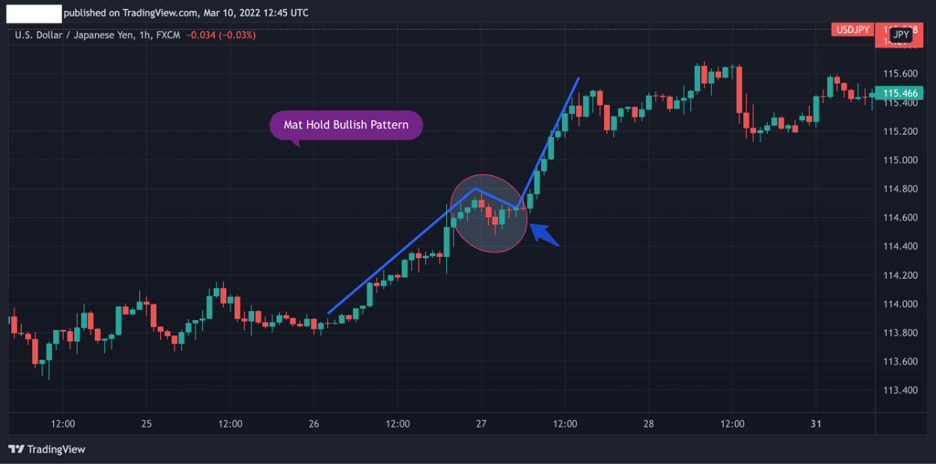

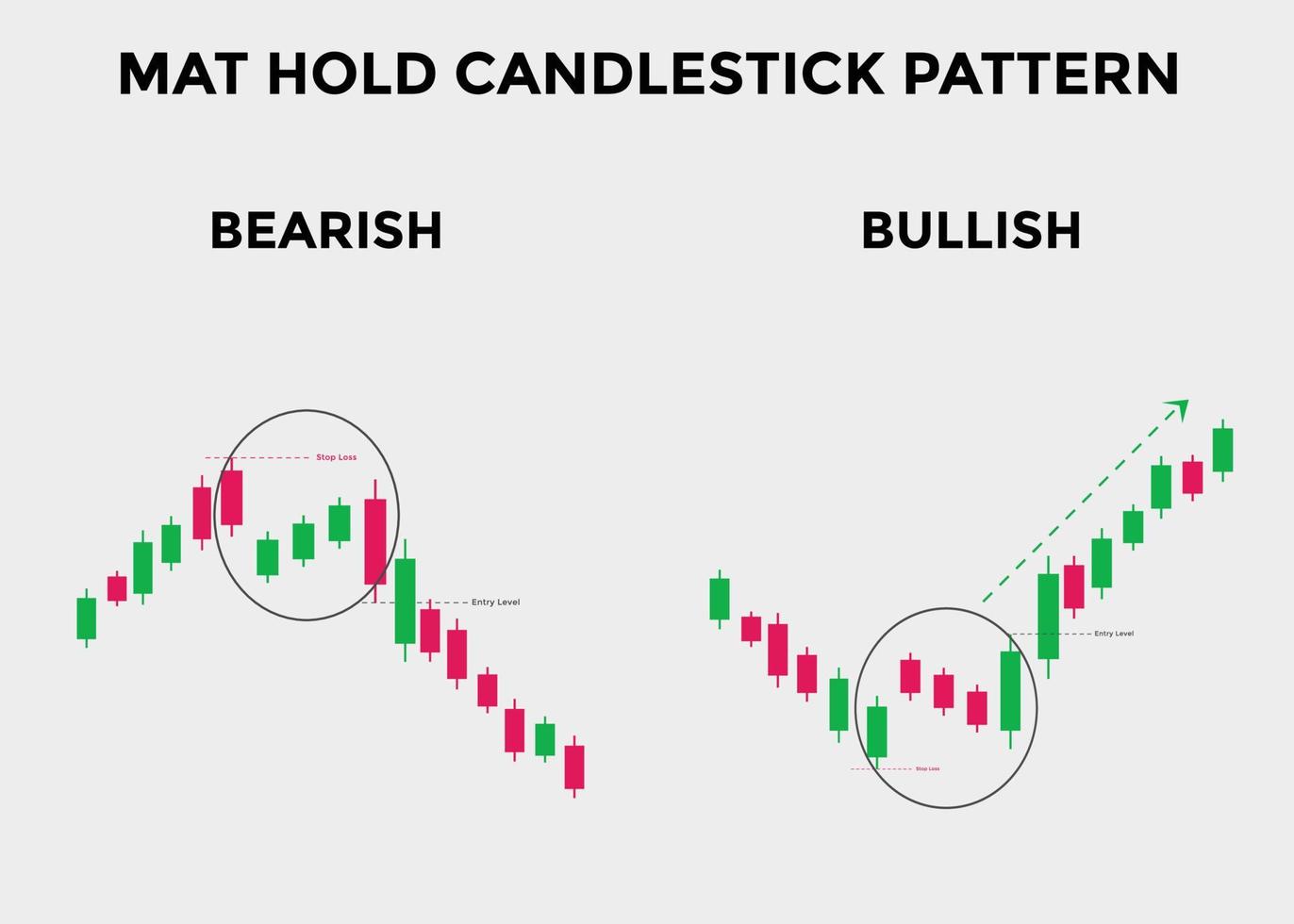

Mat Hold Candlestick Pattern:

Dear my friends Mat Hold Candlestick Pattern aik continuation pattern hai,jise technical analysis mein istemal kiya jata hai.Yeh pattern market mein existing trend ki continuation ko darust karta hai. Iska naam"Mat Hold"is wajah se hai kyunki iski appearance, ek choti mat ki tarah hoti hai jise trend ke beech mein dekha ja sakta hai.Mat Hold pattern ka pehla part market mein aik strong uptrend ke doran hota hai.Yani ke market mein tezzi hoti hai aur prices badti hain. Phir,aik choti si down candle aati hai jo ke trend reversal ko indicate karta hai, lekin yeh candle itna strong nahi hota ke trend ko puri tarah se change karde. Iske baad, Mat Hold pattern ka crucial part ata hai, jise"Mat"kehte hain.Yeh aik choti si green candle hoti hai jo ke previous down candle ke neeche rehti hai.Is green candle ka close,previous down candle ke close se uncha hota hai,lekin overall range kam hoti hai.Mat Hold pattern ka interpretation yeh hota hai ke market mein thora sa profit booking hui hai,lekin bulls control mein hain aur abhi bhi uptrend jaari hai.Is pattern ko confirm karne ke liye traders market ko closely monitor karte hain aur dekhte hain ke agle kuch candles mein kya hota hai.Agar Mat Hold pattern ke baad market phir se upar badhti hai aur uptrend continue hota hai, toh yeh pattern confirm ho jata hai.Traders is signal par bharosa karte hain aur apne positions ko hold karte hain ya phir naye long positions lete hain.Yeh pattern market sentiment ko reflect karta hai aur traders ko aik hint deta hai ke uptrend mein thora sa consolidation ho sakta hai,lekin overall trend abhi bhi bullish hai.Is pattern ki sahi tarah se samajhna aur interpret karna traders ke liye mahatvapurna hai kyunki galat analysis se nuksan ho sakta hai.In conclusion,Mat Hold Candlestick Pattern aik powerful continuation pattern hai jo traders ko existing uptrend ke continuation ke possibilities ke baare mein suchit karta hai.Is pattern ko samajhna aur sahi tarah se interpret karna,technical analysis mein mahir hone ke liye zaroori hai.

Uses of Mat Hold Candlestick Pattern:

Dear forex traders Mat Hold Candlestick Pattern aik continuation pattern hai,jisse technical analysis mein istemal kiya jata hai.Yeh pattern market mein existing trend ki continuation ko darust karta hai.Iska naam"Mat Hold" is wajah se hai kyunki iski appearance,aik choti mat ki tarah hoti hai jise trend ke beech mein dekha ja sakta hai.Mat Hold pattern ka pehla part market mein aik strong uptrend ke doran hota hai,Yani ke market mein tezzi hoti hai aur prices badti hain. Phir, ek choti si down candle aati hai jo ke trend reversal ko indicate karta hai, lekin yeh candle itna strong nahi hota ke trend ko puri tarah se change karde. Iske baad, Mat Hold pattern ka crucial part ata hai, jise"Mat Hold" kehte hain.Yeh aik choti si green candle hoti hai jo ke previous down candle ke neeche rehti hai.Is green candle ka close, previous down candle ke close se uncha hota hai,lekin overall range kam hoti hai.Mat Hold pattern ka interpretation yeh hota hai ke market mein thora sa profit booking hua hai, lekin bulls control mein hain aur abhi bhi uptrend jaari hai. Is pattern ko confirm karne ke liye traders market ko closely monitor karte hain aur dekhte hain ke agle kuch candles mein kya hota hai.Agar Mat Hold pattern ke baad market phir se upar badhti hai aur uptrend continue hota hai, toh yeh pattern confirm ho jata hai. Traders is signal par bharosa karte hain aur apne positions ko hold karte hain ya phir naye long positions lete hain.Yeh pattern market sentiment ko reflect karta hai aur traders ko ek hint deta hai ke uptrend mein thoda sa consolidation ho sakta hai, lekin overall trend abhi bhi bullish hai. Is pattern ki sahi tarah se samajhna aur interpret karna traders ke liye mahatvapurna hai kyunki galat analysis se nuksan ho sakta hai. In conclusion, Mat Hold Candlestick Pattern aik powerful continuation pattern hai jo traders ko existing uptrend ke continuation ke possibilities ke baare mein suchit karta hai.Is pattern ko samajhna aur sahi tarah se interpret karna, technical analysis mein mahir hone ke liye zaruri hai.

Dear my friends Mat Hold Candlestick Pattern aik continuation pattern hai,jise technical analysis mein istemal kiya jata hai.Yeh pattern market mein existing trend ki continuation ko darust karta hai. Iska naam"Mat Hold"is wajah se hai kyunki iski appearance, ek choti mat ki tarah hoti hai jise trend ke beech mein dekha ja sakta hai.Mat Hold pattern ka pehla part market mein aik strong uptrend ke doran hota hai.Yani ke market mein tezzi hoti hai aur prices badti hain. Phir,aik choti si down candle aati hai jo ke trend reversal ko indicate karta hai, lekin yeh candle itna strong nahi hota ke trend ko puri tarah se change karde. Iske baad, Mat Hold pattern ka crucial part ata hai, jise"Mat"kehte hain.Yeh aik choti si green candle hoti hai jo ke previous down candle ke neeche rehti hai.Is green candle ka close,previous down candle ke close se uncha hota hai,lekin overall range kam hoti hai.Mat Hold pattern ka interpretation yeh hota hai ke market mein thora sa profit booking hui hai,lekin bulls control mein hain aur abhi bhi uptrend jaari hai.Is pattern ko confirm karne ke liye traders market ko closely monitor karte hain aur dekhte hain ke agle kuch candles mein kya hota hai.Agar Mat Hold pattern ke baad market phir se upar badhti hai aur uptrend continue hota hai, toh yeh pattern confirm ho jata hai.Traders is signal par bharosa karte hain aur apne positions ko hold karte hain ya phir naye long positions lete hain.Yeh pattern market sentiment ko reflect karta hai aur traders ko aik hint deta hai ke uptrend mein thora sa consolidation ho sakta hai,lekin overall trend abhi bhi bullish hai.Is pattern ki sahi tarah se samajhna aur interpret karna traders ke liye mahatvapurna hai kyunki galat analysis se nuksan ho sakta hai.In conclusion,Mat Hold Candlestick Pattern aik powerful continuation pattern hai jo traders ko existing uptrend ke continuation ke possibilities ke baare mein suchit karta hai.Is pattern ko samajhna aur sahi tarah se interpret karna,technical analysis mein mahir hone ke liye zaroori hai.

Uses of Mat Hold Candlestick Pattern:

Dear forex traders Mat Hold Candlestick Pattern aik continuation pattern hai,jisse technical analysis mein istemal kiya jata hai.Yeh pattern market mein existing trend ki continuation ko darust karta hai.Iska naam"Mat Hold" is wajah se hai kyunki iski appearance,aik choti mat ki tarah hoti hai jise trend ke beech mein dekha ja sakta hai.Mat Hold pattern ka pehla part market mein aik strong uptrend ke doran hota hai,Yani ke market mein tezzi hoti hai aur prices badti hain. Phir, ek choti si down candle aati hai jo ke trend reversal ko indicate karta hai, lekin yeh candle itna strong nahi hota ke trend ko puri tarah se change karde. Iske baad, Mat Hold pattern ka crucial part ata hai, jise"Mat Hold" kehte hain.Yeh aik choti si green candle hoti hai jo ke previous down candle ke neeche rehti hai.Is green candle ka close, previous down candle ke close se uncha hota hai,lekin overall range kam hoti hai.Mat Hold pattern ka interpretation yeh hota hai ke market mein thora sa profit booking hua hai, lekin bulls control mein hain aur abhi bhi uptrend jaari hai. Is pattern ko confirm karne ke liye traders market ko closely monitor karte hain aur dekhte hain ke agle kuch candles mein kya hota hai.Agar Mat Hold pattern ke baad market phir se upar badhti hai aur uptrend continue hota hai, toh yeh pattern confirm ho jata hai. Traders is signal par bharosa karte hain aur apne positions ko hold karte hain ya phir naye long positions lete hain.Yeh pattern market sentiment ko reflect karta hai aur traders ko ek hint deta hai ke uptrend mein thoda sa consolidation ho sakta hai, lekin overall trend abhi bhi bullish hai. Is pattern ki sahi tarah se samajhna aur interpret karna traders ke liye mahatvapurna hai kyunki galat analysis se nuksan ho sakta hai. In conclusion, Mat Hold Candlestick Pattern aik powerful continuation pattern hai jo traders ko existing uptrend ke continuation ke possibilities ke baare mein suchit karta hai.Is pattern ko samajhna aur sahi tarah se interpret karna, technical analysis mein mahir hone ke liye zaruri hai.

تبصرہ

Расширенный режим Обычный режим