Average True Range (ATR) Indicator Ki Wazahat

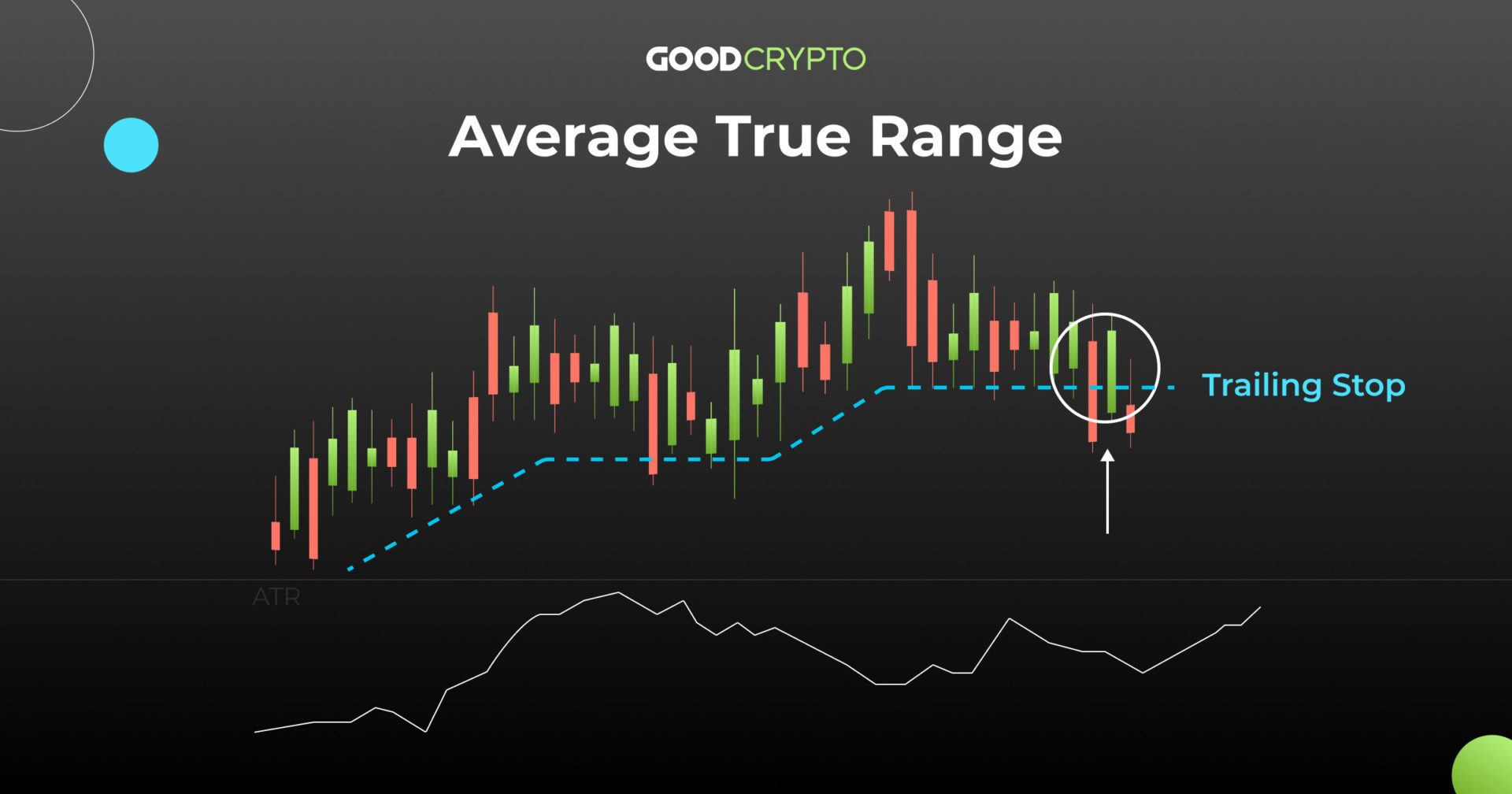

Average True Range (ATR) ek technical indicator hai jo volatility measure karta hai. Isay J. Welles Wilder Jr. ne develop kiya tha aur yeh measure karta hai ki asset kis had tak move hota hai ek specific period ke dauran. ATR use hota hai traders aur investors ke liye taake market ke volatility ko samajh sakein aur apni trading strategies ko accordingly adjust kar sakein.

ATR Ka Function

ATR price movements ki range ko measure karta hai, yeh over a specific period of time calculate hota hai. Typically, 14-period ATR use hota hai jo daily charts par 14 days, hourly charts par 14 hours, aur similarly kisi bhi timeframe par apply hota hai.

ATR ko calculate karne ka method yeh hai:

- True Range (TR) Calculate Karna:

- Current High - Current Low

- Current High - Previous Close

- Current Low - Previous Close

In tino values mein se jo highest hoti hai, woh TR hoti hai. - Average True Range (ATR) Calculate Karna:

- ATR = (Previous ATR * (n - 1) + Current TR) / n

Jahan n number of periods hai.

- Volatility Measure: ATR accurately measure karta hai asset ki volatility ko. Higher ATR values indicate karti hain higher volatility aur lower ATR values indicate karti hain lower volatility.

- Stop-Loss Placement: ATR help karta hai stop-loss levels set karne mein. Higher ATR value ka matlab hai broader stop-loss range taake market noise se bacha ja sake aur lower ATR value ka matlab hai tighter stop-loss range.

- Risk Management: ATR risk management mein madad karta hai. Yeh traders ko position sizing aur risk per trade assess karne mein help karta hai.

- Entry/Exit Signals: ATR use hota hai entry aur exit signals ke liye. Jab ATR high hota hai, toh yeh indicate karta hai ke market volatile hai aur potential breakouts ho sakte hain. Low ATR values stable market conditions ko indicate karti hain.

- Trend Strength: ATR trend strength ko assess karne mein madad karta hai. Rising ATR during a trend indicates strengthening trend aur falling ATR during a trend indicates weakening trend.

- No Directional Indication: ATR price direction ko indicate nahi karta. Yeh sirf volatility measure karta hai, yani yeh nahi batata ke price upar jayegi ya neeche.

- Lagging Indicator: ATR ek lagging indicator hai, yani yeh historical data par base karta hai aur future volatility ko accurately predict nahi kar sakta.

- False Signals: ATR volatile market conditions mein false signals generate kar sakta hai. Yeh kabhi kabar sudden price spikes aur drops ko accurately capture nahi karta.

- Not Suitable for All Assets: ATR har asset ke liye effective nahi hota, especially jo low volatility assets hain unke liye yeh less effective ho sakta hai.

ATR ek useful tool hai jo traders aur investors ko market volatility assess karne mein help karta hai. Iske fayday aur nuksan dono hain, aur isay doosri technical indicators ke sath use karna behtar hota hai taake accurate trading decisions liye ja sakein. ATR ko use karte waqt, traders ko market conditions aur apni trading strategy ko consider karna chahiye aur isay risk management aur stop-loss placement ke liye cautiously use karna chahiye.

تبصرہ

Расширенный режим Обычный режим