Forex Mein Reversal Day Trading Strategies

Introduction

Forex trading mein "Reversal Day Trading" ek ahem strategy hai jismein trader asarate se baazi jeetne ki koshish karta hai jab bazar ulat jata hai ya direction change karta hai. Is strategy ka maqsad, bazar ke reversal points ko pehchanna aur unka faida uthana hota hai. Is guide mein hum Roman Urdu mein samjhaenge ke Forex mein Reversal Day Trading Strategies kya hoti hain aur kaise kaam karti hain.

Reversal Kya Hai?

Reversal wo waqt hota hai jab market ka trend ya to uptrend se downtrend mein badal jaye ya downtrend se uptrend mein. Yeh tab hota hai jab buyers ya sellers apni position ko change karte hain.

Major Reversal Indicators

Reversal Day Trading Strategies

Risk Management

Conclusion

Reversal day trading strategies ko samajhna aur effectively implement karna forex trading mein successful hone ke liye bohot zaroori hai. Support aur resistance levels, candlestick patterns, moving averages, aur RSI jaise indicators ka sahi istemal karte hue, aap bazar ke reversals ko pehchan sakte hain aur unse munafa kama sakte hain. Hamesha yaad rakhein ke risk management strategies ko follow karna bhi utna hi ahem hai jitna ke sahi trading signals ko pehchan na.

Forex trading mein sabar aur disciplined approach zaroori hai. Reversals ko pehchanne aur sahi waqt pe entry aur exit points ko decide karna hi aapko successful trader banata hai.

Introduction

Forex trading mein "Reversal Day Trading" ek ahem strategy hai jismein trader asarate se baazi jeetne ki koshish karta hai jab bazar ulat jata hai ya direction change karta hai. Is strategy ka maqsad, bazar ke reversal points ko pehchanna aur unka faida uthana hota hai. Is guide mein hum Roman Urdu mein samjhaenge ke Forex mein Reversal Day Trading Strategies kya hoti hain aur kaise kaam karti hain.

Reversal Kya Hai?

Reversal wo waqt hota hai jab market ka trend ya to uptrend se downtrend mein badal jaye ya downtrend se uptrend mein. Yeh tab hota hai jab buyers ya sellers apni position ko change karte hain.

Major Reversal Indicators

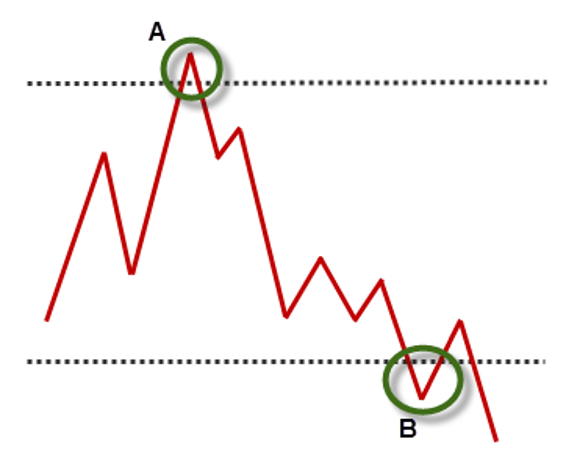

- Support aur Resistance Levels: Support level wo point hota hai jahan price niche se upar ki taraf badhne lagti hai. Resistance level wo point hota hai jahan price upar se niche girne lagti hai. Yeh levels trader ko batate hain ke kab market reversal hone wala hai.

- Candlestick Patterns: Candlestick charts ka istimaal karte hue, kuch khas patterns hote hain jo reversal ka ishara dete hain. Jaise ke Doji, Hammer, aur Engulfing patterns.

- Moving Averages: Moving averages, jaise ke 50-day aur 200-day moving averages, reversal ko pehchannay mein madadgar hote hain. Jab short-term moving average long-term moving average ko cross karta hai, yeh ek reversal ka sign hota hai.

- Relative Strength Index (RSI): RSI ek momentum oscillator hai jo market ki overbought ya oversold condition ko dikhata hai. Jab RSI 70 se upar hota hai, to market overbought hota hai aur reversal expected hota hai. Jab RSI 30 se niche hota hai, to market oversold hota hai aur reversal expected hota hai.

Reversal Day Trading Strategies

- Trend Reversal Strategy: Is strategy mein trader, existing trend ko observe karta hai aur jab trend ulatne lagta hai to apni position change karta hai. Agar market uptrend mein hai aur reversal ka sign dikh raha hai, to trader sell kar deta hai. Isi tarah agar market downtrend mein hai aur reversal ka sign dikh raha hai, to trader buy karta hai.

- Counter-Trend Trading: Yeh strategy uswaqt istimaal hoti hai jab trader short-term price movements ka faida uthata hai. Trader market ke against trade karta hai jab unhe lagta hai ke price ek extreme level pe hai aur ab ulatne wala hai.

- Breakout Reversal: Is strategy mein trader support ya resistance level ka intizaar karta hai. Jab price in levels ko cross karti hai aur wapas revert hoti hai, to trader apni position change karta hai. Yeh strategy un markets mein effective hai jo range-bound hain.

- Divergence Trading: Divergence trading mein trader price aur indicator (jaise ke RSI) ke darmiyan divergence ko dekhta hai. Agar price upar ja rahi hai lekin RSI niche ja raha hai, to yeh bearish divergence hoti hai aur market reversal ka sign hota hai. Isi tarah agar price niche ja rahi hai lekin RSI upar ja raha hai, to yeh bullish divergence hoti hai aur market reversal ka sign hota hai.

Risk Management

- Stop Loss: Stop loss order lagana bohot zaroori hai taake unexpected losses se bacha ja sake. Jab bhi aap reversal strategy use kar rahe ho, stop loss ka istemal zaroor karein.

- Position Sizing: Har trade mein position size ka dhyan rakhna chahiye. Apne account ka sirf chota hissa risk mein daalein.

- Risk-Reward Ratio: Har trade se pehle apna risk-reward ratio evaluate karein. Achi strategy mein risk-reward ratio at least 1:2 hona chahiye.

Conclusion

Reversal day trading strategies ko samajhna aur effectively implement karna forex trading mein successful hone ke liye bohot zaroori hai. Support aur resistance levels, candlestick patterns, moving averages, aur RSI jaise indicators ka sahi istemal karte hue, aap bazar ke reversals ko pehchan sakte hain aur unse munafa kama sakte hain. Hamesha yaad rakhein ke risk management strategies ko follow karna bhi utna hi ahem hai jitna ke sahi trading signals ko pehchan na.

Forex trading mein sabar aur disciplined approach zaroori hai. Reversals ko pehchanne aur sahi waqt pe entry aur exit points ko decide karna hi aapko successful trader banata hai.

تبصرہ

Расширенный режим Обычный режим