Market Chop Kya Hai Aur Kya Is Mein Trade Karna Chahiye?

Market Chop Ki Tashreeh

Market chop, jise hum sideways market bhi kehte hain, wo market ki ek halat hoti hai jahan price kisi khaas direction mein nahi chalti. Yeh halat aksar short-term periods mein hoti hai jahan prices ek range mein upar neechay hoti rehti hain, magar kisi clear uptrend ya downtrend mein nahi jati.

Market Chop Ke Asbab

Market chop aksar un situations mein hota hai jab market participants (traders aur investors) uncertain hote hain future direction ke bare mein. Yeh kuch khas news, economic reports ya major events ka intezar karte hain jo market ko ek clear direction de sakay.

Market Chop Ki Pehchaan

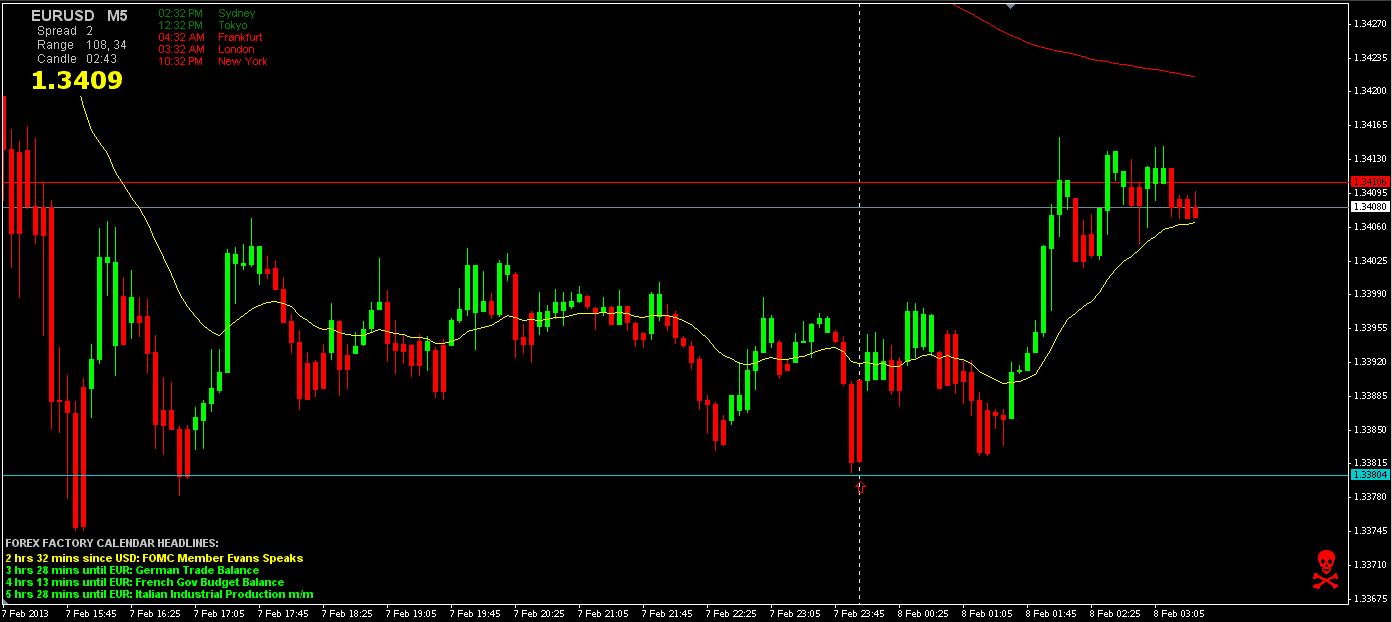

Market chop ko pehchaan ne ke liye kuch khas tools aur techniques hoti hain. Aam taur par technical indicators jaise moving averages, Relative Strength Index (RSI), aur Bollinger Bands istamal kiye jate hain. Agar market chop mein ho, toh yeh indicators sideway movement dikhate hain:

Market Chop Mein Trading Ki Strategies

Market chop mein trading karna challenging ho sakta hai kyun ke price movements predictable nahi hote. Magar kuch traders chop markets mein bhi opportunities dekhte hain. Aam taur par istamal hone wali strategies mein yeh shaamil hain:

Market Chop Mein Trading Ke Risks

Market chop mein trading risky ho sakti hai aur traders ko kuch khas challenges ka samna hota hai:

Market Chop Mein Trading Ke Benefits

Market chop mein trading ke kuch potential benefits bhi hain:

Kya Market Chop Mein Trade Karna Chahiye?

Market chop mein trade karna har trader ke liye suitable nahi hota. Yeh kuch traders ke skillset, experience aur risk tolerance par depend karta hai. Naye traders ke liye chop markets mein trading challenging ho sakti hai, jabke experienced traders ismein opportunities dekh sakte hain.

Naye Traders Ke Liye Tips:

Experienced Traders Ke Liye Tips:

Conclusion

Market chop ek aisi halat hai jahan price kisi clear direction mein nahi chalti aur yeh traders ke liye challenges aur opportunities dono le kar aata hai. Trading karne se pehle proper analysis aur risk management strategies zaroori hain. Naye traders ko education aur practice par focus karna chahiye jabke experienced traders ko disciplined aur adaptable rehna chahiye. Har trader ke liye market chop mein trade karna suitable nahi hota, magar jo ismein successfully navigate kar lete hain, woh consistent profits hasil kar sakte hain.

Market Chop Ki Tashreeh

Market chop, jise hum sideways market bhi kehte hain, wo market ki ek halat hoti hai jahan price kisi khaas direction mein nahi chalti. Yeh halat aksar short-term periods mein hoti hai jahan prices ek range mein upar neechay hoti rehti hain, magar kisi clear uptrend ya downtrend mein nahi jati.

Market Chop Ke Asbab

Market chop aksar un situations mein hota hai jab market participants (traders aur investors) uncertain hote hain future direction ke bare mein. Yeh kuch khas news, economic reports ya major events ka intezar karte hain jo market ko ek clear direction de sakay.

Market Chop Ki Pehchaan

Market chop ko pehchaan ne ke liye kuch khas tools aur techniques hoti hain. Aam taur par technical indicators jaise moving averages, Relative Strength Index (RSI), aur Bollinger Bands istamal kiye jate hain. Agar market chop mein ho, toh yeh indicators sideway movement dikhate hain:

- Moving Averages: Jab short-term moving average aur long-term moving average ek doosre ke qareeb ho aur parallel chal rahe ho, toh yeh chop ka indication ho sakta hai.

- RSI: RSI agar 40-60 ke range mein ho, toh yeh indicate karta hai ke market chop mein hai.

- Bollinger Bands: Jab Bollinger Bands squeeze (narrow) hoti hain, toh yeh bhi chop ka nishan ho sakta hai.

Market Chop Mein Trading Ki Strategies

Market chop mein trading karna challenging ho sakta hai kyun ke price movements predictable nahi hote. Magar kuch traders chop markets mein bhi opportunities dekhte hain. Aam taur par istamal hone wali strategies mein yeh shaamil hain:

- Range Trading: Is strategy mein traders price ke support aur resistance levels identify karte hain aur unhe trade karte hain. Jab price support level ke qareeb ho, toh buy karte hain aur jab resistance level ke qareeb ho, toh sell karte hain.

- Scalping: Yeh strategy short-term price movements ko utilize karti hai. Scalpers choti-choti price movements se profit kamane ki koshish karte hain. Yeh fast execution aur accurate entry/exit points require karti hai.

- Mean Reversion: Is strategy ke mutabiq, agar price apni average ya mean se door ho, toh yeh wapas mean ki taraf return karegi. Traders overbought aur oversold conditions ko identify karke trade karte hain.

Market Chop Mein Trading Ke Risks

Market chop mein trading risky ho sakti hai aur traders ko kuch khas challenges ka samna hota hai:

- False Breakouts: Chop markets mein false breakouts aam hain, jahan price temporarily support ya resistance levels ko breach karti hai magar phir wapas aa jati hai. Yeh traders ke liye losses ka sabab ban sakte hain.

- High Transaction Costs: Frequent trading strategies jaise scalping mein high transaction costs ho sakti hain jo profits ko reduce karti hain.

- Psychological Stress: Chop markets mein price ka clear direction na hone ki wajah se psychological stress badh sakta hai. Yeh traders ko impulsive decisions lene par majboor kar sakta hai.

Market Chop Mein Trading Ke Benefits

Market chop mein trading ke kuch potential benefits bhi hain:

- Opportunities in Volatility: Chop markets mein volatility ke doran multiple trading opportunities hoti hain jo skilled traders utilize kar sakte hain.

- Consistent Small Gains: Range trading aur scalping strategies agar properly execute ki jayein toh consistent small gains provide kar sakti hain.

- Risk Management: Chop markets mein, agar proper risk management techniques istamal ki jayein, toh yeh traders ko large market moves ke impact se bacha sakti hain.

Kya Market Chop Mein Trade Karna Chahiye?

Market chop mein trade karna har trader ke liye suitable nahi hota. Yeh kuch traders ke skillset, experience aur risk tolerance par depend karta hai. Naye traders ke liye chop markets mein trading challenging ho sakti hai, jabke experienced traders ismein opportunities dekh sakte hain.

Naye Traders Ke Liye Tips:

- Education Aur Training: Chop markets mein trading karne se pehle, naye traders ko proper education aur training leni chahiye.

- Paper Trading: Real money risk karne se pehle, paper trading ya demo accounts ka istamal karen taake strategies ko practice kar sakein.

- Risk Management: Stop-loss orders aur proper position sizing ke through risk manage karen.

Experienced Traders Ke Liye Tips:

- Discipline Maintain Karna: Chop markets mein disciplined approach zaroori hai. Emotional trading se bachein.

- Market Conditions Ko Analyze Karna: Market chop identify karne ke baad, proper analysis ke through suitable strategy apply karen.

- Adaptability: Market conditions change hone par, adapt karna zaroori hai. Ek strategy har waqt kaam nahi karti.

Conclusion

Market chop ek aisi halat hai jahan price kisi clear direction mein nahi chalti aur yeh traders ke liye challenges aur opportunities dono le kar aata hai. Trading karne se pehle proper analysis aur risk management strategies zaroori hain. Naye traders ko education aur practice par focus karna chahiye jabke experienced traders ko disciplined aur adaptable rehna chahiye. Har trader ke liye market chop mein trade karna suitable nahi hota, magar jo ismein successfully navigate kar lete hain, woh consistent profits hasil kar sakte hain.

تبصرہ

Расширенный режим Обычный режим