Descending Channel Pattern

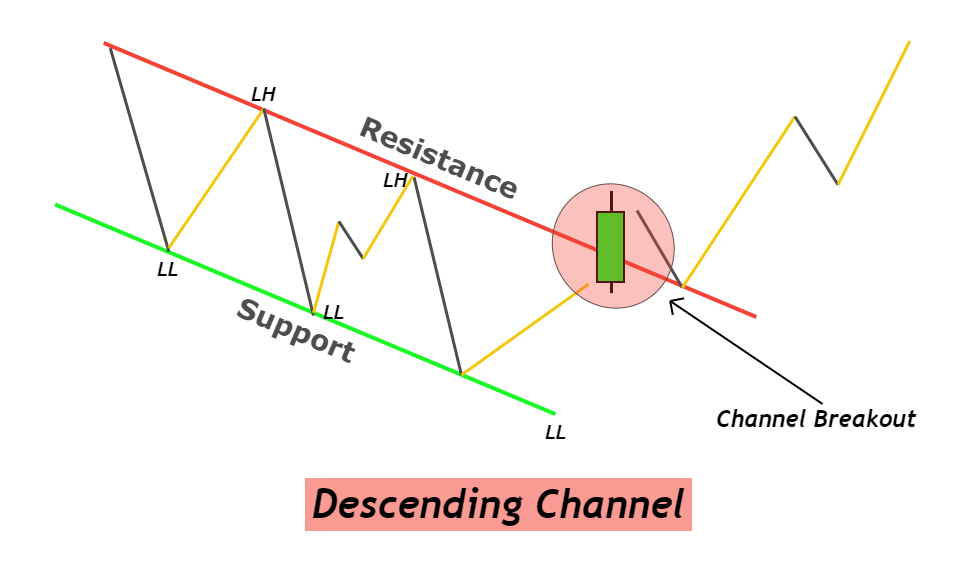

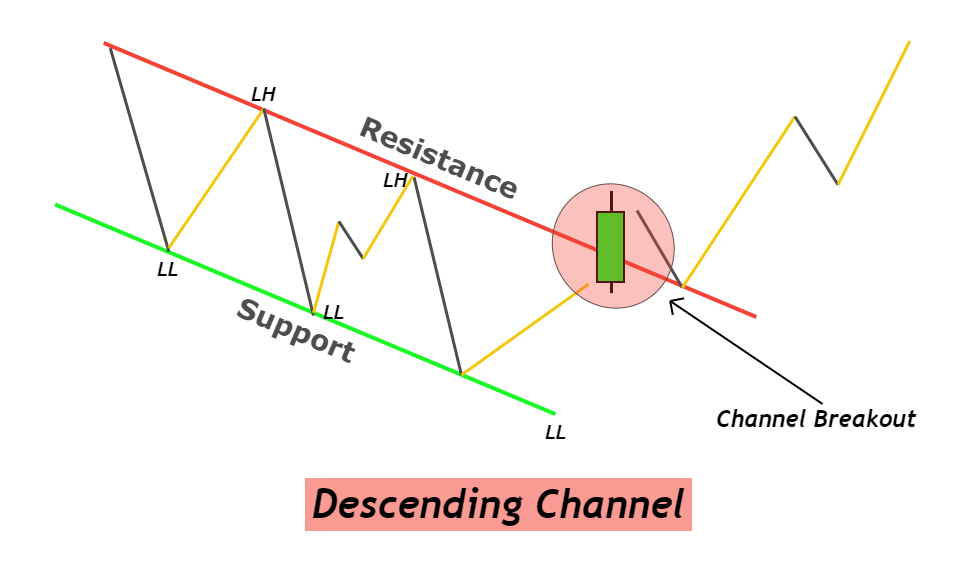

Forex trading mein chart patterns bohat aham hote hain kyun ke yeh market ke mood, trend aur potential reversal ya continuation ko identify kerne mein madad dete hain. In patterns mein se ek hai "Descending Channel Pattern". Yeh pattern aksar downtrend mein nazar aata hai aur price action ko ek defined range ke andar, parallel downward sloping trendlines ke darmiyan move kerte hue dikhata hai. Is pattern ka istemal karke traders market ke bearish sentiment ko samajh sakte hain aur sahi entry/exit points identify ker sakte hain.Descending Channel Pattern ek chart pattern hai jismein price action do parallel lines ke darmiyan continuously downward move ker rahi hoti hai. Upar wali line (upper channel) aur neeche wali line (lower channel) dono descending (neeche jate hue) hoti hain. Yeh pattern aksar bearish market conditions mein nazar aata hai. Is pattern mein, price ek defined range ke andar oscillate karti hai, jahan trendlines price ko support aur resistance ke tor par serve karti hain. Iska matlab hai ke agar aapko descending channel dikhai dey, to market mein sellers ka pressure dominate ker raha hota hai aur overall trend downward hi rehne ke imkanaat zyada hote hain.

• Formation of Descending Channel Pattern

Descending channel ka formation do primary components par mabni hota hai:

• Trendlines:

Is pattern ko form kerne ke liye, sab se pehle aapko chart par do parallel lines draw kerni hoti hain. Uper wali line ko draw kerne ke liye, aap un highs ko connect kerte hain jo consistently lower ho rahe hon. Neeche wali line ko draw kerne ke liye, aap un lows ko connect kerte hain. Dono lines agar parallel aur descending direction mein chal rahi hon, to yeh descending channel kehlata hai.

• Price Action:

Price ka move in dono trendlines ke darmiyan confined rehta hai. Market ke har swing high aur swing low descending order mein aate hain, jo overall bearish trend ko confirm kerte hain. Agar price repeatedly in boundaries ko touch ker rahi ho aur phir bounce ker rahi ho, to yeh descending channel ka clear sign hai.

• Characteristics of Descending Channel Pattern

Descending channel pattern ke kuch khas features hote hain jo isay identify kerna asaan banate hain:

• Parallel Trendlines:

Is pattern mein, uper wali aur neeche wali lines roughly parallel hoti hain. In parallel lines ka hona signal deta hai ke market ka trend consistent hai aur price predictable range ke andar hi move ker raha hai.

• Downward Slope:

Dono trendlines descending yani ke neeche ki taraf slope karti hain, jo overall bearish sentiment aur continuous selling pressure ko reflect karti hain.

• Consolidation Within a Range:

Price action in lines ke andar ek defined range mein rehta hai. Traders dekhte hain ke jab price upper boundary ko touch ker ke bounce ker rahi ho, to yeh resistance ka signal hai, aur jab price lower boundary ko touch ker ke rebound ker rahi ho, to yeh support ka indication hai.

• Volume Behavior:

Aksar descending channel ke dauran volume gradually decrease ker sakta hai, lekin jab breakout occur kerne ka chance ho to volume mein sudden spike aana zaroori hota hai, jo confirmation ka signal deta hai.

• Benefits of Using Descending Channel Pattern

Descending channel pattern ko samajhne aur use kerne ke kai faide hain jo traders ke liye bohot valuable sabit hotay hain:

• Trend Confirmation:

Yeh pattern market ke ongoing bearish trend ko clearly indicate ker deta hai. Agar aap descending channel ko identify ker lete hain, to aap ko pata chal jata hai ke market mein sellers dominant hain aur trend continuation ke chances zyada hain.

• Defined Entry and Exit Points:

Price ka movement defined range ke andar hone se aap clear entry aur exit points set ker sakte hain. Agar price upper boundary ko touch ker ke bounce ker rahi ho, to yeh aapko potential short entry ka mauqa deta hai. Agar price channel ko break ker jaye to yeh breakout signal hai jo exit ya reverse trade ke liye use hota hai.

• Risk Management:

Descending channel pattern ke sath stop loss aur target levels ko set kerna asaan hota hai. Aap apni stop loss ko channel ke upper boundary ke thoda upar aur profit target ko channel ke neeche ya breakout ke hisaab se adjust ker sakte hain. Is se aapka risk controlled rehta hai aur aapka reward-to-risk ratio improve hota hai.

• Simplicity aur Clarity:

Is pattern ka structure simple aur visually clear hota hai. Jo traders market ko quickly analyze kerna chahtay hain, unke liye descending channel ek straightforward signal provide ker deta hai.

• Versatility Across Timeframes:

Descending channel pattern har timeframe par nazar aa sakta hai – chahe aap intraday trading ker rahe hon ya swing trading. Is versatility se aap apne trading style ke mutabiq is pattern ka faida utha sakte hain.

• Uses of Descending Channel Pattern in Forex Trading

Descending channel pattern ko use kerne ke kai practical applications hain:

• Short Entry Opportunities:

Downtrend mein, jab price repeatedly channel ke upper boundary ko touch ker ke reverse ker rahi ho, to yeh short entry ka signal hota hai. Traders is se benefit utha ke short positions open kerte hain, kyun ke yeh pattern trend continuation ko confirm ker deta hai.

• Identifying Breakouts:

Kabhi kabhi, descending channel ke dauran market mein consolidation ke baad breakout occur ker sakta hai. Agar price channel ko break ker ke upper ya lower side par move ker jati hai, to yeh reversal ya continuation signal deta hai. Is se aap additional trading opportunities explore ker sakte hain.

• Risk Management Tool:

Jab aap descending channel pattern ko use kerte hain, to aap apne stop loss aur profit targets ko channel boundaries ke hisaab se set ker sakte hain. Yeh dynamic support aur resistance levels aapko risk management mein madad detay hain.

• Confirmation with Other Indicators:

Descending channel ko doosray technical indicators ke sath integrate ker ke aap apne trading signals ko strengthen ker sakte hain. Misal ke taur par, agar moving averages, RSI ya MACD bullish reversal signal dete hain jab price channel ke lower boundary ko touch ker rahi ho, to yeh entry ke liye confirmation hota hai.

• Steps to Trade Descending Channel Pattern

Trading descending channel pattern ko effectively implement kerne ke liye aapko kuch steps follow kerne honge:

• Pattern Identification:

Sab se pehle chart par descending channel pattern ko identify kerain. Iske liye, do parallel trendlines draw kerain – ek jo recent highs ko join kerte hue descending ho aur doosri jo recent lows ko join kerte hue descending ho.

• Entry Point Decision:

Agar aap short position mein trade kerna chahtay hain, to aap entry ka point tab consider kerain jab price channel ke upper boundary ko touch ker ke reverse ho jaye. Agar market breakout ya reversal ka signal deta hai, to entry execute kerain.

• Stop Loss Setting:

Stop loss ko aap channel ke opposite boundary ke thoda upar (short trades ke liye) ya thoda neeche (long trades ke liye) set kerain. Is se agar market unexpected move ker jaye to aapka loss limited reh jata hai.

• Profit Target Definition:

Profit target ko channel ke depth ya previous support/resistance levels ke hisaab se set kerain. Aap channel ki height ko measure ker ke, target ko us hisaab se define ker sakte hain.

• Confirmation Indicators:

Additional confirmation ke liye, volume analysis aur oscillators ka use kerain. Agar volume breakout ke dauran significantly badh jata hai, to yeh signal confirm ker deta hai ke trend reversal ya continuation sahi hai.

• Benefits of Using Descending Channel Pattern

Descending channel pattern ke kai faide hain jo traders ko decision making mein madad detey hain:

• Clear Visual Representation:

Is pattern ke through market ka bearish sentiment clearly nazar aata hai, jis se aap quickly trend ko samajh sakte hain.

• Defined Trading Range:

Channel ke andar price action ek specific range mein rehta hai, jis se aapko support aur resistance levels easily mil jate hain.

• Enhanced Risk Management:

Dynamic boundaries ke zariye, aap apne stop loss aur profit targets ko accurately set ker sakte hain, jo risk ko minimize kerne mein madad karta hai.

• Versatile Application:

Yeh pattern har timeframe par apply ho sakta hai, jis se intraday se le kar swing trading tak use kiya ja sakta hai.

• Profit Opportunities Through Reversals and Breakouts:

Agar market descending channel ke dauran reversal ya breakout ker deti hai, to aapko significant profit potential mil sakta hai. Yeh pattern market ke turning points ko accurately highlight ker deta hai.

• Limitations of Descending Channel Pattern

Jese har technical indicator aur chart pattern ke kuch limitations hotay hain, waise descending channel pattern ke bhi kuch challenges hain:

• False Signals:

Kabhi kabhi market noise ya consolidation ke duran false breakouts ho sakte hain. Is liye, additional confirmation indicators ka istemal zaroori hai.

• Delayed Reaction:

Kuch cases mein, descending channel pattern late form hota hai, jis se entry ka mauqa miss ho sakta hai.

• Dependence on Market Conditions:

Yeh pattern mostly bearish trend mein kaam karta hai, aur sideways ya uptrending market mein iski reliability kam ho jati hai.

• Subjectivity in Drawing Trendlines:

Different traders alag alag tareeqon se trendlines draw kerte hain, jis se pattern ki interpretation mein farq aa sakta hai. Is liye, consistency aur experience bohat aham hotay hain.

• Practical Example in Forex Trading

Maan lijiye aap EUR/USD ke chart par trading ker rahe hain aur aap ne descending channel pattern identify ker liya hai. Aap dekhte hain ke price pehle consistently descending highs aur lows create ker rahi hai. Aap chart par do parallel trendlines draw kerte hain – ek upper line jo recent swing highs ko join ker rahi hai, aur ek lower line jo swing lows ko connect ker rahi hai. Jab price channel ke upper boundary ko touch ker ke reversal ka signal deti hai aur phir wapas neeche jati hai, to aap short position ke liye entry consider kerte hain. Aap apna stop loss channel ke upar set ker dete hain, aur profit target ko channel ke height ke hisaab se define kerte hain. Is practical example se aap dekh sakte hain ke descending channel pattern ke signals ko follow ker ke, aap market ke bearish moves ka faida utha sakte hain.Descending Channel Pattern forex trading mein ek effective continuation pattern hai jo market ke bearish trend ko clearly reflect ker deta hai. Is pattern ke through, traders ko defined support aur resistance levels mil jate hain, jis se unhein sahi entry, exit, aur risk management ke decisions lene mein madad milti hai. Jab market descending channel ke andar price action show ker rahi hoti hai, to aapko market ke overall sentiment aur trend ko samajhne ka clear signal milta hai. Is pattern ko use kerte waqt additional confirmation ke liye volume analysis aur oscillators ka istemal kerna zaroori hai, taake false signals se bach sakein. Effective implementation se aap apne trades ko optimized risk-reward ratio ke sath execute ker sakte hain.

Consistent practice, experience aur disciplined approach se, descending channel pattern aapko market ke turning points aur trend continuation ko accurately identify kerne mein madad deta hai. Is tarah se aap apni forex trading journey ko zyada profitable aur sustainable bana sakte hain.

Forex trading mein chart patterns bohat aham hote hain kyun ke yeh market ke mood, trend aur potential reversal ya continuation ko identify kerne mein madad dete hain. In patterns mein se ek hai "Descending Channel Pattern". Yeh pattern aksar downtrend mein nazar aata hai aur price action ko ek defined range ke andar, parallel downward sloping trendlines ke darmiyan move kerte hue dikhata hai. Is pattern ka istemal karke traders market ke bearish sentiment ko samajh sakte hain aur sahi entry/exit points identify ker sakte hain.Descending Channel Pattern ek chart pattern hai jismein price action do parallel lines ke darmiyan continuously downward move ker rahi hoti hai. Upar wali line (upper channel) aur neeche wali line (lower channel) dono descending (neeche jate hue) hoti hain. Yeh pattern aksar bearish market conditions mein nazar aata hai. Is pattern mein, price ek defined range ke andar oscillate karti hai, jahan trendlines price ko support aur resistance ke tor par serve karti hain. Iska matlab hai ke agar aapko descending channel dikhai dey, to market mein sellers ka pressure dominate ker raha hota hai aur overall trend downward hi rehne ke imkanaat zyada hote hain.

• Formation of Descending Channel Pattern

Descending channel ka formation do primary components par mabni hota hai:

• Trendlines:

Is pattern ko form kerne ke liye, sab se pehle aapko chart par do parallel lines draw kerni hoti hain. Uper wali line ko draw kerne ke liye, aap un highs ko connect kerte hain jo consistently lower ho rahe hon. Neeche wali line ko draw kerne ke liye, aap un lows ko connect kerte hain. Dono lines agar parallel aur descending direction mein chal rahi hon, to yeh descending channel kehlata hai.

• Price Action:

Price ka move in dono trendlines ke darmiyan confined rehta hai. Market ke har swing high aur swing low descending order mein aate hain, jo overall bearish trend ko confirm kerte hain. Agar price repeatedly in boundaries ko touch ker rahi ho aur phir bounce ker rahi ho, to yeh descending channel ka clear sign hai.

• Characteristics of Descending Channel Pattern

Descending channel pattern ke kuch khas features hote hain jo isay identify kerna asaan banate hain:

• Parallel Trendlines:

Is pattern mein, uper wali aur neeche wali lines roughly parallel hoti hain. In parallel lines ka hona signal deta hai ke market ka trend consistent hai aur price predictable range ke andar hi move ker raha hai.

• Downward Slope:

Dono trendlines descending yani ke neeche ki taraf slope karti hain, jo overall bearish sentiment aur continuous selling pressure ko reflect karti hain.

• Consolidation Within a Range:

Price action in lines ke andar ek defined range mein rehta hai. Traders dekhte hain ke jab price upper boundary ko touch ker ke bounce ker rahi ho, to yeh resistance ka signal hai, aur jab price lower boundary ko touch ker ke rebound ker rahi ho, to yeh support ka indication hai.

• Volume Behavior:

Aksar descending channel ke dauran volume gradually decrease ker sakta hai, lekin jab breakout occur kerne ka chance ho to volume mein sudden spike aana zaroori hota hai, jo confirmation ka signal deta hai.

• Benefits of Using Descending Channel Pattern

Descending channel pattern ko samajhne aur use kerne ke kai faide hain jo traders ke liye bohot valuable sabit hotay hain:

• Trend Confirmation:

Yeh pattern market ke ongoing bearish trend ko clearly indicate ker deta hai. Agar aap descending channel ko identify ker lete hain, to aap ko pata chal jata hai ke market mein sellers dominant hain aur trend continuation ke chances zyada hain.

• Defined Entry and Exit Points:

Price ka movement defined range ke andar hone se aap clear entry aur exit points set ker sakte hain. Agar price upper boundary ko touch ker ke bounce ker rahi ho, to yeh aapko potential short entry ka mauqa deta hai. Agar price channel ko break ker jaye to yeh breakout signal hai jo exit ya reverse trade ke liye use hota hai.

• Risk Management:

Descending channel pattern ke sath stop loss aur target levels ko set kerna asaan hota hai. Aap apni stop loss ko channel ke upper boundary ke thoda upar aur profit target ko channel ke neeche ya breakout ke hisaab se adjust ker sakte hain. Is se aapka risk controlled rehta hai aur aapka reward-to-risk ratio improve hota hai.

• Simplicity aur Clarity:

Is pattern ka structure simple aur visually clear hota hai. Jo traders market ko quickly analyze kerna chahtay hain, unke liye descending channel ek straightforward signal provide ker deta hai.

• Versatility Across Timeframes:

Descending channel pattern har timeframe par nazar aa sakta hai – chahe aap intraday trading ker rahe hon ya swing trading. Is versatility se aap apne trading style ke mutabiq is pattern ka faida utha sakte hain.

• Uses of Descending Channel Pattern in Forex Trading

Descending channel pattern ko use kerne ke kai practical applications hain:

• Short Entry Opportunities:

Downtrend mein, jab price repeatedly channel ke upper boundary ko touch ker ke reverse ker rahi ho, to yeh short entry ka signal hota hai. Traders is se benefit utha ke short positions open kerte hain, kyun ke yeh pattern trend continuation ko confirm ker deta hai.

• Identifying Breakouts:

Kabhi kabhi, descending channel ke dauran market mein consolidation ke baad breakout occur ker sakta hai. Agar price channel ko break ker ke upper ya lower side par move ker jati hai, to yeh reversal ya continuation signal deta hai. Is se aap additional trading opportunities explore ker sakte hain.

• Risk Management Tool:

Jab aap descending channel pattern ko use kerte hain, to aap apne stop loss aur profit targets ko channel boundaries ke hisaab se set ker sakte hain. Yeh dynamic support aur resistance levels aapko risk management mein madad detay hain.

• Confirmation with Other Indicators:

Descending channel ko doosray technical indicators ke sath integrate ker ke aap apne trading signals ko strengthen ker sakte hain. Misal ke taur par, agar moving averages, RSI ya MACD bullish reversal signal dete hain jab price channel ke lower boundary ko touch ker rahi ho, to yeh entry ke liye confirmation hota hai.

• Steps to Trade Descending Channel Pattern

Trading descending channel pattern ko effectively implement kerne ke liye aapko kuch steps follow kerne honge:

• Pattern Identification:

Sab se pehle chart par descending channel pattern ko identify kerain. Iske liye, do parallel trendlines draw kerain – ek jo recent highs ko join kerte hue descending ho aur doosri jo recent lows ko join kerte hue descending ho.

• Entry Point Decision:

Agar aap short position mein trade kerna chahtay hain, to aap entry ka point tab consider kerain jab price channel ke upper boundary ko touch ker ke reverse ho jaye. Agar market breakout ya reversal ka signal deta hai, to entry execute kerain.

• Stop Loss Setting:

Stop loss ko aap channel ke opposite boundary ke thoda upar (short trades ke liye) ya thoda neeche (long trades ke liye) set kerain. Is se agar market unexpected move ker jaye to aapka loss limited reh jata hai.

• Profit Target Definition:

Profit target ko channel ke depth ya previous support/resistance levels ke hisaab se set kerain. Aap channel ki height ko measure ker ke, target ko us hisaab se define ker sakte hain.

• Confirmation Indicators:

Additional confirmation ke liye, volume analysis aur oscillators ka use kerain. Agar volume breakout ke dauran significantly badh jata hai, to yeh signal confirm ker deta hai ke trend reversal ya continuation sahi hai.

• Benefits of Using Descending Channel Pattern

Descending channel pattern ke kai faide hain jo traders ko decision making mein madad detey hain:

• Clear Visual Representation:

Is pattern ke through market ka bearish sentiment clearly nazar aata hai, jis se aap quickly trend ko samajh sakte hain.

• Defined Trading Range:

Channel ke andar price action ek specific range mein rehta hai, jis se aapko support aur resistance levels easily mil jate hain.

• Enhanced Risk Management:

Dynamic boundaries ke zariye, aap apne stop loss aur profit targets ko accurately set ker sakte hain, jo risk ko minimize kerne mein madad karta hai.

• Versatile Application:

Yeh pattern har timeframe par apply ho sakta hai, jis se intraday se le kar swing trading tak use kiya ja sakta hai.

• Profit Opportunities Through Reversals and Breakouts:

Agar market descending channel ke dauran reversal ya breakout ker deti hai, to aapko significant profit potential mil sakta hai. Yeh pattern market ke turning points ko accurately highlight ker deta hai.

• Limitations of Descending Channel Pattern

Jese har technical indicator aur chart pattern ke kuch limitations hotay hain, waise descending channel pattern ke bhi kuch challenges hain:

• False Signals:

Kabhi kabhi market noise ya consolidation ke duran false breakouts ho sakte hain. Is liye, additional confirmation indicators ka istemal zaroori hai.

• Delayed Reaction:

Kuch cases mein, descending channel pattern late form hota hai, jis se entry ka mauqa miss ho sakta hai.

• Dependence on Market Conditions:

Yeh pattern mostly bearish trend mein kaam karta hai, aur sideways ya uptrending market mein iski reliability kam ho jati hai.

• Subjectivity in Drawing Trendlines:

Different traders alag alag tareeqon se trendlines draw kerte hain, jis se pattern ki interpretation mein farq aa sakta hai. Is liye, consistency aur experience bohat aham hotay hain.

• Practical Example in Forex Trading

Maan lijiye aap EUR/USD ke chart par trading ker rahe hain aur aap ne descending channel pattern identify ker liya hai. Aap dekhte hain ke price pehle consistently descending highs aur lows create ker rahi hai. Aap chart par do parallel trendlines draw kerte hain – ek upper line jo recent swing highs ko join ker rahi hai, aur ek lower line jo swing lows ko connect ker rahi hai. Jab price channel ke upper boundary ko touch ker ke reversal ka signal deti hai aur phir wapas neeche jati hai, to aap short position ke liye entry consider kerte hain. Aap apna stop loss channel ke upar set ker dete hain, aur profit target ko channel ke height ke hisaab se define kerte hain. Is practical example se aap dekh sakte hain ke descending channel pattern ke signals ko follow ker ke, aap market ke bearish moves ka faida utha sakte hain.Descending Channel Pattern forex trading mein ek effective continuation pattern hai jo market ke bearish trend ko clearly reflect ker deta hai. Is pattern ke through, traders ko defined support aur resistance levels mil jate hain, jis se unhein sahi entry, exit, aur risk management ke decisions lene mein madad milti hai. Jab market descending channel ke andar price action show ker rahi hoti hai, to aapko market ke overall sentiment aur trend ko samajhne ka clear signal milta hai. Is pattern ko use kerte waqt additional confirmation ke liye volume analysis aur oscillators ka istemal kerna zaroori hai, taake false signals se bach sakein. Effective implementation se aap apne trades ko optimized risk-reward ratio ke sath execute ker sakte hain.

Consistent practice, experience aur disciplined approach se, descending channel pattern aapko market ke turning points aur trend continuation ko accurately identify kerne mein madad deta hai. Is tarah se aap apni forex trading journey ko zyada profitable aur sustainable bana sakte hain.

تبصرہ

Расширенный режим Обычный режим