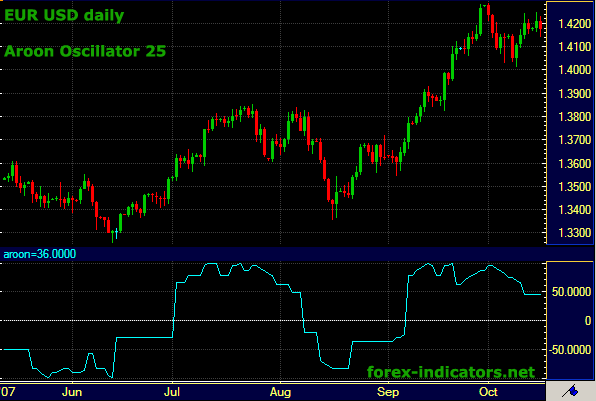

**Aroon Oscillator in Forex Trading**

Aroon Oscillator ek technical indicator hai jo forex trading mein market trends ko identify karne aur unki strength ko assess karne ke liye use hota hai. Is indicator ko Tushar Chande ne develop kiya tha, aur is ka main purpose market ki momentum aur trend strength ko measure karna hai. Aroon Oscillator ka use karke traders ko trend reversals aur trend strength ke bare mein insights milti hain jo trading decisions ko behtar bana sakti hain.

Aroon Oscillator ko do main components mein divide kiya jata hai: Aroon Up aur Aroon Down. Aroon Up indicator market ke high points ko track karta hai, jabke Aroon Down indicator market ke low points ko track karta hai. Yeh dono components mil kar Aroon Oscillator banate hain, jo ek single line ke form mein present hota hai.

**Aroon Oscillator ki Calculation**

Aroon Oscillator ki calculation karna kaafi simple hai. Pehle, Aroon Up aur Aroon Down ko calculate kiya jata hai:

1. **Aroon Up Calculation:**

- Aroon Up = [(N - Number of periods since the highest high) / N] * 100

2. **Aroon Down Calculation:**

- Aroon Down = [(N - Number of periods since the lowest low) / N] * 100

Yahan, N woh period hai jiske liye aap calculation kar rahe hain. For example, agar aap 14-period ka Aroon Oscillator calculate kar rahe hain, toh N = 14 hoga.

**Aroon Oscillator ka Interpretation**

Aroon Oscillator ko analyze karte waqt kuch key points hain jo traders ko help karte hain:

1. **Positive Aroon Oscillator Value:** Jab Aroon Up ki value Aroon Down se zyada hoti hai, tab Aroon Oscillator positive hota hai. Iska matlab hota hai ke market mein strong uptrend hai. Traders is signal ko buy opportunities ke liye use karte hain.

2. **Negative Aroon Oscillator Value:** Jab Aroon Down ki value Aroon Up se zyada hoti hai, tab Aroon Oscillator negative hota hai. Yeh signal market mein downtrend ke liye hota hai. Traders is signal ko sell opportunities ke liye consider karte hain.

3. **Crossovers:** Jab Aroon Oscillator line zero line ko cross karti hai, yeh trend reversal ka indication hota hai. Agar oscillator zero line ko upar se niche cross karta hai, toh yeh bearish signal hai, aur agar niche se upar cross karta hai, toh yeh bullish signal hai.

**Aroon Oscillator ke Advantages**

1. **Trend Strength Measurement:** Aroon Oscillator market ke trend ki strength ko accurately measure kar sakta hai. Isse traders ko clear view milta hai ke market kitni strongly trending hai.

2. **Reversal Indication:** Yeh indicator trend reversals ko bhi detect karne mein help karta hai. Jab oscillator zero line ko cross karta hai, toh yeh trend reversal ka signal hota hai jo timely trading decisions mein madadgar hota hai.

3. **Simplicity:** Aroon Oscillator ka calculation aur interpretation relatively simple hai, jo isse beginners ke liye bhi useful banata hai.

**Conclusion**

Aroon Oscillator forex trading mein ek powerful tool hai jo market ke trends aur unki strength ko identify karne mein madad karta hai. Iska use karte waqt traders ko careful analysis aur market conditions ka dhyan rakhna chahiye, lekin yeh indicator trading strategies ko refine karne aur better decision making mein zaroor madad kar sakta hai.

Aroon Oscillator ek technical indicator hai jo forex trading mein market trends ko identify karne aur unki strength ko assess karne ke liye use hota hai. Is indicator ko Tushar Chande ne develop kiya tha, aur is ka main purpose market ki momentum aur trend strength ko measure karna hai. Aroon Oscillator ka use karke traders ko trend reversals aur trend strength ke bare mein insights milti hain jo trading decisions ko behtar bana sakti hain.

Aroon Oscillator ko do main components mein divide kiya jata hai: Aroon Up aur Aroon Down. Aroon Up indicator market ke high points ko track karta hai, jabke Aroon Down indicator market ke low points ko track karta hai. Yeh dono components mil kar Aroon Oscillator banate hain, jo ek single line ke form mein present hota hai.

**Aroon Oscillator ki Calculation**

Aroon Oscillator ki calculation karna kaafi simple hai. Pehle, Aroon Up aur Aroon Down ko calculate kiya jata hai:

1. **Aroon Up Calculation:**

- Aroon Up = [(N - Number of periods since the highest high) / N] * 100

2. **Aroon Down Calculation:**

- Aroon Down = [(N - Number of periods since the lowest low) / N] * 100

Yahan, N woh period hai jiske liye aap calculation kar rahe hain. For example, agar aap 14-period ka Aroon Oscillator calculate kar rahe hain, toh N = 14 hoga.

**Aroon Oscillator ka Interpretation**

Aroon Oscillator ko analyze karte waqt kuch key points hain jo traders ko help karte hain:

1. **Positive Aroon Oscillator Value:** Jab Aroon Up ki value Aroon Down se zyada hoti hai, tab Aroon Oscillator positive hota hai. Iska matlab hota hai ke market mein strong uptrend hai. Traders is signal ko buy opportunities ke liye use karte hain.

2. **Negative Aroon Oscillator Value:** Jab Aroon Down ki value Aroon Up se zyada hoti hai, tab Aroon Oscillator negative hota hai. Yeh signal market mein downtrend ke liye hota hai. Traders is signal ko sell opportunities ke liye consider karte hain.

3. **Crossovers:** Jab Aroon Oscillator line zero line ko cross karti hai, yeh trend reversal ka indication hota hai. Agar oscillator zero line ko upar se niche cross karta hai, toh yeh bearish signal hai, aur agar niche se upar cross karta hai, toh yeh bullish signal hai.

**Aroon Oscillator ke Advantages**

1. **Trend Strength Measurement:** Aroon Oscillator market ke trend ki strength ko accurately measure kar sakta hai. Isse traders ko clear view milta hai ke market kitni strongly trending hai.

2. **Reversal Indication:** Yeh indicator trend reversals ko bhi detect karne mein help karta hai. Jab oscillator zero line ko cross karta hai, toh yeh trend reversal ka signal hota hai jo timely trading decisions mein madadgar hota hai.

3. **Simplicity:** Aroon Oscillator ka calculation aur interpretation relatively simple hai, jo isse beginners ke liye bhi useful banata hai.

**Conclusion**

Aroon Oscillator forex trading mein ek powerful tool hai jo market ke trends aur unki strength ko identify karne mein madad karta hai. Iska use karte waqt traders ko careful analysis aur market conditions ka dhyan rakhna chahiye, lekin yeh indicator trading strategies ko refine karne aur better decision making mein zaroor madad kar sakta hai.

تبصرہ

Расширенный режим Обычный режим