Introduction

forex market mein order block candlestick pattern aik khas kesam ke price ke range hote hey Bank or baray idaray es candlstick pattern ko follow kartay hein liquidity mein masail keajah say order block candlestick pattern ko nafaz nahi keya ja sakta hey or yeh forex market mein en ke salehat ko kam kar sakta hey yeh he wajah hote hey keh yeh forex market mein profit ko barhanay kay ley single order ko chotay chotay tokray mein paish kartay hein esbat ko bhe yaqene bana sakta hey keh forex market order ko taqseem kar sakte hey

chonkeh order block bray tradr or forex market kay baray idaray kar saktay hein to es ley es ko order block ka naam deya jata hey

forex market ke trading kay doran es ko zahain mein rakhna chihay keh market ka 86% volume banks or idaron ko control karta hey lahza en kay trading nakash kay baray mein kheyal rakha ja sakta hey or dosray khordah trader ke wajah say mosabaqte bartaree hasell ho ge

Types of Order Block

Bullish Order Block

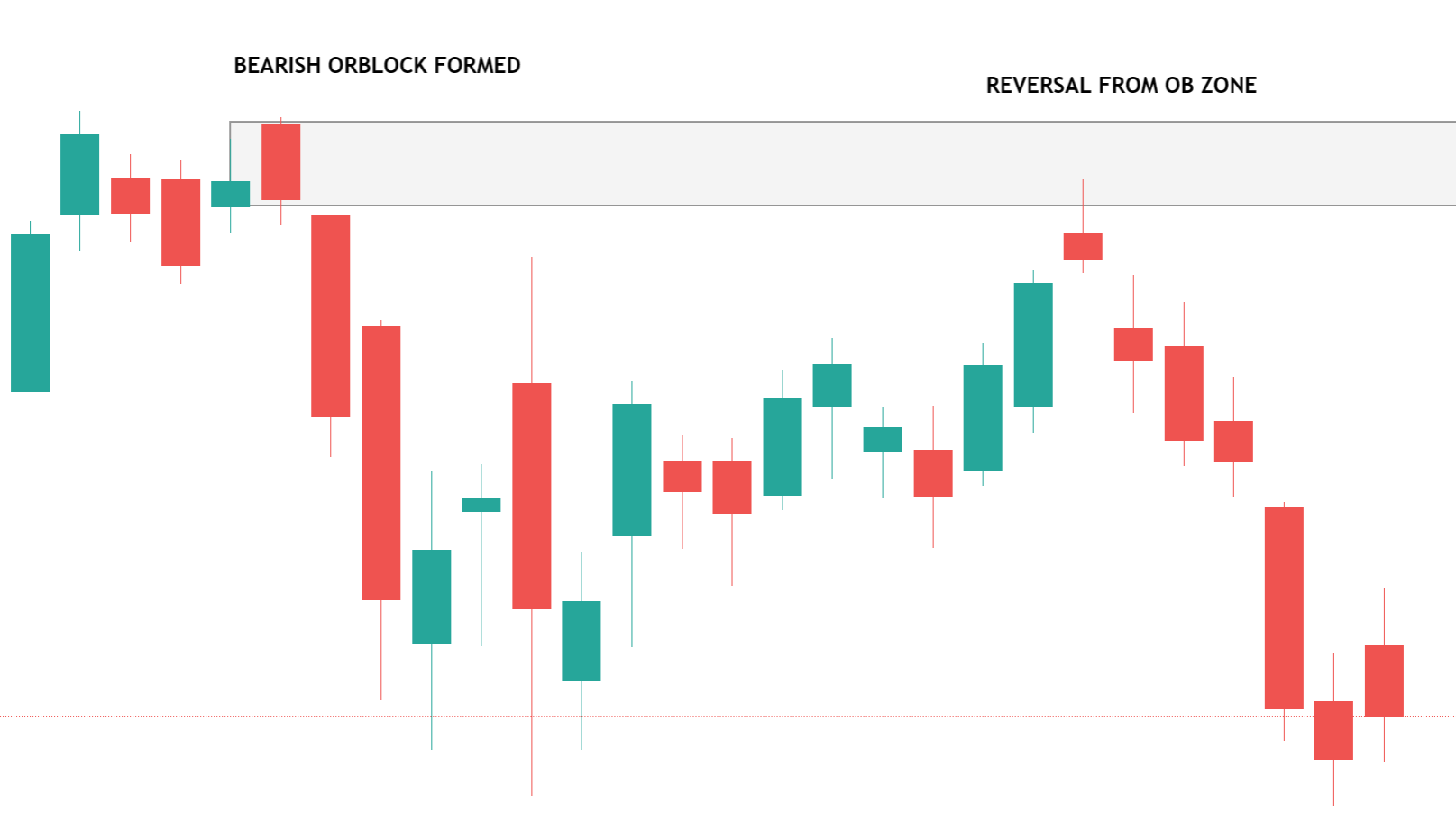

Bearish Order Block

Bullish Order Block

AGER forex market mein price kay chart par bullish order block banta hey to hum forex market mein buy ka order dein gay banks or dosray idaray trader ko buy ke wajah say trader bullish ka trend kaim ho jata hey bad mein hum en ko follow karen gay or forex market kay trend ko agay increase kar saken gay

Bearish Order Block

ager forex market mein prie kay chart par bearish order block banta hey to hum os ko price ke limit mein sell ka order open kar saken gay baray idaron ke wajah say sell kay order ke wajah say order block say bearish ka trend start ho jay ga yeh hum ko bearish kay trend par ssawar honay day ga

Order Block KA maksad

Forex market mein humare basic towajah technical analysis kay estamal karnay par he hota hey forex market kay price kay chart par order block ko identify keya ja sakta hey ager humen forex market mein order block mel jatay hein to yeh forex market mein aglay step ko he identify kartay hein es say forex market mein anay wala profit bhe paida keya ja sakta hey taleem yafta or higher trading mein adad mel sakte hey

yeh forex market mein aik kesam ke reality hote hey keh forex market ko bananay walay es ke madad kar saken gay retail trader es mein nakam ho jatay hein kunkeh market banay wallay pechay rah jatay hein

Order Block ka kam

yeh forex market mein technical analysis ka chart pattern hota hey kunkeh forex market mein humaree towajah market mein repeat honay walay pattern par he hote hey forex chart par methay trading jazbaat ko talash karna chihay order block indicator es tarah kam kar sakta hey

forex market mein order block indicator price ke range ko indicate kar sakte hey or forex market kay baray idaron mein market kay tokray he ho jatay hein forex market ke price order ko filling kay sath he le jate hey chart mein aik khas patter ko zahair karte hey or humaray indicator ko estamal keya jata hey order block ke wajah aik bara bullish ya bearish trend start ho jata hey

forex market mein order block candlestick pattern aik khas kesam ke price ke range hote hey Bank or baray idaray es candlstick pattern ko follow kartay hein liquidity mein masail keajah say order block candlestick pattern ko nafaz nahi keya ja sakta hey or yeh forex market mein en ke salehat ko kam kar sakta hey yeh he wajah hote hey keh yeh forex market mein profit ko barhanay kay ley single order ko chotay chotay tokray mein paish kartay hein esbat ko bhe yaqene bana sakta hey keh forex market order ko taqseem kar sakte hey

chonkeh order block bray tradr or forex market kay baray idaray kar saktay hein to es ley es ko order block ka naam deya jata hey

forex market ke trading kay doran es ko zahain mein rakhna chihay keh market ka 86% volume banks or idaron ko control karta hey lahza en kay trading nakash kay baray mein kheyal rakha ja sakta hey or dosray khordah trader ke wajah say mosabaqte bartaree hasell ho ge

Types of Order Block

Bullish Order Block

Bearish Order Block

Bullish Order Block

AGER forex market mein price kay chart par bullish order block banta hey to hum forex market mein buy ka order dein gay banks or dosray idaray trader ko buy ke wajah say trader bullish ka trend kaim ho jata hey bad mein hum en ko follow karen gay or forex market kay trend ko agay increase kar saken gay

Bearish Order Block

ager forex market mein prie kay chart par bearish order block banta hey to hum os ko price ke limit mein sell ka order open kar saken gay baray idaron ke wajah say sell kay order ke wajah say order block say bearish ka trend start ho jay ga yeh hum ko bearish kay trend par ssawar honay day ga

Order Block KA maksad

Forex market mein humare basic towajah technical analysis kay estamal karnay par he hota hey forex market kay price kay chart par order block ko identify keya ja sakta hey ager humen forex market mein order block mel jatay hein to yeh forex market mein aglay step ko he identify kartay hein es say forex market mein anay wala profit bhe paida keya ja sakta hey taleem yafta or higher trading mein adad mel sakte hey

yeh forex market mein aik kesam ke reality hote hey keh forex market ko bananay walay es ke madad kar saken gay retail trader es mein nakam ho jatay hein kunkeh market banay wallay pechay rah jatay hein

Order Block ka kam

yeh forex market mein technical analysis ka chart pattern hota hey kunkeh forex market mein humaree towajah market mein repeat honay walay pattern par he hote hey forex chart par methay trading jazbaat ko talash karna chihay order block indicator es tarah kam kar sakta hey

forex market mein order block indicator price ke range ko indicate kar sakte hey or forex market kay baray idaron mein market kay tokray he ho jatay hein forex market ke price order ko filling kay sath he le jate hey chart mein aik khas patter ko zahair karte hey or humaray indicator ko estamal keya jata hey order block ke wajah aik bara bullish ya bearish trend start ho jata hey

تبصرہ

Расширенный режим Обычный режим