what is average true range

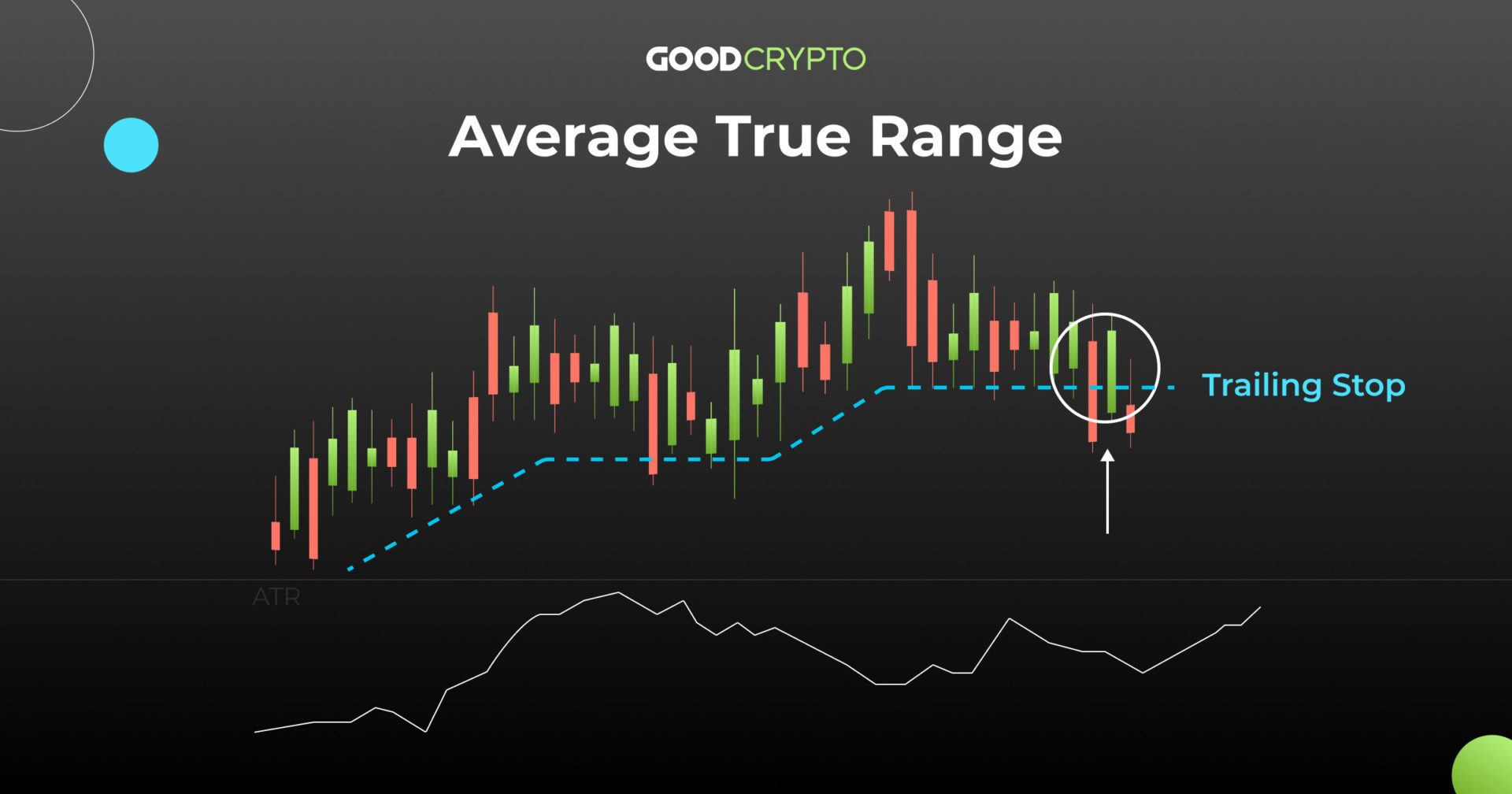

forex market mein ATR aik technical indicator hota hey forex market mein kame ka trend hota hey jo keh es bat ko he indicate kar sakta hey keh forex market ke average pric kes side mein movement kar rehe hote hey jab forex market ke price zyada jare tor par movement kar rehe hote hein to forex market ka indicator chalang lagata hey jaisa keh green box mein dekhaya geya hey

ATR forex market mein direction kay tor par agnostic indicator hota hey serf es mein shamel size par towajah markoz kar saktay hein barhte hove range mein strong value ATR ko identify kar sakte hey

Setting Stop with ATR

jab forex market ka aik trader ATR ko read karna janta hey to forex market yeh indicator estamal hotay hovay pehlay say he low ho choka hota hey jaisa keh hum nay oper daily chart mein daikha hey EUR/USD mein 92.0 pips barah raha hota hey

jaisa keh forex tradr EUR/USD ke position mein bhe enter hota hey yeh forex market mein ghor karnay ka bhe element hota hey trade kay aghaz kay ley indicator stop par set keya jata hey ATR ka 50% daily 2X hota hey yeh forex market mein mokamal tor par es bat par depend karta hey forex market mein risk management say he kam layna chihay

Trading Example With ATR

fored market mein ATR aik kesam ka technical indicator hota hey forex market mein EUR/USD ke trading example mein forex trading kay aghaz mein indicator setting par stop loss set kar sakta hey ATR aik element kay tor par estamal hota hey ager woh forex market mein sakhat kesam kay wasee stop loss set karna chahtay hein or forex market mein ATR ke 14 period ka estamal keya jata hey yeh forex market kay long period or short period market mein estamal ho sakta hey

barhte hove otar charhao jaisa keh ATR kay zarey say he dekhaya jata hey bad mein forex market kay tradr es bat ka tayon karnay kay ley estamal kar sakta hey keh forex market mein kon ce strategy ko nafaz karna hota hey yeh forex market mein ken signals par amal karta hey hallankeh forex market mein apni strategy kay ley he chahtay hein ATR trader kay ley bohut he important kesam ka trading data day sakta hey jo keh forex market ka assan tareka hota hey

forex market mein ATR aik technical indicator hota hey forex market mein kame ka trend hota hey jo keh es bat ko he indicate kar sakta hey keh forex market ke average pric kes side mein movement kar rehe hote hey jab forex market ke price zyada jare tor par movement kar rehe hote hein to forex market ka indicator chalang lagata hey jaisa keh green box mein dekhaya geya hey

ATR forex market mein direction kay tor par agnostic indicator hota hey serf es mein shamel size par towajah markoz kar saktay hein barhte hove range mein strong value ATR ko identify kar sakte hey

Setting Stop with ATR

jab forex market ka aik trader ATR ko read karna janta hey to forex market yeh indicator estamal hotay hovay pehlay say he low ho choka hota hey jaisa keh hum nay oper daily chart mein daikha hey EUR/USD mein 92.0 pips barah raha hota hey

jaisa keh forex tradr EUR/USD ke position mein bhe enter hota hey yeh forex market mein ghor karnay ka bhe element hota hey trade kay aghaz kay ley indicator stop par set keya jata hey ATR ka 50% daily 2X hota hey yeh forex market mein mokamal tor par es bat par depend karta hey forex market mein risk management say he kam layna chihay

Trading Example With ATR

fored market mein ATR aik kesam ka technical indicator hota hey forex market mein EUR/USD ke trading example mein forex trading kay aghaz mein indicator setting par stop loss set kar sakta hey ATR aik element kay tor par estamal hota hey ager woh forex market mein sakhat kesam kay wasee stop loss set karna chahtay hein or forex market mein ATR ke 14 period ka estamal keya jata hey yeh forex market kay long period or short period market mein estamal ho sakta hey

barhte hove otar charhao jaisa keh ATR kay zarey say he dekhaya jata hey bad mein forex market kay tradr es bat ka tayon karnay kay ley estamal kar sakta hey keh forex market mein kon ce strategy ko nafaz karna hota hey yeh forex market mein ken signals par amal karta hey hallankeh forex market mein apni strategy kay ley he chahtay hein ATR trader kay ley bohut he important kesam ka trading data day sakta hey jo keh forex market ka assan tareka hota hey

تبصرہ

Расширенный режим Обычный режим