculate karte waqt initial SMA nikaal kar, uske baad exponential factor (weighting multiplier) apply kiya jata hai jo recent prices ko zyada importance deta hai. EMA ko short-term trading aur volatile markets mein zyada use kiya jata hai kyun ke yeh jaldi react karta hai recent price changes par. Commonly used EMA periods 12-day aur 26-day hain.

COMPARISON OF SMA AND EMA

EMA jaldi react karta hai price changes par kyun ke yeh recent prices ko zyada weightage deta hai, jabke SMA comparatively slow hota hai. Long-term trends ke liye SMA zyada useful hota hai, jabke short-term trends aur quick market changes ke liye EMA zyada effective hai. Dono moving averages lagging indicators hain, yani yeh past price data ko use karte hain, isliye inka signal thoda delay hota hai.

GOLDEN CROSS

Jab short-term MA (jaise 50-day) long-term MA (jaise 200-day) ko upar ki taraf cross kare, to yeh bullish signal hota hai.Moving Averages ka ek aur common usage crossover strategy hai. Jab short-term MA long-term MA ko cross karta hai, to yeh buy ya sell signal generate kar sakta hai.

DEATH CROSS

Jab short-term MA long-term MA ko neeche ki taraf cross kare, to yeh bearish signal hota hai. Moving Averages trading decisions mein bahut madadgar hoti hain kyun ke yeh trends ko smooth karke dekhne mein asaani deti hain. SMA aur EMA dono apni jagah effective hain aur traders inko apni trading strategy ke mutabiq use karte hain.

Forex trading mein moving averages ka istemal bahut aam hai. Moving Averages price data ko smooth karke trends ko identify karne mein madadgar hoti hain. Yahan normal moving averages ke baare mein tafseel se bataya gaya hai. Simple Moving Average ek basic moving average hai jo given period ka average price show karta hai. Is mein past prices ka average nikaal kar current value calculate ki jati hai.

CALCULATION

SMA ko calculate karne ke liye, specific period (jaise 10, 20, 50 days) ki closing prices ko add karke total number of periods se divide karte hain. SMA ko trend direction aur potential support/resistance levels ko identify karne ke liye use kiya jata hai. Agar price SMA se upar ho, to uptrend ka indication hota hai, aur agar price SMA se neeche ho, to downtrend ka indication hota hai.

EXPONENTIAL MOVING AVERAGE (EMA)

Exponential Moving Average SMA ka advanced version hai jo recent price data ko zyada weightage deta hai. Isse recent price movements par zyada focus hota hai. EMA calculate karte waqt initial SMA nikaal kar, uske baad exponential factor (weighting multiplier) apply kiya jata hai jo recent prices ko zyada importance deta hai. EMA ko short-term trading aur volatile markets mein zyada use kiya jata hai kyun ke yeh jaldi react karta hai recent price changes par. Commonly used EMA periods 12-day aur 26-day hain.

COMPARISON OF SMA AND EMA

EMA jaldi react karta hai price changes par kyun ke yeh recent prices ko zyada weightage deta hai, jabke SMA comparatively slow hota hai. Long-term trends ke liye SMA zyada useful hota hai, jabke short-term trends aur quick market changes ke liye EMA zyada effective hai. Dono moving averages lagging indicators hain, yani yeh past price data ko use karte hain, isliye inka signal thoda delay hota hai.

GOLDEN CROSS

Jab short-term MA (jaise 50-day) long-term MA (jaise 200-day) ko upar ki taraf cross kare, to yeh bullish signal hota hai.Moving Averages ka ek aur common usage crossover strategy hai. Jab short-term MA long-term MA ko cross karta hai, to yeh buy ya sell signal generate kar sakta hai.

DEATH CROSS

Jab short-term MA long-term MA ko neeche ki taraf cross kare, to yeh bearish signal hota hai. Moving Averages trading decisions mein bahut madadgar hoti hain kyun ke yeh trends ko smooth karke dekhne mein asaani deti hain. SMA aur EMA dono apni jagah effective hain aur traders inko apni trading strategy ke mutabiq use karte hain.

تبصرہ

Расширенный режим Обычный режим