**Diamond Chart Pattern Trading Strategy: Ek Jaiza**

Trading ke duniya mein, chart patterns ka use karke market trends aur price movements ko predict karna ek aam practice hai. Unmein se ek khaas pattern hai “diamond pattern,” jo apni distinct shape aur significant trading signals ki wajah se trade karne walon ke liye badi ahmiyat rakhta hai. Yeh pattern trend reversal ko indicate karta hai aur traders ko entry aur exit points identify karne mein madad deta hai.

Diamond chart pattern ek complex formation hai jo two major trend lines ke intersection se banta hai. Yeh pattern bullish aur bearish trends dono mein develop ho sakta hai. Pattern ka shape ek diamond ki tarah hota hai, jisme ek upward trend hota hai jo phir sideways aur downward movement mein convert hota hai, aur finally phir upward trend ke sath complete hota hai.

Is pattern ko samajhne ke liye, sab se pehle aapko iske formation ke stages ko identify karna hoga. Diamond pattern ki formation kuch specific steps se guzarti hai:

1. **Uptrend**: Pattern ka shuruat ek strong upward trend se hota hai.

2. **Broadening Formation**: Iske baad price chart wide swings banati hai, jo diamond shape create karti hai.

3. **Consolidation**: Phir price ek narrow range mein consolidate hoti hai, jo pattern ki peak ko form karta hai.

4. **Downtrend**: Finally, pattern complete hone ke baad price downward movement ko show karti hai.

Trading strategy ke liye, diamond pattern ka use karte waqt kuch key points dhyan mein rakhne chahiye:

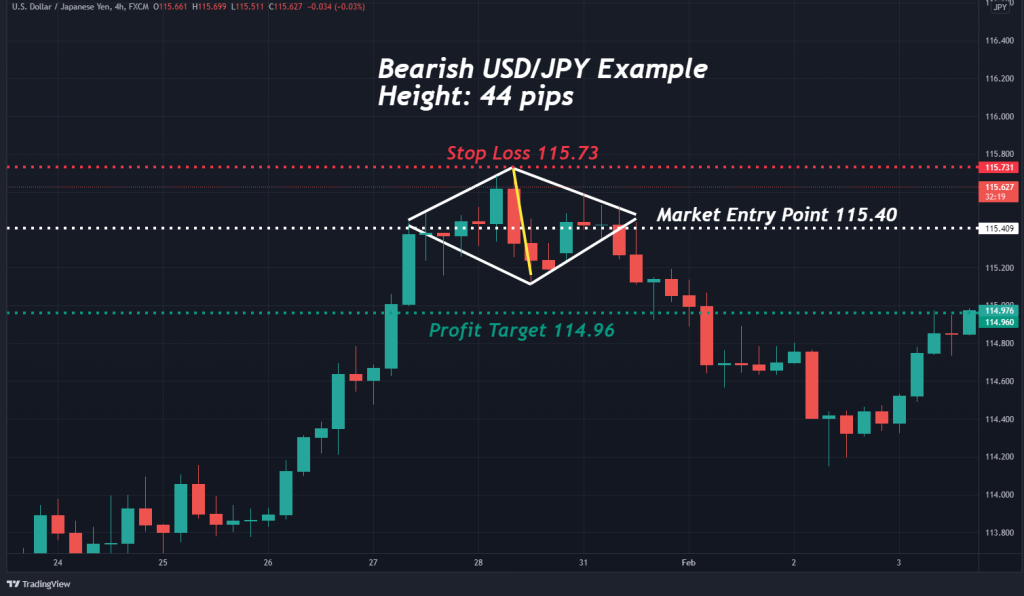

- **Confirmation**: Pattern ki confirmation ke liye, price ko diamond pattern ke breakout point se break karni chahiye. Breakout ke baad, ek clear trend reversal ke signals dekhne ko milte hain.

- **Volume Analysis**: Volume ka analysis bhi important hota hai. Pattern ke formation aur breakout ke doran, trading volume ka increase hona zaroori hai.

- **Stop Loss aur Target Setting**: Risk management ke liye, stop loss aur target levels set karna zaroori hai. Pattern ke breakout ke baad, stop loss ko pattern ke peak ya low ke aas-paas set karein aur target ko pattern ki height ke mutabiq calculate karein.

Diamond chart pattern trading strategy ko implement karte waqt patience aur practice ki zaroorat hoti hai. Yeh pattern market ke significant reversals ko identify karne mein madadgar ho sakta hai, lekin hamesha risk management aur additional confirmation tools ka use karna chahiye. Is tarah se, aap diamond pattern ke signals ko effectively utilize kar sakte hain aur trading decisions ko optimize kar sakte hain.

Trading ke duniya mein, chart patterns ka use karke market trends aur price movements ko predict karna ek aam practice hai. Unmein se ek khaas pattern hai “diamond pattern,” jo apni distinct shape aur significant trading signals ki wajah se trade karne walon ke liye badi ahmiyat rakhta hai. Yeh pattern trend reversal ko indicate karta hai aur traders ko entry aur exit points identify karne mein madad deta hai.

Diamond chart pattern ek complex formation hai jo two major trend lines ke intersection se banta hai. Yeh pattern bullish aur bearish trends dono mein develop ho sakta hai. Pattern ka shape ek diamond ki tarah hota hai, jisme ek upward trend hota hai jo phir sideways aur downward movement mein convert hota hai, aur finally phir upward trend ke sath complete hota hai.

Is pattern ko samajhne ke liye, sab se pehle aapko iske formation ke stages ko identify karna hoga. Diamond pattern ki formation kuch specific steps se guzarti hai:

1. **Uptrend**: Pattern ka shuruat ek strong upward trend se hota hai.

2. **Broadening Formation**: Iske baad price chart wide swings banati hai, jo diamond shape create karti hai.

3. **Consolidation**: Phir price ek narrow range mein consolidate hoti hai, jo pattern ki peak ko form karta hai.

4. **Downtrend**: Finally, pattern complete hone ke baad price downward movement ko show karti hai.

Trading strategy ke liye, diamond pattern ka use karte waqt kuch key points dhyan mein rakhne chahiye:

- **Confirmation**: Pattern ki confirmation ke liye, price ko diamond pattern ke breakout point se break karni chahiye. Breakout ke baad, ek clear trend reversal ke signals dekhne ko milte hain.

- **Volume Analysis**: Volume ka analysis bhi important hota hai. Pattern ke formation aur breakout ke doran, trading volume ka increase hona zaroori hai.

- **Stop Loss aur Target Setting**: Risk management ke liye, stop loss aur target levels set karna zaroori hai. Pattern ke breakout ke baad, stop loss ko pattern ke peak ya low ke aas-paas set karein aur target ko pattern ki height ke mutabiq calculate karein.

Diamond chart pattern trading strategy ko implement karte waqt patience aur practice ki zaroorat hoti hai. Yeh pattern market ke significant reversals ko identify karne mein madadgar ho sakta hai, lekin hamesha risk management aur additional confirmation tools ka use karna chahiye. Is tarah se, aap diamond pattern ke signals ko effectively utilize kar sakte hain aur trading decisions ko optimize kar sakte hain.

تبصرہ

Расширенный режим Обычный режим