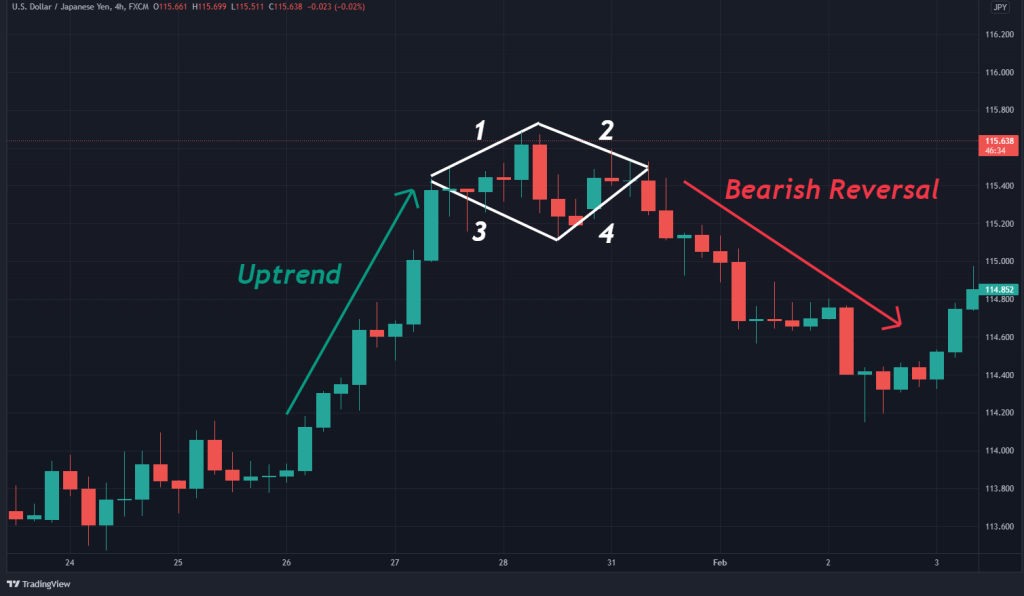

Diamond chart pattern ek technical analysis tool hai jo traders ko market reversals predict karne mein madad karta hai. Ye pattern typically trend continuation ke baad form hota hai aur iski shape diamond jaisi hoti hai. Is pattern ka naam iski distinct diamond shape ki wajah se hi pada hai.

Pattern Formation

Diamond chart pattern tab banta hai jab price action ek symmetrically opposite pattern create karta hai. Yeh pattern do symmetrical triangles se mil kar banta hai. Pehle triangle expanding hota hai, aur doosra contracting. Yeh pattern aksar reversal ka signal hota hai, lekin kabhi kabhi continuation bhi ho sakta hai.

Identification Karne Ka Tariqa

Diamond pattern ko identify karne ke liye aapko chart par chaar key points dhoondhne honge:

In chaar points ko connect karne par aapko diamond shape milegi.

Trading Strategy

Diamond chart pattern ko trade karne ke liye aapko breakout ka intezar karna hoga. Breakout ka matlab hai jab price diamond pattern ke boundary se bahar nikalti hai.

Diamond chart pattern ko effectively use karne ke liye aapko pattern ko sahi tarah se identify karna aana chahiye aur proper risk management techniques apply karni chahiye. Is pattern ka istemal karte waqt discipline aur patience ka hona zaroori hai, taki aap profitable trades execute kar sakein.

Pattern Formation

Diamond chart pattern tab banta hai jab price action ek symmetrically opposite pattern create karta hai. Yeh pattern do symmetrical triangles se mil kar banta hai. Pehle triangle expanding hota hai, aur doosra contracting. Yeh pattern aksar reversal ka signal hota hai, lekin kabhi kabhi continuation bhi ho sakta hai.

Identification Karne Ka Tariqa

Diamond pattern ko identify karne ke liye aapko chart par chaar key points dhoondhne honge:

- Left Top: Yahan se pattern start hota hai.

- Left Bottom: Price yahaan se niche girti hai.

- Right Top: Price phir se upar jati hai aur left top ke barabar ya usse thoda upar hoti hai.

- Right Bottom: Price yahaan se phir se niche girti hai aur left bottom ke barabar ya usse thoda neeche hoti hai.

In chaar points ko connect karne par aapko diamond shape milegi.

Trading Strategy

Diamond chart pattern ko trade karne ke liye aapko breakout ka intezar karna hoga. Breakout ka matlab hai jab price diamond pattern ke boundary se bahar nikalti hai.

- Breakout Confirmation: Sabse pehle, aapko breakout ka wait karna chahiye. Yahan, volume bhi zaroor dekhna chahiye kyunki high volume breakout ko confirm kar sakta hai.

- Entry Point: Jab breakout confirm ho jaye, tab aap entry kar sakte hain. Agar breakout upside ki taraf ho, to buy signal hota hai. Agar downside breakout ho, to sell signal hota hai.

- Stop Loss: Stop loss set karna zaroori hai. Yeh aap previous swing ke high ya low par set kar sakte hain, depending on the direction of the breakout.

- Target: Target price ko calculate karne ke liye aap diamond pattern ki height ko use kar sakte hain. Yeh distance aap breakout point se measure kar sakte hain.

Diamond chart pattern ko effectively use karne ke liye aapko pattern ko sahi tarah se identify karna aana chahiye aur proper risk management techniques apply karni chahiye. Is pattern ka istemal karte waqt discipline aur patience ka hona zaroori hai, taki aap profitable trades execute kar sakein.

تبصرہ

Расширенный режим Обычный режим