what is Bullish Hammer Pattern

forex market mein bullish hammer pattern aik kesam ka pattern hota hey jo keh forex market mein trend ko indicate karnay kay ley he estamal keya ja sakta hey e pattern ko zyada tar trader forex market mein estamal kartay hein yeh candlestick pattern market kay baray mein important baserat frahm kar sakta hey khas tor par bullish hammer forex chart par reversal trend ke baserat frahm kar sakta hey

Forex market mein bullish hammer pattern aik kesam ka singl candlestick pattern hota hey jo keh forex market kay price kay chart par he paya jata hey jo keh bullish hammer pattern kay reversal janay ko he identify kar sakta hey yeh forex market kay candlestick pattern say he mokhtalef ho sakta hey kunkeh es ka single candlestick pattern turning point par kame kay trend ko he identify kar sakta hy

nechay de gai candlestick pattern inverted hammer candlestick pattern mein kame kay trend ko he identify kar sakte hey yeh forex arket kay high ya cloe level ko he indicate kar kay le ja sakte hey prices forex market mein wazah tor par price ko kam karna chahtay hein jes kaybad forex market ke price aik chote ce body rakhte hein or es kay bad ke price identify keja sakte hey

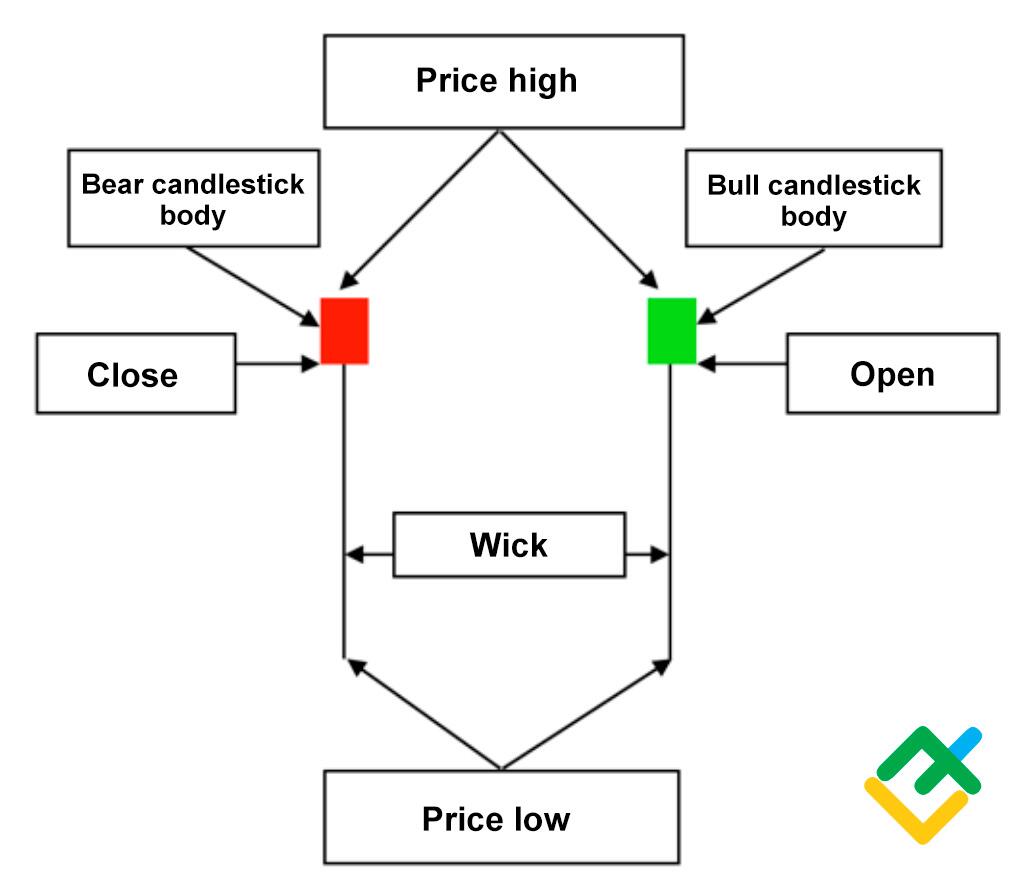

forex market mein yeh bat bhe hamaisha yad rakhne chihay keh bullish hammer pattern forex marke mein aik important kesam ka pattern hota hey forex market mein yeh bat open close high ya low level ko lay kar de ja sakte hey forex market mein new lows bananay kay ley market mein wazah kame kar de jate hey jes ke wajah say price aik chote body rakhte hein prices close ho jate hein

Trade with Bullish Hammer

nechay AUD/USD ka chart deya geya hey bullish hammer candlestick chart pattern say mel kar bane hote hein AUD/USD kay daily kay chart pattern ke mesal e gay hein jes mein bullish hamer candlestick pattern ke mesal de gay hey AUD/USD 892 pips tak ger geya hey or forex market mein es kame kay trend ka end bullish hammer candlestick pattern say he keya ja sakta hey es kay bad price action nay ajj kay price action kay sath mel kar es kame kay trend ka end keya hey 792 pips tak he ho jata hey

chonkeh forex market mein hammer candlestick pattern ke strength graph mein os k jagah par he depend karte hey aam tor par candlestick pattern os ke jagah par he depend kar sakta hey or es ka dosray indicator kay sath mela kar estamal kartay hein es mein forex market kay tools ka estamal karna bhe shamel hota hey Fibonacci retrcement or pivot point indicator ka he estamal keya ja sakta hy Hammer ke wick support lvel mein ghos jay ge trader es ke support kay nechay he stop loss ko set karen gay

forex market mein bullish hammer pattern aik kesam ka pattern hota hey jo keh forex market mein trend ko indicate karnay kay ley he estamal keya ja sakta hey e pattern ko zyada tar trader forex market mein estamal kartay hein yeh candlestick pattern market kay baray mein important baserat frahm kar sakta hey khas tor par bullish hammer forex chart par reversal trend ke baserat frahm kar sakta hey

Forex market mein bullish hammer pattern aik kesam ka singl candlestick pattern hota hey jo keh forex market kay price kay chart par he paya jata hey jo keh bullish hammer pattern kay reversal janay ko he identify kar sakta hey yeh forex market kay candlestick pattern say he mokhtalef ho sakta hey kunkeh es ka single candlestick pattern turning point par kame kay trend ko he identify kar sakta hy

nechay de gai candlestick pattern inverted hammer candlestick pattern mein kame kay trend ko he identify kar sakte hey yeh forex arket kay high ya cloe level ko he indicate kar kay le ja sakte hey prices forex market mein wazah tor par price ko kam karna chahtay hein jes kaybad forex market ke price aik chote ce body rakhte hein or es kay bad ke price identify keja sakte hey

forex market mein yeh bat bhe hamaisha yad rakhne chihay keh bullish hammer pattern forex marke mein aik important kesam ka pattern hota hey forex market mein yeh bat open close high ya low level ko lay kar de ja sakte hey forex market mein new lows bananay kay ley market mein wazah kame kar de jate hey jes ke wajah say price aik chote body rakhte hein prices close ho jate hein

Trade with Bullish Hammer

nechay AUD/USD ka chart deya geya hey bullish hammer candlestick chart pattern say mel kar bane hote hein AUD/USD kay daily kay chart pattern ke mesal e gay hein jes mein bullish hamer candlestick pattern ke mesal de gay hey AUD/USD 892 pips tak ger geya hey or forex market mein es kame kay trend ka end bullish hammer candlestick pattern say he keya ja sakta hey es kay bad price action nay ajj kay price action kay sath mel kar es kame kay trend ka end keya hey 792 pips tak he ho jata hey

chonkeh forex market mein hammer candlestick pattern ke strength graph mein os k jagah par he depend karte hey aam tor par candlestick pattern os ke jagah par he depend kar sakta hey or es ka dosray indicator kay sath mela kar estamal kartay hein es mein forex market kay tools ka estamal karna bhe shamel hota hey Fibonacci retrcement or pivot point indicator ka he estamal keya ja sakta hy Hammer ke wick support lvel mein ghos jay ge trader es ke support kay nechay he stop loss ko set karen gay

تبصرہ

Расширенный режим Обычный режим