Golden Cross or Death Cross.

Introduction.

Stock market aur technical analysis mein Golden Cross aur Death Cross do ahem indicators hain. Yeh indicators moving averages ki base par price action ko samajhne mein madad karte hain. Golden Cross bullish trend ko indicate karta hai, jabke Death Cross bearish trend ko darshata hai.

Golden Cross.

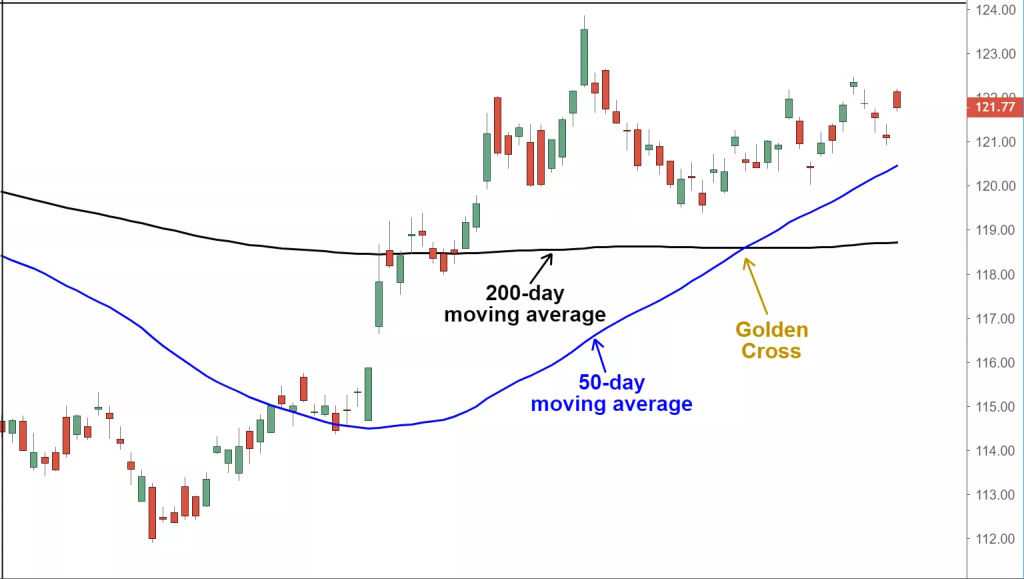

Golden Cross kya hai? Golden Cross wo wakht hota hai jab 50-day moving average (50-DMA) 200-day moving average (200-DMA) ko upar ki taraf cross kar jata hai. Iska matlab yeh hota hai ke market mein bullish trend shuru ho raha hai.

Indicators ka Matlab:

Golden Cross ke Stages:

Golden Cross ki Ahmiyat: Golden Cross ko bullish signal mana jata hai. Yeh investor aur trader ko batata hai ke market bullish sentiment mein hai aur aage chal kar prices barh sakti hain.

Death Cross.

Death Cross kya hai? Death Cross wo wakht hota hai jab 50-day moving average (50-DMA) 200-day moving average (200-DMA) ko neeche ki taraf cross kar jata hai. Iska matlab yeh hota hai ke market mein bearish trend shuru ho raha hai.

Indicators ka Matlab:

Death Cross ke Stages:

Death Cross ki Ahmiyat: Death Cross ko bearish signal mana jata hai. Yeh investor aur trader ko batata hai ke market bearish sentiment mein hai aur aage chal kar prices gir sakti hain.

Importance aur Practical Use.

Trading Strategy: Golden Cross aur Death Cross ko trading strategies mein istimaal kiya jata hai. Jab Golden Cross hota hai to yeh signal hota hai ke buy positions lein, aur jab Death Cross hota hai to yeh signal hota hai ke sell positions ya short positions lein.

Market Sentiment: Yeh indicators market sentiment ko samajhne mein madadgar hote hain. Golden Cross optimism aur positivity ko indicate karta hai, jabke Death Cross pessimism aur negativity ko darshata hai.

Backtesting: Traders aksar in indicators ko historical data ke sath backtest karte hain taake yeh dekha ja sake ke kis tarah yeh signals past mein work karte rahe hain aur unka kya asar raha hai.

Limitations aur Cautions.

Lagging Indicators: Golden Cross aur Death Cross lagging indicators hain, iska matlab yeh hai ke yeh past data par base karte hain aur current ya future events ko predict karna mushkil hota hai.

False Signals: Kabhi kabhi yeh indicators false signals bhi de sakte hain, jahan market temporary fluctuations ki wajah se crossover hota hai magar trend sustain nahi hota.

Combination with Other Tools: Best results ke liye, Golden Cross aur Death Cross ko dusre technical indicators jaise RSI, MACD, aur volume analysis ke sath combine karke dekhna chahiye.

Introduction.

Stock market aur technical analysis mein Golden Cross aur Death Cross do ahem indicators hain. Yeh indicators moving averages ki base par price action ko samajhne mein madad karte hain. Golden Cross bullish trend ko indicate karta hai, jabke Death Cross bearish trend ko darshata hai.

Golden Cross.

Golden Cross kya hai? Golden Cross wo wakht hota hai jab 50-day moving average (50-DMA) 200-day moving average (200-DMA) ko upar ki taraf cross kar jata hai. Iska matlab yeh hota hai ke market mein bullish trend shuru ho raha hai.

Indicators ka Matlab:

- 50-Day Moving Average (50-DMA): Yeh past 50 dinon ka average price hota hai.

- 200-Day Moving Average (200-DMA): Yeh past 200 dinon ka average price hota hai.

Golden Cross ke Stages:

- Initial Uptrend: Pehle, 50-DMA neeche hoti hai magar woh ooper ki taraf move karna shuru karti hai.

- Crossover: Jab 50-DMA 200-DMA ko cross kar jati hai, yeh Golden Cross kehlata hai.

- Uptrend Continuation: Golden Cross ke baad, market mein aksar bullish trend continue rehta hai.

Golden Cross ki Ahmiyat: Golden Cross ko bullish signal mana jata hai. Yeh investor aur trader ko batata hai ke market bullish sentiment mein hai aur aage chal kar prices barh sakti hain.

Death Cross.

Death Cross kya hai? Death Cross wo wakht hota hai jab 50-day moving average (50-DMA) 200-day moving average (200-DMA) ko neeche ki taraf cross kar jata hai. Iska matlab yeh hota hai ke market mein bearish trend shuru ho raha hai.

Indicators ka Matlab:

- 50-Day Moving Average (50-DMA): Yeh past 50 dinon ka average price hota hai.

- 200-Day Moving Average (200-DMA): Yeh past 200 dinon ka average price hota hai.

Death Cross ke Stages:

- Initial Downtrend: Pehle, 50-DMA ooper hoti hai magar woh neeche ki taraf move karna shuru karti hai.

- Crossover: Jab 50-DMA 200-DMA ko cross kar jati hai, yeh Death Cross kehlata hai.

- Downtrend Continuation: Death Cross ke baad, market mein aksar bearish trend continue rehta hai.

Death Cross ki Ahmiyat: Death Cross ko bearish signal mana jata hai. Yeh investor aur trader ko batata hai ke market bearish sentiment mein hai aur aage chal kar prices gir sakti hain.

Importance aur Practical Use.

Trading Strategy: Golden Cross aur Death Cross ko trading strategies mein istimaal kiya jata hai. Jab Golden Cross hota hai to yeh signal hota hai ke buy positions lein, aur jab Death Cross hota hai to yeh signal hota hai ke sell positions ya short positions lein.

Market Sentiment: Yeh indicators market sentiment ko samajhne mein madadgar hote hain. Golden Cross optimism aur positivity ko indicate karta hai, jabke Death Cross pessimism aur negativity ko darshata hai.

Backtesting: Traders aksar in indicators ko historical data ke sath backtest karte hain taake yeh dekha ja sake ke kis tarah yeh signals past mein work karte rahe hain aur unka kya asar raha hai.

Limitations aur Cautions.

Lagging Indicators: Golden Cross aur Death Cross lagging indicators hain, iska matlab yeh hai ke yeh past data par base karte hain aur current ya future events ko predict karna mushkil hota hai.

False Signals: Kabhi kabhi yeh indicators false signals bhi de sakte hain, jahan market temporary fluctuations ki wajah se crossover hota hai magar trend sustain nahi hota.

Combination with Other Tools: Best results ke liye, Golden Cross aur Death Cross ko dusre technical indicators jaise RSI, MACD, aur volume analysis ke sath combine karke dekhna chahiye.

تبصرہ

Расширенный режим Обычный режим