Introduction:

Positional trading ek trading strategy hai jo investors aur traders ke liye longer-term market movements par focus karti hai. Is strategy mein, traders apni positions ko weeks, months, ya kabhi kabhi saalon tak hold karte hain with the aim to profit from major price trends.

Key Features of Positional Trading

Positional Trading Ka Process

Example

Agar ek trader ne analysis ke baad decide kiya ke ek specific stock jo abhi $50 par trade ho raha hai, uske fundamentals strong hain aur yeh stock next 6 months mein $70 tak ja sakta hai, toh yeh trader $50 par stock buy karega aur apni position ko hold karega until stock $70 par pohanch jaye ya kuch significant changes ho jayein.

In conclusion, positional trading ek effective strategy hai for those who prefer less frequent trading and aim to profit from major market trends. Yeh approach disciplined research aur patience demand karta hai, magar yeh significant returns generate kar sakta hai for committed traders.

Positional trading ek trading strategy hai jo investors aur traders ke liye longer-term market movements par focus karti hai. Is strategy mein, traders apni positions ko weeks, months, ya kabhi kabhi saalon tak hold karte hain with the aim to profit from major price trends.

Key Features of Positional Trading

- Long-term Perspective: Positional traders long-term view rakhte hain aur short-term price fluctuations ko ignore karte hain. Unka focus broader market trends aur fundamental analysis par hota hai.

- Use of Fundamental Analysis: Positional traders aksar fundamental analysis par rely karte hain, jo company ke financial health, industry trends, economic indicators, aur other macroeconomic factors ko evaluate karta hai.

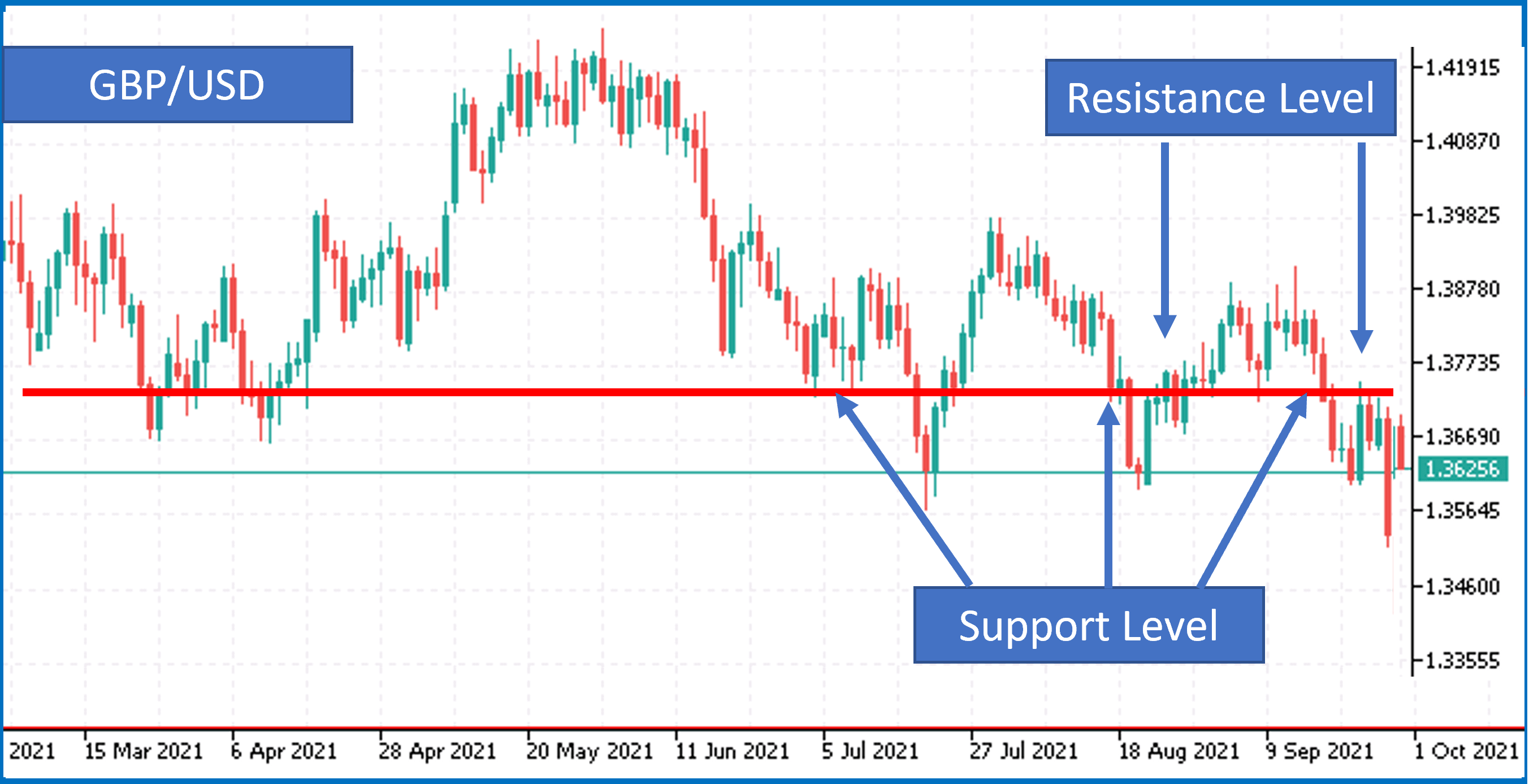

- Technical Analysis: Yeh traders technical analysis tools bhi use karte hain jaise trend lines, support and resistance levels, moving averages, and other indicators to identify potential entry and exit points.

- Lower Transaction Costs: Kyunki positional traders kam frequency par trades execute karte hain, unhein lower transaction costs ka faida milta hai compared to short-term traders or day traders.

- Less Time-Consuming: Positional trading relatively less time-consuming hota hai kyunki traders ko har roz market monitor karne ki zaroorat nahi hoti. They can make decisions based on longer-term data and trends.

Positional Trading Ka Process

- Market Research: Sabse pehle, traders detailed market research karte hain, including fundamental analysis of potential investments and economic conditions.

- Identifying Opportunities: Fundamental aur technical analysis ka istemal karke potential trading opportunities ko identify karte hain. Yeh include karta hai strong fundamentals wali companies ko dekhna aur positive long-term growth prospects ko assess karna.

- Entry Point: Technical indicators aur support/resistance levels ko dekh kar entry point decide karte hain. Entry tab hoti hai jab market favorable lagta hai aur price expected direction mein move hone ka potential dikhata hai.

- Holding the Position: Position ko hold karna hota hai for an extended period, during which short-term price volatility ko ignore kiya jata hai. Yeh period weeks, months, ya even years tak ho sakta hai.

- Exit Point: Pre-determined profit targets ya fundamental changes jaise factors ko dekh kar exit point decide hota hai. Exit tab hoti hai jab price desired level tak pahunch jaye ya market conditions unfavorable lagne lagti hain.

- Reduced Stress: Short-term price fluctuations se stress kam hota hai kyunki trades longer-term perspective se kiye jate hain.

- Potential for Higher Profits: Long-term trends ko capture karne ka potential hota hai, jo significant profits generate kar sakta hai.

- Lower Transaction Costs: Frequent trading nahi hota, isliye transaction costs aur commissions kam lagti hain.

- Less Market Monitoring: Daily market monitoring ki zaroorat nahi hoti, jo time save karta hai.

- Capital Lock-In: Capital longer period ke liye invested hota hai, jo short-term liquidity reduce kar sakta hai.

- Market Risk: Long-term positions par market risk zyada hota hai kyunki unpredictable market events affect kar sakte hain.

- Patience Required: Profits realize karne ke liye patience zaroori hai, jo har trader ke liye easy nahi hota.

Example

Agar ek trader ne analysis ke baad decide kiya ke ek specific stock jo abhi $50 par trade ho raha hai, uske fundamentals strong hain aur yeh stock next 6 months mein $70 tak ja sakta hai, toh yeh trader $50 par stock buy karega aur apni position ko hold karega until stock $70 par pohanch jaye ya kuch significant changes ho jayein.

In conclusion, positional trading ek effective strategy hai for those who prefer less frequent trading and aim to profit from major market trends. Yeh approach disciplined research aur patience demand karta hai, magar yeh significant returns generate kar sakta hai for committed traders.

تبصرہ

Расширенный режим Обычный режим