Introduction.

Assalamualaikum aj is post me apko me Pakistan Forex Trading ke ak bhot he important topic ke bare me btao ga or me ummed karta ho ke jo information me apse share karo ga wo apke knowledge or experience me zaror izafa kare ge or agar ap mere is post pe amal karte he to ak kamyab trader ban sakte he .

Martingale Trading Strategy.

Forex trading main Martingale Trading Strategy aik trading approach hy jo primarily probability aur risk management par mabni hy. Ye strategy asal main gambling se ai hy, lekin isay financial markets main bhi apply kiya jata hy, khas tor par Forex trading main. Martingale Strategy ki mufassal wazahat ye hy:

Martingale Strategy ka Basic Concept:

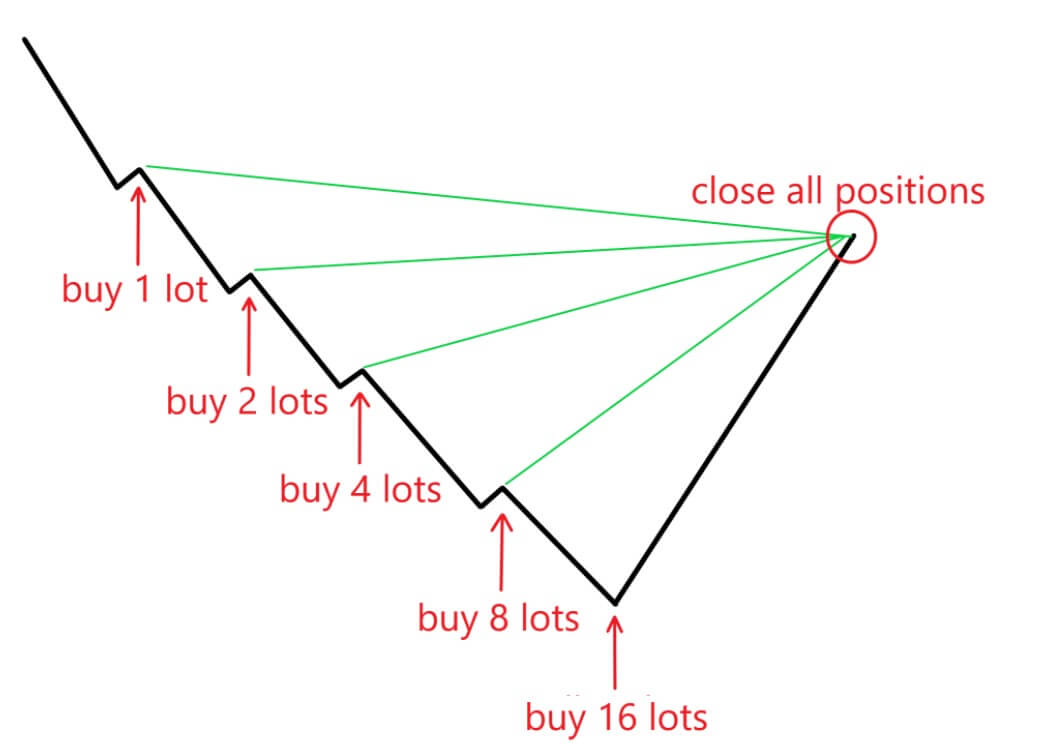

Martingale Strategy ka basic concept ye hy ke agar aap aik trade mein loss hota hy, tou aap apne next trade ki position size ko double kar lete hain. Is tarah, jab bhi aapki winning trade hogi, tou aap pehle wali sabhi losses ko cover kar leinge aur kuch profit bhi earn kar leinge. Isay aik example se samajhna asaan hy:

1. Aap $10 se aik trade start karte hain.

2. Agar ye trade loss hoti hy, tou aap next trade $20 ki position ke sath karte hain.

3. Agar ye trade bhi loss hoti hy, tou next trade $40 ki position ke sath karte hain.

4. Jab aapki koi trade win hoti hy, tou aap apne sabhi pehle losses ko cover kar leinge aur profit bhi earn kar leinge.

Martingale Strategy ka Practical Implementation:

1. Initial Trade Size.

Pehle aap aik choti amount se trade start karte hain.

2. Doubling Down.

Har loss ke baad, aap apne trade size ko double karte hain.

3. Winning Trade.

Jab aapki koi trade win hoti hy, tou aap apne losses cover kar leinge aur kuch profit bhi earn kar leinge.

4. Reverting to Initial Size.

Winning trade ke baad, aap apne initial trade size par wapas aa jate hain aur cycle dobara start karte hain.

Martingale Strategy ke Risks aur Drawbacks:

1. High Risk of Large Losses.

Agar aapko consecutive losses hoti hain, tou aapki position size exponentially barh jati hy, jo k bohat zyadah capital ka requirement karti hy.

2. Account Blowout.

Agar aapke paas capital ka limit hy aur aapko lagataar losses hoti rehti hain, tou aapka account quickly blowout ho sakta hy.

3. Psychological Pressure.

Exponentially barhti huwi position sizes ke sath trading karna psychological pressure ko barha sakta hy, jo trading decisions ko negatively affect kar sakta hy.

Martingale Strategy ke Pros aur Cons:

Pros.

Loss Recovery.

Agar sufficient capital available ho, tou Martingale Strategy theoretically sabhi losses ko recover kar sakti hy aur profit bhi earn kar sakti hy

Simple Rules.

Ye strategy simple aur straightforward hy, jisay asani se follow kiya ja sakta hy.

High Capital Requirement.

Ye strategy bohat zyadah capital ka requirement karti hy.

Risk of Large Drawdowns.

Exponential growth of position sizes consecutive losses ke case mein bohat bara risk create karti hy.

Assalamualaikum aj is post me apko me Pakistan Forex Trading ke ak bhot he important topic ke bare me btao ga or me ummed karta ho ke jo information me apse share karo ga wo apke knowledge or experience me zaror izafa kare ge or agar ap mere is post pe amal karte he to ak kamyab trader ban sakte he .

Martingale Trading Strategy.

Forex trading main Martingale Trading Strategy aik trading approach hy jo primarily probability aur risk management par mabni hy. Ye strategy asal main gambling se ai hy, lekin isay financial markets main bhi apply kiya jata hy, khas tor par Forex trading main. Martingale Strategy ki mufassal wazahat ye hy:

Martingale Strategy ka Basic Concept:

Martingale Strategy ka basic concept ye hy ke agar aap aik trade mein loss hota hy, tou aap apne next trade ki position size ko double kar lete hain. Is tarah, jab bhi aapki winning trade hogi, tou aap pehle wali sabhi losses ko cover kar leinge aur kuch profit bhi earn kar leinge. Isay aik example se samajhna asaan hy:

1. Aap $10 se aik trade start karte hain.

2. Agar ye trade loss hoti hy, tou aap next trade $20 ki position ke sath karte hain.

3. Agar ye trade bhi loss hoti hy, tou next trade $40 ki position ke sath karte hain.

4. Jab aapki koi trade win hoti hy, tou aap apne sabhi pehle losses ko cover kar leinge aur profit bhi earn kar leinge.

Martingale Strategy ka Practical Implementation:

1. Initial Trade Size.

Pehle aap aik choti amount se trade start karte hain.

2. Doubling Down.

Har loss ke baad, aap apne trade size ko double karte hain.

3. Winning Trade.

Jab aapki koi trade win hoti hy, tou aap apne losses cover kar leinge aur kuch profit bhi earn kar leinge.

4. Reverting to Initial Size.

Winning trade ke baad, aap apne initial trade size par wapas aa jate hain aur cycle dobara start karte hain.

Martingale Strategy ke Risks aur Drawbacks:

1. High Risk of Large Losses.

Agar aapko consecutive losses hoti hain, tou aapki position size exponentially barh jati hy, jo k bohat zyadah capital ka requirement karti hy.

2. Account Blowout.

Agar aapke paas capital ka limit hy aur aapko lagataar losses hoti rehti hain, tou aapka account quickly blowout ho sakta hy.

3. Psychological Pressure.

Exponentially barhti huwi position sizes ke sath trading karna psychological pressure ko barha sakta hy, jo trading decisions ko negatively affect kar sakta hy.

Martingale Strategy ke Pros aur Cons:

Pros.

Loss Recovery.

Agar sufficient capital available ho, tou Martingale Strategy theoretically sabhi losses ko recover kar sakti hy aur profit bhi earn kar sakti hy

Simple Rules.

Ye strategy simple aur straightforward hy, jisay asani se follow kiya ja sakta hy.

High Capital Requirement.

Ye strategy bohat zyadah capital ka requirement karti hy.

Risk of Large Drawdowns.

Exponential growth of position sizes consecutive losses ke case mein bohat bara risk create karti hy.

Summery.

In summary, Martingale Strategy ek high-risk trading approach hy jo sabhi losses ko cover karne ka aim rakhti hy, lekin ismein bohat zyadah capital aur risk tolerance ki zaroorat hoti hy. Ye strategy un traders ke liye zyada suitable nahi hy jo limited capital ya risk tolerance rakhte hain.

تبصرہ

Расширенный режим Обычный режим